["Industry In-depth Research"] Li Shufu's "Decentralization"

![]() 11/22 2024

11/22 2024

![]() 608

608

Author | Meng Xiao For more financial information | BT Finance Data Link Total text: 4002 words, estimated reading time: 11 minutes

"All Geely sub-brands are beginning to converge, potentially marking a new strategic direction for Li Shufu."

Recently, Geely Auto has been making frequent moves, with Radar Auto merging into the Geely Auto Group, becoming a first-tier organization within it, and Geometry Auto also being integrated into the Geely Galaxy series. Before these two sub-brands' convergence was complete, news came from Zeekr and Lynk & Co.

On November 14, Geely announced the optimization of its shareholding structure for its two major brands, Zeekr and Lynk & Co, to comprehensively promote strategic synergy. Geely Holdings will transfer its 11.3% stake in Zeekr to Geely Auto for a consideration of approximately RMB 5.8 billion, increasing Geely Auto's shareholding in Zeekr to 62.8%. Lynk & Co's 20% equity will be sold to Zeekr for RMB 3.6 billion. Volvo will also sell its 30% stake in Lynk & Co to Zeekr for RMB 5.4 billion. Zeekr will also subscribe to new registered capital of Lynk & Co for RMB 367 million, acquiring a 1% stake. After the transaction is completed, Zeekr will hold 51% of Lynk & Co's shares, with the remaining 49% continuing to be held by a wholly-owned subsidiary of Geely Auto.

The above four transactions involve a total amount exceeding RMB 15 billion, with Geely Auto being the biggest beneficiary, essentially directly or indirectly holding the two major new energy brands, Zeekr and Lynk & Co. Li Shufu has once again demonstrated his exceptional ability in capital operation. Industry insiders generally believe that this is a major integration of Zeekr and Lynk & Co. Lin Jinwen, Vice President of Zeekr, even described this integration of the two brands as a "historic moment," with both official Weibo accounts simultaneously posting hopeful posts about the integration.

Both Zeekr and Lynk & Co are new energy vehicle brands under Geely. Zeekr was established relatively recently, in 2021, and went public on the US stock market three years after its establishment, becoming the fourth new energy vehicle company to list on the US stock market after NIO, XPeng, and Li Auto, and the fastest new carmaker to go public in history. Lynk & Co, established in 2017, is a joint venture brand between Geely Auto and Volvo, and is popular in the market with its young and sporty brand image. Its cumulative sales have exceeded 1 million units.

According to reports, the reason for Li Shufu's major integration may be that there are issues of product overlap and vague brand positioning to some extent between Zeekr and Lynk & Co, which not only restricts their respective development but also causes a waste of resources. Geely Holdings also stated that this series of adjustments are aimed at "reducing related-party transactions, eliminating horizontal competition, and unwaveringly promoting the in-depth integration and efficient fusion of internal resources."

Li Shufu's major move has not yet triggered a reaction in the capital market. The day after the official announcement of the major integration, Geely Auto's share price fell by 5.18%, the third largest decline in 2024. Prior to this, on October 8, it fell by 12.37% in a single day, setting the year's highest daily decline, and on October 31, it fell by 5.27%. Overall, Geely Auto's share price has performed well this year, with a nearly 60% increase from the opening price of RMB 8.42 at the beginning of the year to the closing price on November 19, with a market value of approximately HKD 134 billion.

1

Lynk & Co and Zeekr Merger

Although both Lynk & Co and Zeekr belong to Geely, they are almost independent in the market. Lynk & Co is positioned as a global mid-to-high-end new energy brand, with a "trendy, sporty, and individual" brand tone, focusing on small and medium-sized vehicles for the mid-to-high-end market. Zeekr is positioned as a global luxury technology brand, with a "luxurious, extreme, and technological" brand tone, focusing on medium and large vehicles for the high-end luxury market. There may be some market conflict between the two.

Lynk & Co was established much earlier than Zeekr. In 2013, Geely Holdings established its European R&D center and Gothenburg Design Center. Three years later, Lynk & Co was born as a new brand integrating the advantages of Volvo Cars and Geely Auto. Ningbo Geely Automobile Industry Co., Ltd., Volvo Cars, and Geely Holdings respectively held 50%, 30%, and 20% shares. The first model, Lynk & Co 01, was officially launched in November 2017.

Lynk & Co has deep Volvo genes from its inception, using Volvo's Drive-E series engines, City Safety urban safety systems, and Pilot Assist autonomous driving assistance systems, earning it the reputation of being a "mini Volvo." Relying on its safety and sportiness, as of December 2023, Lynk & Co had accumulated sales of 1.05 million units. Currently, among the three new carmaking forces of NIO, XPeng, and Li Auto, only Li Auto has reached the milestone of 1 million units, with NIO and XPeng falling short. Li Auto took nearly a decade to achieve this, while Lynk & Co only took six years.

Zeekr was established relatively late, perhaps as part of Li Shufu's strategic layout to complement the electric luxury market. Since its establishment in March 2021, Zeekr has specialized in the pure electric market and quickly launched the Zeekr 001.

As domestic competition in the new energy vehicle market intensifies, almost all new energy vehicle brands have abandoned the single-legged approach and enriched their "arsenals" by offering both pure electric and extended-range/hybrid options to give consumers more choices. Zeekr has entered the extended-range and hybrid markets, while Lynk & Co has launched its first pure electric sedan, the Z10, entering the pure electric market.

Before the launch of the Z10, Lynk & Co had a wide range of models, covering the price range of RMB 100,000 to 400,000, including traditional fuel vehicles (pure fuel + mild hybrid) and plug-in hybrids. Meanwhile, Zeekr, originally targeting luxury models, has unknowingly begun to penetrate the mid-to-low end market. According to information from Autohome, the Zeekr X is priced between RMB 149,000 and 199,000, and Lynk & Co and Zeekr may face competitive relations.

Lynk & Co's attempt at a pure electric route has been interpreted by the outside world as potentially competing with Zeekr, which has always focused on pure electric vehicles. Overlapping businesses between siblings inevitably lead to competition. In particular, the Lynk & Co Z10 AWD version and the 2025 Zeekr 001 AWD version use the same model of front 270kW induction asynchronous + rear 310kW permanent magnet synchronous dual-SiC motors, making "sibling rivalry" inevitable.

Jiang Dongshan, a Zeekr 001 owner, said that the emergence of the Lynk & Co Z10 has made the Zeekr 001 and 007 slightly awkward. "I feel that both the Lynk & Co Z10 and the Zeekr 001 are positioned as mid-to-large sedans with highly similar exterior designs, even in terms of powertrain and performance parameters. The Zeekr models, which are positioned slightly lower as mid-size sedans, are priced between RMB 200,000 and 300,000, while the Lynk & Co Z10 is priced between RMB 180,800 and 329,800, creating an overlap."

Jiang Dongshan is optimistic about the integration of Lynk & Co and Zeekr. "Firstly, since their technologies are basically the same, there will be advantages in research and development, significantly saving R&D costs. They can also reduce costs through supply chain optimization and economies of scale. Even in channel construction, the two can be highly complementary, enabling cost reduction and efficiency enhancement."

2

Li Shufu Sounds the Rallying Cry

Li Shufu's integration actually had signs a few months ago. In September, Li Shufu announced in the "Taizhou Declaration" that Geely had entered a new stage of strategic transformation. The five major initiatives of "strategic focus, strategic integration, strategic synergy, strategic robustness, and strategic talent" were put on Li Shufu's agenda. His goal is clear: to focus on the automotive industry, deploy a technological ecosystem, and enhance competitiveness.

In the over 20 years since Li Shufu entered the automotive industry, his understanding of automobiles has changed significantly. Two decades ago, Li Shufu believed that "a car is nothing more than four wheels, two sofas, and a metal shell." However, as Li Shufu acquired Volvo and launched hybrid systems, his perspective on automobiles evolved. With Geely's many brands racing in the smart race of new energy vehicles, Li Shufu also changed his tune, stating that automobiles would certainly become a mobile terminal.

In the "Taizhou Declaration," Li Shufu proposed to "comprehensively review all business segments of the company, clarify business positioning, formulate medium- and long-term development goals, adjust and optimize the industrial layout structure, further clarify the positioning of each brand, straighten out equity relationships, reduce conflicts of interest and duplicate investments, and improve resource utilization efficiency." He also indirectly acknowledged the conflicts of interest between Lynk & Co and Zeekr, which may be the root cause of his integration plan.

Shortly after, Geely Auto merged its Geometry brand, launched in 2019, into the Geely Galaxy brand, which will be upgraded to an independent new energy vehicle brand. This decision was based on the unsatisfactory performance of Geometry since its launch and the impressive market performance of the Galaxy series since its launch in 2023, making it the main force in Geely's new energy vehicle lineup.

In an announcement on October 21, Geely Auto stated that it would acquire 100% of the equity of Ningbo Passenger Vehicles for RMB 120 million. This was also part of Li Shufu's preparations for integration, aiming to effectively utilize resources, boost sales, and achieve cost reduction and efficiency enhancement. After the merger of Lynk & Co and Zeekr, there will be reinforcement and synergy in technology, products, supply chains, manufacturing, marketing and services, and international market expansion. Li Shufu has high hopes for them, expecting the two brands to achieve annual production and sales of 1 million units by the end of 2026.

An Conghui, CEO of Zeekr, responded to the merger with Lynk & Co during Zeekr's third-quarter earnings call, stating that the merger was not a simple combination but a deep reorganization of both businesses, leading to stronger synergies and helping Zeekr rapidly expand its product and market space. After the merger, the brand can cover 60% of China's passenger car market segments and gain more shares in the hybrid market, with R&D costs and optimization support department expenses reduced by 10% to 20%.

3

Excellent Third-Quarter Reports from Geely and Zeekr

Li Shufu's major integration is not due to poor performance of Geely Auto or Zeekr. On the contrary, both have performed exceptionally well. In the first ten months, Lynk & Co's cumulative sales reached 226,700 units, a year-on-year increase of 38%. Li Shufu's adjustment during this period of outstanding performance demonstrates his courage and determination.

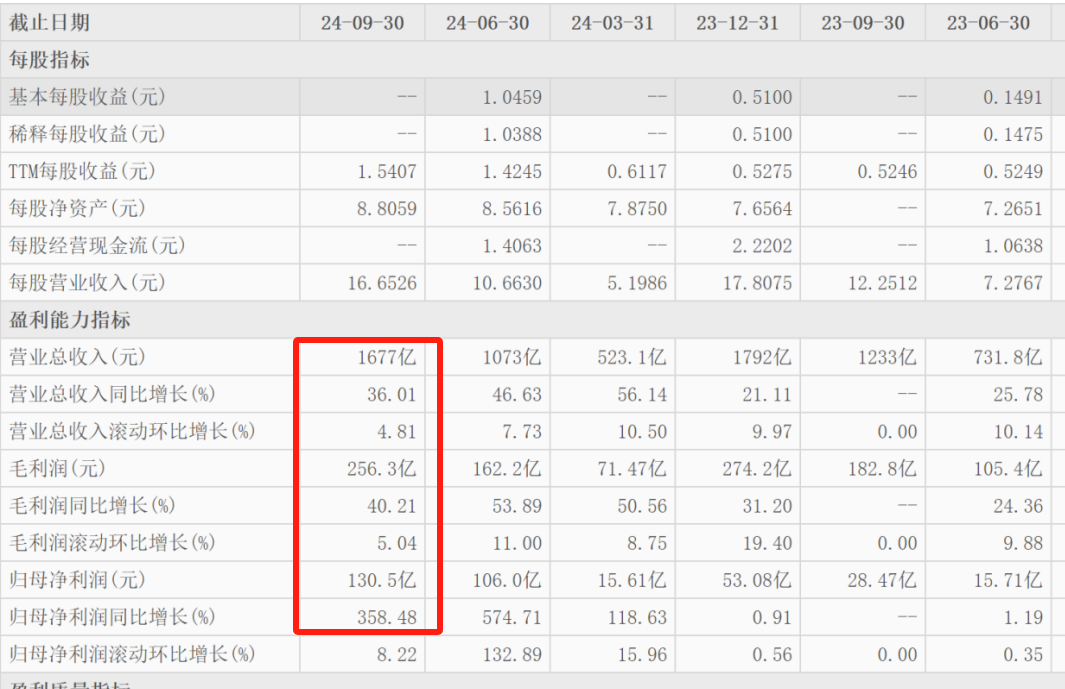

The financial report shows that Geely Auto's revenue for the first three quarters of 2024 was RMB 167.7 billion, a year-on-year increase of 36.01%, with a net profit of RMB 13.05 billion, a year-on-year increase of 358.48%, making it one of the few domestic automakers with a net profit exceeding RMB 10 billion in the first three quarters. It is worth noting that Geely Auto's net profit in 2023 was only RMB 5.308 billion, meaning that the money earned in the first three quarters of this year is already 2.5 times that of last year's entire year.

It is worth mentioning that in the third quarter of this year, Geely Auto's net profit margin reached 7.71%, compared to 2.07% in the same period last year, an increase of 5.64 percentage points. Such a significant increase in net profit margin is rare among many automakers. In 2023, Geely Auto's annual net profit margin was only 2.75%.

Zeekr, listed on the US stock market, also recently released its third-quarter report for 2024. The report shows that Zeekr's total revenue in the third quarter of 2024 was RMB 18.36 billion, a year-on-year increase of 30.7%, with a net loss of RMB 1.139 billion, a year-on-year narrowing of 21.7%. From January to October this year, Zeekr's cumulative sales reached 168,000 units, a year-on-year increase of 82%.

In the first three quarters of this year, Zeekr's total revenue was RMB 53.13 billion, a year-on-year increase of 50.46%, with a net loss of RMB 5.431 billion, a year-on-year increase of 1.32% compared to the net loss of RMB 5.36 billion in the same period last year. Entering 2024, Zeekr's gross profit margin has been continuously improving over the three quarters, with 11.80% in the first quarter, 14.92% in the second quarter, and 15.30% in the third quarter. Meanwhile, the net profit margin has also been improving, with -13.72% in the first quarter, -11.02% in the second quarter, and -9.35% in the third quarter. Although Zeekr's current net profit margin is still negative, it is continuously improving.

After Zeekr released its mid-year report for the first half of this year, many well-known institutions such as Citibank and Bank of America upgraded their ratings for Zeekr. Among them, Deutsche Bank gave Zeekr its first rating, a "Buy" with a target share price of USD 35, representing approximately a 67% upside potential based on Zeekr's current share price.

Investor Shi Baogang said that after the merger of Zeekr and Lynk & Co, they can leverage their resource advantages while avoiding internal competition. Forming a synergistic force will be more conducive to seizing the new energy vehicle market. "With deep synergy in technology, products, and profitability, Geely's move is expected to achieve sales of 1 million units amid fierce competition in the new energy vehicle market, gaining an advantage in the domestic new energy vehicle market and significantly helping its future performance."

Every "major change" by Li Shufu has had an extremely profound impact on the industry. Making changes when performance is outstanding requires tremendous courage and determination. This may be Li Shufu's strategy and foresight, as over the decades, Li Shufu has always been one step ahead, enabling Geely to achieve today's accomplishments.

The article represents the author's personal views. For any questions or feedback, please leave a comment or send an email directly.