Tesla's third-quarter revenue reached 179.6 billion yuan. It is always controversial, but its strength cannot be denied

![]() 11/22 2024

11/22 2024

![]() 502

502

Many people like to perceive companies as organizations that fulfill 'social responsibilities' and seek the welfare of the country and people. It seems that a money-making institution must be packaged as a carrier that benefits society and serves the public before it can win people's hearts and gain widespread social praise. However, in the eyes of ordinary people, the essence of a company is to make profits. If it doesn't make money, what is the necessity of its existence?

Therefore, who is the most profitable company has always been a topic of keen interest. Looking domestically, without mentioning the astonishingly profitable tobacco industry or the banks with mouth-dropping profitability, just considering the major enterprises that have flourished in the new energy field in recent years, BYD and CATL are representatives among them. But even though BYD's average daily profit in 2023 was close to 100 million yuan and CATL's reached 120 million yuan, far ahead of domestic enterprises, a comparison with Tesla, another international new energy giant, reveals that neither BYD nor CATL is in the same league as Tesla.

Many people will immediately question this claim upon seeing it, instinctively listing many advantages of BYD and CATL, as well as their various potentials and huge room for future growth. But don't forget that, compared to Tesla, BYD and CATL, for now, are far behind in terms of profitability alone. In 2023, Tesla had an average daily net profit of 230 million yuan. This figure alone is enough to render any rebuttal powerless, not to mention that Tesla is not just a car company in the traditional sense but a truly comprehensive company with future technological innovation capabilities.

Saying that Tesla launches satellites, makes mobile phones, and dabbles in stock trading is going too far. Let's put that aside for now. Simply looking at the financial reports for the first three quarters of 2024 has already silenced China's new energy vehicle companies collectively!

Overnight, the market value surged by an amount equivalent to that of CATL

Since its establishment in 2011, CATL has risen from obscurity to the pinnacle of the new energy industry, with a market value exceeding the trillion-yuan mark. However, due to the cyclical fluctuations of the industry, its market value has shrunk to 716.5 billion yuan as of now, a drop of 600 billion yuan from its peak. Surprisingly, Tesla's net profit more than doubled in 2022, reaching 85.5 billion yuan, and its market value soared due to its impressive performance.

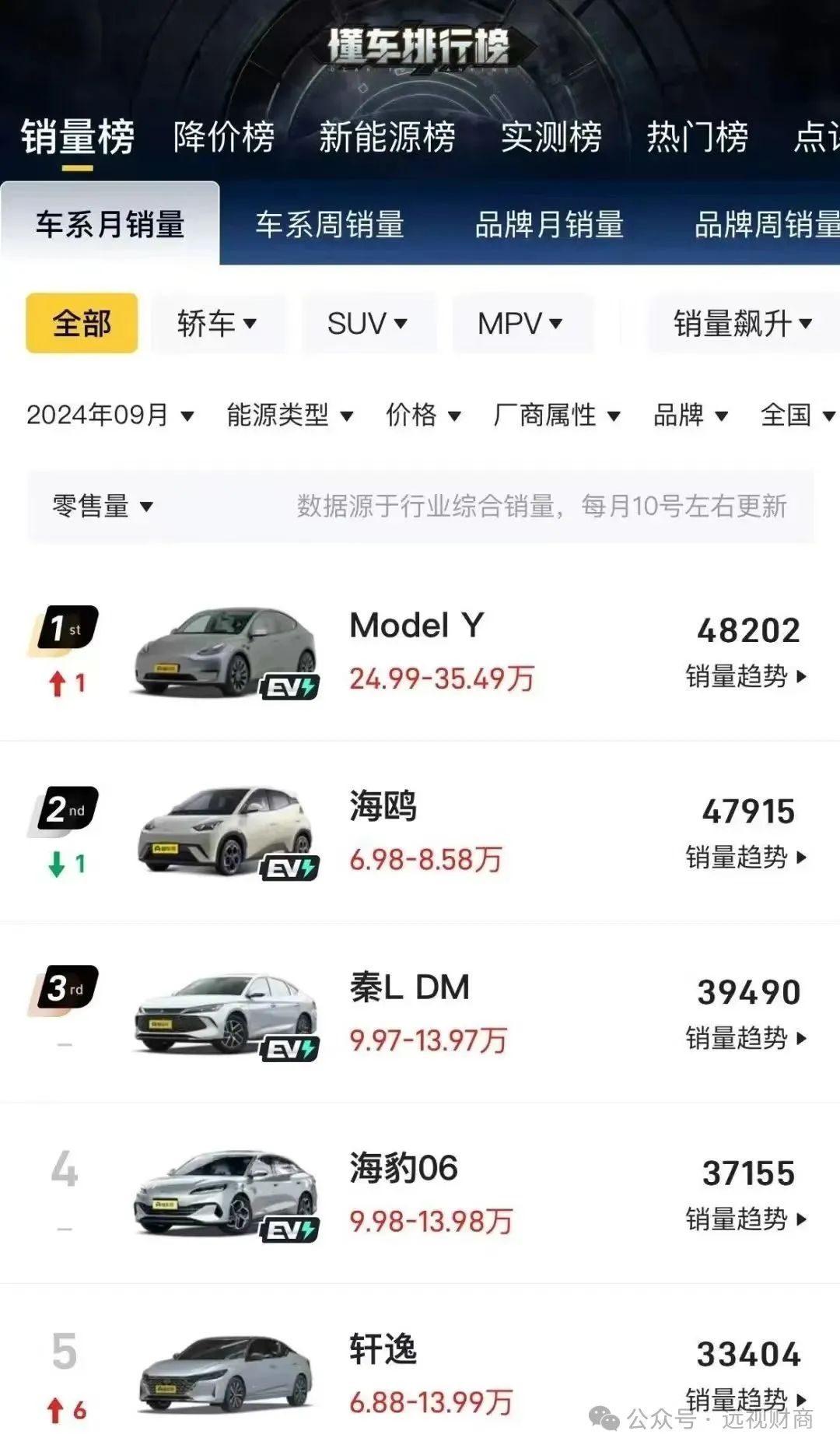

Of course, Tesla's strong performance is not only due to its high electric vehicle sales but also because its energy storage business installed capacity increased by 64% year-on-year, setting a delivery record of 1.31 million vehicles while opening 42,000 supercharging stations globally. In 2024, Tesla's third-quarter revenue reached 179.6 billion yuan, an 8% year-on-year increase, with a net profit of 2.167 billion dollars (equivalent to 15.4 billion yuan in RMB), a 17% year-on-year increase, according to the financial report released on October 24.

It is worth noting that this financial report, which does not seem to show a significant increase, is nonetheless big news for China's new energy vehicle companies. In the third-quarter financial report, Tesla set a new record for the lowest single-vehicle cost in history and the second-highest carbon credit revenue for the third quarter. The cost per vehicle decreased by 730 dollars, while the gross profit margin increased by 2.4% to 17.1%, resulting in third-quarter earnings exceeding expectations. The direct impact of this was evident in the stock market the next day, with share prices rising 21.9% after the opening, and the total market value surging by 154.1 billion dollars (approximately 1.097 trillion yuan RMB) overnight, equivalent to the addition of another CATL.

It is always controversial, but you cannot deny its strength

Following the release of Tesla's third-quarter financial report, its share price and market value soared, accompanied by various controversial voices domestically. In summary, the arguments boil down to this: Tesla's highlights are only temporary, and only China's new energy sector has the potential for long-term development. The technological advantage of the future lies in China, and China's new energy will eventually take the lead in the world!

Generally, those who make such statements are not professionals in China's new energy sector. After all, there are many internet bloggers who pretend to know what they are talking about and rely on bombastic statements to attract traffic. The Chinese internet likes to target Tesla CEO Elon Musk, considering him someone who likes to create public opinion and stir up controversy. However, even so, no one denies Musk's "genius" – a person who can single-handedly pull down Tesla's market value can also single-handedly raise its share price and earn more from stock trading than from his position as Tesla's CEO!

Every success of Tesla is inseparable from Musk's "making trouble." No one can deny that this is a controversial company and a controversial person, but also a person and a company of formidable strength. Because Musk and Tesla will not stop progressing and do not know when to quit while they are ahead. Although they have already earned astonishing wealth through electric vehicles, their goal is not to make money but to change humanity! This is perhaps the biggest difference between Tesla and other new energy vehicle companies.

Autonomous driving and low-altitude flight are probably not secrets to Tesla, and if they decide to pursue them, there will be no competition. In addition to leading internationally in battery technology, Tesla also has rich technical reserves in motors and electronic control systems and has sufficient funds to continuously invest in technological innovation. Rather than focusing solely on sleek car bodies and cool smart configurations, Tesla prioritizes enhancing core technologies to highlight its profound technological foundation.

Considering Tesla's unshakeable core competitiveness over the years, its impeccable hardware technology, and its comprehensive services and infrastructure, including the number of charging stations and the coverage of maintenance outlets, it becomes evident that its "dominant" position is not based on sales generated through marketing but on tangible core technologies. This alone is enough to silence China's new energy vehicle companies collectively!