Tengshi D9 sales decline, BYD's high-end path encounters setbacks

![]() 11/24 2024

11/24 2024

![]() 634

634

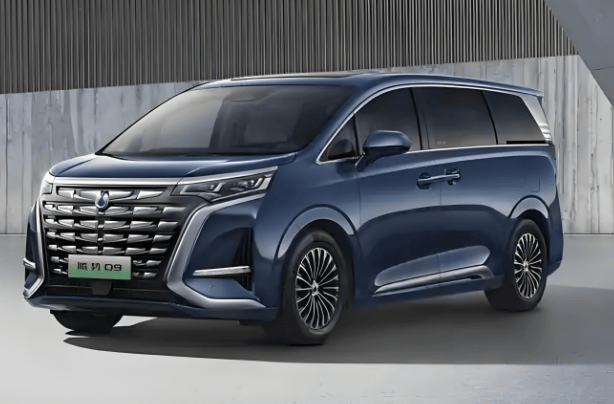

In the fierce competition in the MPV market, Tengshi D9 once shone like a bright star, successfully topping the monthly sales chart with its unique positioning and BYD's strong background. However, recently, this star seems to have lost its former glory, with sales continuously declining, raising deep concerns about its future prospects.

Since the launch of the new Buick GL8 with a starting price below 300,000 yuan, the landscape of the MPV market has quietly changed. Tengshi D9, the former king, appears to be struggling in this round of competition. In September, it lost its sales crown to the Toyota Sienna from GAC Toyota, and in October, it was even squeezed out of the top three by two fuel-powered MPVs—the Sienna and the Gracia, as well as the new Lantu Dream Home, also a new energy MPV, ranking only fourth.

Such results are undoubtedly a heavy blow to Tengshi D9. As the sales bearer of BYD's high-end brand Tengshi, its performance is not only crucial to the survival of the Tengshi brand but also reflects, to a certain extent, the success or failure of BYD's "brand upward" strategy. However, the continuous decline in Tengshi D9 sales undoubtedly casts a shadow over BYD's high-end path.

Currently, BYD's car sales are mainly concentrated in the mid-to-low-end market, with relatively weak competitiveness in the high-end market. Taking October as an example, BYD sold 502,657 new vehicles, of which 96.18%, or 483,437 vehicles, were from the Dynasty and Ocean series, priced below 200,000 yuan. Although some models in the Dynasty and Ocean series exceed 200,000 yuan, such as the Tang, Han, and Guardian, sales of these high-priced models are far lower than those of lower-priced models.

Among BYD's high-end brands, the sales of Tengshi, Fangchengbao, and Yangwang are insufficient to support market share above 200,000 yuan, with their combined sales in October totaling less than 20,000 vehicles. Among them, the Tengshi brand performs relatively well but mainly relies on a single model—Tengshi D9. In 2023, Tengshi Automobile sold a total of 127,800 vehicles, with Tengshi D9 accounting for approximately 93%.

This reliance on a single hit model exposes the Tengshi brand to the risk of a single product line. Once Tengshi D9 sales decline, the overall sales of the Tengshi brand will also be severely affected. In fact, this concern has already materialized: since the second half of the year, Tengshi D9's monthly sales have continuously declined year-on-year. From July to October, Tengshi D9 sales were 9,030, 9,181, 8,122, and 7,381 vehicles, respectively, all falling short of 10,000 units, compared to sales of over 10,000 units in the same period last year, indicating a clear downward trend.

So, how did Tengshi D9 end up in this situation? The reasons may not be complicated. First, in terms of price, the starting price of Tengshi D9 is as high as 339,800 yuan, compared to only 299,800 yuan for the Sienna and Gracia, a full 40,000 yuan lower. Coupled with significant discounts for the Sienna and Gracia in the terminal market, consumers are naturally more inclined to choose models with higher cost-effectiveness.

Secondly, in terms of product capabilities, although Tengshi D9 performs well in intelligence and comfort, it still struggles against the strong challenge from the new Lantu Dream Home. The new Lantu Dream Home not only has a lower starting price but also achieves a full-dimensional upgrade in intelligence and luxurious comfort, becoming a leading-generation intelligent luxury MPV. Such product capability advantages undoubtedly put Tengshi D9 at a disadvantage in the competition.

Nowadays, the continuous decline in Tengshi D9 sales has severely impacted its brand image and market position. If the downtrend cannot be reversed in a short period, the Tengshi brand may even face the risk of collapse. Consequently, BYD's high-end path will also be greatly affected.

Faced with this dilemma, can Tengshi D9 regain its former glory? This is a question worth pondering. Judging from the current situation, if Tengshi D9 wants to regain the sales crown in a short period, it may only focus on price or discounts. However, while such an approach may bring short-term sales improvements, it is not a fundamental solution in the long run. After all, when choosing a car model, consumers value not only the price but also the quality and performance of the product.

Therefore, to truly overcome its difficulties and achieve sustainable development, Tengshi D9 must focus on enhancing its product capabilities and service quality. Only in this way can it remain invincible in the fierce market competition and regain the favor of consumers. However, this path will undoubtedly be full of challenges and hardships.