"Sales friends, stop pressuring customers with the phase-out of replacement subsidies"

![]() 11/29 2024

11/29 2024

![]() 488

488

Introduction

Introduction

Driven by policies, China's auto market is destined to become even more competitive next year.

"Don't wait, with that production capacity, even if you order now, delivery might not be guaranteed in January next year. By then, the replacement subsidy will be gone, and you'll lose 20,000 yuan for nothing."

"We can deliver the car within two weeks, and you can still catch the last chance."

"Don't hesitate, with similar prices, our configuration is obviously better."

This is not made up; these three consecutive phone calls actually happened to a friend. As the end of the year approaches, he was ready to buy an electric SUV priced around 200,000 yuan. While hesitating between the last two options, a salesperson from one brand started to pressure him precisely.

From the result, it can be said that it was very effective. Of course, compared to the long wait and comparable product capabilities, the real focus for him was the actual money saved.

At the beginning of this article, I spent some time presenting such a real-life case to prove a phenomenon: "This year, the strong trade-in and replacement subsidy policies have indeed received unanimous praise from consumers and driven many upgrade users. As a result, the imminent end of this sharp tool has gradually become the most powerful sales tactic at the terminal."

However, considering the positive signals from various dimensions recently, perhaps salespeople who are trying every means to boost sales will be disappointed. Because relevant policies are highly likely to continue next year, safeguarding the continuous growth of the entire market.

Policy continuation is almost explicit

In fact, looking at China's auto market this year, although it has experienced certain fluctuations and shocks to some extent, and some OEMs have had a tough time due to price wars, from the cumulative sales perspective, there has still been widespread "applause".

From traditional fuel vehicles to smart electric vehicles, as long as you have strong capabilities or competitive pricing, you will face fierce competition. The biggest "catalyst" behind this undoubtedly goes to the "Notice on Further Improving the Work Related to Car Trade-ins and Renewals" issued by the Ministry of Commerce, the Ministry of Finance, and five other departments in August this year.

It proposed increasing the subsidy standards for individual consumers who scrap and renew their vehicles to purchase new energy passenger vehicles and fuel passenger vehicles to 20,000 yuan and 15,000 yuan, respectively.

Compared to before, the amount has at least doubled. Against this background, regions across the country have responded to the call and successively issued sincere and inclusive policies based on their actual situations.

In short, many hands make light work, and prosperity is not accidental.

As evidence, let's take the recent "Silver October" as an example. According to statistics from the China Passenger Car Association (CPCA), narrow-sense passenger vehicle retail sales reached 2.261 million units, up 11.3% year-on-year and 7.3% month-on-month, exceeding previous expectations.

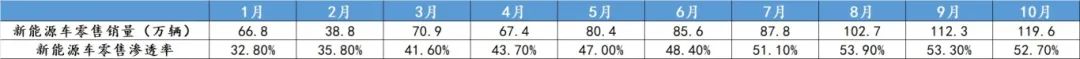

Among them, retail sales of traditional fuel vehicles reached 1.066 million units, down 16.1% year-on-year, but the decline began to narrow due to policy support. In contrast, retail sales of new energy vehicles reached 1.196 million units, with a penetration rate of 52.8%, showing a trend of rapid growth.

For November, which is still ongoing, according to CPCA forecasts, narrow-sense passenger vehicle retail sales are expected to be approximately 2.4 million units, up 15.4% year-on-year and 6.1% month-on-month. Based on this, retail sales of new energy vehicles are expected to reach 1.28 million units, with a penetration rate of approximately 53.3%.

In addition, it is worth sharing that as of November 18, Beijing time, the total number of applications for national car trade-in subsidies exceeded 4 million, with over 2 million applications each for scrap and replacement subsidies, and the average daily number of subsidy applications has remained high.

In summary, as mentioned earlier, faced with sufficiently attractive benefits, a significant portion of the "stubborn faction" chose to "surrender" on their own initiative. After all, who would pass up a free meal right in front of them?

Little did they know that good news came just last week.

Song Yingjie, a second-level investigator in the Department of Consumption Promotion of the Ministry of Commerce, stated at the 2024 Auto Finance Industry Summit, "To stabilize market expectations, we will continue to implement the existing subsidy policies and a series of supporting support policies, scientifically assess the effectiveness of this year's policies, and plan in advance for next year's car trade-in continuation policies."

The Ministry of Commerce also plans to continuously improve automobile-related policies to promote secure and convenient transactions of used cars, further activating the automobile market.

Rationally and objectively speaking, the signals are already very clear.

Similarly, just last week, Cui Dongshu, Secretary-General of the CPCA, tweeted directly, "Next year will be an exceptionally small year for consumption and industrial production, with enormous pressure on stable growth at the beginning of the year."

Therefore, to ensure the prosperity and rapid development of China's auto market, in addition to continuing the currently effective trade-in and replacement subsidy policies, it is recommended to start halving the vehicle purchase tax for new cars as early as January 1 to encourage first-time buyers to place orders before the Spring Festival.

This will have a better stimulating effect on pursuing stable growth at the beginning of next year, and it should be noted that first-time buyers have weaker spending power and are more sensitive to policy stimuli.

In my opinion, whether it's a spoiler or a hint, it's almost an "explicit indication". At this moment, the only suspense left is: When will the relevant policies be officially announced? Will they be further increased or slightly reduced compared to this year?

The answer will soon be revealed.

Who are the biggest beneficiaries of subsidy policies?

There is still over a month left before the end of this year.

Standing at this juncture, I always ponder a question: As stated in the subtitle of this section, looking ahead to China's auto market next year, assuming that strong trade-in and replacement subsidy policies continue, including the halving of the vehicle purchase tax for new cars, who will be the biggest beneficiaries?

Firstly, it's undoubtedly us, the ones holding onto our money and waiting.

From first-time buyers to upgrade users, undoubtedly, everyone can enjoy the benefits brought by these policies. To reiterate, "Consumers today are too lucky."

Because compared to the rigid seller's market of many years ago, the entire market has gradually shifted to a buyer's market. We have diverse options with high cost-effectiveness, coupled with policy incentives, making it indeed a good time to "buy a car".

Secondly, it's the autonomous passenger vehicle giants.

This year, as BYD's total sales are set to exceed the 4 million mark, and autonomous passenger vehicle giants including Geely, Chery, and Changan have collectively risen, they have collectively proven a truth: "When a big cake nurtured by policy is clearly present, it is always the strong who get the most."

Next year, thanks to the increasingly significant Matthew Effect, high-quality resources are destined to further concentrate among the top-tier members. Autonomous passenger vehicle giants will earn even more through policy dividends, capturing the largest share of China's auto market and consolidating their "moats".

In contrast, third place goes to the struggling joint venture brands.

In fact, since the retail penetration rate of new energy vehicles first surpassed the 50% mark in July, there has been no explosive growth in this indicator in August, September, October, and the ongoing November.

In other words, traditional fuel vehicles and new energy vehicles seem to be in a state of dynamic equilibrium. The "great collapse" of the former has not come as quickly as imagined.

Trying to analyze the reasons behind this, on the one hand, it is due to the frantic self-devaluation of traditional fuel vehicles, allowing some players to regain the attention of potential customers; on the other hand, this year's trade-in and replacement subsidies have also motivated many old car owners who are not interested in new energy vehicles to continue to stay in their original camps.

It is precisely based on this background that with the continuation of policies next year, joint venture brands with slower electrification transformation in China will gain a slight respite. By selling traditional fuel vehicles, they can "transfuse" funds for their own transformation.

Reading this far, some readers may think, "This model of constantly growing with crutches is extremely unhealthy." To this, I can only say, "You simply don't understand the strategic significance currently carried by China's auto market."

Emotionally and rationally, this sector cannot afford to fail. The reason why the national level spares no effort to protect it through various means is ultimately to usher in an even more splendid bloom.

As the article gradually approaches its conclusion, what I want to share last is that an email requesting suppliers to reduce prices for BYD passenger vehicles circulated widely on the internet this week. The email was titled "BYD Passenger Vehicle Cost Reduction Requirements for 2025" and was signed by He Zhiqi, Executive Vice President of BYD Group and Chief Operating Officer of Passenger Vehicles.

Instantly, it sparked discussions among everyone.

Soon, Li Yunfei, General Manager of BYD's Brand and Public Relations Department, responded in a post, "Annual price negotiations with suppliers are a common practice in the automotive industry. Based on large-scale bulk purchasing, we propose price reduction targets to suppliers, which are not mandatory requirements, and everyone can negotiate and move forward."

As an observer, I read a deeper meaning from this: Next year's China auto market is destined to become even more competitive. Driven by policies, the frontrunners are about to start their final harvest.

The decisive battle for the overall situation is about to begin...