Under the shadow of a $2.6 billion loss, Pony.ai lists below its IPO price

![]() 11/29 2024

11/29 2024

![]() 654

654

It is still difficult to judge whether Pony.ai can wait for the dawn of the industry.

@TechNewKnow Original

After years of continuous losses, Pony.ai finally completed its IPO on Nasdaq, claiming to be the first Robotaxi stock.

However, from a business model perspective, the performance of this company, founded in 2016, has been far from optimistic in the past three years (from 2022 to the first three quarters of 2024), with accumulated losses reaching $367 million, equivalent to approximately RMB 2.659 billion. The IPO valuation was $4.55 billion, nearly half of the $8.5 billion valuation two years ago.

As an epilogue before the listing, Pony.ai expanded its IPO size - from the originally planned 15 million ADS to 20 million ADS, an increase of 33.3%; the offering range was set at $11 to $13 per ADS. If the underwriters exercise their over-allotment option, the offering size will further increase to 23 million ADS.

However, Pony.ai's performance on the day of listing was quite intriguing, with its share price rising from the opening but falling below the issue price throughout the day. The closing price on the first day was $12, down 7.69%. The huge volatility seemed to indicate investors' divergence regarding the company. Furthermore, while optimists like Musk continue to set timelines for Robotaxi, the practical application of autonomous driving technology remains quite limited.

This can also be seen to some extent in the performance of another domestic autonomous driving leader, WeRide, which listed earlier. After listing, WeRide's performance can be described as barely satisfactory, with a recent weekly decline of about 13%. From an investor's perspective, the entire autonomous driving industry seems to require more time to achieve a true rise.

Furthermore, from the perspective of industrial structure and future expectations, such embarrassment seems likely to persist in the long term.

01

Striving to be the Chinese version of Waymo

Interestingly, both WeRide and Pony.ai seem to have intentionally positioned themselves as the first Robotaxi stock and the Chinese version of Waymo in their pre-IPO publicity. This reflects the industry's expectations for this popular direction.

Whether it's Musk's Tesla or the already operational Luobo Kuaipao, in the foreseeable blueprint, Robotaxi will be a super product that saves the industry. However, from a practical perspective, such visions and expectations have yet to find true buyers.

Specifically looking at Pony.ai's revenue, Robotaxi service revenue was $4.7 million in the first three quarters of 2024, while the corresponding autonomous trucking (Robotruck) business revenue was $27.4 million in the same period.

The main revenue driver has not become the company's label, while the secondary revenue source has become the "cloak" the company desperately wants to wear. To some extent, the company seems to intentionally convey that it will still rely on unrealistic "concepts" to maintain its valuation for a considerable period in the future.

Specifically comparing Pony.ai's two businesses, in the Robotruck direction, Pony.ai is operating a fleet of over 190 autonomous trucks, including self-operated and cooperative operations with Sinotrans, China's largest freight logistics company. The fleet has accumulated about 5 million kilometers of autonomous driving and transported over 767 million ton-kilometers in commercial operations. It has also collaborated with Sany Group to jointly develop L4 autonomous trucks.

In terms of Robotaxi, Pony.ai currently operates a fleet of over 250 Robotaxis. As of now, Robotaxi has accumulated over 33.5 million kilometers of autonomous road testing, including nearly 4 million kilometers of driverless road testing. In the first half of 2024, Pony.ai's fully driverless Robotaxis averaged over 15 orders per day per vehicle. As of the end of June 2024, Pony.ai's PonyPilot mobile app had over 220,000 registered users. As of the end of August 2024, about 70% of registered users used the app multiple times.

From a data perspective, the Robotruck business is clearly healthier, but the company still seems to want to convey the imagination space of Robotaxi, which has a large user base.

02

Profitability remains a challenge

A similar situation also exists with WeRide. According to WeRide's prospectus, its Robotaxi business revenue from 2021 to 2023 was not specifically listed separately, and the operating revenue of Robotaxi was classified under service revenue, indicating that this part of the revenue was relatively small and not significant.

However, time and huge costs are variables that cannot be ignored. In terms of R&D investment, Pony.ai's total R&D, sales, and administrative expenses amounted to $1.14 billion in 2023; WeRide's total R&D, sales, and administrative expenses amounted to $1.72 billion in 2023.

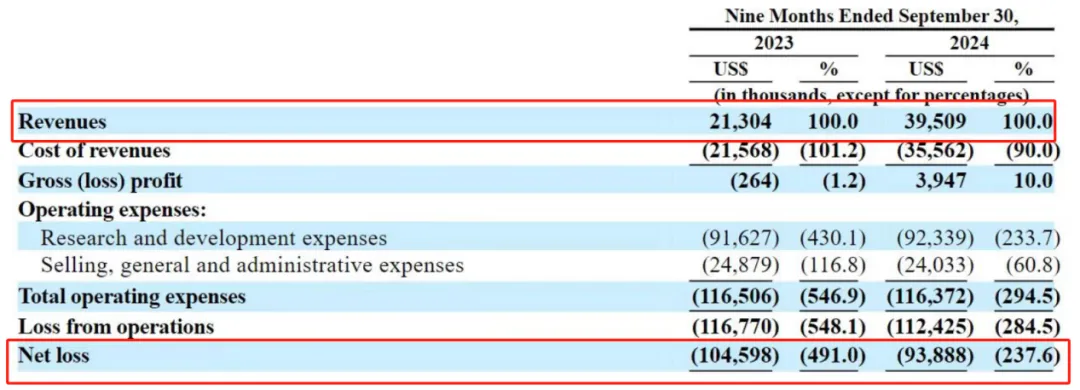

In terms of loss statistics, Pony.ai's net losses in 2022 and 2023 were $1.05 billion and $890 million, respectively, with a loss of $93.89 million in the first three quarters of 2024. WeRide's net losses in 2022 and 2023 were $1.3 billion and $1.95 billion, respectively, with cumulative losses exceeding RMB 5.1 billion from 2021 to the first half of 2024.

The two leading companies cannot conceal their narrowing losses. Furthermore, if domestic intelligent driving does not accelerate in its implementation, these two listed companies are likely to remain in a state of loss for a long time.

However, the good news is that Luobo Kuaipao seems to have made a good start this year, breaking the circle for the first time and showcasing the potential of intelligent driving to consumers. However, from another perspective, Luobo Kuaipao is more of a gimmick to attract traffic rather than a true replacement. On the other hand, Tesla, as a technology leader and industry leader, remains a sword of Damocles hanging over domestic autonomous driving.

Autonomous driving undoubtedly has a long way to go in the future, and it is still difficult to judge whether Pony.ai can wait for the ultimate dawn.

- The end -