8.1 billion dowry! Thalys “marries” Longsheng New Energy, turning the tenant into a landlord

![]() 12/01 2024

12/01 2024

![]() 607

607

Thalys has recently embarked on a "shopping spree" mode.

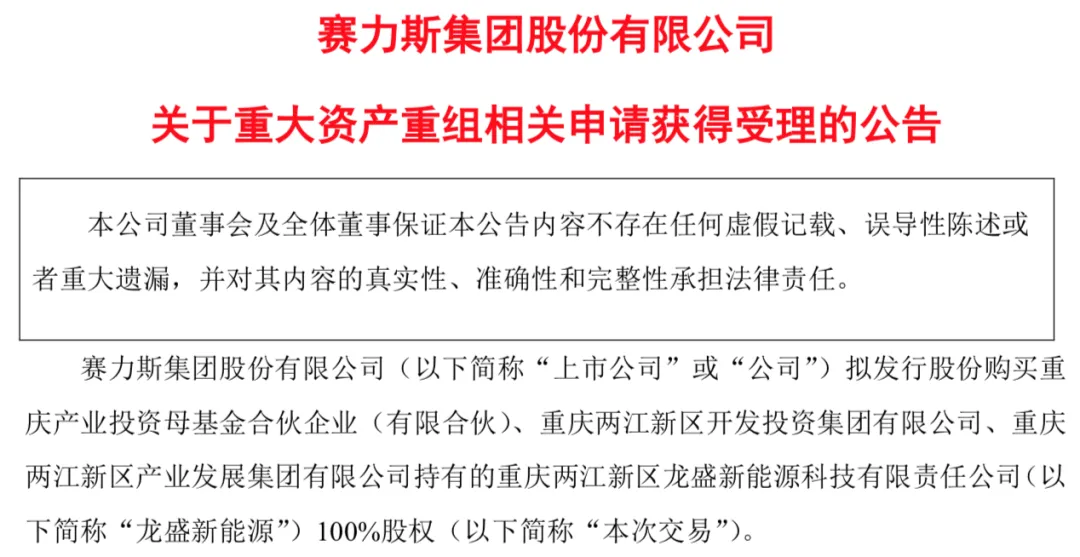

On the evening of November 26, Thalys announced that the company plans to issue shares to purchase 100% equity of Longsheng New Energy Technology Co., Ltd. The application was accepted by the Shanghai Stock Exchange on November 26, 2024, and reviewed in accordance with the law.

Source: Thalys

The total transaction value is 8.164 billion yuan. Before the transaction, Thalys mainly leased a super factory from Longsheng New Energy for the production of Wenjie series products. After the completion of the transaction, Longsheng New Energy will become a wholly-owned subsidiary of Thalys, and Thalys will obtain ownership of the super factory.

In layman's terms, Thalys and Longsheng New Energy were originally the tenant and landlord relationship, but later the two hit it off. Thalys spent 8.164 billion yuan as a dowry to marry the landlord, turning into the owner of the house.

Thalys' official announcement stated that after Longsheng New Energy becomes a wholly-owned subsidiary of Thalys, it can reduce the company's asset-liability ratio, optimize capital structure, and enhance anti-risk ability. At the same time, Thalys does not need to pay additional rent, which can reduce annual operating cash outflows. The saved funds can be further used for daily R&D and production activities.

In 2024, Thalys has frequently made capital deployments

What can solve worries? Only spending money.

Since entering 2024, Thalys has made continuous big moves.

In addition to announcing the acquisition of 100% equity of Longsheng New Energy, on July 2 this year, Thalys acquired 919 registered or pending textual and graphical trademarks of the Wenjie series and 44 related design patents held by Huawei for 2.5 billion yuan.

On August 9, Thalys acquired a 19.355% stake in Thalys Automobile Company held by Chongqing Jinxin Equity Investment Fund for 1.329 billion yuan. After the transaction was completed, Thalys Automobile Company became a wholly-owned subsidiary of Thalys with 100% ownership.

On September 20, Thalys announced that its wholly-owned subsidiary Thalys Automobile intended to purchase a 10.00% stake in Shenzhen Yinwang Intelligent Technology Co., Ltd. held by Huawei Technologies by paying cash. The transaction price was 11.5 billion yuan.

Source: HarmonyOS Intelligent Mobility

In addition, Thalys is also actively expanding its new dealer network, especially targeting luxury brand dealers such as Mercedes-Benz, BMW, and Audi.

Since July, multiple luxury brand dealers have contacted Thalys. Thalys provides flexible store opening policies, allowing dealers to prioritize the use of existing store resources to shorten renovation and opening cycles.

According to LatePost Auto, China's largest auto dealer, the Zhongsheng Group, is negotiating a preliminary agreement with Thalys. The two parties will further negotiate on cooperative distribution. The first AITO Wenjie user center under Zhongsheng opened on November 18 and was rebuilt from the former Fujian Benz 4S store of Zhongsheng. Currently, 28 of the top 100 dealers have Wenjie stores, and 9 have HarmonyOS Intelligent Mobility stores.

With Huawei's support, Thalys has left the novice village and begun to unleash its potential.

Accelerating shopping spree, Thalys weaves its own territory

Judging from various large-scale investment trends, Thalys is gradually enhancing its intelligent driving capabilities and market discourse power.

This is actually easy to understand. Everyone knows that Thalys relies on Huawei's empowerment, but if we extend the timeline, this strongly bound model still poses certain hidden dangers.

Last year, Thalys tried the effect of "de-Huawei." In March 2023, Thalys launched its own new energy vehicle brand - BluePower. The BluePower brand has launched three models: BluePower E5, BluePower E3, and the newly pre-sold BluePower E5 PLUS. However, according to data from Chezhijia, from January to October 2024, the cumulative sales of BluePower E5 models were 20,944 units, with 634 units sold in October, performing averagely.

Source: Thalys BluePower

The reason may be that under Huawei's glow, Thalys' brand awareness is poor, and due to its reliance on Huawei's channels, it lacks a comprehensive sales and service network.

In contrast, NIO, which is the benchmark for Wenjie, although facing many challenges, has advantages over Thalys as an independent brand with independent R&D capabilities and a relatively complete sales and service network.

Compared with its competitors, Thalys should also show investors and consumers the construction and improvement of its core competitiveness as soon as possible while pursuing short-term dividends from cooperation with Huawei.

Fortunately, from Thalys' series of investment actions, we can also see signs of Thalys' desire for change.

Reclaiming the Wenjie series trademarks, from Thalys' perspective, is to regain control of the Wenjie brand. In the future, Thalys can plan the development direction of the Wenjie brand according to its strategic goals. At the same time, after obtaining the Wenjie trademark, Thalys can focus more on automobile manufacturing without worrying about changes in the cooperative relationship with Huawei.

Source: Wenjie

In addition, Thalys has plans to go overseas, while Huawei is restricted in some overseas regions due to well-known reasons, which may expose the Wenjie brand to the risk of sanctions in overseas markets, thereby affecting product promotion and sales. After Thalys reclaims the Wenjie trademark, as an independent brand owner and manufacturer, the risk of interference from external factors during the overseas expansion process is relatively small.

The acquisition of a 10% stake in Yinwang is to make up for deficiencies in intelligent driving. As an independent entity after Huawei's BU split, Yinwang carries Huawei's core technologies and resources in the fields of intelligent driving solutions, smart cockpits, and intelligent automobile digital platforms for automobiles.

Thalys' investment in Yinwang aims to grasp the core resources for competition in the second half of the intelligent era, thereby better coping with market competition. In addition, after acquiring its equity, Thalys will have a greater say in related business decisions and development directions, further enhancing its influence and control over the Wenjie brand.

It is easy to understand the acquisition of 100% equity of Longsheng New Energy, mainly to ensure the safety, stability, autonomy, and controllability of the company's product production end. After all, we have seen too many stories of sales being hindered by limited production capacity.

It can be seen that each move Thalys makes has a logical basis: acquiring Longsheng New Energy to strengthen control over the production end; acquiring a 10.00% stake in Yinwang to grasp the core resources of intelligent competition; acquiring the Wenjie series of textual and graphical trademarks to strengthen discourse power and layout overseas markets.

Now that the chessboard is set, it remains to be seen whether Thalys can "enter the game and win half a move over heaven."

After making up for its shortcomings, Thalys heads towards the stars and the sea

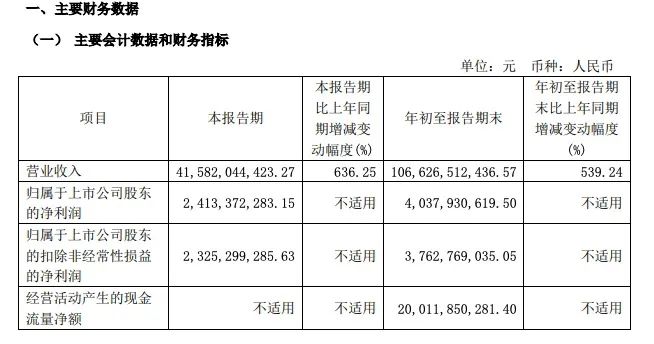

Thalys' financial report shows that in the first three quarters of 2024, Thalys' revenue was 106.627 billion yuan, a year-on-year increase of 539.24%; the net profit attributable to shareholders of listed companies was 4.038 billion yuan.

In terms of sales volume, Thalys sold a total of 369,400 vehicles in the first three quarters, a year-on-year increase of 170.07%. Among them, sales of new energy vehicles were 316,700 units, a year-on-year increase of 364.23%, and sales of Thalys vehicles were 293,000 units, a year-on-year increase of 625.34%.

Source: Thalys Announcement

In addition to the double growth in revenue and sales volume, the financial report also shows that Thalys' R&D expenses in the first three quarters of this year were 4.368 billion yuan, a year-on-year increase of 300.37%.

In May this year, Zhang Xinghai, Chairman of Thalys, stated at the National Youth Entrepreneurs Conference that Thalys' cumulative core R&D investment had exceeded 12 billion yuan, mainly invested in three-electric technology, range extension technology, electronic and electrical architecture, intelligent driving, and other areas.

On November 12, Zhang Xinghai also stated at the 31st Annual Conference of the China Society of Automotive Engineers: "I once said that I was afraid of being poor, but in fact, I was afraid of being technically poor."

Thalys is well aware of the importance of R&D and attempts to find its own value through technology. In fact, Thalys is a technology-driven company. For your information, although the mention of range extension now immediately brings to mind NIO, Thalys was actually one of the first enterprises to invest in range extension technology research and development.

As early as 2016, Thalys began investing in and deploying range extension technology research and development, and it would not be an exaggeration to say that it is a pioneer in range extension technology. Its self-developed new-generation Thalys super range extension system has an actual efficiency of over 3.6kWh/L, equivalent to generating more than 3.6 kWh of electricity from 1L of fuel, which can reduce comprehensive fuel consumption by 15% and reduce noise perception by 90%.

In contrast, NIO equips its vehicles with a 1.5T four-cylinder turbocharged gasoline engine as a range extender. In terms of power generation efficiency, there is still a certain gap between NIO and Wenjie's new-generation super range extension system.

Source: Thalys Official

In addition, Thalys has independently developed the Mofu platform, which is currently the only complete vehicle platform in the industry that can be compatible with three new energy power forms: super range extension, pure electric, and super hybrid. It supports full-size and full-model expansion from B-class to D-class, as well as from sedans to SUVs and MPVs.

It is unknown how many "fish" are still in the technology "pond." In short, Thalys' trump card is not only Huawei. These self-developed technologies will become Thalys' trump card at the new energy table in the future.

Against the backdrop of intensifying competition in the new energy vehicle industry, can Thalys solidify its position in the first tier in the future? Please forgive Electric Vehicle News, as a small witness to the centennial transformation of the automotive industry, from giving an accurate answer. However, from Thalys' ESG rating, we can roughly judge.

Unlike corporate financial reports, ESG is essentially not an evaluation system for financial factors but focuses on the common development of the interests of enterprises, users, and society. If financial reports allow investors to see a company's operating conditions, ESG can predict future corporate governance and risk management, indirectly revealing a company's future possibilities.

Source: Wind ESG Rating

Recently, Wind released the "2024 Wind China Listed Company ESG Best Practices Top 100" list. With its outstanding performance in environmental, social, and governance aspects, Thalys successfully made the list with an ESG rating of AA and ranked first in the automobile manufacturing industry.

This also indirectly shows that Thalys' future possibilities are positive.

It must be acknowledged that there is still a significant gap between Thalys and world-class OEMs. As a new force, Thalys has not yet formed its brand culture and unique values. For example, BMW emphasizes driving pleasure, while Volvo focuses on safety. These brand concepts are deeply rooted in people's minds. In contrast, Thalys is relatively weak in shaping and disseminating its brand culture and values, and has not yet formed a distinctive, unique, and highly recognized brand image in the minds of global consumers.

However, as Thalys makes up for its shortcomings, the gap with world-class OEMs may be significantly shortened. Take your time and let the bullets fly for a while.

Cover image source: Thalys

Source: Lei Technology