Electric vehicle technology will face a new round of elimination within 6 months

![]() 12/02 2024

12/02 2024

![]() 654

654

The main focus from 2023 to 2024 is selling cars, but in 2025, it will shift to knocking out the competition.

There are two ways to knock out the competition: one is to continue price wars, such as BYD and SAIC MAXUS recently proposing a 10% decrease in annual procurement premiums with suppliers, similar to what other Chinese brands have done in 2023. The second is to launch surprise attacks on competitors through technological innovation, like BYD's current all-in approach to intelligent driving, the integration of its intelligent driving team, and the self-development of an 80 TOPS computing power chip, which were preemptively exposed by the media.

Only after knocking out the competition and gaining market dominance will the turning point for profit recovery come. This is similar to the rise of the Internet+, Didi and iQIYI, and smartphones and mobile internet. Price wars are full of uncertainties, but technological wars are visible.

"I'm afraid of being asked a question when selling cars recently. I saw a new model online for next year, and it looks like there are significant upgrades. Is what's said online correct?" A year ago, Liu Zhang didn't feel anxious about such questions when selling phones in a specialty store because he could easily deflect them by saying, "There's been another price drop of 300 yuan recently. You can save 1,000 yuan compared to the new model next year." But now, a year later, after switching from selling phones to cars, he's less confident in responding with the early-bird discount argument.

Because cars often cost hundreds of thousands of yuan, and the cost consumers have to bear is much higher than the few hundred or a thousand yuan for a phone, causing much greater pain.

Will the intelligent driving system I buy now be outdated in 6 months?

What makes it difficult for Liu Zhang to respond are the potential intelligent upgrades of the revised models and the likely power upgrades of the new models. An inappropriate response could lead to losing a sale and failing to win over the consumer.

Most mainstream brands in the entire automotive market face these two homogenization issues.

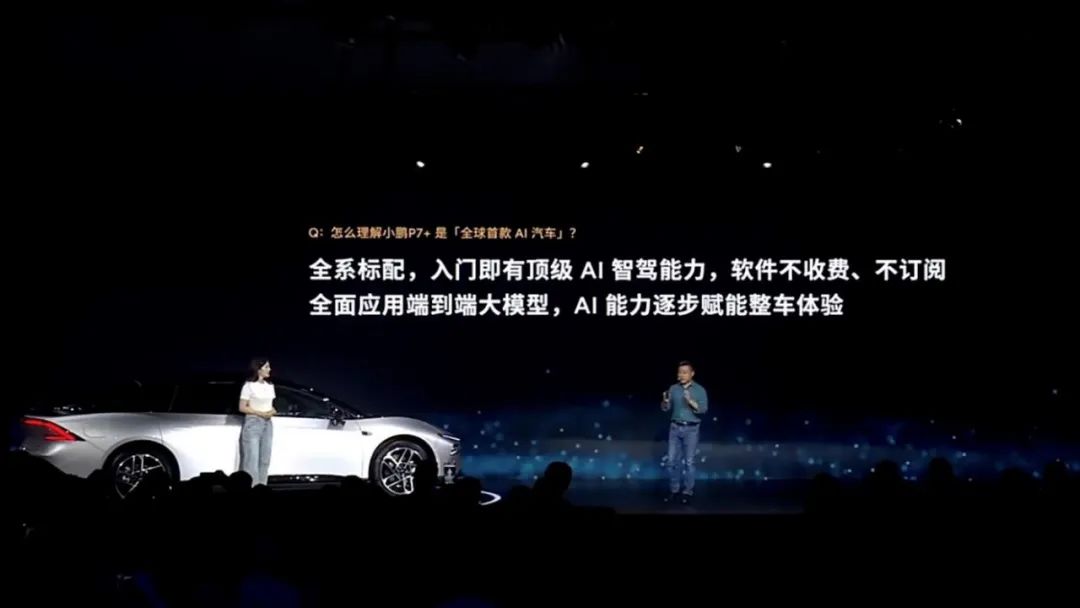

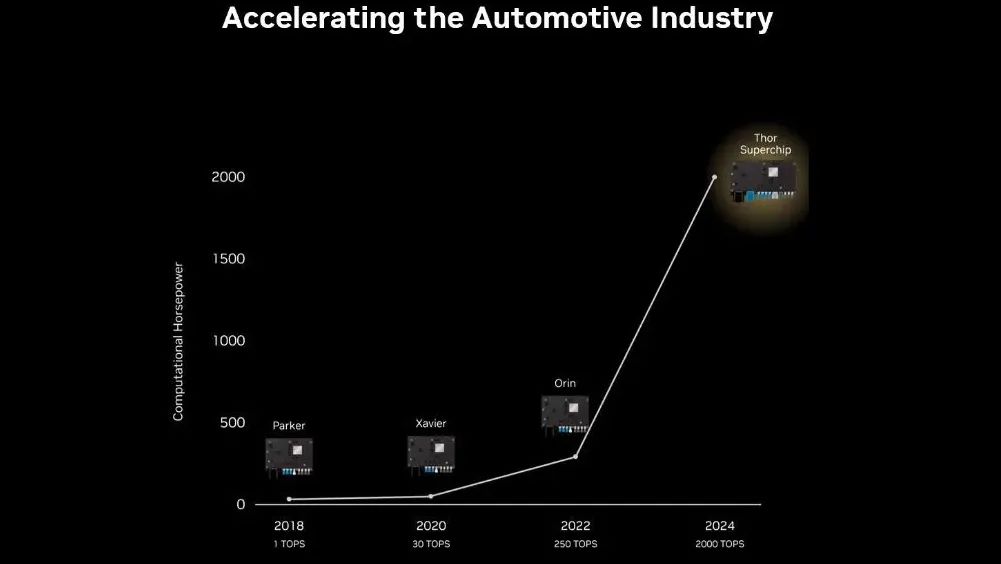

In the area of intelligent driving, there will likely be a global reshuffle, mainly due to the entry of NVIDIA's Thor chip. This is similar to the smartphone era, where without self-developed and self-produced (or contract manufacturing partner) capabilities, one can only wait for the first launch of chips like Qualcomm's.

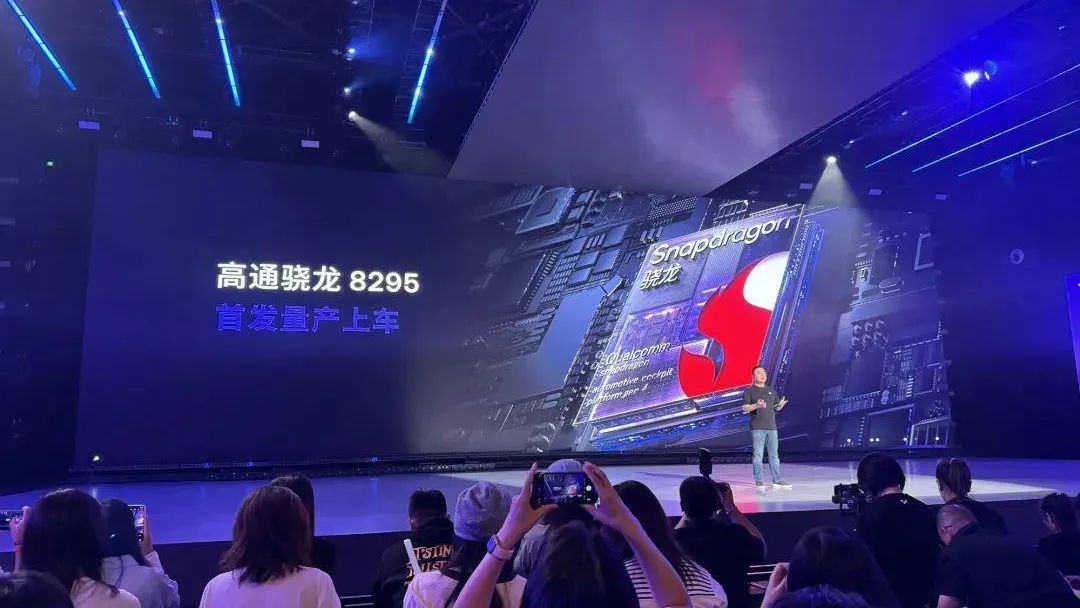

In the tech world, securing the first launch of a Qualcomm chip is considered the core technology of major Android phone manufacturers. In the automotive market, this scenario has been playing out for over two years and will intensify starting in 2025.

Great Wall Motors secured the first launch rights for the 8155 chip after choosing Qualcomm's full intelligent driving solution. For the 8295 chip, the winner was the Geely group, from the Geely ZEEKR 001 to the ZEEKR brand and Geely Galaxy E8. For intelligent cockpits, companies compete for Qualcomm chips, while for intelligent driving, they compete for NVIDIA chips, from Orin to Orin-X and subsequent Orin-N.

The competition for the first launch of chips doesn't necessarily mean high sales. For example, the ZEEKR 001, which was the first to launch with the 8295 chip, averaged less than 1,000 sales per month in the first half-year after its launch. Similarly, the Denza N7, which was the first to launch with Orin-N, saw its monthly sales drop from over 1,000 to 320 in the sixth month after its launch. However, looking at today's mainstream best-selling cars, especially relatively high-end models and sales dark horses, these popular names are not absent. The same is true for Li Auto, NIO, XPeng, Weltmeister, ZEEKR, Geely, and Mercedes-Benz.

However, by the critical node of 2025, if there is a fight for new chip sectors, it is not a low probability event that a chain reaction of sales collapses will occur.

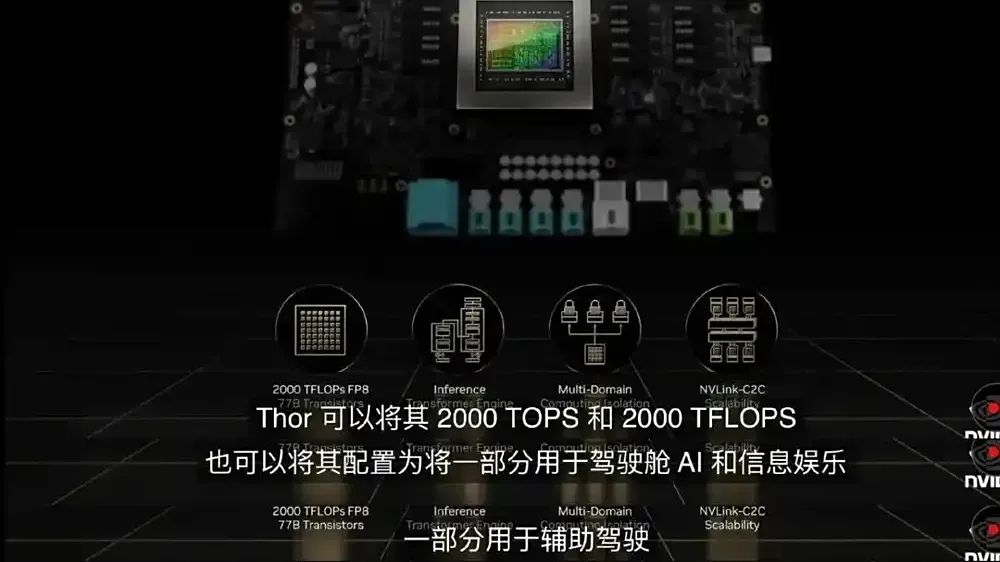

Originally, NVIDIA planned to launch the Atlan chip with a single computing power of 1,000 TOPS to succeed the Orin chip with a single computing power of 254 TOPS. However, this has been changed to launching the Thor chip with a maximum computing power of 2,000 TOPS one year later. According to the latest news, Thor will start being installed in vehicles as early as the end of April 2025, with the global first launch on the ZEEKR brand, which paid a high price this year to quickly switch to the Haohan Intelligent Driving 2.0 system, even at the expense of betraying early adopters.

From a computing power perspective, the current mainstream dual-Orin-X chips have a total computing power of 508 TOPS, supporting up to Level 3 autonomous driving. However, the Thor chip to be launched in 2025 will be a Level 4 computing power chip. If automakers use a dual-chip structure, the maximum computing power can reach 4,000 TOPS, seven times that of the current system.

The price of the new chip may not be much higher than the current one. According to recent statements by XPeng Motors personnel online, due to continuous delays in the delivery of Thor chips, the XPeng P7+ missed the opportunity to integrate them and instead uses dual Orin-X chips. Considering that the XPeng P7+ has entered the market as a cost-effective killer, the increase in costs for automakers is relatively limited.

Mainstream L2+ intelligent driving technology will soon be obsolete

Moreover, it's not just the new chip and its computing power that make existing technologies obsolete. It also includes more software and hardware. The Thor chip has confirmed multiple derivative versions: the 1,000 TOPS Thor X, the 700 TOPS Thor S, the 500 TOPS Thor U, and the 300 TOPS Thor Z, with a top version providing up to 2,000 TOPS of computing power.

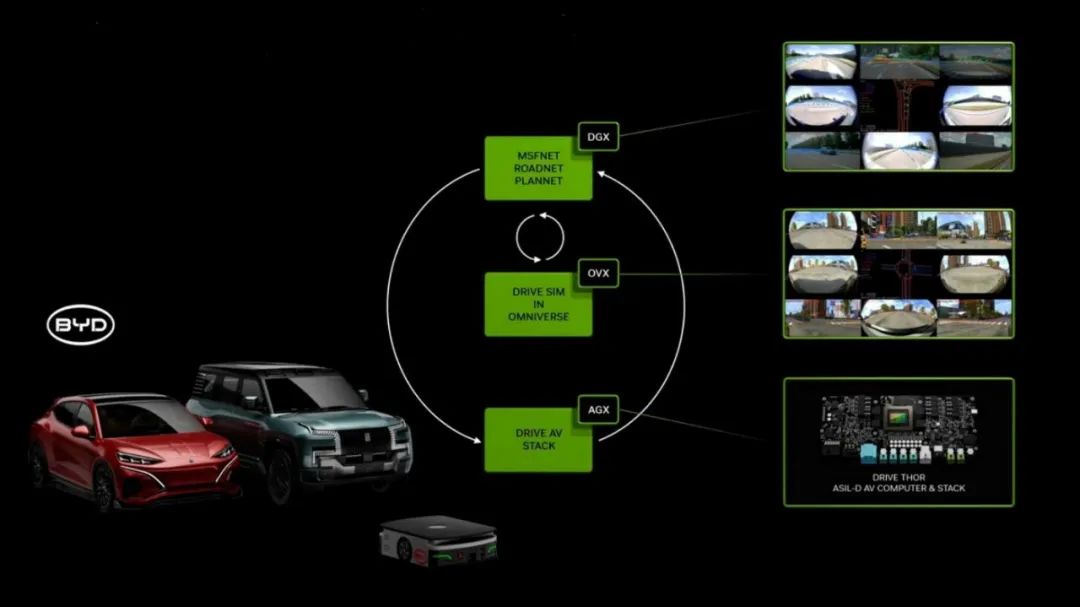

Regarding Thor's vehicle integration plans, the list of automakers will include ZEEKR, Li Auto, AITO, Geely ZEEKR, Chery, XPeng, and more. The current impact is much broader than the Orin era. In addition to the aforementioned automakers, it will also affect BYD.

BYD's contact with NVIDIA's Thor was early and in-depth, and it is already advancing related peripheral research and development at the IDC Intelligent Driving R&D Center. It will also affect Momenta, which provides solutions for many joint venture automakers, as its next round of new technology applications will also be based on Thor.

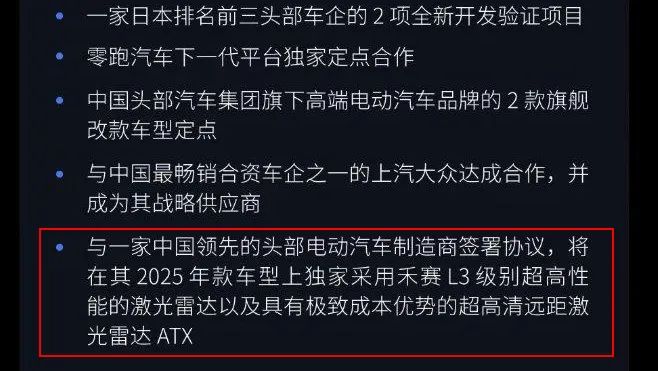

In addition, changes in hardware also include lidar. In Li Auto's recent debunking, Hesai's financial report announced that it will soon provide thousand-yuan-level lidar to China's leading new energy vehicle companies in 2025, as well as a high-end version of the radar that supports high-speed Level 3 autonomous driving. Although Li Auto denied being the company Hesai referred to, there is no doubt that the standard configuration of lidar will further increase in the new products of leading electric vehicle manufacturers, and even car prices may continue to decline.

For consumers, the general situation will be that the high-end version of cars purchased this year can achieve L2++++ autonomous driving functionality, but by 2025, these features will be available on the same models in cheaper mid-range versions. High-end models purchased at the same price in 2025 will directly offer quasi-Level 3 autonomous driving functionality.

Moreover, this will not only affect ordinary people but also Huawei's Zenith S800, which was showcased at a recent press conference. Although it was only mentioned as being developed based on a Level 3 autonomous driving architecture, the underlying meaning is clear. While no one can currently sell new energy vehicles well above 1 million yuan, adding the words "Level 3 autonomous driving" will create at least a 500,000-yuan premium space.

This means that the dividing line for top luxury cars will emerge in 2025.

Almost everything indicates that the models with urban NOA assistance features purchased in 2024 will not only become increasingly popular in 2025 but will also undergo significant screening and elimination due to the excessive computing power brought by Thor.

Interestingly, due to the current prevalence of pure vision technology, combined with high computing power and large models, car prices are also expected to continue to decline.

Additionally, the reshuffle will also include plug-in hybrids and extended-range electric vehicles, and the patterns are clear.

The trend in the plug-in hybrid sector is that each new entrant exceeds the previous mainstream standards in terms of fuel economy and range. BYD launched its fifth-generation DM system in 2024, demonstrated on the Qin L, with a fuel consumption of 3.8L-3.98L/100km under the NEDC test cycle. Geely, which launched the EM-i system half a year later, further reduced this figure to below 2.7L/100km under the CLTC test cycle, with a thermal efficiency of 46.5%, outperforming BYD's 46.06%. Another indicator is the Geely Galaxy Starship 7's maximum combined range of 2,390.5km with a full tank and full charge, exceeding BYD by nearly 300km.

In 2025, players in the plug-in hybrid sector will also include Chery and Volkswagen, among others. The pace will be similar to the competition between Geely and BYD, with further downward exploration to new lows. Chery's approach is also differentiated competition. Geely focuses on using a 1.5L naturally aspirated engine for family-oriented vehicles with rigid demand, while gradually introducing 1.5T and 3DHT equipment for models that emphasize performance. BYD follows a similar strategy, with DM-i engines available in 1.5L and 1.5T versions, along with a more powerful DM-p version with a stronger electric motor.

However, Chery currently only uses one strategy for its newly launched plug-in hybrid models: the C-DM system, which uses 1.5T engines across the board. Compared to Geely and BYD, this approach is powerful but straightforward, and the pricing is strategically positioned between Geely's and BYD's 1.5L and 1.5T models. For example, the starting price of the C-DM version of the Tiggo 7 is set at 119,900 yuan, which was previously the price range for entry-level versions like the BYD Song Pro DM-i.

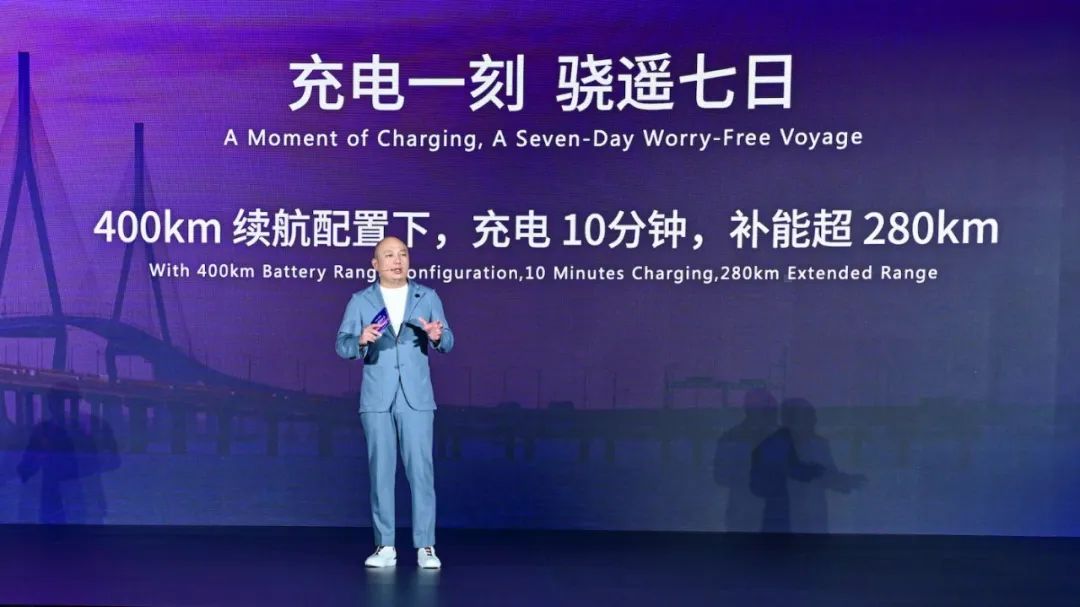

The technological obsolescence of extended-range electric vehicles (EREVs) is already happening. The main reason behind this is CATL, with its strong technological innovation capabilities, launching a new battery specifically for EREVs by the end of 2024. According to CATL's announcement at the press conference, the new battery can provide a maximum pure electric range of 400 kilometers and support 4C fast charging, which allows for a range extension of 280 kilometers in just 10 minutes. Additionally, it optimizes the previous issues of EREVs, such as limited power output, slower acceleration, and longer acceleration times at low battery levels. Moreover, due to its new formulation of mixed sodium and lithium, it also addresses the issues of low-temperature charging and battery drain in winter.

Compared to current mainstream EREVs, this is almost a generational leap in experience. Comparing HiCar and Li Auto, both leaders in sales and technology, the official charging time for the HiCar M7's battery is 20-30 minutes, while the Li Auto L6 can fully charge in 20 minutes, highlighting the difference between 3C and 4C charging speeds.

In other words, comparing the mainstream plug-in hybrids and EREVs currently available with the new technologies to be introduced in 2025, the energy consumption gap will be 5% or even higher, and the charging speed difference for EREVs will be 10% or even more.

Final Thoughts

Ultimately, automotive products, which have deeply integrated the logic of digital products, have truly entered the era of annual major upgrades. Moreover, the pace of progress is much faster than before. This leads to a new conclusion for automotive consumers: if one is simply looking for a means of transportation, they only need to focus on models that meet their usage needs and wait for price drops. When the price reaches the expected level, there is no need to hesitate.

However, for those who are increasingly seeking new features and technologies in vehicles, the choice will be very difficult. This is because the new models introduced each year, equipped with the latest chips and batteries, will show significant improvements over the current models, and their prices may even decrease.

Whoever has the technology will have the right to speak, and this will be a long-term competitive advantage. There are two typical examples: NIO, which supports battery swapping and has high intelligence, has further increased the average transaction price of its vehicles to around 330,000 yuan in 2024. The NIO ES6 has surpassed the BMW X3 and Audi Q5L.

The same is true for Li Auto, which has been the top-selling Chinese brand passenger car priced above 200,000 yuan for eight consecutive months, penetrating into the core market of BBA. Coupled with the introduction of a new round of three-year zero-interest rate policies, its sales growth potential will be evident within a month.