Lidar: Reduce prices and survive!

![]() 12/03 2024

12/03 2024

![]() 663

663

Recently, Hesai Technology plans to halve the price of lidar next year, aiming to make lidar more widely used in electric vehicles.

According to Hesai CEO Li Yifan, halving the price will make lidar attractive for use in low-cost electric vehicles priced below 150,000 Chinese yuan (about $20,000). For electric vehicles priced above 150,000 yuan, the adoption rate of lidar technology may jump to 40%.

The first shot in the price war was not fired by Hesai recently.

It can be said that lidar prices have been declining over the past few years. In 2019, the average selling price of Hesai's lidar was $17,400, roughly equivalent to 120,000 Chinese yuan. In January of this year, Icing Tech shouted the slogan, "lidar for all, entering the thousand-yuan era."

Over five years, prices have dropped from ten thousand yuan to one thousand yuan, reflecting lidar manufacturers' struggle to "survive."

01

"Sunrise in the east, rain in the west"

The global status of the lidar industry can be described as "dark on the west, bright on the east."

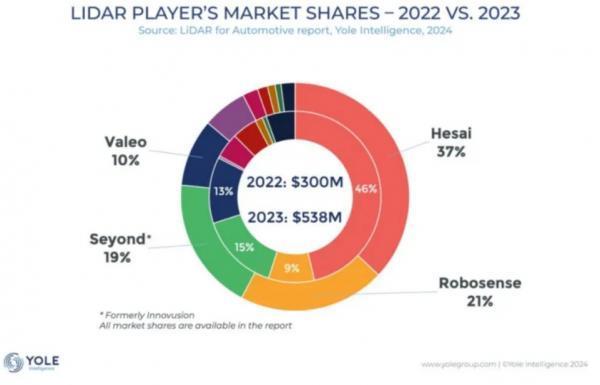

According to the global automotive lidar market report released by YOLE Group, the global automotive lidar market share was $538 million in 2023, a year-on-year increase of 80%.

The top nine vendors are: Hesai Technology (37% market share), Robosense (21% market share), Seyond (formerly Innovusion, 19% market share), Valeo (10% market share), Huawei (6% market share), Waymo (2% market share), Livox (1% market share), Ouster (1% market share), and Luminar (1% market share).

Chinese lidar suppliers collectively hold 84% of the global market share.

However, despite the sunrise in the east, lidar manufacturers have consistently suffered losses. Industry leader Hesai Technology lost 476 million yuan last year and lost 107 million yuan, 72 million yuan, and 70 million yuan in Q1, Q2, and Q3 of this year, respectively. Second-place Robosense lost 4.337 billion yuan last year and 269 million yuan in the first half of this year.

The turbulent fate of lidar manufacturers is a microcosm of the controversy surrounding lidar technology itself.

"Do we really need lidar?"

There are two distinct paths in the development of autonomous driving: one is Tesla's pure vision-based solution, which relies primarily on cameras and AI to obtain road condition information; the other is multi-sensor fusion, installing various sensors such as cameras, lidars, and millimeter-wave radars on vehicles.

The reasons for corporate losses are straightforward: large R&D investments, high mass production costs, and industry price wars. These three points all apply to lidar.

First, R&D investments are significant. Hesai Technology invested 791 million yuan in R&D in 2023, a year-on-year increase of 42.4%, accounting for 42.1% of total revenue. In the third quarter of 2024, R&D investment was 222 million yuan, an increase of 14.3% compared to the same period in 2023.

Robosense's R&D investment accounted for 56.7% of total revenue in 2023 and about 42.6% in the first half of 2024.

Second, costs are high. As the most efficient and accurate 3D imaging tool currently available to humans, lidar is indeed expensive. GF Securities previously reported that in 2021, vehicle models equipped with lidar generally cost more than 400,000 yuan, and the price of pre-installed vehicle lidars generally exceeded 5000 yuan. This resulted in limited space for lidar in vehicles in previous years, with it mainly being installed in mid-to-high-end models.

Finally, there is the price war. The continuous expansion of domestic lidar manufacturers' scale is closely related to the brutal reality of "compensating for price reductions with volume." According to Guolian Securities' estimates, the average price of lidars used in ADAS (Advanced Driver Assistance Systems) will fall by 15.56% year-on-year to 3800 yuan in 2024.

The unit price of Robosense's products has decreased year by year. From 2021 to 2023, the price of Robosense's lidar dropped from 10,000 yuan to 4300 yuan and then to about 3200 yuan. In the first quarter of 2024, the average unit price of its ADAS lidar further dropped to about 2600 yuan.

The price war is not limited to lidar manufacturers; automakers on the application side have also joined the fray. BYD Chairman and CEO Wang Chuanfu has publicly stated, "We have many technologies that will be gradually applied, such as lidar. If the market price is 3000 yuan per unit, our cost may only be 900 yuan."

Judging from the choices of automakers, Huawei removed lidar from the basic version of the Wenjie M7 PRO intelligent driving solution; XPeng launched a new generation of XPeng AI Eagle Eye vision solution; Geely Auto released the ASD intelligent driving solution with "pure vision + end-to-end large model"; NIO's second brand Letao's first model L60 is equipped with a pure vision solution; Baojun Yunhai has achieved city memory navigation and highway navigation with a binocular pure vision solution.

Intense price wars and high R&D costs. This is why in September this year, Mobileye announced that it had decided to terminate the internal development of the next-generation FMCW lidar for driving assistance and fully autonomous driving systems. Mobileye plans to close its lidar R&D department by the end of this year.

As early as 2020, Bosch began developing lidar, announcing the launch of a lidar specifically designed for automobiles to enhance autonomous driving safety. However, by 2023, Bosch suddenly announced that it would abandon self-developed lidar.

Before 2023, many lidar companies failed to survive funding and went bankrupt. In October 2022, Ibeo, the German developer and pioneer of lidar, filed for bankruptcy due to the inability to obtain further growth funding; in November, two listed lidar companies, Velodyne and Ouster, confirmed a full-stock merger to improve cash flow; in December, Quanergy, a lidar manufacturer that had only been listed for ten months, declared bankruptcy, initiated a business sale process, and laid off almost all its employees.

02

Three paths to survival

Nowadays, whether to meet market demand or to "survive," lidar manufacturers have taken different paths.

The first path is technological upgrading. In the first half of the year, Hesai Technology released the new high-performance long-range lidar ATX, a compact ultra-wide-angle long-range lidar based on the fourth-generation chip architecture, targeting L2+ intelligent driving applications. As an upgraded version of the main product AT128, ATX is 60% smaller and 50% lighter, achieving a longer detection range, better resolution, and a broader field of view, while reducing costs by 20% to 30%.

In April this year, Robosense released the new generation of medium-to-long-range lidar MX, equipped with Robosense's fully self-developed dedicated SoC chip M-Core and using the same 2D MEMS scanning chip as the M platform. It also achieved chip iteration and upgrading of the transceiver system, making it a masterpiece of lidar chip design and leading the industry into the "thousand-yuan era" by pricing lidar below $200 for the first time.

Seyond also newly launched the third-generation image-level ultra-long-range main view lidar Falcon K3 and the ultra-wide-angle lidar Robin D, becoming one of the few companies in the industry that have successfully matured both 1550nm and 905nm technology routes.

The second path is manufacturing upgrading. Lidar is essentially still a manufacturing industry, where larger scale leads to lower average costs. Now, leading lidar manufacturers have chosen the path of product platform production and self-developed chips, significantly contributing to cost reduction.

Looking at the current mainstream lidar manufacturers, Robosense has formed three major platforms: the M platform, E platform, and R platform; Seyond has the Falcon and Robin platforms; and Hesai Technology also has a mature AT series platform architecture design.

Since May 2020, Hesai has been building the "Maxwell" smart manufacturing center at a total cost of nearly 1 billion yuan. Currently, the production line has an annual planned capacity of 1.5 million units, with one lidar coming off the line every 40 seconds. Seyond has highly automated production lines in Suzhou, Deqing, Pinghu, and other places, with an annual production capacity of nearly one million high-performance lidars.

The third path is switching tracks. Although they claim that the automotive sector is still a priority, some lidar manufacturers have already turned to businesses such as industry and robotics.

According to Robosense's third-quarter report, the gross margin of ADAS products was 14.1%, while that of robotics products was 34.6%, significantly higher. Robosense believes that the robotics business will become a new growth engine, and the number of its partners in the robotics field has grown to 2600. Robosense expects that its lidar shipments in the robotics field next year "will likely exceed six figures," that is, over 100,000 units.

Wanji Technology's lidar has been widely used in industrial robots such as AMRs, AGVs, and forklifts, as well as service robots for commercial guidance, delivery, disinfection, cleaning, and inspection, and it continues to supply multiple leading companies.

Super Star Technology has focused on lidar business since 2016. Its controlled subsidiary Hangzhou Oulai Laser Technology Co., Ltd. has a strong brand influence and technical strength in the domestic industrial robot lidar field, and its exports of industrial robot lidars rank first among domestic brands.

Research shows that driven by the increase in robot shipments and the number of lidars installed per robot, the lidar market has also "risen with the tide" in recent years. It is expected that the global robot lidar solution market will grow rapidly at a compound annual growth rate of 50.6%, and the market size is expected to reach 216.2 billion yuan by 2030, with the Chinese market accounting for an estimated 31.8%.

03

When will profitability begin?

In the first half of 2024, the installation rate of lidar in new energy vehicles in China was approximately 10% to 13%. That is, about one out of every ten new energy vehicles is equipped with lidar.

Looking at individual companies, the trend of lidar market explosion is evident. According to Robosense's semi-annual report, the company sold 243,000 lidar units in the first half of this year, a 415.7% increase from the same period in 2023. Hesai Technology's semi-annual report showed that it delivered 146,000 lidars in the first half of the year, a year-on-year increase of 67.5%.

All major manufacturers are striving to achieve profitability, with Hesai Technology showing a positive trend in this regard.

On November 26, Hesai Technology released its third-quarter 2024 financial data, reporting revenue of 540 million yuan, a year-on-year increase of 21.1%. The quarterly total lidar deliveries reached 134,208 units, a significant year-on-year increase of 182.9%.

At the earnings presentation, Hesai Technology co-founder and CEO Li Yifan stated that the company's gross margin for the year is stable, and the gross margins for the third and fourth quarters are expected to be close to 40%. When asked about when the company expects to achieve break-even, Li Yifan said that with cost control and economies of scale, Hesai expects to approach profitability in the fourth quarter of 2024 and is optimistic about profitability in the second half of 2024.

In the third quarter of 2024, Robosense sold a total of 138,600 lidars, a dramatic increase of 224% year-on-year and 12.7% quarter-on-quarter. Among them, sales of products for ADAS (Advanced Driver Assistance Systems) accounted for nearly 95% of total sales at 131,400 units, becoming the main engine of sales growth.

Regarding when Robosense can achieve profitability, the company has repeatedly stated its position publicly. During the release of its semi-annual report this year, Robosense CEO Qiu Chunchao stated that the company expects to achieve profitability in a quarter of 2025 and potentially for the full year in 2026.