Li Auto's sales decline again in November, posing challenges to its annual target

![]() 12/03 2024

12/03 2024

![]() 446

446

"Li Auto has repeatedly revised its annual sales target downwards, and based on the current delivery situation, there is still a gap from the annual sales target."

@TechNews Original

The November "report card" for new energy vehicles has been released, with Li Auto experiencing a month-on-month decline for two consecutive months!

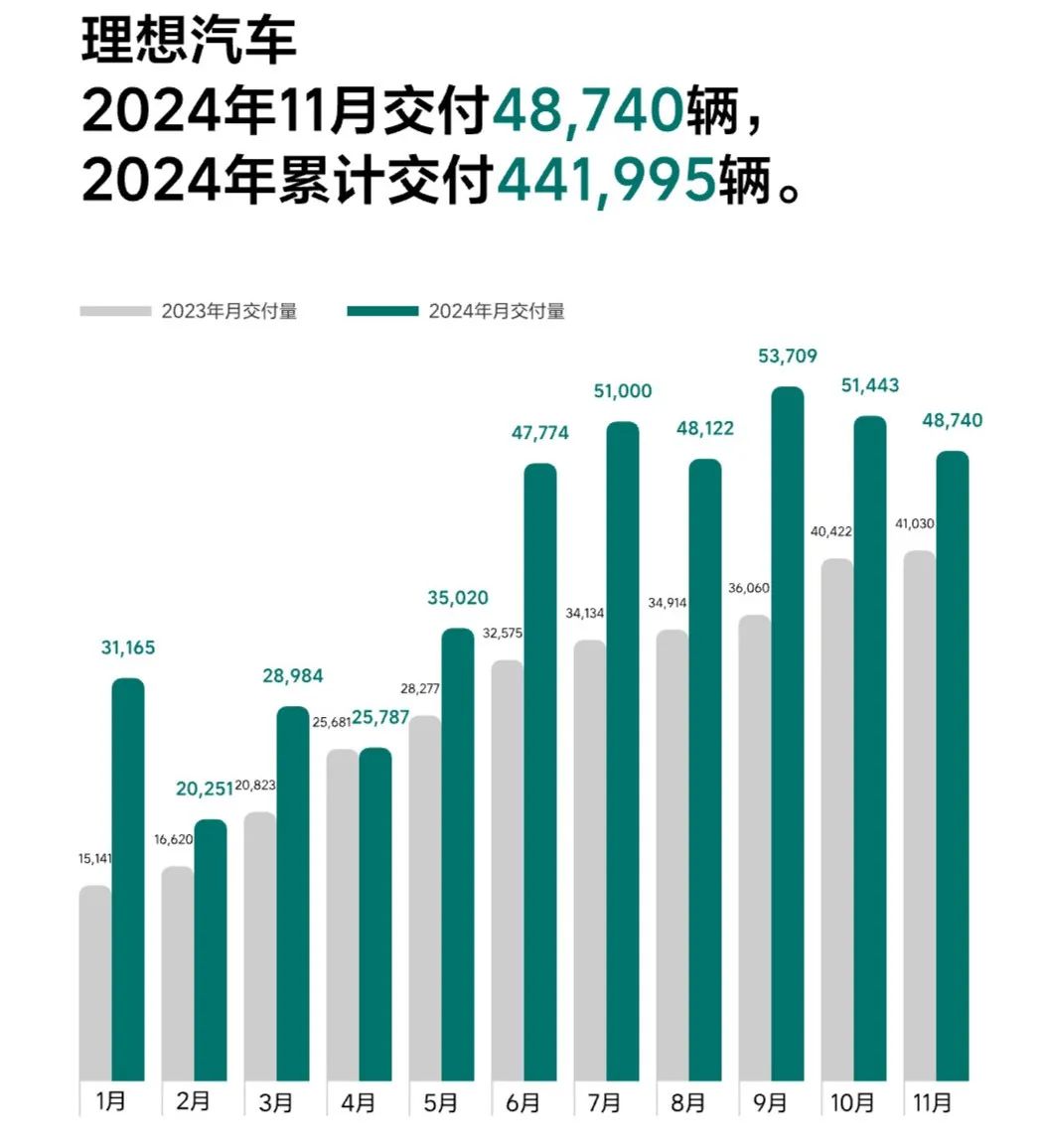

On December 1, multiple A-share listed automotive companies released their delivery performance for the previous month. Among the emerging auto companies, Li Auto continued to lead in deliveries. Li Auto delivered 48,740 vehicles in November, a year-on-year increase of 18.8% but a month-on-month decline of 5.25%, marking the second consecutive month of decline. As of the end of November, Li Auto had delivered a cumulative total of 441,995 vehicles this year.

In an effort to achieve its annual sales target, Li Auto has been "sparing no effort" and has repeatedly revised its annual sales target downwards, from the 800,000 vehicles announced in February to a revised guidance of 560,000 to 640,000 vehicles in March, and then to a confident commitment during the second-quarter earnings call to deliver 500,000 vehicles for the year. Based on the current delivery situation, Li Auto still has a gap to reach its annual sales target of 500,000 vehicles.

However, as the year-end approaches, Li Auto is still going all out to boost sales. On the morning of November 29, Li Auto officially announced its end-of-year promotion policy. From now until December 31 of this year, customers purchasing Li Auto vehicles will enjoy a 3-year interest-free financing plan. It is worth noting that Tesla, NIO, and other automakers have already launched price reduction activities, hinting at a new round of price wars that may soon arrive.

01

Reducing Prices for Sales

In March 2023, Li Xiang, the founder of Li Auto, announced on Weibo that Li Auto would not reduce prices. However, under immense competitive pressure, Li Auto could not remain immune and had to join the "price war". As early as April this year, Li Auto implemented a large-scale price reduction, with the entire Li L9 series reduced by RMB 20,000, the Li L7 and Li L8 models reduced by RMB 18,000 to RMB 20,000, and the MEGA model reduced by RMB 30,000 to RMB 529,800.

One of the reasons for this price adjustment, according to industry insiders, may be intra-brand competition between the L6 and L7 models. The L series has introduced its fourth product, the L6, with a starting price of RMB 249,800, lowering the price threshold to below RMB 250,000. The L6 shares a similar design and size with the L7, with only minor configuration differences.

Behind Li Auto's price reduction was the intensifying market competition. BYD led the way with a price reduction at the beginning of the year, followed by a wave of price cuts across the industry. After the launch of Xiaomi's first automotive product, more automakers began to lower their prices, including AITO. On the other hand, after the failure of the MEGA model, Li Auto's sales growth also encountered a bottleneck.

The addition of lower-priced models and price reductions also impacted Li Auto's second-quarter gross margin on vehicles and dragged down the company's overall gross margin for the first half of the year. Moreover, the average selling price per vehicle in the second quarter was only RMB 279,000, a decrease of RMB 22,000 from the previous quarter.

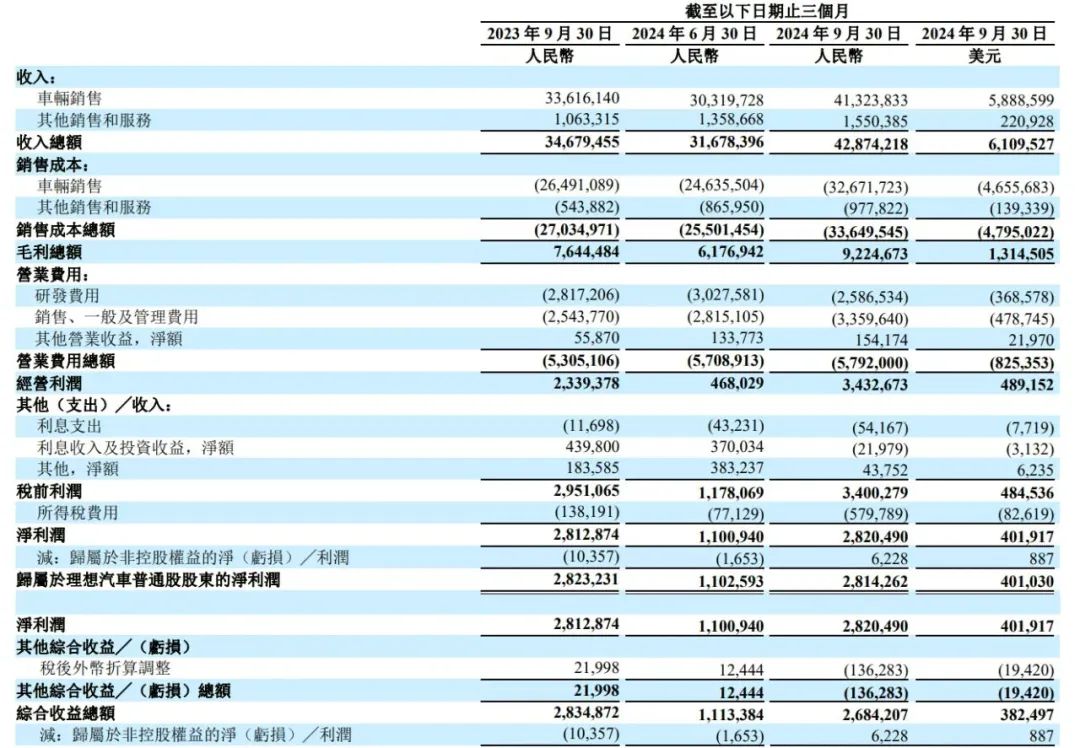

However, in the third quarter of this year, Li Auto performed relatively well, achieving revenue of RMB 42.9 billion, an increase of 23.6% compared to RMB 34.7 billion in the third quarter of 2023, and a record high with a quarter-on-quarter increase of 35.3%. The company has also been profitable for eight consecutive quarters, with a net profit of RMB 2.821 billion, a slight year-on-year increase of 0.3%.

In terms of gross margin, Li Auto's third-quarter automotive gross margin was 20.9%, higher than market expectations of 20.2% and also above Li Auto's previous guidance. The key to exceeding expectations was that the decline in the average selling price per vehicle was lower than market expectations. The average selling price per vehicle in the third quarter was RMB 270,000, a decrease of RMB 9,000 from the previous quarter but exceeding market expectations of RMB 266,000. The decline in the average selling price per vehicle was not as significant as market expectations.

However, the capital market was unimpressed, with Li Auto's stock falling more than 13% on the day of the third-quarter earnings release on U.S. stock markets. The next day, Li Auto's stock fell more than 10% within the first half hour of trading on Hong Kong stock markets.

02

Product Gap Period

During the first-quarter earnings call, Li Xiang stated that the company would not introduce any new products in the second half of the year and that pure electric vehicles would be postponed to 2025, meaning that the Li L6 was the company's last new model launch for the year. Previously, Li Auto had planned to release four pure electric models this year. Now, Li Auto has entered the year-end product gap period and the off-season for market sales.

Recently, multiple automakers have announced their entry into the extended-range vehicle market. Li Auto has firmly held the top spot in sales among emerging auto companies with its extended-range models, while AITO and ZERO Run also achieved sales breakthroughs by quickly introducing extended-range models. More and more domestic automakers are joining the ranks of extended-range electric vehicles. As one of the first batch of emerging Chinese automakers, XPeng announced that it will launch its first extended-range model next year.

Since April this year, sales and market share of extended-range models in the new energy vehicle market have begun to rise rapidly. From April to August, extended-range models achieved year-on-year growth rates ranging from a minimum of 64% to a maximum of 115%, showing a continuous upward trend.

Through its product definition of "refrigerators, TVs, and large sofas," Li Auto has stood out in the fiercely competitive automotive market. However, Li Auto's "doll-like" product structure has been criticized. During the second-quarter earnings call, the company's founder and CEO, Li Xiang, announced that the Li Auto brand plans to release a new pure electric SUV model in the first half of 2025, aiming to serve a broader range of family users.

Li Xiang hopes that within about two years, Li Auto will rank among the top players in the high-end pure electric vehicle market. Recalling the confidence Li Xiang had before the launch of the MEGA model, one wonders if the new pure electric products to be launched next year will live up to Li Auto's ambitions.