Lego Empire Stellantis: Made by Carlos Tavares, lost by Carlos Tavares

![]() 12/05 2024

12/05 2024

![]() 489

489

Introduction

Where is the Lego Empire heading?

Carlos Tavares has 'escaped'. Just like his Chinese name implies, we thought he would be practical, but in reality, he is very 'pragmatic'.

Publicly, Carlos Tavares resigned from his position as CEO of Stellantis Group due to performance pressure. However, from a timing perspective, Tavares can be said to have 'escaped unscathed'. Moreover, he has left a bigger challenge for Stellantis Group.

Of course, Tavares' resignation, with an annual salary of up to €36.5 million (equivalent to RMB 279 million), will shock many people. However, upon closer examination, you will understand that Tavares' choice to leave now is even luckier than another Carlos – Carlos Ghosn, who was arrested. It is a complete 'escape from the top'.

For the 'Lego' empire with 14 brands and 2 mobility brands, now that the helmsman has suddenly withdrawn, will the Stellantis building blocks collapse, and where is it heading?

The two faces of Carlos Tavares

Previous news indicated that Tavares would officially retire in 2026, ending his five-year term. Now, the process has suddenly accelerated, with the 66-year-old Tavares resigning abruptly. Although the board of directors has kept silent about the reason for Tavares' sudden resignation, it is not difficult to judge that internal disagreements, incoordination, and dissatisfaction are natural.

According to sources who spoke to the Financial Times, a recent point of contention between Tavares and the board was Tavares' aggressive push for an electric vehicle strategy to meet stringent EU emissions regulations, while the board preferred a more flexible approach to maintain factory operations and profit margins.

Amid sharp disagreements and conflicts arising from Tavares' short-term efforts to restore his reputation (damaged by the group's financial performance collapse), the Stellantis board unanimously decided to part ways with the outspoken Tavares.

Bernstein analysts also stated that the sudden announcement on December 1 indicates that the disagreements between the board and Tavares must have been severe, as both parties would rather let the company operate without a CEO in the short term, essentially becoming "driverless" all of a sudden.

Hints of this can also be seen in the statement by Senior Independent Director Henri de Castries, who said, 'The success of the Stellantis Group since its inception has stemmed from the perfect synergy between shareholders, the board, and the CEO. However, differing viewpoints have emerged in recent weeks, leading to today's decision by the group's board and CEO.'

Photo | John Elkann, Chairman of the Stellantis Group

The aftermath is expected to be completed in the first half of 2025. Currently, the Stellantis Group has appointed a new interim executive committee composed of 9 senior executives, led by Chairman John Elkann. He is a member of the Italian industrialist Agnelli family. According to a Stellantis Group statement, the process of appointing a new CEO is 'progressing smoothly'.

Who will succeed and clean up this 'Lego' mess? We don't know. However, at present, although Tavares' mindset is outdated and he has failed to update his cognition in the era of intelligent electrification, it seems that no one can replace him in building the Stellantis blocks.

The board is very troubled. Finding a successor to Tavares is a challenge, even though Chairman Elkann is known for his ability to identify talent.

'Made by the same person, lost by the same person.' The tense relationship between the board and Tavares has a long history. As an excellent 'cost killer', Tavares, who studied under Carlos Ghosn, is well-versed in the 'art of thick darkness' in the workplace. His methods are ruthless, and his skills in 'cutting arrows' and 'patching pots' are truly superb. Although the financial statements look good, the board believes that Tavares' 'aggressive actions', including layoffs, are too radical.

In a challenging economic environment, including facing powerful union forces, leading such a global automaker is a very complex task. 'Old money' prefers certainty. Tavares' departure has suddenly created a short-term vacuum in the Stellantis Group.

Now, Stellantis Group is facing fierce competition, changing consumer preferences, and the transition to electrification. It's like playing chess; the next move is crucial, but the problem is that the player has suddenly left the game.

Carlos Tavares, a 66-year-old Portuguese with a glittering career resume, needs no further elaboration here. His highlight moment began in 2021 when he led the merger of FCA Group and PSA Group to form the world's fourth-largest automaker, Stellantis Group. This 'Lego' empire includes 14 brands such as Chrysler, Jeep, Ram, Dodge, Fiat, Peugeot, Opel, and Maserati.

Even during the COVID-19 pandemic, Tavares led Stellantis Group to achieve profitability, surpassing competitors General Motors and Ford Motor Company, and achieved a record profit of €18.6 billion in 2023.

Under Tavares' leadership, Stellantis Group appears to be one of the rare success stories in the history of the automotive industry. During his tenure, Stellantis Group took several groundbreaking initiatives. One of his major decisions was to accelerate the transition to electric vehicles. Stellantis Group is investing heavily in electric vehicle production, aiming to have a diverse portfolio of electric vehicles across all brands by 2030.

The problem is that the situation changes faster than turning a page. By 2024, the situation had suddenly deteriorated. In the first half of this year, global sales of Stellantis Group declined by 10%, with a steeper drop of 20% in the third quarter.

Tavares, who values his privacy, of course cherishes his reputation. This also leads to his strong sense of ego, where the group's significant and long-term interests naturally take a back seat in his heart. As someone familiar with a conversation among Stellantis board members revealed, '(Tavares) focuses on short-term interests rather than the company's long-term interests, which has angered everyone involved in the process.'

Of course, Tavares may not have wanted to leave early. Just in October, he began reorganizing the management of the group's brands, including Jeep, Maserati, and Alfa Romeo.

Tavares' departure not only marks the end of a European automotive era but also signals the beginning of new turmoil for Stellantis Group. From Carlos Ghosn to Herbert Diess, the former CEO of Volkswagen Group, to Tavares now, a generation of heroes has always faced setbacks, whether from within or due to the times. That's for later discussion; the immediate focus is on the present.

The Art of Cost Cutting

As the first and only CEO of Stellantis Group so far, Tavares' secret weapon for success has been his 'Art of Cost Cutting.' In fact, his methods are similar to those of Jack Welch at General Electric. As described in Jeff Immelt's 'Touching the Void,' they both focus more on 'management techniques,' making them sophisticated egoists.

Controlling costs and sustaining profitability are Tavares' key tools in navigating the 'automotive world,' and they are also the first principle he follows when discussing any matter or making any decision with his team. When he first took over as CEO of PSA Group, Tavares customized a development strategy called 'Back in the Race' for PSA, with the clear goal of profitability.

In Tavares' view, the principle of profitability applies to all processes, whether it's new products, technologies, markets, or brand enhancement activities such as racing and auto shows. Any proposal that does not promise a return is unrealistic. If a project's return falls short of expectations, it should be terminated. From this perspective, it is very similar to Welch's philosophy of 'be number one or number two in any market you serve, or get out.'

Early in his tenure as CEO of Stellantis Group, Tavares achieved profitability and won a reputation by unifying the use of four major platform architectures, reducing procurement and operating costs, and expanding market scale. If nothing unexpected had happened, it was expected that this success could be continuously replicated. However, man plans, and God laughs.

During the initial merger of FCA and PSA, with the exception of Faurecia, the components manufacturer controlled by the former PSA Group, the number of Stellantis Group employees remained almost unchanged in the first year, at around 300,000. It seemed that Tavares had honored his initial promise – no layoffs or plant closures after the merger.

Ultimately, Tavares' 'cost razor' was unsheathed with a vengeance.

Since cost reduction is an important task for Stellantis Group, including the promised €8.4 billion (equivalent to $9 billion) in cost savings after the merger, it is only natural for Tavares to publicly refute claims that the company's efforts to drastically cut costs have caused problems.

Public documents show that from December 2019 to the end of 2023, the number of Stellantis Group employees decreased by 15.5%, or about 47,500. This year, Stellantis has further laid off thousands of workers in the United States and Italy, angering trade unions in both countries.

Of course, by drastically reducing costs, Tavares has built a strong and stable balance sheet for Stellantis Group and earned an exceptionally high salary in 2023. However, in September, the group issued a profit warning, stating that its free cash flow in 2024 would be between -€5 billion and -€10 billion.

According to the Financial Times, his cost-cutting measures are notorious within the company, with critics claiming he has 'cut to the bone.'

For example, due to a significant reduction in IT spending, Stellantis lost track of thousands of cars in France. Another example is a supplier being informed that they could not receive payment because the person handling payment transactions was on maternity leave, and the company had no replacement.

This year, guests invited to the Stellantis plant in Ellesmere Port, UK, also found that the coffee served was brewed using a coffee machine brought from a factory over 100 miles away in Luton because employees here were not allowed to purchase coffee machines. Cost-cutting has been pushed to such an extreme.

The US market, on the other hand, has become Tavares' 'Waterloo.' US sales declined by 17% in the first nine months of this year, with high dealer inventories.

Just as Tavares was making his resignation decision, Stellantis Group faced persistently high prices for cars and trucks in North America, declining sales, outdated US model lines, and excess inventory. For months, investors, dealers, and trade unions have criticized and expressed deep disappointment with Tavares.

In the third quarter of this year, the net income of this 'Lego' empire was €33 billion (equivalent to $36 billion), lower than the €45 billion in the same period last year. Excluding South America, all regions saw double-digit declines in revenue, with North America declining by 42% to €12.4 billion and Europe by 12% to €12.5 billion.

According to automotive website Edmunds, the average selling price of a Stellantis vehicle in the US was $58,000 by the fourth quarter of 2023. According to CoPilot data, Stellantis Group increased its product prices in the US by 50% from 2019 to 2024, far exceeding the 23% inflation rate during the same period. With higher prices comes weaker competitiveness.

The collapse of the situation in the United States has put Carlos Tavares in a dilemma. After all, Americans are not as easy to deal with as Chinese.

It's like a Shakespearean tragedy-comedy, with equally thrilling highs and lows. On the positive side, Tavares' strength lies in simplifying and improving operational efficiency, cutting costs, and creating a global automotive giant through mergers. However, on the negative side, he failed to address challenges in key markets like the United States, where dealers accused him of damaging the reputation of brands like Jeep, Dodge, Ram, and Chrysler. He went too far.

Ultimately, the paradox between cost cutting and the huge investment required to maintain product innovation led to Tavares' resignation earlier than expected.

Abandoning the Chinese market

Tavares' biggest 'blunder' was probably abandoning the Chinese market. In other words, it seems like Tavares has a 'grudge' against China.

Tavares is a very complex but outspoken person. But when it comes to China, he seems 'simplistic'. Previously, Tavares spent 30 years at Renault, becoming the second-in-command after Carlos Ghosn, before taking the helm of the Stellantis empire. However, this immense power blinded him to the facts.

No multinational automaker would ignore the Chinese market, the largest automobile consumer market in the world, but Tavares did. Perhaps everything was doomed from the moment Stellantis did not have a Chinese name.

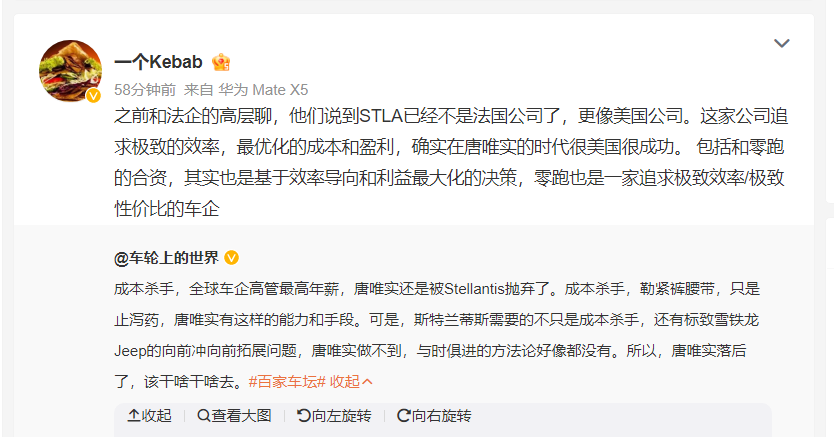

Despite insisting that they would not leave the Chinese market, actions like unilaterally announcing an increase in GAC FCA's shareholding, terminating the joint venture with GAC FCA, and the rumored 'two-bedroom, one-living room' plan for Dongfeng Peugeot, all confirmed the outcome.

To clarify, the initial plan referred to the 'two bedrooms' where Dongfeng Peugeot and Dongfeng Citroen brands would be led by separate parties, with Dongfeng responsible for the Citroen brand, and the 'one living room' sharing common areas such as product planning, technology, quality, and industrial production. This is no longer mentioned.

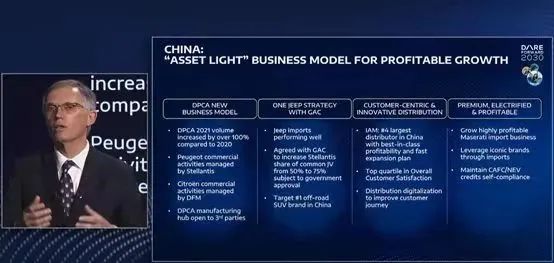

Moreover, Stellantis' 'asset-light' operations in the Chinese market have made its presence weaker. The embarrassing fact that Stellantis' market share in China is less than 0.2% makes their insistence pale in comparison.

Marchionne's unsuccessful 'subtraction' was achieved under Tavares. Besides the exited Fiat, the three core brands Alfa Romeo, Maserati, and the only locally produced Jeep in China, along with the DS brand, have gradually shifted to an 'asset-light' operating model.

Under Tavares' rule, all Stellantis brands in China refused to change for Chinese consumers. This included slow product updates, failing to keep up with consumer demand and China's policies encouraging new energy vehicles and reducing fuel consumption.

In 2015, under Tavares' leadership, PSA turned a profit of €1.202 billion, the most profitable year for the group since 2002. China became PSA's largest overseas market, with its three major brands Peugeot, Citroen, and DS launching 13 models in China that year.

And that was it. Who would have thought that Dongfeng Peugeot-Citroen, once on par with SAIC Volkswagen and FAW-Volkswagen, would peak at 700,000 vehicles in 2016, only to halve that number by 2020, reaching just 50,000. Dongfeng Peugeot-Citroen's desperate counterattack is another story.

In the first half of 2024, Stellantis' performance was mainly supported by the North American, European, and South American markets, with only 37,700 vehicles sold in China. In September, Maserati's imported sales in the Chinese market were only 38 units, a staggering 87% year-on-year drop, the steepest decline among ultra-luxury brands.

Moreover, revenues and profits in the combined China, India, and Asia-Pacific markets have been declining. Adjusted operating profits in these three markets fell from €289 million in the first half of 2022 to €57 million in the first half of 2024.

For the Chinese market, Tavares' only response was criticism.

'Our partner does not comply with the joint venture agreement,' he said. 'This undermines mutual trust. We can no longer work together and can only end the cooperation.' In January 2022, Stellantis attempted to seize control of GAC FCA by unilaterally proposing to increase its shareholding from 50% to 75%, but GAC Group refused to budge. Both parties wanted to adjust their strategies according to their own ideas, leading to a breakdown. Their cooperation ended on July 18 of that year.

All good things must come to an end, no matter how beautiful they seem. In the latest Fortune Global 500 list for 2024, Stellantis ranked 28th, third among automakers, behind Volkswagen and Toyota but ahead of Ford, GM, BMW, and Mercedes-Benz.

With 14 automotive brands and two mobility brands, over 250,000 employees in more than 130 countries and regions, and production bases in over 30 countries, Stellantis aims to become the fourth-largest automaker by sales and the third-largest by revenue globally. Based on the first-half performance of this year, it has basically achieved this goal. However, it is drifting further away from the Chinese market.

It is worth mentioning that despite his dislike for the Chinese market, Tavares was very attentive and responsive to China's electrification technology.

On October 26, 2023, Stellantis announced plans to invest around €1.5 billion (approximately RMB 11.59 billion) to acquire approximately 20% equity in Leap Motor and become a strategic shareholder.

On the evening of May 13 the following year, Tavares rushed to Hangzhou to meet with Leap Motor's Zhu Jiangming. The next day, they announced the establishment of a joint venture, 'Leapmotor International,' with a shareholding ratio of 51:49, controlled by Stellantis. The joint venture will operate under the Leap Motor brand, and its models will begin export sales in the second half of 2024, two years ahead of Volkswagen and XPeng's new models.

'To compete with China, you have to "become Chinese."' In this regard, Tavares is indeed a 'master of disguise.'

This quote came from Tavares' speech at a Reuters event in Munich in May. He said that imposing tariffs on Chinese cars imported to Europe and the United States 'is a major trap.' Tariffs will only exacerbate local inflation in imposing countries and hurt traditional Western automakers, making them unable to compete with electric vehicles produced by Chinese automakers at about one-third the price.",According to Reuters' analysis, facing competition from Chinese electric vehicles, Tavares avoided the 'trap' of tariffs in Europe and the United States through a 'reverse joint venture' with a Chinese automaker, which is also considered a future trend in electric vehicle industry cooperation.

'We will strive to "become Chinese automakers" ourselves,' said Tavares. 'This means that facing China's offensive, we are no longer purely defensive but hope to become a part of it.'

However, just two years ago, Tavares did not say this.

'Obviously, electrification is a technology chosen by politicians, not by the industry,' Tavares said, losing control during an interview with French newspaper Les Echos, German newspaper Handelsblatt, Italian newspaper Corriere della Sera, and Spanish newspaper El Mundo in January 2022. Facing the forced transition to electrification, Tavares expressed rare anger and lament.

Just two years later, Tavares' attitude did a complete 180-degree turn.

This shows that Tavares is well aware that electric vehicles are increasingly becoming a new stage for economic and technological competition between major powers amidst direct confrontation between China and the United States. Chinese and American automakers will lead the future of electrification and intelligence, which also means that traditional second-tier Western countries, including France, the United Kingdom, and Sweden, will have increasingly weaker voices in the new automotive era. In this competition, the 'LEGO' group is forced to choose sides.

In fact, since 2020, China's electric vehicle market has led the world in total volume, not only changing the development trend since the third industrial revolution but also shaking up the previous geopolitical landscape.

Failing to grasp these forward-looking changes and not visiting China in four years, Tavares, an unusually arrogant and biased individual, did one absolutely right thing before stepping down. In contrast, every BBA management that deeply understands and anticipates China's electrification and intelligence trends, such as Ola Källenius of Mercedes-Benz, Oliver Zipse of BMW, and Oliver Blume of Volkswagen, have long been actively embracing change with wide-open eyes.

Whether Tavares was pretending to sleep in the face of the era of intelligent electrification, we do not know. However, the awakened Tavares had to admit, as stated in last year's article 'Shanghai Awakens a Group of Pretending Sleepers,' that 'history always passes this way, with the young being modeled, followed, and ultimately surpassed by even younger generations.'

The road to catching up in electrification

Tavares' sudden resignation also indicates that the world's fourth-largest automaker feels a strong sense of crisis. After all, peers like Volkswagen and Ford are also struggling to cope with stringent emissions regulations, plant closures, layoffs, and extreme competition from Chinese rivals.

Regarding the 'Stellantis crisis,' Enzo Perufo, a professor of business strategy at Rome Luis University, said, 'This is an example of Europe's lack of vision in the automotive industry. Ambitious climate goals have been set, but there is a lack of implementation in industrial strategy.'

Promoting the development of electrification is an inevitable choice to keep pace with the times. However, Stellantis' transition strategy in Europe is still a step behind the pace. The progress of building an electric ecosystem in North America is also severely lagging.

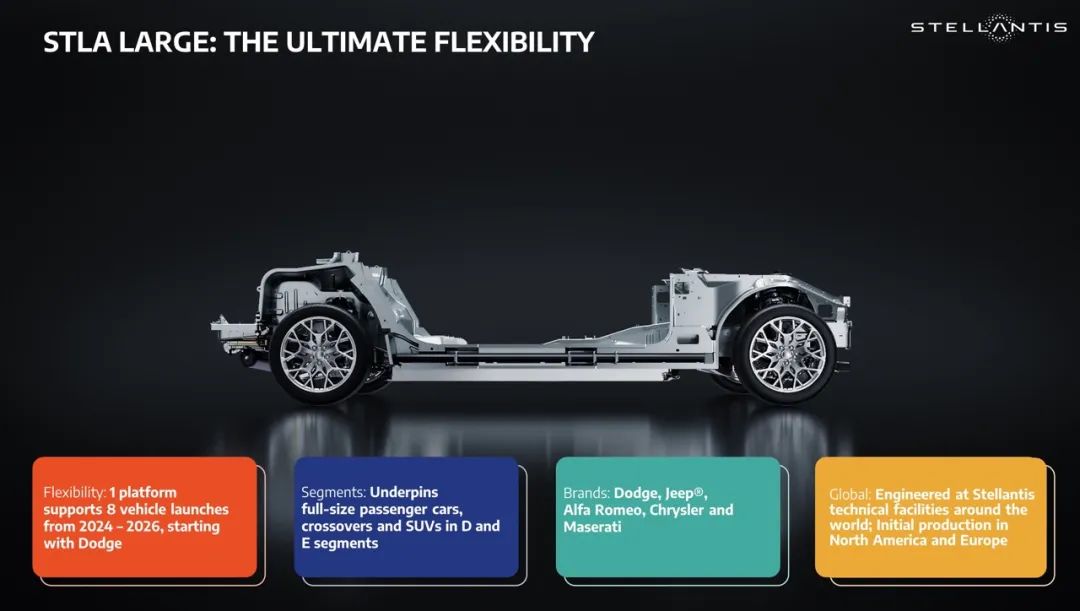

Stellantis announced its electrification strategy as early as July 2021, unveiling four production platforms centered on pure electric vehicles. These platforms are said to be highly flexible and share components, each capable of supporting an annual production capacity of up to 2 million vehicles, achieving economies of scale. In reality?

Two years later, in July 2023, the STLA Medium platform for mid-size cars was officially launched, used in the Peugeot e-3008. The STLA Medium pure electric mid-size car platform can produce mainstream C-segment and D-segment models, equipped with high-performance modules for a range of over 700 kilometers on a full charge or standard modules for over 500 kilometers.

The STLA Large platform, above the mid-size platform, was even more delayed, officially launching only in mid-January of this year. It comes with 400V and 800V architectures, an 85~118kWh center-mounted battery pack, and is compatible with hybrid and internal combustion power systems. The third platform, STLA Frame, was officially launched on November 19 and will be used for the first time in Jeep and Ram models, which will also be exported to Europe.

The STLA Small platform is not expected to be launched until the end of 2025 or early 2026. As for the new generation of pure electric vehicles based on these platforms, it will take at least two years from design to market launch.

When it comes to electrification technology, it was only after the 'reverse joint venture' that Stellantis could use Leap Motor's 'four-leaf clover architecture' technology to refresh its own architecture. For a traditional European company, this is a humiliating blow to its pride. Times have changed, and fortune favors the bold.

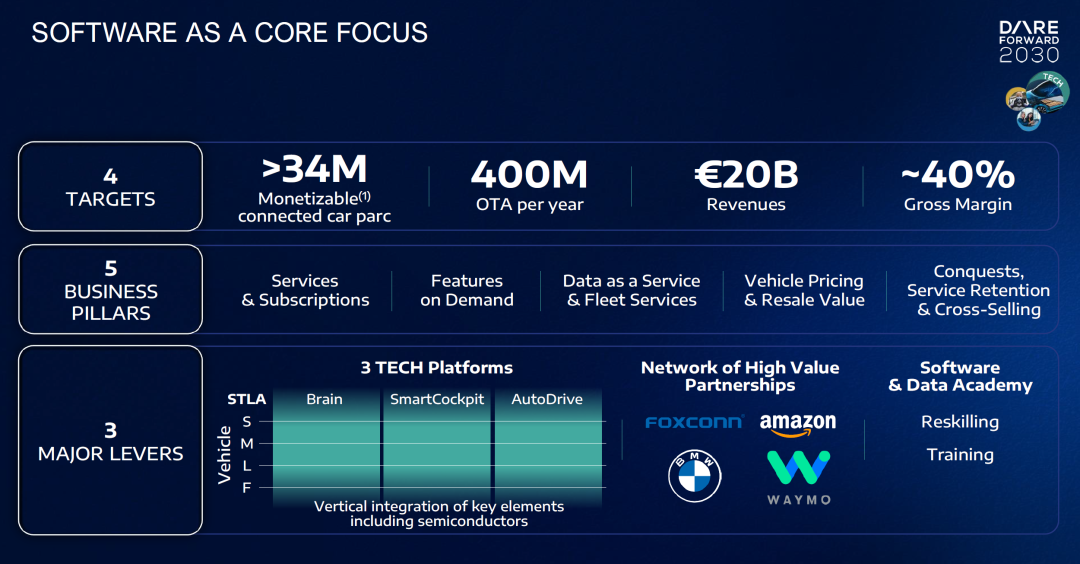

In its DARE FORWARD 2030 strategy announced in March 2022, Stellantis aims to achieve €30 billion in software as a service (SaaS) revenue by 2030, including service subscriptions, on-demand features, and data as a service. However, none of the group's vehicles can support this SaaS business model, so there is an urgent need to find a partner that can provide such a product architecture. Leap Motor C10's 'four-leaf clover architecture' is undoubtedly an ideal choice.

After all, in terms of platforms, among the current models sold by the Stellantis Group, the TOP3 platforms CMP, SUSW, and DS/DJ only cover 40% of total sales, and there are a large number of outdated platforms with a relatively scattered sales distribution.

Regarding core components, the Stellantis Group only plans to cooperate with Samsung SDI in 2022 to invest over $2.5 billion in Kokomo, Indiana, USA, to establish its first battery production base in the United States, which is expected to commence production in the first quarter of 2025. The initial production capacity is 23GWh, and it will eventually increase to 33GWh. In October last year, it was announced that a second battery factory would be built in the United States with Samsung SDI, and a cooperation with battery giant CATL was reached to explore the possibility of establishing a joint venture.

In Europe, Stellantis is building a battery factory with ACC (Automotive Cells Company) at its Termoli plant in Italy, with a production capacity of 120GWh by 2030. ACC is a battery joint venture jointly established by Stellantis, Mercedes-Benz, and TotalEnergies in 2021.

However, on June 5th of this year, the Stellantis Group and Mercedes-Benz Group announced a suspension due to slowing demand and high costs, and decided to switch to a lower-cost lithium iron phosphate battery route.

In terms of charging, Stellantis launched the Free2move Charge platform, jointly established a charging joint venture with six major automakers in the United States, and cooperated with Ample, an American battery swapping company.

In addition, Stellantis also announced an investment in Niron Magnetics, an electric vehicle magnet startup, to reduce dependence on the Chinese supply chain. By acquiring shares in Symbio and establishing a battery recycling joint venture with Orano, Stellantis has strengthened its presence in the fields of hydrogen energy and battery recycling.

It may seem like a flurry of activity, but compared to Tesla, the "catfish" that has disrupted the automotive landscape on its own, the Stellantis Group started too late. Moreover, due to the collapse of NorthVolt, the European version of CATL, the vision of establishing a complete European electric supply chain has become a mirage.

As mentioned in "Why Nations Fail?", the root cause of national failure lies in extractive institutions. Compared to inclusive institutions, extractive institutions sacrifice long-term interests and the interests of the majority for short-term goals. Judging from Carlos Tavares' approach, he has also designed and used extractive institutions, sacrificing the group's long-term development for his own reputation.

Now, the "Losers' League" Stellantis Group is being grilled from both inside and outside. From this perspective, Carlos Tavares is not at all wronged if he is removed. "He is a performing psychopath," emphasized Laurent Valy, CFDT manager at the Stellantis Rennes plant, "After squeezing the employees, he can now squeeze grapes in his vineyard in Portugal."

Carlos Tavares' Resume:

Born on August 14, 1958, in Lisbon, Portugal.

From 1975 to 1981, after studying mathematics in preparatory school, he attended the prestigious École Centrale Paris (French Grandes Écoles).

In 1981, he began his career at Renault Group, holding various engineering and management positions.

From 1981 to 2013, he held senior positions at Renault Group and Nissan and was renowned for his focus on cost control, helping troubled companies turn losses into profits on multiple occasions.

In 2014, he became CEO of the PSA Group and played a crucial role in its transformation. During his tenure, the PSA Group achieved milestone achievements, such as acquiring Opel from General Motors and creating the DS Automobiles brand, targeting the high-end market.

In 2021, he led the merger of FCA and PSA, forming the Stellantis Group and becoming its first CEO.

On December 1, 2024, he resigned as CEO of the group.