End-of-year price cuts to boost sales, 60% of automakers have given up

![]() 12/05 2024

12/05 2024

![]() 630

630

Some new car prices hit new lows at the end of the year, but the rule that buying a car at the end of the year is cheaper is gradually being broken, as most automakers can't afford to lower prices any further.

In early 2023, the price war officially began, linked to Tesla's official price cuts; by the end of 2024, the price war had continued at a high intensity for 18 months, and after a six-month lull that began in mid-2024, it was reignited by Tesla.

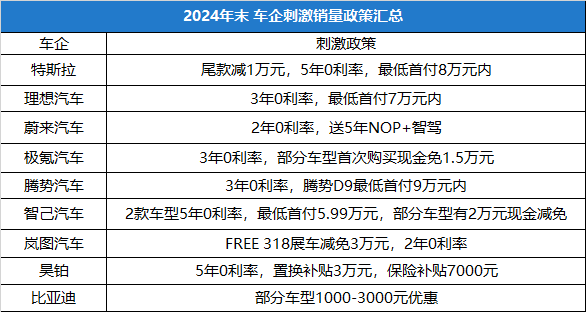

The fuse was lit by Tesla's sudden increase in December limited-time offers, with most models offering a final payment reduction of 10,000 yuan. Tesla's Model Y, which starts at 239,900 yuan in the Chinese market, once again became the lowest-priced globally, combined with a five-year 0% interest rate offer that has lasted for six months. The minimum down payment for the Model Y is within 80,000 yuan, with a minimum monthly payment of 2,700 yuan. Subsequently, a series of automakers followed Tesla's lead in increasing year-end incentives.

Li Auto offered a three-year 0% interest rate, with the minimum down payment for the Li Auto L6 being nearly 10,000 yuan less than that of the Model Y; NIO maintained its two-year 0% interest rate policy but increased the offer of a five-year NOP+ advanced intelligent driving system. If calculated based on a monthly subscription fee of 380 yuan, this is equivalent to an indirect discount of 22,800 yuan; ZEEKR continued its zero down payment and up to a three-year 0% interest rate policy, and due to sufficient production capacity, it launched a campaign promoting its trade-in program, putting pressure on consumers to make purchases; TANGEV offered a three-year 0% interest rate, with the minimum down payment for the TANGEV D9 within 90,000 yuan and the minimum down payment for the TANGEV Z9 within 100,000 yuan.

Unlike most similar automakers that use a three-year 0% interest rate policy, IM Motors, which is also based in Shanghai like Tesla, followed up with a five-year 0% interest rate policy for its new IM Motors L6 and LS6 models, with a minimum down payment of 59,900 yuan; BYD also announced its December policy, offering discounts of 1,000 to 3,000 yuan on some models; HOVOS also kept up, offering a limited-time discount of 30,000 yuan on FREE 318 showroom models, along with a two-year 0% interest rate; AION offered a five-year 0% interest rate, a 7,000 yuan insurance subsidy, and a 30,000 yuan trade-in subsidy; other followers included traditional automakers, such as the GL8 Luzun, which offered a two-year 0% interest rate.

And as always happens, when intense competition arises, it is accompanied by comparisons among peers and a marketing war of public opinion. For example, some automakers have already begun to showcase their relatively larger discounts in promotional materials, creating promotional posters.

End-of-year price cuts to boost sales are now the privilege of only a few automakers

Many well-known brands and models can no longer afford to lower their prices. This inability to lower prices is not due to a refusal to do so, but rather the inability to offer the same level of discounts as during the year-end sales rush in previous years, such as offering a 20,000 yuan discount during regular times and a 30,000 yuan discount at the end of the year.

The discourse power now mainly lies in the hands of leading new energy automakers.

"On average, prices can be 10,000 yuan cheaper than in October and November, and in some cases, they can be 30,000 yuan cheaper than before." It has become difficult to lower prices further, and this is no longer just a sales tactic to pressure customers into making a purchase, but a real dilemma for automakers.

The profit margin in the automotive industry has repeatedly hit new lows, with 6.2% in 2020, 6.1% in 2021, 5.7% in 2022, and 5.0% in 2023. According to data released by the China Passenger Car Association in the third quarter of this year, the total revenue of the automotive industry from January to September 2024 was 7.35 trillion yuan, an increase of 3% year-on-year, while total profit was 336 billion yuan, a decrease of 1.2% year-on-year; the overall profit margin of the automotive industry was only 4.6%. This is already lower than the average profit margin of 6.1% for downstream industrial enterprises, indicating a relatively poor performance in the automotive industry.

Although sales reports at the beginning of each month are often labeled as "record-breaking" or "best ever," in reality, sales figures for most automakers are declining, leading to declines in revenue and profit. Moreover, this is not just a case in the Chinese automotive market but a global issue. Nissan's latest financial report shows a 93.5% decrease in profit for the April-September period, with a profit reduction of 19.2 billion yen. This was followed by a 20% reduction in global production capacity and layoffs of 9,000 employees. Toyota's profit decreased by 26.4%, and Honda's profit margin fell to 6.9%.

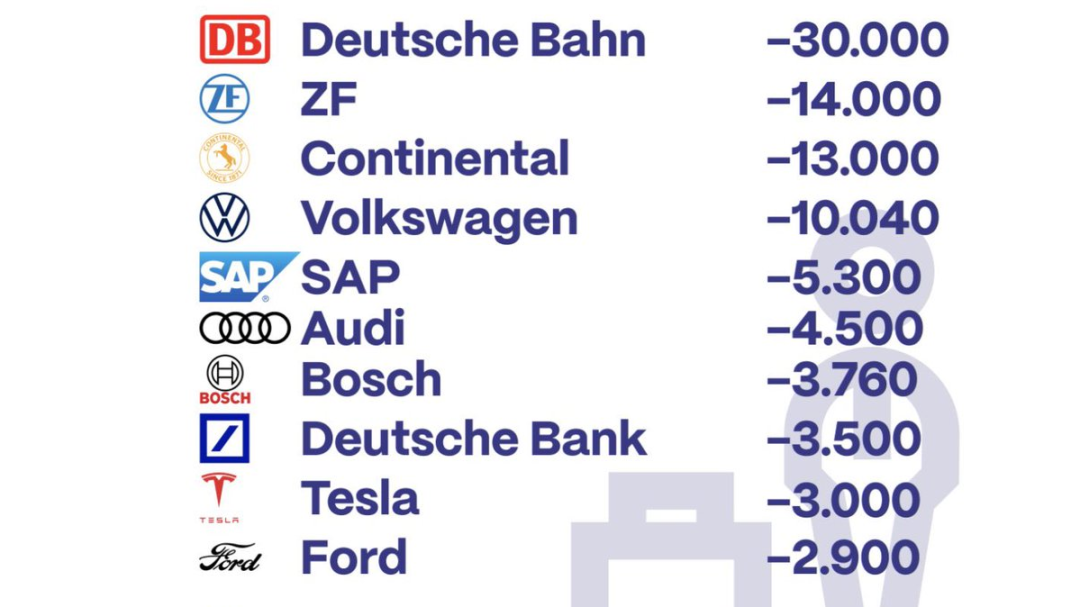

Similarly, the European automotive industry has also experienced a significant decline, with ZF laying off 14,000 employees, Continental laying off 13,000, Volkswagen laying off 10,000, Audi laying off 4,500, and Bosch laying off 3,800. This means that nearly 50,000 layoffs have occurred among the top European automakers. Even Tesla has laid off 3,000 employees in 2024.

There are also many examples happening around us. BYD recently required its suppliers to reduce procurement costs for 2025 by 10%, which is also a way to increase revenue and reduce expenses, ensuring the company's normal cash flow and providing more room for further reductions in car prices.

However, as of now, only the above-mentioned 10 automakers have followed the low down payment and 0% interest rate policies. Moreover, many dealers not only lack the momentum to boost sales at the end of the year but even show more of a laid-back attitude.

"Just lower prices, there's nothing else we can do." Liu Qing is the general manager of a direct-sales store for a German luxury brand. When asked how they plan to respond to the wave of automakers offering three-year or five-year 0% interest rate offers since the beginning of December, the answer was that there was nothing they could do.

From the beginning of 2024 to the present, there have been official price cuts, changes in senior management teams, and following the playbook of new forces, but each stimulus has not been strong enough. Moreover, since the annual sales target is definitely unattainable, they have directly moved on to considering strategies for 2025. This is true for both high-priced luxury cars and ordinary gasoline-powered cars from civilian brands.

"Car prices were never expensive to begin with, and now they are as cheap as cabbage. A five-year 0% interest rate offer has little effect; most offers are for two to three years," said one industry insider. For gasoline-powered cars with a guide price of less than 200,000 yuan, there is currently no need for a five-year 0% interest rate installment plan. Discounts of 30,000 to 50,000 yuan are common, making installment plans less necessary.

Is the rule that buying a car at the end of the year is the cheapest about to change?

Whether to participate in a price war is naturally related to a company's operational rhythm and goals. The two core indicators are: one, whether the sales target is nearly met; and two, whether to choose to forgo profit for market share.

These two factors can well explain the scale and sustainability expectations of this round of price wars at the end of the year.

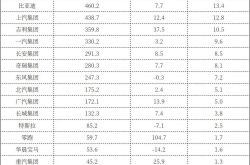

From the first perspective, as November's auto sales figures are gradually released, the brands that have already achieved their 2024 sales targets include BYD and NIO, with sales targets of around 3.6 million units and 250,000 units, respectively. Their cumulative sales from January to November have reached 3.757 million and 251,000 units, respectively. Therefore, in terms of participation, BYD has offered small discounts to prepare for orders and deliveries in January 2025, while NIO has not participated in the price war because its pricing is already low enough and meets sales expectations.

The main participants at this juncture are those who can achieve or basically achieve their sales targets with some effort. Hovos needs to sell 12,000 units in December to reach its sales target of 100,000 units; ZEEKR needs to sell around 35,000 units in December to reach its sales target of 230,000 units; Li Auto needs to sell 40,000 units in December to reach its sales target of 480,000 units; NIO needs to sell 40,000 units in December to reach its sales target of 230,000 units.

Therefore, they are the main force in this round. Those at the lower end of the spectrum have basically confirmed that they cannot achieve their sales targets, but due to the upward momentum after the launch of new products, they need policy incentives to continue. Those further down the spectrum are unable to achieve their sales targets, which is the case for most in the market today, who are basically maintaining previous discount levels.

This list includes Volkswagen, Toyota, Honda, Nissan, etc. The discounts on car prices are basically similar to those in November. SAIC Motor, which offers fixed prices for multiple models, has no more room for price reductions, as doing so would violate its fixed-price policy.

In addition, it also includes most Chinese brand gasoline-powered car models, from Great Wall to Chery, to Geely and Changan. Since gasoline-powered cars have already reached a very low price point in previous intense price wars, there is currently no room for further discounts.

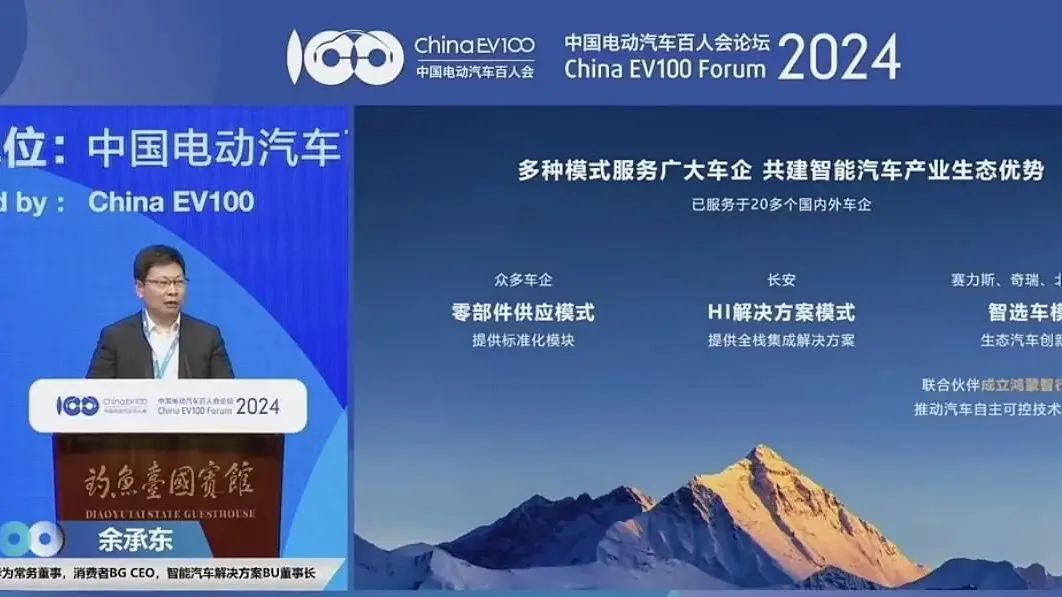

Moreover, looking at the leading enterprises that best represent the trend, Huawei HarmonyOS Intelligent Drive has already achieved profitability. According to previous statements, the automotive business unit (BU) is expected to achieve profitability this year. Coupled with the expanding depth of cooperation with the entire industry, its strategy is not to offer significantly cheaper promotions before the new year due to different communication cycles.

The driving effect of leading enterprises in today's market is very obvious. Nowadays, BYD and Huawei HarmonyOS Intelligent Drive do not have a particularly strong desire to boost sales at the end of the year, so their impact on the automotive market is actually limited.

Moreover, there are still many variables at play. Unlike the habits of Chinese brands or joint ventures, Tesla, as a leader in niche markets and a disruptor in the overall market, often makes big moves based on the Gregorian calendar rather than the Chinese lunar calendar.

Every year-end and new year, Tesla always makes big moves. In December 2022, some employees took an early New Year's holiday due to production line adjustments. In January 2023, Tesla began a combination of indirect price cuts and official price cuts, offering up to an 8,000 yuan insurance subsidy, along with significant price reductions for the Model 3 and Model Y, starting at 229,900 yuan and 259,900 yuan, respectively. This move was later reviewed as the most direct spark for the 2023 automotive price war. In January 2024, Tesla once again made significant price cuts, reducing the prices of the Model 3 and Model Y by a minimum of 6,500 yuan and a maximum of 15,500 yuan.

The current reduction of 10,000 yuan in the final payment and the continuation of 0% interest rate for 5 years are also interpreted by the outside world as another major move in January 2025. There are two main reasons: first, spy shots of new Tesla vehicles have been taken at the Shanghai factory, and it has been revealed that the refreshed Model Y has already started small-scale pre-production. Second, when Tesla announced its new policy, the delivery cycle was 1-3 weeks, indicating a relatively high inventory level. Therefore, the current series of actions are interpreted as Tesla clearing inventory of older models, with the refreshed Model Y set to be launched in 2025 after upgrading many essential configurations for Chinese users, such as enhanced seat comfort, longer range, and higher specifications.

In fact, based on our communication with multiple automakers, many marketing teams do not intend to make significant moves at the end of this year. Instead, they are waiting for Tesla to complete its moves at the beginning of 2025 before devising countermeasures.

Final Thoughts

Since 2023, the pace and sales logic of year-end car sales have been continuously evolving. Despite the fact that many car prices have hit new lows at the end of 2024, the traditional rule that "buying a car at the end of the year is significantly cheaper" is no longer as evident in the market.

According to statistics from the China Passenger Car Association and other channels, there are currently about 50 automakers/brands with a certain sales volume in the Chinese auto market. Currently, 10 of them are intensifying their price wars, while automakers like Geely are avoiding the traditional price war by introducing relatively low-priced new models that offer complete features from the outset. Approximately 20 automakers have the capacity to compete on price, which means that the remaining 60% of automakers are temporarily unable to do so.