BYD and Xiaomi take the lead in meeting targets, with some brands' achievement rates below 50%

![]() 12/05 2024

12/05 2024

![]() 472

472

With less than a month to go before the end of 2024, auto companies have gradually offered highly attractive discounts since September to boost their annual sales figures. These include limited-time fixed pricing for new cars and interest-free policies announced by Tesla and Li Auto.

Based on the released sales data, EV News compiled information and found that many auto companies have shown significant year-on-year growth, with quite a few setting new sales records in November. More importantly, amid such fierce market competition, Xiaomi, BYD, and Leapmotor have already surpassed their sales targets set at the beginning of the year.

Illustration: EV News

So, what did Xiaomi, BYD, and Leapmotor do right?

Xiaomi has no worries about sales but struggles with production capacity

Since its delivery, Xiaomi SU7 has consistently seen its monthly sales rise, with sales of 7,058, 8,630, and 14,296 units in April, May, and June, respectively. In the following third quarter, monthly sales stabilized at around 14,000 units. (Data sourced from a third-party platform)

Image source: Xiaomi Auto official

Xiaomi Auto has gained significant popularity, but as a newcomer in the automotive industry, production capacity remains one of its weaknesses at this stage. Based on a monthly sales volume of 14,000 units, Xiaomi Auto's annual sales volume for this year is expected to exceed 110,000 units.

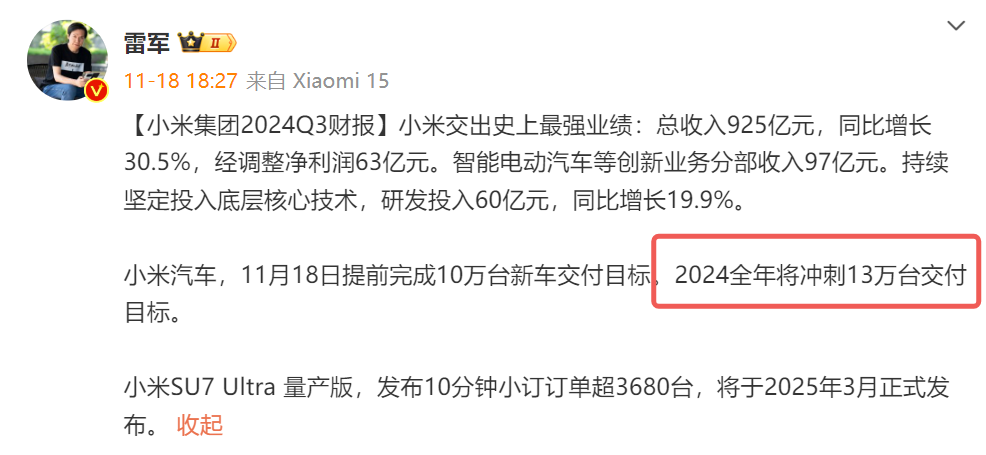

Therefore, in April this year, Lei Jun announced with confidence that Xiaomi SU7's annual sales target was over 100,000 units. A month later, Lei Jun adjusted the target to a guaranteed delivery of 100,000 units, with a challenge of 120,000 units. When Xiaomi Auto Group released its third-quarter financial report, Lei Jun again updated the target: a full-year sprint to 130,000 units.

Image source: Weibo @Lei Jun

Currently, Xiaomi Auto's production capacity fully relies on its Phase I factory, with a rated annual capacity of 150,000 units and a monthly capacity of about 12,500 units. Combining double shifts and automated production measures, the factory's production line utilization rate is close to 200%, but consumers still need to wait 19-27 weeks to receive their cars.

That said, since Xiaomi Auto's November sales have already exceeded 20,000 units, and its cumulative sales have surpassed 110,000 units, achieving the 130,000-unit target should not be a major issue. However, Xiaomi Auto expects to launch an SUV in the first quarter of next year, while its Phase II factory will officially commence production as early as July next year. Before July, the Phase I factory may face significant production pressure, and the delivery times for Xiaomi SU7 and its new SUV will only increase.

BYD and Leapmotor rely on best-sellers

In November, BYD's monthly sales once again exceeded 500,000 units, while Leapmotor's deliveries exceeded 40,000 units for the first time, setting a new record. It is evident from the sales composition of these two brands that the fundamental reason for their early achievement of annual sales targets can be summed up with one word: best-sellers.

Looking back at 2023 sales performance, BYD Group sold 3,024,417 units for the entire year, while Leapmotor sold 144,155 units. The 2024 sales targets set for these two brands represented an increase of 575,500 units and 105,800 units, respectively, with Leapmotor's target growth rate approaching 50%.

Image source: EV News production

The reason why these two auto companies dared to set such ambitious targets undoubtedly relates to their product planning. BYD Group's primary sales come from the Dynasty series and Ocean Network, with new models like the Qin L, Seal 06 DM-i, and Song L DM-i all surpassing 20,000 units in monthly sales. While maintaining a price advantage, BYD has also quickly integrated its latest fifth-generation DM technology into its products, directly impacting similar gasoline-powered vehicles in the same class.

When Leapmotor announced its 2024 sales target, EV News was actually skeptical, as it didn't have a single model with stable monthly sales exceeding 10,000 units at the time. However, Leapmotor's products this year have been truly refreshing, with the C16 and C10 models, as well as the upgraded T03 and C11, all offering high cost-effectiveness.

Smartly, Leapmotor's C series aims at the currently best-selling Li Auto L series in the automotive market, making it highly attractive to users who have a limited budget but still want a similar driving experience.

Image source: EV News production

You might think that Leapmotor's focus on cost-effectiveness and adherence to the budget home vehicle market below 200,000 yuan is just a "trade-off between price and volume." However, through the economies of scale created by increased sales and continuous cost management optimization, Leapmotor achieved a gross margin of 8.1% in the third quarter, a significant improvement from the 2.8% in the second quarter, with adjusted net losses also reduced compared to the second quarter.

By "trading price for volume," Leapmotor is gradually approaching the first tier of new forces in the industry. The only drawback may be that its brand image is already fixed, making it difficult to aspire to the premium market.

BYD Group's systemic capabilities are much stronger than Leapmotor's. In addition to the Dynasty series and Ocean Network, it also has three more premium new energy brands: Denza, FANGCHENGBAO, and NIO. It has no obvious shortcomings in the domestic market and no longer worries about profitability issues. It can even rely on its systemic capabilities to negotiate cost reductions with suppliers, creating greater benefits for both the enterprise and consumers.

What went wrong for the "underachievers" in terms of target completion?

Based on November sales figures, it can be basically confirmed that Li Auto will have no major issues in meeting its sales target. However, Zeekr, NIO, and Thalys will need to step up their efforts in December to potentially achieve their targets. As for the other brands in the table, they can only sigh in frustration at the sales targets they initially set, with Xiaopeng, Aion, IM Motors, and ARCFOX only achieving 50% of their targets, which is quite astonishing.

Analyzing the reasons why these brands struggled to meet their sales targets, EV News believes it is due to a combination of two factors.

Firstly, the sales targets set at the beginning of the year were too ambitious, such as for Xiaopeng, Aion, and ARCFOX. Among them, Xiaopeng and ARCFOX have introduced many important new models this year, and setting such high sales targets undoubtedly reflects their confidence in these new products.

Image source: EV News production

Many of these new models have indeed shown good sales figures. The Xiaopeng MONA M03 has become the sales champion in the 100,000-yuan pure electric sedan market, with over 7,000 units of the Xiaopeng P7+ delivered in November, and monthly sales of the ARCFOX S07 stabilized at over 10,000 units.

However, Xiaopeng only sold 141,600 units in 2023, while ARCFOX sold only 136,000 units. Yet both set a sales target of 280,000 units for 2024, which is still challenging for them to achieve given their current performance. The officials may have higher expectations for these new models, but they are already performing at a normal level.

In the next five years, Xiaopeng and ARCFOX may need to pay more attention to their target planning. Unrealistic and unattainable targets are meaningless.

Secondly, their market performance has been disappointing, with no best-sellers emerging. The sales targets set by Haval and IM Motors were not particularly high, and they have introduced many new products this year. Especially for Haval, new models like the Haval Dreamer, Haval Listener, and Haval FREE 318 are not weak. IM Motors has also launched the IM L6, which competes with the Xiaomi SU7.

However, due to various factors such as product positioning and brand recognition, these new models have struggled to become best-sellers. If even one model could stabilize its monthly sales at over 10,000 units, Haval and IM Motors would not face much pressure to achieve their sales targets of 100,000 and 120,000 units, respectively.

Image source: EV News production

Thalys' set target may seem ambitious, but based on its market performance earlier in the year, Thalys could rely on the AITO M7 to compete with Li Auto's entire L series. If the AITO M7 could maintain its sales trend from the beginning of the year, achieving the sales target of 480,000 units would have been entirely possible.

However, the mid-to-large SUV market where the AITO M7 operates has become increasingly competitive. In addition to Li Auto's gradually expanding L series, new models like the Leapmotor C16 and the new IM LS6 have also entered this market segment, eroding the AITO M7's market share. Currently, it can only maintain a monthly sales volume of around 16,000 units.

Setting higher sales targets at the beginning of the year may be inspiring, but as time passes, the drawbacks of overly ambitious targets become apparent, bringing anxiety and unease to brand development. Frankly, it's not a big deal if auto companies fail to meet their self-set sales targets. They can always try again next year. However, what auto companies need to do is adjust their targets while summing up experience and humbly learning from top performers.

Source: Leitech