Great Wall Motors' Ora brand is "falling out of favor"

![]() 12/10 2024

12/10 2024

![]() 493

493

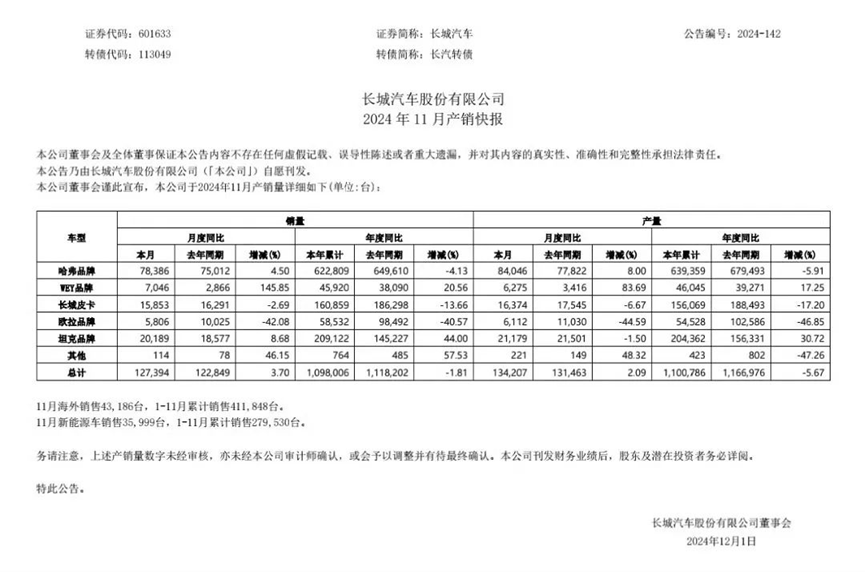

Recently, Great Wall Motors released its production and sales report for November. The data shows that the company sold 127,394 vehicles in November, an increase of 3.7% compared to the same period last year. Cumulative sales for the first 11 months of this year amounted to 1,098,006 vehicles, a decrease of 1.81% year-on-year.

In terms of individual brands, sales of WEY, Tank, and Haval increased by 145.85%, 8.68%, and 4.50% year-on-year, respectively, while sales of Pickup and Ora declined by 2.69% and 40.57% year-on-year. Among them, Ora has seen the largest sales decline among Great Wall Motors' brands. In fact, Ora's market performance has been less than optimistic since 2022. After peaking at 135,000 sales in 2021, sales began to decline. In 2022, cumulative sales declined by 22.98%, followed by a slight increase of 4.35% in 2023, but then declined by 42.08% in 2024.

The sharp decline in Ora's sales can be attributed to the cessation of production of its two main models, the Ora Black Cat and White Cat, in 2022. Due to a sharp increase in raw material prices, the cost of producing these small cars became prohibitively high, leading to losses. The more units sold, the greater the losses incurred. However, it should be noted that the price range of under RMB 100,000 for the Ora Black Cat and White Cat was not only the main driver of Ora's sales but also held a significant market share in the A0-segment market. With the cessation of production of these two models, Ora's market presence declined sharply, leading to a decrease in brand recognition.

In reality, it is an open secret in the industry that micro-cars have thin margins, low profits, and often operate at a loss. However, from a market perspective, there is still ample room for growth in the micro-car segment, with potential for increased sales. Moreover, an increase in the market presence of micro-cars can help enhance brand recognition. This is precisely why automakers such as Geely, Chery, and Changan continue to actively invest in this segment despite ongoing losses. Subsequently, Ora opted to reposition its brand, targeting the RMB 100,000-200,000 market segment and even venturing into the premium segment above RMB 200,000. Models like the Ballet Cat and Lightning Cat were introduced, but their market performance has been subdued, with monthly sales consistently remaining in the triple digits.

The primary reason for this is the fierce competition in the RMB 100,000-200,000 segment. Models like the Ora Good Cat and Ballet Cat, with their overly feminine designs, have a limited audience. In contrast, brands that are not traditionally considered "female-oriented" are gaining favor with female consumers. For example, XPeng's MONA M03 has eroded market share in the RMB 100,000 segment, while Xiaomi's SU7 has captured the premium female market segment above RMB 200,000, further jeopardizing Ora's market position. With the cessation of production of high-volume models and declining sales of mainstay models, Ora has become a drag on Great Wall Motors. To reduce costs, the Great Wall Ora app ceased operations in December of last year, with related services being migrated to the Great Wall app. In terms of sales and after-sales channels, Ora shares them with other Great Wall Motors brands. In some regions, Haval dealers have already begun selling Ora models. Industry insiders analyze that the integration of Ora and Haval channels is a signal of brand consolidation. Currently, the female-oriented branding that once made Great Wall Motors proud is gradually becoming a constraint rather than an advantage.

(Images sourced from the internet. Please remove if infringing upon copyright)