What drives Leap Motor's sales to double: products or channels?

![]() 12/10 2024

12/10 2024

![]() 476

476

"As the saying goes, provisions must be ready before troops march."

"The sufficient condition for scale is channels."

"Adhering to full self-research, cost-based pricing, and providing users with a sense of well-being through affordable yet high-quality products"...

I happened to see Leap Motor's brand advertisement on CCTV recently (it actually aired as early as July this year). Its founder, Zhu Jiangming, personally appeared in the advertisement, concisely and straightforwardly conveying Leap Motor's brand philosophy.

The advertisement is short and down-to-earth, devoid of gimmicks or overly conceptual content, aligning with Leap Motor's pragmatic nature.

Evidently, emphasizing cost-effectiveness is Leap Motor's competitive strategy, and achieving this through low gross margins is how they build their competitive moat. The space for compressing gross margins comes from over 60% of 'electrified' BOM components being self-researched and manufactured by Leap Motor.

Leap Motor's ability to consistently pursue this strategy hinges on its pragmatic nature, strategic focus, and determination (i.e., achieving scale through low gross margins), which significantly reduces sunk costs during development and minimizes the pressure of price wars and financial constraints.

Returning to Leap Motor a year later, many points from the previous article, "A Steady Leap Motor: How to Break Through the Ceiling," have resonated.

Latest data shows that Leap Motor delivered over 250,000 vehicles cumulatively from January to November this year (a year-on-year increase of 100%), with over 40,000 vehicles delivered in November alone (a year-on-year increase of 117%), thereby surpassing its 2024 sales target ahead of schedule. Building on this, Leap Motor aims to sell 500,000 vehicles in 2025 and reach a production capacity of 1 million vehicles by the end of next year.

This document will focus on two aspects: First, how did Leap Motor achieve over 100% growth amidst an industry growth rate of less than 30% for domestic new energy vehicles? Second, what is the rationale behind Leap Motor's 2025 sales and production targets of 500,000 and 1 million vehicles, respectively?

I believe these two questions are closely related to Leap Motor's channel model and its resource investment in channel construction.

In summary, after years of cautious advancement in the industry, Leap Motor has shown signs of preparing for accelerated growth. This is likely the beginning of its efforts to "break through the ceiling."

01

—

Channel Distribution Model Supports Doubled Sales

Leap Motor's monthly sales first exceeded 18,000 units in October last year, remaining stable at around that figure for the following eight months. In June this year, monthly sales surpassed 20,000 units for the first time, and just five months later, they doubled to reach 40,000 units.

Comparing these two periods, the rapid growth in Leap Motor's sales in the latter period can be attributed to two factors: First, on the supply/product side, Leap Motor launched two new models, the C10 and C16, in March and June this year, expanding its C-series lineup and quickly gaining sales through high cost-effectiveness.

Second, on the market/channel side, Leap Motor's "1+N" marketing network model was first mentioned in its 2023 financial report. This model refers to a regional center store with 4S services supporting multiple display stores within the region. Leap Motor assists dealers in expanding their retail capabilities through city managers (i.e., Leap Motor's sales staff).

In my opinion, while Leap Motor's models offer high cost-effectiveness and strong competitiveness in the 150,000 RMB new energy vehicle segment, this alone does not fully explain the leap from 20,000 to 40,000 monthly sales in just five months. In other words, new models do not generate such a significant natural flow of customers.

It is more likely that changes and results on the channel side were the primary drivers of Leap Motor's rapid sales growth in the third quarter of this year.

Further analysis reveals:

At the end of 2022, Leap Motor had 582 sales outlets (including 79 direct-sales outlets) covering 180 cities.

At the end of 2023, there were 560 sales outlets covering 182 cities.

In the first half of 2024, there were 474 sales outlets and 328 service outlets covering 187 cities.

In the third quarter of 2024, there were 493 sales outlets and 362 service outlets covering 204 cities.

From 2022 to the first half of 2024, Leap Motor's sales and marketing staff decreased from approximately 1,345 to 1,170, accounting for less than 11% of the company's total employees, down from around 17%.

These outlet and staffing data directly show that, first, Leap Motor's outlet count did not increase with sales but actually decreased by 100 outlets. Second, the number of sales and marketing staff also decreased despite increasing sales, which is counterintuitive.

This means that as Leap Motor's sales grow from 140,000 vehicles in 2023 to an estimated 300,000 vehicles in 2024, the sales per outlet will double, and inventory levels will also need to double, placing higher demands on dealers' financial operations.

As a result, some dealers with weaker financial strength and their outlets will gradually be excluded from Leap Motor's channel network.

Focusing further on dealers and outlets, without a significant increase in natural flow, dealers or individual outlets must either significantly reduce prices or open additional branches to double their sales. Considering Leap Motor's price reductions are not significantly greater than competitors', dealers are likely expanding through additional branches to match overall sales growth.

However, the decrease in Leap Motor's sales outlets in recent years indicates that dealers are not opening new outlets but rather increasing sales through the "N" in the "1+N" model, further distributing within their regions to scale up sales.

Leap Motor, through its sales staff (city managers), assists dealers in integrating regional resources and channels, thereby expanding its channel network and achieving sales growth.

02

—

'Disappeared' Marketing Investment of 1.6 Billion RMB

However, rapidly building the "1+N" model is not easy. Brands must meet two prerequisites: strong product competitiveness to ensure easy sales (i.e., low monetization costs or high monetization efficiency) and additional resource or cost investment in this channel model to drive rapid expansion.

For Leap Motor, we must focus on its specific resource investment in channels.

In the "1+N" model, as dealers' sales double, they need to invest more operational funds, increasing inventory risks. Therefore, Leap Motor must provide greater incentives, such as increased monthly/quarterly/annual sales rebates.

Leap Motor's city managers also need to invest in marketing and development expenses to effectively integrate local resources and channels into dealers' operations.

With these incentives and collaborations, Leap Motor's channels can support doubled sales in a short period.

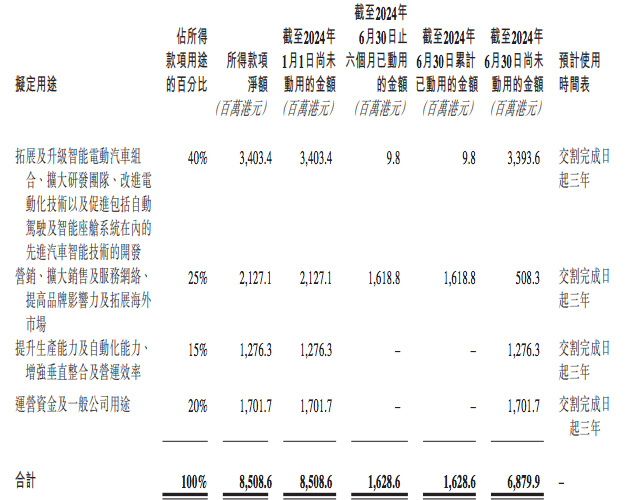

This channel construction investment is evident in Leap Motor's new round of strategic financing announcement (dated October 9, 2024), which disclosed the use of a 8.5 billion HKD investment from Stellantis received at the end of 2023.

As of the first half of 2024, Leap Motor had not utilized the planned funds for R&D, capacity expansion, or operations but had used three-quarters of the funds allocated for marketing and expanding the sales and service network, totaling over 1.6 billion HKD. This suggests significant resource investment in the "1+N" channel model in the first half of this year.

However, these 1.6 billion HKD are not fully reflected in Leap Motor's first-half 2024 financial report, which showed sales expenses of only 900 million RMB (a mere 10% year-on-year increase). This level of sales expenses is insufficient to drive rapid expansion of the "1+N" channel model.

In fact, Leap Motor's sales expenses in the third quarter of 2024 were only 550 million RMB, a 24.5% increase from the 440 million RMB in the third quarter of 2023, far behind revenue growth.

So far, the 'disappeared' 1.6 billion RMB for marketing and expanding the sales and service network remains puzzling. Logically, this money should have been invested in channel construction as expenses but is not reflected in the first-half 2024 financial data (whether expensed or capitalized).

If these 1.6 billion HKD were indeed invested in channel construction in the first half of this year but not fully accounted for in first-half expenses, then Leap Motor's first-half 2024 net loss figure may require scrutiny.

Data shows that Leap Motor's first-half 2024 operating loss was 2.395 billion RMB, a mere 2.7% increase in losses year-on-year.

03

—

Excellent Supply Chain Management

Both in terms of market sales and financial structure, Leap Motor is exhibiting a steady and significant increase in sales volume, driving a notable improvement in gross profit margins and a narrowing of net profit margins, indicating a smooth and deterministic business logic.

While the industry generally attributes this positive momentum to Leap Motor's models' outstanding cost-effectiveness, I believe that Leap Motor's resource investment in marketing and channels cannot be overlooked, as it is hard to explain the doubling of sales in just five months without it.

Therefore, I infer that the primary driver of Leap Motor's sales growth is marketing.

In the capital market, companies primarily driven by marketing for revenue/scale growth often face sustainability and business efficiency concerns. As a result, listed companies are generally reluctant to admit heavy reliance on marketing investments.

However, Leap Motor is different. First, its models are competitive, and dealers can quickly clear inventory after expanding the channel network, avoiding excess inventory.

Second, Leap Motor's strategic model inherently prioritizes long-term, low-margin operations. Short-term channel construction/expansion investments may temporarily affect the financial structure (primarily net profit margins), but as long as products sell well, the expanded channel network will gradually become an integral part of Leap Motor's system in the long run.

This inference is further supported by Leap Motor's excellent management of upstream suppliers and downstream dealers.

In 2022, 2023, the first half of 2023, and the first half of 2024, Leap Motor's accounts payable as a percentage of revenue were 48%, 59%, 102%, and 105%, respectively, indicating enhanced leverage over upstream suppliers as sales volume grows (partly due to Leap Motor's self-research and production of over 60% of components).

Correspondingly, Leap Motor's accounts receivable as a percentage of revenue were 0.3%, 0.4%, 0.6%, and 1.5% at these four time points. Despite some revenue growth, these percentages are exceptionally low (typically between 10% and 20% in the industry), suggesting that downstream dealers need to pay cash upfront for vehicle delivery.

Under these circumstances, Leap Motor's inventory has remained stable at around 1.5 to 1.7 billion RMB, indicating a significant improvement in inventory turnover.

Leap Motor's management capabilities have continuously strengthened with its growing scale, demonstrating business sustainability and commercial certainty.

This further deepens my confusion regarding the 'disappeared' 1.6 billion RMB in marketing expenses. Logically, there is no need to conceal this investment.

04

—

Channel Priority for Scaling Up

Currently, Leap Motor's channel network can support monthly sales of 40,000 vehicles. Theoretically, its existing channel system can handle the 2025 sales target of 500,000 vehicles, meaning Leap Motor has completed channel investments and layouts a year ahead of schedule.

Beyond this sales target, Leap Motor aims to achieve a total production capacity of 1 million vehicles by the end of 2025 (or early 2026), representing a 100% year-on-year increase, indicating Leap Motor's accelerated scaling efforts.

This likely means Leap Motor will face greater financial pressures in 2025. While its gross profit margins may increase due to economies of scale, the annual amortization cost for 1 million units of production capacity could exceed 800 million RMB (approximately 2% of revenue). Given Leap Motor's low-margin business model, its future gross profit margin growth will be limited (expected to be around 10% in 2025).

Additionally, Leap Motor must continue investing more resources in its channel network to match the million-unit production capacity in 2026. These investments, whether capitalized or expensed, will reduce Leap Motor's profit margins that year.

Simultaneously, Leap Motor's R&D expenses are increasing, primarily to address its shortcomings in 'intelligent driving' and keep pace with industry competition.

The fundamental reason for Leap Motor's accelerated scaling is industry competition.

Leap Motor has focused on China's lower-tier markets, which have been less competitive than first- and second-tier markets. However, as brands like Xiaopeng, Letao, Shenlan, Aion, Yinhe, and Yipai grow, they will also target lower-tier markets, leaving Leap Motor with a limited time window.

In this context, Leap Motor needs to rapidly expand its channel network in lower-tier markets, encompassing dealers, agents, 4S stores, and franchised stores previously handling all fuel vehicle brands. If Leap Motor fails to convert a significant portion of these channels during this challenging period, other new energy brands may seize these opportunities, hindering Leap Motor's scaling process and potentially leading to longer-term competition for limited resources.

Therefore, Leap Motor has reached a point where it needs to adjust its pace and demonstrate a more proactive (even aggressive) stance.

In my opinion, Leap Motor's critical performance indicator over the next one to two years will be its ability to capture a significant share of the lower-tier market, rather than achieving an overall profit.

Currently, Leap Motor has ample cash reserves, a new partnership with Stellantis, and strong support from local government funds, positioning it well to capture more market share and demonstrate its potential and capability in the industry's next phase.

Hence, behind Leap Motor's large-scale capacity expansion and channel development in 2025 lies its intention to utilize the limited time window to accelerate its scale advantages and competitive moats in lower-tier markets, attracting more channel partners by proactively signaling its scaling ambitions.

As the saying goes, 'supplies come first, and then the troops move', competing for channel resources is an important prerequisite for Lingpao's large-scale expansion.