Exploring the Turmoil in Geely's New Energy Vehicle Landscape Through Geyue Automobile

![]() 12/17 2024

12/17 2024

![]() 457

457

As 2024 drew to a close, Geyue Automobile's "collapse" sent shockwaves through the automotive industry.

Due to financial constraints, Xia Yiping, CEO of Geyue Automobile, was confronted by a group of agitated employees at the company's headquarters. Even during live streams, Geyue employees auctioned off company equipment, and dealerships across the nation shut their doors.

Employees, concerned about their social security and compensation, and users, focused on after-sales issues, finally received a joint statement from "mother" Baidu Holdings and "stepfather" Geely Holdings on December 13.

The statement indicated that as shareholders, Baidu and Geely would actively assist Jidu's management in addressing related matters: promptly resolving employee social security contributions and aftercare for departing employees; maintaining normal use, after-sales service, and maintenance of user vehicles; and promoting the reasonable and legal resolution of other issues.

Upon reading the statement, two intriguing points emerged: first, Geyue Automobile "imploded," yet the statement began with "Jidu Auto Co., Ltd."; secondly, despite Geely being the majority shareholder, Baidu was mentioned first, both in wording and signature.

Exploring Geely Holdings' new energy layout through Geyue Automobile reveals a complex "family tree" far from orderly.

Why is Geely referred to as Geyue's "stepfather," or why is Geyue deemed insignificant? A review of Geyue's history provides clarity.

Geyue's "past life" was Jidu Auto. In 2021, Baidu and Geely jointly established "Jidu Auto Co., Ltd.," with Baidu holding 55% and Geely holding 45%, giving Baidu the controlling stake. In June 2022, Jidu unveiled its first concept car, the ROBO-01.

However, despite Baidu's enthusiasm and significant investment, the lack of an auto manufacturing license—a necessary "admission ticket"—severely hindered Jidu Auto's market entry. This led to a series of subsequent actions where Baidu ceded control.

In June 2022, Geely and Baidu "parted ways." Shanghai Huapu Automobile Co., Ltd. (renamed Zhejiang Geely Huapu Automobile Co., Ltd. in June 2023), part of the "Geely family," withdrew from Jidu Auto's shareholder list, and Baidu's affiliated company, Dazi County Bairuixiang Venture Capital Management Co., Ltd., increased its shareholding from 55% to 100%.

In December 2022, Jidu Auto Co., Ltd. underwent another business change, with the company name being changed to Shanghai Miyang Automobile Co., Ltd.

On August 9, 2023, Geely and Baidu joined forces again, this time with Geely becoming the majority shareholder. Hangzhou Jiyueyue Automobile Technology Co., Ltd. was established with Zhejiang Geely Industrial Investment Holding Co., Ltd. holding 65% and Shanghai Miyang Automobile Co., Ltd. holding 35%.

On August 14, 2023, the "Geyue" brand was officially launched, with the first model officially named "Geyue 01." On the same day, the Ministry of Industry and Information Technology's website officially announced the 374th batch of new automotive products, including the "Geyue 01."

Geyue Automobile embraced its "present life."

Although Geely has become the majority shareholder of Geyue, comparing it to Geely's other brand, Zeekr, reveals why Geyue is undervalued.

Zeekr's CEO is An Congrui, who also serves as President of Geely Holding Group and Chairman of Geely Auto Group. In contrast, Geyue's CEO, Xia Yiping, is the former co-founder and Chief Technology Officer of Mobike. Although he has worked for automakers like Fiat Chrysler and Ford, his appointment as CEO of a domestic new energy vehicle company is somewhat perplexing.

As Xia Yiping stated in a lengthy apology letter released on December 16, "Some say at Geyue, I'm just a professional manager." Although he continued, "I've always considered myself a true entrepreneur," it was precisely due to his lack of experience that he could not accurately estimate the funding required for vehicle manufacturing. Misjudgments in strategy and financing led Geyue Automobile into a quagmire, with mistakes also made in human resources, management, and marketing.

It can be said that while Geely's initial intention as the majority shareholder of Geyue may have stemmed from a sense of mission to "create a new species of automotive robots," it was more due to possessing an auto manufacturing license that it became the majority shareholder. Geely's primary responsibility was to provide Geyue with a platform and technology, charging for manufacturing services.

Therefore, in the joint statement issued by Geely and Baidu on December 13, Baidu took the lead. For Geely, the "big pie" of Geyue's entrepreneurial 2.0 is far less substantial than the overdue manufacturing fees it is owed.

As the "king of acquisitions" in the automotive industry, Geely has always adhered to the principle of "not putting all your eggs in one basket" when it comes to its new energy vehicle layout.

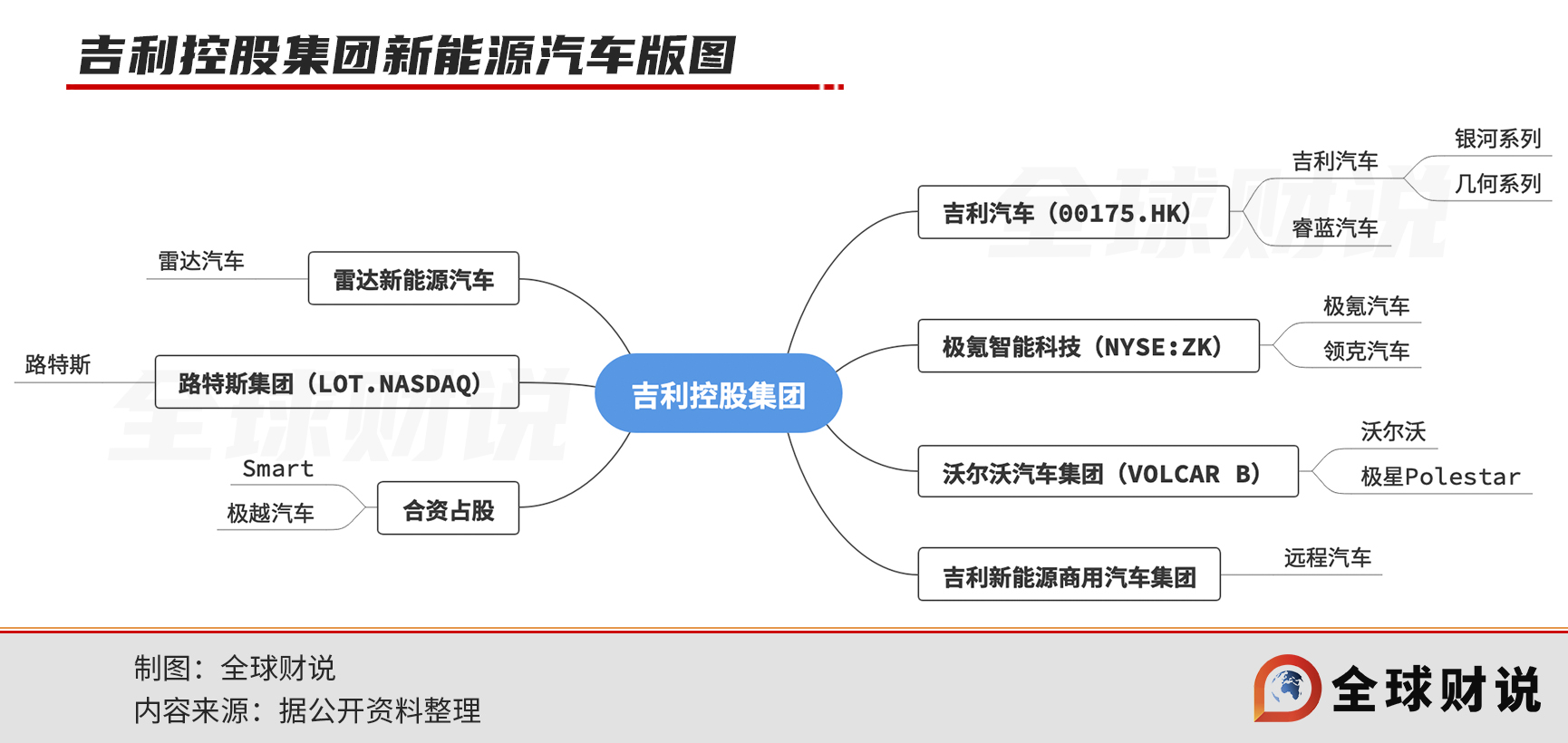

According to an incomplete count by Global Finance News after reviewing publicly available information, Geely's new energy vehicle landscape encompasses 12 new energy vehicle brands/series, earning it the title of "The Twelve Disciples" and undoubtedly making it the leader among domestic automakers in China.

As seen in the image above, these 12 brands originate from seven "sons" of Geely Holding Group: Geely Auto (00175. HK), Zeekr Intelligence Technology (NYSE: ZK), Volvo Cars Group (VOLCAR B), Geely New Energy Commercial Vehicles Group, Radar New Energy Vehicles, Lotus Group (LOT. NASDAQ), and joint venture holding companies including Geyue.

Among them, Geely Auto stands out as the most competitive. In 2024, Geely Auto made rapid progress in the new energy sector, with cumulative sales of 777,000 units in the first 11 months, a year-on-year increase of 92%, solidly ranking second in new energy vehicle sales. It not only surpassed the sales of Chery New Energy and Changan New Energy but is also virtually assured of finishing second in annual new energy vehicle sales for 2024.

Another topical brand is Zeekr. As a sought-after player in the pure electric field, on November 14, 2024, Geely Holding announced the optimization of the equity structure of Zeekr and Lynk & Co., streamlining equity relationships, reducing related-party transactions, eliminating horizontal competition, and promoting deep internal resource integration and efficient synergy.

After a series of internal adjustments, Zeekr will hold a 51% stake in Lynk & Co., with the remaining 49% continuing to be held by a wholly-owned subsidiary of Geely Auto. Essentially, Lynk & Co. has become a subsidiary of Zeekr.

In May, Zeekr Intelligence Technology officially listed on the New York Stock Exchange with the ticker symbol 'ZK.' From its announcement on April 15, 2021, to its successful listing on the NYSE, Zeekr set a new record as the fastest new energy vehicle company to go public, taking just 37 months.

Next is the luxury brand Volvo, a globally renowned name whose electrification progress has been somewhat sluggish in the new energy era. It was only this year that Volvo's first true pure electric platform model, the EX90, was officially unveiled. Polestar, as a brand under the Volvo Cars Group focused on high-performance electrification, was also launched with ambitions to compete with Tesla.

Additionally, in October, Geely Auto merged the less visible Geometry brand, which had little presence in the market, into the highly successful Yinhe series.

Geely's landscape also includes Radar Automobiles, which specializes in pickups and off-road SUVs, and Lotus, which makes sports cars. Relatively speaking, the jointly established Geyue is not prominent in Geely's entire landscape and can only be considered an added bonus, even if it excels.

"The company has numerous subsidiaries and multiple management levels." This is a quote from Geely Holding Group's 2023 annual report.

Geely's business model has been facetiously referred to by outsiders as "the more children, the better the fight." Indeed, the multi-pronged approach has brought significant growth to Geely, but the large number of subsidiaries also poses numerous management challenges.

It must be acknowledged that in the past few years, new energy vehicle startups and traditional automakers have been in a phase of significant expansion or capital games. Due to the inability of their main brands to cover a sufficient market share, they have launched sub-brands or third brands in the hope of capturing more market share or attracting more attention.

This approach has led to endless internal competition or internal friction.

A prime example is Lynk & Co.'s Z10 and Zeekr's 001. Both are pure electric sedans with similar models and aesthetics. Originally, both models were intended to jointly "encircle and suppress" Xiaomi's SU7, but Zeekr 001 was launched before the Lynk & Co. Z10. After the Z10's launch, a "price war" ensued.

However, amidst this internal competition, Xiaomi's SU7 sold exceptionally well.

In September 2024, Geely Holding Group issued the "Taizhou Declaration," clarifying that it would further define the positioning of each brand, reduce conflicts of interest and duplicative investments, enhance group operational efficiency, and focus on integration as the main theme of Geely's next adjustment.

Interestingly, in addition to the integration of Zeekr and Lynk & Co., Polestar may also face integration. For example, there have been reports that An Congrui will replace Shen Ziyu as the Chairman of Polestar, which is seen as a precursor to future integration or collaboration between Polestar and Zeekr.

Previously, it was reported that Radar Automobiles had also been downgraded or would be integrated into the Geely Auto Group. After integration, Radar Automobiles will become a first-tier organization within the Geely Auto Group, with its head, Ling Shiquan, reporting to Gan Jiayue, CEO of Geely Auto Group.

Clearly, the frenzy of expansion is nearing its end, and the era of integration and fierce competition is upon us. Geyue Automobile, once a pioneer in the new energy vehicle industry, may have become just another grain of sand in the grand era.