Honda and Nissan Mull Merger: What Does This Mean for China's New Energy Vehicle Startups?

![]() 12/23 2024

12/23 2024

![]() 468

468

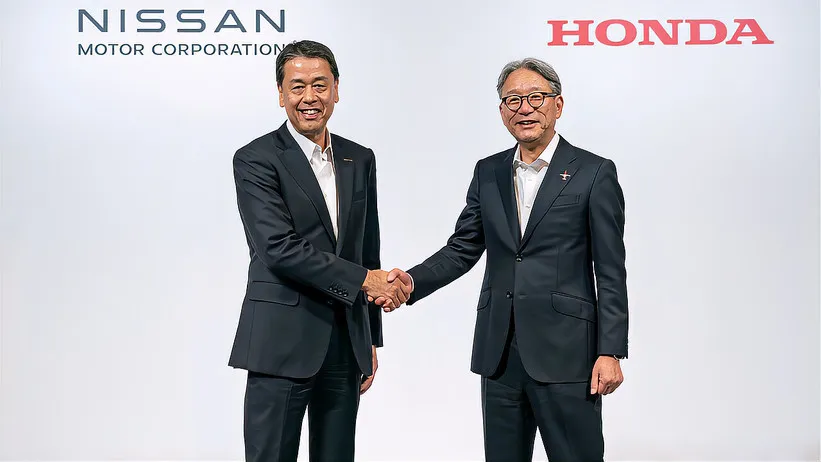

On December 18, media outlets reported that Japan's two largest automakers, Honda Motor (HMC.US) and Nissan Motor (NSANF), were entering merger negotiations, considering the establishment of a holding company, and planning to incorporate Nissan-owned Mitsubishi Motors into this new entity.

Why are they considering a merger, and will it actually happen?

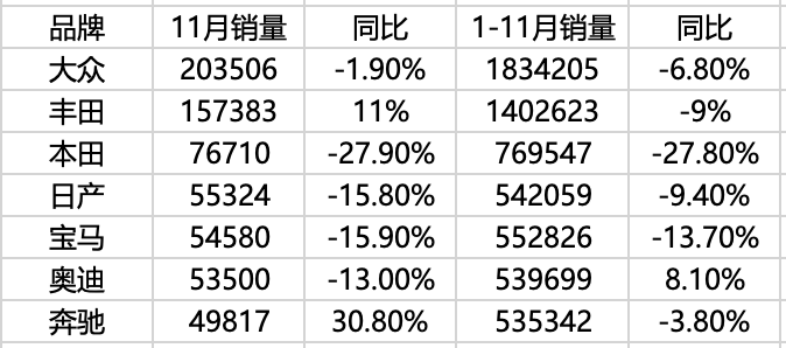

A glance at sales figures provides clarity. With the rapid rise of new energy vehicle (NEV) companies like Tesla and BYD, the market share of traditional automakers has been steadily eroded. Unable to compete effectively, they are compelled to form alliances to cut costs, survive, enhance technological capabilities, and await an opportunity to thrive. From an investment market perspective, this is positive news, sending a favorable signal to the capital market and facilitating subsequent financing.

As electric vehicles, the primary type of NEV, gain popularity, traditional automakers' joint development of various electric vehicle technologies has become a means to leapfrog the competition. To compete with early adopters like Tesla, BYD, and Hongmeng Zhixing, they must establish their own core competencies. Prior to the potential merger, the two companies have already collaborated and made preliminary preparations in electric vehicle batteries and software, planning to jointly explore next-generation software-defined vehicle platforms, share resources like motors and inverters, and develop new batteries and electric axles.

Should the integration proceed smoothly, the combined annual sales of the merged company are expected to reach 8 million vehicles, making it the world's third-largest automaker after Toyota and Volkswagen. This also signifies that Japan's automotive industry will form two major camps: the "Honda-Nissan-Mitsubishi Alliance" and the Toyota Group, gradually evolving from a chaotic competitive landscape to a more balanced one.

However, the merger has not been confirmed, and everything remains uncertain. Nissan China told Caijing that the information had not been released by the two companies. Honda, Nissan, and Mitsubishi are indeed discussing various possibilities for future cooperation, but no decisions have been made yet.

Nevertheless, alliances among traditional automakers are inevitable.

In fact, for China's NEV startups, the possibility of forming alliances, cooperating, or even merging in the future cannot be ruled out.

The proposed merger between Nissan and Honda provides a development strategy for many local Chinese non-joint venture automakers as well.

So, who might consider a merger or acquisition?

History of Mergers in the Automotive Industry

Let's first look at some major mergers and acquisitions of the past few decades.

Volkswagen acquires Audi: One of the most successful mergers in the automotive industry over the past 50 years. Audi, once a wholly-owned subsidiary of Mercedes-Benz, was sold due to losses and successfully acquired by Volkswagen, making it Mercedes-Benz's biggest competitor in China.

Daimler-Benz acquires Chrysler: In 1998, Daimler-Benz acquired Chrysler for $36 billion. Despite an agreement for an "equal merger," differences in brand philosophy, lack of complementary product lines, and low technology sharing levels led to difficulties, ultimately ending in failure. In 2007, 80% of Chrysler's shares were sold to the American private equity firm Cerberus.

Renault-Nissan Alliance: In 1999, Renault and Nissan signed an alliance agreement, with Renault holding 44.4% of Nissan's shares and Nissan holding 15% of Renault's shares. This is a renowned alliance in the automotive industry.

Stellantis Group: A global automotive group formed by the 50:50 merger of PSA Group (Peugeot Citroen Group) and FCA Group (Fiat Chrysler Group) in 2021, encompassing multiple well-known automotive brands.

Geely Holding acquires Volvo: In 2010, Zhejiang Geely Holding Group acquired Volvo Cars from Ford Motor Company for $1.8 billion, marking a landmark event in Chinese automakers' overseas mergers and acquisitions.

Tata acquires Jaguar Land Rover: In 2008, Indian automaker Tata Motors acquired Jaguar Land Rover from Ford for $2.3 billion, a significant milestone for the Indian automotive industry.

BMW acquires Rover: In 2000, BMW acquired British automaker Rover for $2.7 billion but later sold Jaguar Land Rover to Ford for $3.9 billion due to Rover's poor performance, retaining ownership of Mini. Ford then sold Jaguar and Land Rover to India's Tata Group for $2.3 billion.

Is a Merger Possible Among Domestic NEV Startups?

Companies or brands considering a merger typically have a stable customer base, successful models, established brand presence, and possibly unique patents. However, they may lack new investments to develop new model lines or further increase sales. In such cases, they might seek a partner with complementary capabilities or a similar size to leverage synergies, grow together, or offload burdens and cash out. These brands or automakers are usually not the largest in market size but leaders in niche segments, akin to Jaguar and Land Rover.

Leading automakers, with ample funds and potential investments, often prioritize self-developed products and technologies. However, if another company excels in a particular model line and the automaker faces challenges in scaling up, it may consider merging with other brands to expand its scale, business scope, and stabilize its market position.

Referencing many international mergers and acquisitions, it's common for leading automakers to acquire niche market giants or for emerging market giants to acquire established brands from mature countries.

Recently, Link&Co. was integrated into Zeekr, technically not a corporate merger but more like internal resource integration within Geely.

Given the many joint venture automakers in the Chinese market, it's possible for the state-owned shareholders behind these companies to merge with NEV startups. The sales pressure on their joint venture brands makes this clear, but they will likely wait for lagging NEV startups to command a good price.

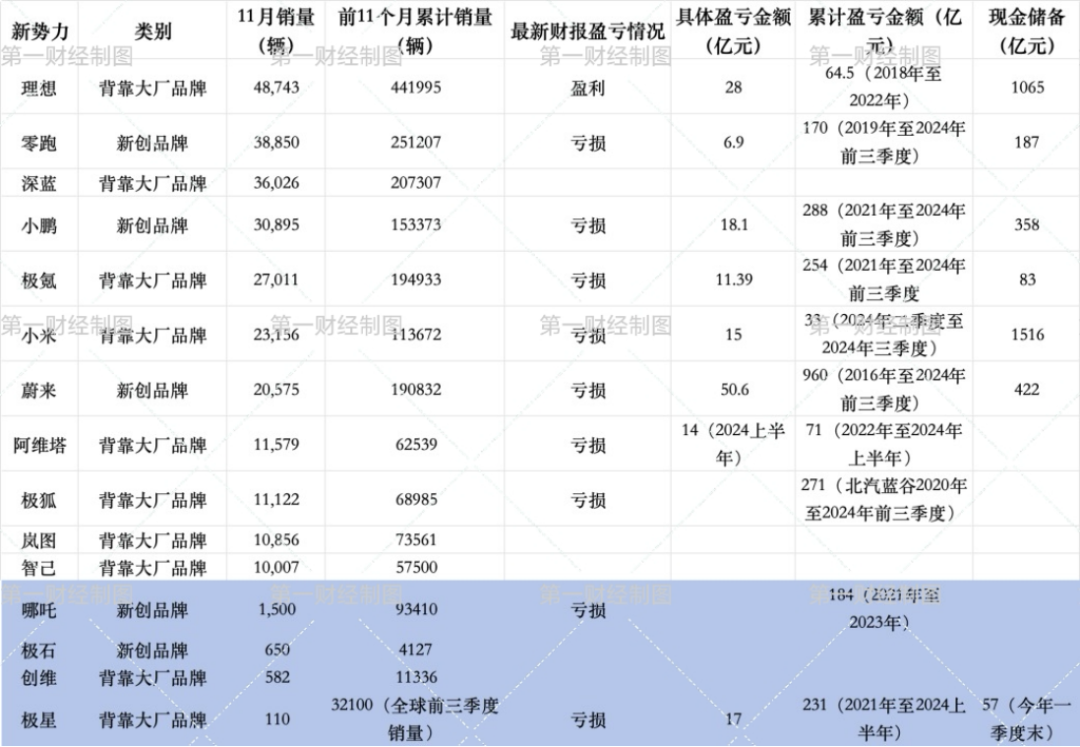

Let's look at the sales rankings of domestic NEV startups for the first 11 months of 2024. (Note: The claim that Li Auto is backed by a major manufacturer is inaccurate.)

Now, let's consider the sales rankings of NEV startups for a specific week in December.

Frankly, brands with sales rankings outside the top 10 and incurring losses are likely to merge within larger companies or be acquired by other investors or automakers, especially new brands. Of course, this is just current speculation, and the market is constantly changing, but competition will undoubtedly intensify next year.

Even among the top 10 NEV startups, there are various capital movements and undercurrents. According to Caijing News, Avitar, jointly created by Changan, Huawei, and CATL, will receive over 11 billion yuan in Series C funding. Earlier in October, Avitar President Chen Zhuo revealed that the company was fundraising with a post-investment valuation exceeding 30 billion yuan. With funding finalized, Avitar will prepare for an IPO in 2026.

On December 15, local media in the United Arab Emirates reported that Abu Dhabi-based investment firm CYVN Holdings had reached a deal with Bahrain's sovereign wealth fund Mumtalakat Holding to acquire McLaren's sports car business. Additionally, the deal grants CYVN a non-controlling stake in McLaren's racing business.

Notably, CYVN is the single largest shareholder of NIO, having acquired a 20.1% stake through two investments totaling $3.3 billion (approximately 23 billion yuan) in 2023. However, Li Bin remains NIO's single largest shareholder with voting rights and retains control.

Therefore, if the capital behind these NEV startups has broader ambitions, they can certainly afford to engage in mergers and acquisitions or promote mergers.

The years 2025-2026 are poised to witness more historic moments in the automotive industry.

References: Caijing, China Business News