The Rise and Fall of Automotive Newcomers: Lessons from Geely-Baidu's 'Sudden Demise'

![]() 12/24 2024

12/24 2024

![]() 635

635

By the end of 2024, news of Geely-Baidu Automobile's 'sudden demise' sent shockwaves through the automotive industry. As a joint venture between Baidu and Geely, Geely-Baidu's fate came as a surprise to many. More concerning, however, is that Geely-Baidu's downfall is not isolated but rather indicative of the fleeting fortunes of automotive newcomers. In recent years, numerous once-promising startups, from Tianji to WM Motor, Byton to HiPhi, have crumbled one after another. Their failures serve as a wake-up call for an industry that seemingly offers endless possibilities, prompting a reassessment of the harsh realities behind the buzzword 'new forces'.

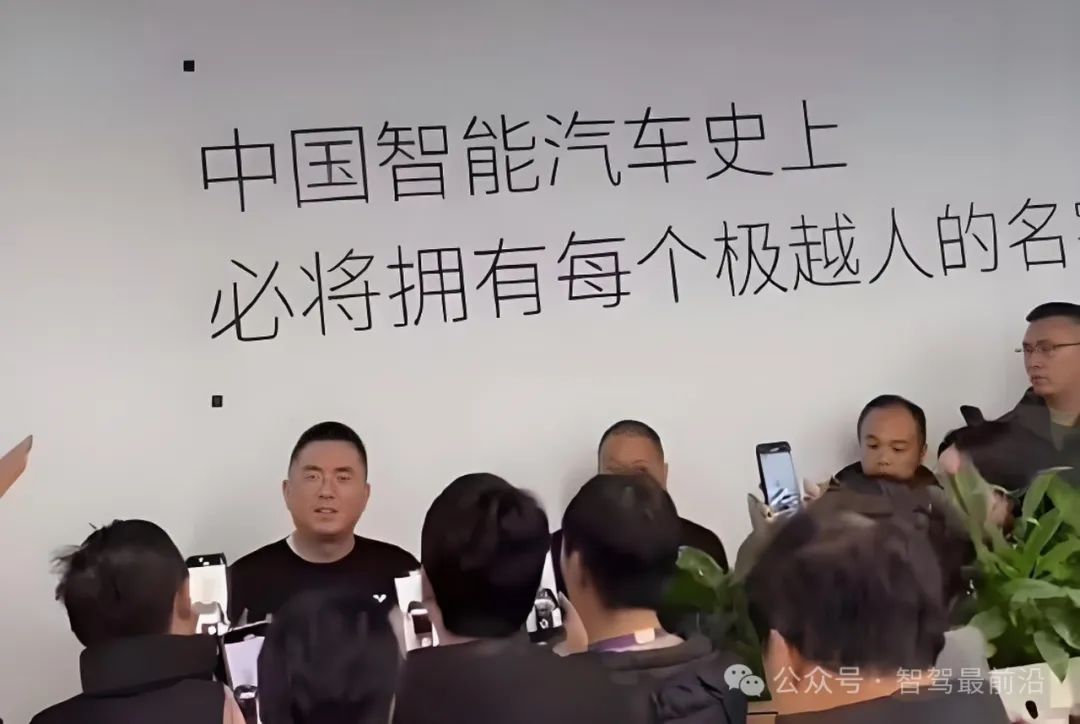

Geely-Baidu's Collapse: From Peak to Trough in Just Three Years and Nine Months

Established in March 2021 as a joint venture between Baidu and Geely, Geely-Baidu Automobile (formerly Jidu Auto) was heralded as the perfect fusion of 'technology + traditional automotive.' In August 2023, Jidu officially changed its name to Geely-Baidu and embarked on its journey as an independent brand. In October of that same year, its first mass-produced model, the Geely-Baidu 01, was unveiled. Positioned as an intelligent and high-end vehicle, it was seen as a dark horse among newcomers. However, just a year later, Geely-Baidu not only failed to gain a foothold in the market but also collapsed due to financial woes, becoming one of the shortest-lived automotive brands. This raises the question: what really led to its fleeting existence?

1. Brand Renaming: A Cognitive Disruption

During its 'Jidu' era, Geely-Baidu already struggled with vague market positioning. When it abruptly changed its name to 'Geely-Baidu' in 2023, external perception of the brand was immediately thrown into disarray. Consumers struggled to comprehend the rationale behind the name change, fostering a sense of distrust. From a marketing standpoint, frequent name changes weaken rather than strengthen a brand's core value. Geely-Baidu's risky decision to rename itself during a crucial launch period was self-destructive.

2. Disconnection Between New Car Promotion and Sales

The launch of the Geely-Baidu 01 and Geely-Baidu 07 was separated by less than a year, aimed at maintaining momentum through rapid product introductions. However, in terms of sales performance, Geely-Baidu failed to achieve a genuine breakthrough. Its product advantages lacked robust market promotion, and terminal performance fell far short of expectations. By rushing to launch the second model before stabilizing sales of the first, Geely-Baidu spread its resources thin, missing the market window.

3. Financing Difficulties and Cash Flow Crisis

Baidu and Geely, Geely-Baidu's backers, initially injected considerable resources, but these were insufficient to cover the long-term capital demands of an automotive newcomer. Car manufacturing is a capital-intensive sector where continuous spending is the norm. Geely-Baidu apparently lacked a stable funding source to sustain this 'money-burning' phase. The collapse of its funding chain within just three years exposed fundamental flaws in its business model.

Geely-Baidu's downfall is both a result of excessive capital dependence and a true reflection of the company's lack of self-sustainability. More profoundly, it mirrors common problems among many newcomers – a lack of patience for long-term operations and a limited understanding of market dynamics.

The Path to Success Is Paved with Failures: A Review of Fallen Newcomers

Geely-Baidu's fate is not isolated. Around 2014, Chinese automotive newcomers, represented by NIO, XPeng, Li Auto, and others, emerged, marking the rise of new forces in Chinese car manufacturing. Subsequently, more new brands sprang up like mushrooms after rain, sparking a technology and capital carnival. At the time, entering the automotive industry became a means for many listed companies to prove their strength and gain market recognition. However, within just a few years, dozens of brands have fallen one by one, including once-glorious star enterprises.

1. Tianji Automobile: The Fate of Marginalization in the Market

Founded in 2015, Tianji Automobile launched two models, the ME5 and ME7, focusing on extended-range hybrids and pure electrics, respectively. However, these vehicles performed lukewarmly in the market, lacking technical highlights and user recognition. In April 2023, certain positions at Tianji Automobile were suspended, and the company entered bankruptcy liquidation in 2024. Tianji's ultimate failure can be attributed to its insufficient product competitiveness and extremely low brand presence, making it difficult to secure a share in the fiercely competitive market. Tianji's fate also underscores that 'car manufacturing' alone does not constitute market competitiveness. For newcomers, brand building and differentiated positioning are equally crucial; otherwise, they will gradually fade into obscurity at the market's fringes.

2. WM Motor: From Champion to Lost 'Dream'

WM Motor was one of the earliest newcomers to enter the market. Its first model, the EX5, topped new force sales charts for 17 consecutive months. However, starting in 2020, WM Motor gradually lost its edge in the mid-range market, and subsequent models failed to replicate the EX5's success. Ultimately, WM Motor filed for bankruptcy reorganization in October 2023. WM Motor's downfall underscores a universal rule: during the golden window period for newcomers, capturing users and the market is paramount. Once that window closes, it's easy for later entrants to catch up in products and technology, causing the original market advantage to vanish.

The Dilemma of Newcomers: Why Has Failure Become the Main Theme?

Over the past decade, automotive newcomers have experienced a rollercoaster ride, transitioning from being hotly pursued by capital to frequently 'imploding.' Initially, these newcomers garnered significant attention with their slogan of 'disrupting the traditional automotive industry,' even shaking up the entire sector.

Time is the ultimate test. From Tianji Automobile to WM Motor, and from Byton to Geely-Baidu, many newcomers ultimately failed to escape the fate of closure, bankruptcy, or even 'disappearance.' While these failures may seem diverse, they share common underlying issues that reveal the dilemmas faced by the newcomer industry as a whole.

1. Capital Dependence Syndrome: Unable to Survive Without a Transfusion

The rise of automotive newcomers is essentially driven by capital. Unlike traditional automakers, the founders of these enterprises generally lack deep roots in the automotive industry, hailing from fields such as the internet, technology, finance, and even manufacturing. Their over-reliance on capital throughout the brand's development process is pervasive.

Car manufacturing for newcomers is a 'money-burning' game, requiring massive investments in every aspect, from product development to market promotion and supply chain management. However, this capital-dependent model poses significant risks. Once the capital chain breaks, the enterprise quickly finds itself in trouble. Byton, for example, attracted over 8.4 billion yuan in financing but was unable to complete the mass production of its first model due to rapid capital consumption. Tianji Automobile is a more typical example, shutting down directly after burning through billions of yuan in financing.

Delving deeper, the profit-seeking nature of capital dictates that it will not support a 'hopeless' enterprise for long. Capital's interest in newcomers is concentrated during boom periods. As industry competition intensifies and the bubble bursts, the financing environment worsens. Without capital support, these enterprises' fragile 'self-sustaining ability' is exposed, leading to a vicious cycle: lack of funds delays product delivery, further damaging consumer and investor confidence, ultimately collapsing the capital chain. Capital is a booster but not a lifeline. Newcomers that overly rely on external funds without prioritizing self-sustainability are doomed to fail in the long run.

2. Insufficient Product Competitiveness: 'Pseudo-Innovation' That Fails to Impress Consumers

Product competitiveness is the core of the automotive industry and the foundation for all automakers in the market. However, for many newcomers, 'product competitiveness' seems more of a concept than a tangible achievement. Many newcomers focus excessively on marketing gimmicks like 'intelligence' and 'technology' while neglecting the basic reliability, durability, and driving experience of cars as means of transportation. A significant portion of the models launched by newcomers, while advanced and eye-catching in terms of intelligent configuration, are filled with '鸡肋' (chicken ribs) functions in actual experience: sluggish voice interaction, frequent malfunctions in advanced assisted driving systems, unstable software updates... These issues greatly reduce consumers' willingness to purchase.

Moreover, many brands suffer from severe product homogeneity, lacking truly differentiated highlights that impress consumers. Many newcomers in car manufacturing use very high-end and flowery language when promoting intelligent driving functions, but the actual experience falls far short of the promotional effect and is often criticized by consumers for being overpriced and unreliable. Intelligence is actually a double-edged sword; without solid basic performance, no amount of technological configurations can compensate. Without hard power that withstands market scrutiny, the 'innovation' of newcomers is ultimately self-deception.

3. Brand Positioning Mistakes: The Awkward Situation of Being Neither Here Nor There

Brand positioning is crucial for the success of automotive enterprises. However, many newcomers have chosen to 'take the unconventional path' in this regard, attempting to quickly grab attention through 'premiumization' but overlooking the alignment of their own resources and capabilities, ultimately leading to an embarrassing market performance.

Byton initially positioned itself as a high-end smart electric vehicle brand and launched the BYTON Concept with a starting price of 300,000 yuan. Consumers in this price range have extremely high requirements for brand recognition and product reliability, and Byton was obviously unable to compete with mature brands like Tesla and BMW. A similar situation occurred with HiPhi and Qiantu Motors, which both attempted to create an image of 'luxury electric vehicles' but struggled with persistently low sales due to their narrow market positioning.

In contrast, some newcomers have chosen a lower market positioning but triggered a series of credibility crises due to product quality and service that fail to meet consumer expectations. Some models from WM Motor received user complaints due to battery fires, directly leading to a decline in brand trust. This shows that brand positioning cannot be achieved solely through 'premiumization' or 'technology.' Newcomers need to have a more precise understanding of the needs of target users rather than blindly imitating leading enterprises.

4. Weak Supply Chain and Mass Production Capabilities: Delivery Becomes the Biggest Challenge

For traditional automakers, production and supply chain management are basic skills, but for newcomers, they pose a significant hurdle. Many newcomers lack profound manufacturing experience and heavily rely on contract manufacturers for production capacity, leading to insufficient delivery capabilities and frequent quality issues.

In its early announced mass production plans, Byton promised to produce 300,000 vehicles annually, but the construction progress of its Nanjing factory lagged far behind schedule, delaying the launch of its first model. WM Motor, upon its establishment, cooperated with other manufacturers for contract production to quickly capture the market, reducing upfront investment costs but resulting in insufficient product quality and supply chain control.

Newcomers in car manufacturing also face 'choking points' in the upstream supply chain. The tight supply of core components such as power batteries and chips exacerbates delivery difficulties, and the chip shortage crisis has forced many newcomers to postpone deliveries due to a lack of bargaining power. This uncertainty directly affects consumer confidence. Manufacturing is not something that can be done with enthusiasm alone; newcomers must establish real barriers in supply chain management and manufacturing capabilities or will eventually be dragged down by the complexity of the industrial chain.

5. Competitive Pressure: Strong Enemies Everywhere, Where Is the Way Out?

In a sense, the biggest dilemma for newcomers lies in the increasingly fierce competitive environment. Automakers led by overseas brands like Tesla, with their mature supply chain systems and strong brand effects, have few rivals in the global market and have dominated the high-end electric vehicle market.

Furthermore, traditional automakers are accelerating their transformation and continuously launching more cost-effective and higher-performance electric vehicle models, posing a strong squeeze on newcomers. Domestic traditional automakers such as BYD and GAC AION have quickly captured the low- and mid-end markets through years of technological accumulation and market layout.

This "double squeeze" situation has placed many newcomers in an awkward position: unable to compete with high-end brands or low-cost models, they find themselves increasingly marginalized in the market. As the living space for these newcomers dwindles, only those who genuinely identify unique value propositions and continue to innovate will stand out in the competition.

The failures of new entrants in the automotive industry are not coincidental but rather reflect a lack of understanding and neglect of the fundamental laws governing the sector. The automotive industry is characterized by long product cycles, high investment, and low returns, thriving not on short-term trends but on long-term endurance. Enterprises that excel at storytelling but are reluctant to put in the necessary hard work are destined to falter during industry cycles.

Perhaps, the demise of Geely EV and Weltmeister marks the beginning of a "purge" in the industry. In the future, only those newcomers who remain grounded and focus on product and user value will endure this protracted battle and truly reshape the industry landscape.

Lessons from the Survivors: How Can Newcomers Break Through?

Amid the influx of newcomers in recent years, many have fallen at the first hurdle, while others have emerged victorious. These survivors have not only survived but have gradually gained a foothold in the industry, even becoming significant players in the new energy sector. A close examination of their success stories offers profound insights for newcomers and the industry at large.

1. User-Centric Approach: From 'Making Cars' to 'Creating Experiences'

A common trait among survivors is their profound understanding of user needs and continuous refinement of service experiences. In today's industry, where "intelligence" and "electrification" are the norms, providing user-centric differentiated value is crucial for success. NIO, labeled as a "user-centric company," exemplifies this. Beyond viewing cars as mere products, NIO fosters a highly cohesive community among car owners. Services such as battery swapping, butler-like after-sales support, and engaging user interactions on the NIO App have garnered a loyal user base, distinguishing the brand in a fiercely competitive market. NIO even self-identifies as "not a car manufacturing company, but a user enterprise," reflecting a mindset that balances product strength with service excellence.

Another notable example is XPeng Motors, whose consistent investment in intelligence and evolving user interaction experiences has endeared it to younger consumers. XPeng prioritizes enriching driving scenarios, emphasizing the convenience and fun offered by technology through its XPILOT autonomous driving system.

Successful automakers do not merely manufacture cars; they "create experiences." The shift from selling products to services and from features to emotional connections signifies that future competition will increasingly focus on "maximizing user value." This necessitates a comprehensive approach to meeting user needs in product design, service models, and brand culture.

2. Product Strength Focus: Winning with 'Real Skills'

Among the survivors, product strength remains the cornerstone of market presence. Whether in design, technology, or manufacturing processes, product quality must withstand market scrutiny. Without quality products, no amount of marketing or capital can sustain long-term success.

BYD's rise underscores this principle. Although not strictly a "newcomer," its rapid development underscores the importance of core technology in market dominance. From blade battery technology to the DM-i hybrid system, BYD's robust R&D capabilities have fortified its product hard power, expanding its market share. The success of models like the BYD Han and Song PLUS validates the strategy of "excellent technology + cost-effectiveness."

Li Auto targets the extended-range electric vehicle market, catering to family users. By addressing specific needs like spacious interiors, anxiety-free driving, and smart cockpits, Li Auto has carved a niche, differentiating itself from giants like Tesla and BYD. This strategy has allowed Li Auto to compete uniquely, charting its own survival path.

To survive, newcomers must possess "knockout products." While storytelling may attract capital temporarily, only robust product strength can earn user trust and market recognition. This demands not only strong R&D capabilities but also precise product planning and user insight.

3. Financial Stability: Spending Money Wisely

Entering the automotive industry is a protracted battle, with capital chain stability as its core. Excessive capital dependence has doomed many newcomers, whereas successful enterprises demonstrate prudent fund management.

Tesla's success epitomizes financial stability. Despite early financial crises, Tesla achieved stable profitability through production efficiency, supply chain optimization, and cost reduction. Today, Tesla is not only the world's most valuable automotive company but also self-sustaining, supporting technological R&D and market expansion.

Similarly, NIO found stable financing after multiple near-bankruptcies, ensuring capital chain stability while expanding operations. This pragmatic financial strategy was crucial during crises. Newcomers must learn fiscal prudence, earning and saving to avoid past mistakes and establish self-sustainability.

4. Niche Market Focus: Avoiding the Red Ocean and Deepening Cultivation

In today's competitive market, the "big and complete" strategy is outdated, with "specialized and refined" approaches more likely to secure survival space. Successful survivors often target niche markets, forming unique competitiveness.

Li Auto epitomizes this strategy, avoiding direct competition with Tesla in high-performance EVs. Instead, it focuses on family users and extended-range EVs, quickly occupying this niche through unique positioning and technology. The market performance of Li Auto's L9 and L7 underscores this success.

NIO targets the high-end market, appealing to high-net-worth individuals with innovative services and branding. For instance, its battery swap stations address charging anxiety, strengthening brand-user connections. This differentiation has become a potent weapon in the high-end market.

Pursuing "bigness and completeness" dilutes resources, hindering competitiveness. Newcomers should choose niche markets based on resources and capabilities, finding footholds amidst powerful competitors.

5. Grounded Approach: Less Hype, More Patience

Impatience and the quest for quick success often doom newcomers. Initially pursuing high valuations and exposure while neglecting product and technology refinement leads to premature demise. Successful survivors adopt a long-term, grounded strategy.

Tesla took a decade to achieve profitability, focusing on R&D and supply chain optimization rather than concept car launches. NIO, XPeng, and Li Auto also endured prolonged losses but persisted in core technology and service investments, surviving industry cycles through patience and perseverance.

Automaking is a marathon, not a sprint. Only through pragmatic accumulation and less hyped promotion can newcomers endure the "storm" and welcome their spring. Survivors' experiences show that the future of automotive newcomers lies in enhancing user experience, product strength, financial stability, and niche market positioning. These "success codes" guide both current and future players.

There are no shortcuts to success. Only enterprises that respect industry rules, user needs, and continuous innovation will triumph in this "reshuffle." For failed enterprises, their greatest legacy may be the lessons they provide—dreams are vital, but grounded effort is indispensable.

Conclusion: The Fate and Future of Newcomers

Geely EV's collapse reaffirms that the automotive newcomer race is not about "first to market, first to win" but a prolonged elimination process. Only truly user-centric brands with solid technology and continuous innovation will endure. Capital and trends may wane, but patience in product development and market trust determine victory. This is not an era of "storytelling" but one of strength.

In 2024, Geely EV fell; who will be next?