Will Neta's "Going Overseas" Strategy Change Flavor After November Sales Decline and Fang Yunzhou's Equity Freeze?

![]() 12/25 2024

12/25 2024

![]() 541

541

In the classic Chinese novel "Investiture of the Gods," Nezha, after causing chaos in the seas, commits suicide but is fortunately revived by the Immortal Taiyi, leading to the narrative's subsequent twists. In reality, Neta is also enduring a fall and seeking a chance to "revive," but market competition is far from a fairy tale. Despite significant changes, Neta continues to struggle.

In November, Neta sold only 1,500 vehicles in the domestic retail market, marking a 75% decrease from the previous month. From January to November, cumulative sales totaled just over 60,000 vehicles, a nearly 40% year-on-year decline. In the valued Thai market, November sales amounted to merely 858 vehicles, far from ideal.

Although it is evident that this abrupt sales drop stems from the brand's tumultuous period, investors seem increasingly impatient with Neta. Some speculate that the recent freeze on Fang Yunzhou's equity worth 19.86 million yuan is due to investors' dissatisfaction with the company's poor market performance, suggesting a bleak outlook for an IPO through market operations...

Therefore, some industry insiders believe that Neta's issues are becoming a broader phenomenon, reflecting the potential pitfalls and hidden dangers in the overseas expansion of emerging Chinese brands...

Small Scale, Slow Transformation, and a Tough Market in Southeast Asia

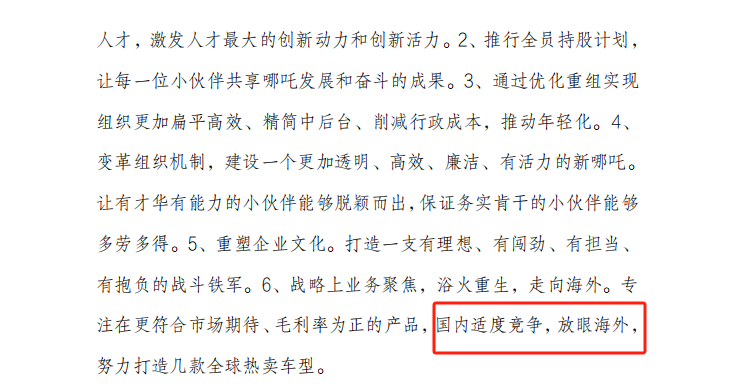

Whether it's Zhang Yong or Fang Yunzhou, "going overseas" is pivotal to Neta's development and a crucial bargaining chip for its IPO. Fang Yunzhou's attitude seems more radical, as evidenced in his "letter to all employees": moderate competition domestically, looking beyond to overseas markets, and striving to create several globally popular models.

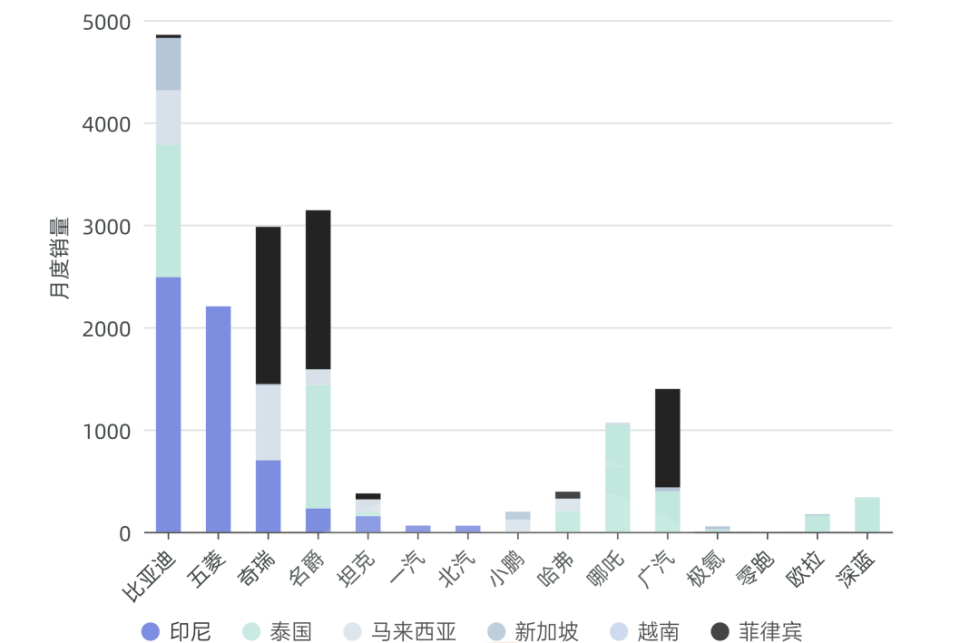

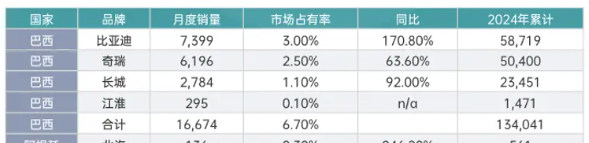

However, Neta's overseas sales are hardly satisfactory. In its prized Thai market, cumulative sales for the first 11 months of the year were 7,298 vehicles, with a market share of 11%, significantly lower than BYD's 25,559 vehicles. However, this cannot solely be attributed to Neta, as the Southeast Asian market is inherently small, and the competitive environment is unforgiving.

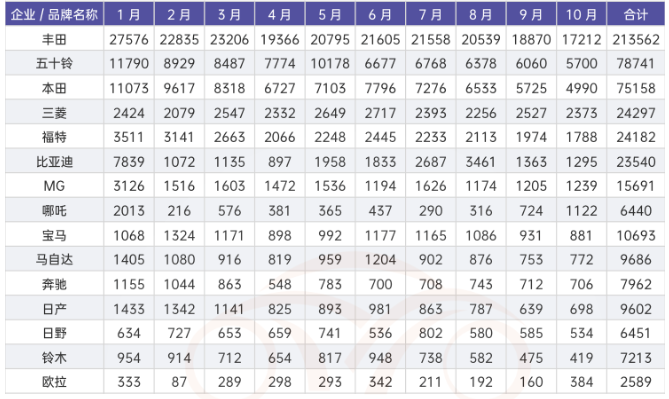

Data indicates that in the first 10 months of this year, total car sales in Southeast Asia amounted to 2.5561 million vehicles. Indonesia and Malaysia, with the largest volumes, sold 710,400 and 661,200 vehicles, respectively, which is still a relatively small market overall. Thailand ranks third in volume, with domestic sales of 476,300 vehicles in the first 10 months, a 26.2% year-on-year decline. Additionally, Japanese brands dominate the market, with Toyota, Isuzu, and Honda combined selling nearly 370,000 vehicles, accounting for over 77% of the market.

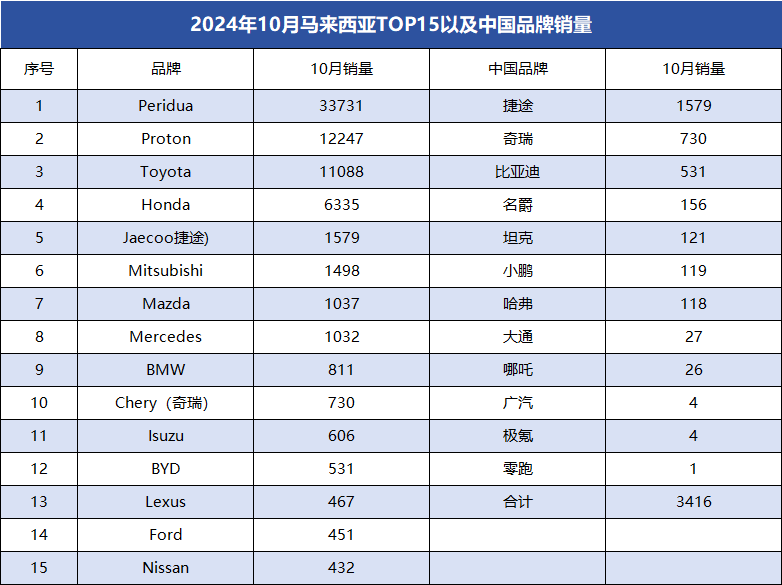

The same is true in Malaysia, where the government prioritizes supporting local "autonomous brands" Perodua and Proton, while Japanese brands still hold a significant position. Among Chinese brands, Chery performs best, with combined sales of over 2,300 vehicles in October, while Neta sold only 26.

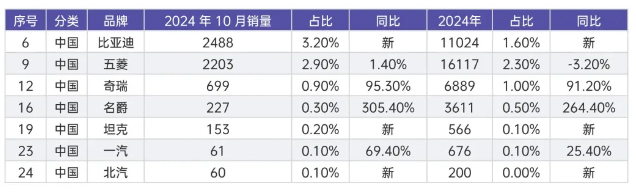

In the Indonesian market, the only Chinese brands with a market share exceeding 1% in the first 10 months were BYD, Wuling, and Chery, with sales of 11,024, 16,117, and 6,889 vehicles, respectively.

It is not an easy feat for Chinese cars to achieve a "dimensional reduction strike" in the Southeast Asian market, requiring substantial financial and time investments. Coupled with international geopolitics and changes in local government policies, it is fundamentally unrealistic for emerging Chinese auto brands to solely rely on "going overseas" for survival, unless they sell to foreign capital, like AITO Motor.

Failure to Achieve Two Types of "Localization" May Turn "Going Overseas" into Escape?

As we all know, "going abroad and going global" has always been the dream of Chinese manufacturing, particularly the Chinese automotive industry, which aims to achieve fame and fortune through overseas expansion. However, to explore overseas markets, a reliable domestic market must first be established as the foundation, a well-acknowledged principle. This holds true for traditional joint ventures such as Tesla, Japanese, and German brands. Among Chinese brands, in addition to established giants like BYD, Geely, Chery, Great Wall, and Changan, ZERO has also announced its intention to "go overseas" in 2025 after stabilizing its domestic market with sales exceeding 250,000 vehicles this year and a monthly sales volume of over 40,000 vehicles.

The second aspect is the localization of overseas market demand, which simply means developing product capabilities according to consumer needs. This is a long-term investment with no shortcuts. A prime example is Suzuki, the "king of small cars," which is fully integrated with the Indian market. According to its fiscal 2024 first-half financial report, Suzuki sold 1.566 million vehicles globally, with 343,000 sold in the Japanese market and 861,000 in the Indian market.

Another scenario is when a brand has deep historical roots in its origin, making it easier for local acceptance when technology is transferred. A notable example is MG, considered an "autonomous brand" by British consumers. In the first 11 months of this year, its cumulative sales in the UK reached 74,800 vehicles, and over 220,000 vehicles in Europe.

Both scenarios are challenging for emerging auto brands without a solid foundation to achieve, and Neta has not been able to effectively accomplish either.

Therefore, many believe that with Neta's current domestic market performance at an all-time low, unclear future plans, and losses exceeding 18.3 billion yuan, its overseas expansion capabilities are severely limited, as evidenced by its performance in the Thai market. Simultaneously, due to its unsatisfactory performance in both domestic and international markets, its valuation has significantly dropped – by July this year, its valuation had shrunk from 45 billion yuan to 30 billion yuan. A series of scandals emerged after October, and the emergency appointment of a new CEO in December was followed by the freezing of equity, which may further impact Neta's valuation.

It remains to be seen whether Fang Yunzhou can balance Neta's domestic and international sales in 2025. If, like in 2024, the company continues to neglect the domestic market and focuses on overseas expansion at all costs, and if it succeeds, then "going overseas" will be justified. If not, the term "going overseas" will take on a delicate meaning – will "new forces" that can no longer survive in the domestic market use overseas expansion as a pretext for escape?