Annual Sales Poised to Surpass 4 Million: BYD’s Most Successful Year Yet, Establishing Itself as the Technological King

![]() 12/26 2024

12/26 2024

![]() 612

612

Having cemented its reputation for cost-effectiveness, BYD now aims to reign supreme in the realm of technological competition.

BYD achieved its year-start goal of a 20% sales increase in 2024 by November, and given the current growth trajectory, it is highly anticipated that BYD's annual sales will exceed the record of 4 million vehicles this year.

The launch of the Qin PLUS DM-i, equipped with the DM-i super hybrid system, marked a turning point for BYD. The low energy consumption of its vehicles quickly gained widespread public favor. Subsequent models from the Dynasty series, the Ocean Network, and Denza followed suit. Since 2022, BYD's dominant position in the domestic market has been firmly established.

2024 was a pinnacle year for BYD: the Dynasty series and Ocean Network continued to serve as the cornerstone of sales, while Denza, NIO, and FANGCHENGBAO all surpassed their previous year's results. However, Electric Car News observed that BYD's product and technological strategies underwent significant changes this year. As part of Leitech's annual special topic, Electric Car News endeavors to provide a comprehensive review of BYD's 2024 performance in this article—given BYD's vast scope, reviewing its year is indeed a challenging task, but we shall strive to do our best.

Having firmly established its cost-effectiveness, BYD is now poised to "fiercely compete in technology."

After the 2024 Chinese New Year, BYD was the first to drop a "bombshell" in the automotive market by unveiling multiple Honor Edition models from the Dynasty series and Ocean Network. The Champion Edition models in 2023 emphasized "same price for petrol and electric," while the 2024 Honor Edition models directly proclaimed the slogan "electric cheaper than petrol," further reducing prices.

Unlike the gradual launch of the Champion Edition models, the Honor Edition models adopted a clustered market entry strategy, achieving nearly full coverage of mainstream market segments by the end of March.

The first quarter is typically a slow season for the domestic automotive market, but BYD leveraged this strategy to maintain exceptionally high sales growth. Official data reveals that BYD's cumulative sales exceeded 620,000 units in the first quarter, accounting for over 15% of the domestic market share.

Source: BYD

Initially, it was believed that BYD would continue its "price reduction and specification upgrade" strategy for the Honor Edition models. However, after entering May, BYD adopted a new strategic approach—launching the fifth-generation DM hybrid technology with lower fuel consumption and longer comprehensive driving range, and subsequently introducing new products such as Qin L, Seal 06 DM-i, Seal 06GT, Seal 07, Dolphin 05 DM-i, and Song L DM-i, swiftly integrating this technology across its product line.

Analyzing this, prior to introducing the fifth-generation DM hybrid technology, the first-quarter Honor Edition models attracted consumers with lower prices, prompting suspicions of "clearing inventory." Fortunately, since the prices of the Honor Edition models were already low, there was minimal change in the starting prices of models equipped with the fifth-generation DM hybrid technology, minimizing the sense of "betrayal" among users.

While cost-effectiveness is crucial for product success, it is evident that BYD's approach to enhancing cost-effectiveness has evolved this year: The Champion Edition models in 2023 and the Honor Edition models in the first quarter of this year adopted the traditional strategy of improving cost-effectiveness—reducing prices and increasing specifications, which is more noticeable to consumers. However, after applying the fifth-generation DM hybrid technology, BYD began to leverage technology as the driving force for competition.

Electric Car News believes that while the traditional approach is effective, automobiles are significant consumer goods with intricate supply chains, making it challenging to consistently meet consumers' escalating expectations for cost-effectiveness. Only through technological innovation can products achieve a new level of cost-effectiveness.

Nonetheless, BYD's pure electric vehicle models launched this year still adhere to the traditional approach. Taking the 2025 BYD Han EV as an example, the new car features a five-link rear suspension and adds configurations such as an all-domain 800V high-voltage platform, AR projection sensing tailgate, and Dipilot 300 on different model versions. However, there are no significant upgrades to the trinity (battery, motor, and electronic control system), which consumers prioritize. Rumors suggest that the second-generation Blade Battery will be released next year, offering faster charging and higher energy density, but this information has not been officially confirmed.

Source: BYD

Furthermore, BYD's Military Ship series in the Ocean Network no longer seems to be favored by the brand. Apart from the Destroyer 05 DM-i, no other models in the Military Ship series have been updated this year, possibly continuing under the Biological series, such as the successor to the Frigate 07, Dolphin 07.

BYD's Military Ship series faced a lukewarm reception in the domestic automotive market already in 2023, while the Seal series emerged as the more popular mid-to-high-end product within the Ocean Network. To address its shortcomings, BYD decided to shift resources from the Military Ship series to the Biological series this year, aiming to propel more models to the forefront of their respective market segments while streamlining BYD's product line for better brand and product communication.

In 2024, BYD's Dynasty series and Ocean Network have found their respective development directions. However, some competitors have already mass-produced vehicles equipped with "scalpel batteries" with higher energy density this year. BYD needs to intensify its efforts in the pure electric vehicle sector next year.

Denza, FANGCHENGBAO, and NIO: Each Sub-brand Shines Uniquely

In 2023, BYD established product lines for four sub-brands: the mainstream market relies on the Dynasty series and Ocean Network, while the high-end and personalized markets are explored by Denza, FANGCHENGBAO, and NIO. However, the cumulative sales of Denza, FANGCHENGBAO, and NIO last year accounted for less than 5% of BYD's total sales, which is naturally unsatisfactory for BYD.

Source: Electric Car News Photography

Historically, Denza has relied heavily on the Denza D9, with the Denza N7 and Denza N8 having minimal presence. In 2024, the Denza N7 underwent an upgrade, while there has been no news about the refreshed Denza N8. It is only the Denza Z9GT launched this year that truly alleviated some of the sales pressure on the Denza D9. Data shows that Denza sold a total of 10,002 vehicles in November, including 6,100 Denza D9s and 3,557 Denza Z9GTs.

While there may seem to be no direct competitors for the Denza Z9GT in the market, it effectively contends for market share with luxury vehicles like the Mercedes-Benz E-Class, Audi A6L, and BMW 5 Series, as there is no significant price difference after considering terminal discounts for these models.

In terms of brand power, the Denza Z9GT is unlikely to emerge victorious, so the new car not only boasts luxurious configurations but also introduces dual-body styling, intelligence, and unique technologies to compete with traditional luxury models. Of course, the monthly sales of the Denza Z9GT have not yet surpassed 4,000 units (as of December 2024), lagging behind BBA models that often sell over 10,000 units per month. However, it is now evident that the Denza Z9GT has established its differentiated advantages.

Source: Electric Car News Photography

FANGCHENGBAO has been relatively inactive this year, introducing only the new Leopard 8 model and a new variant of the Leopard 5, while also announcing that the Fangchengbao Titanium series' first pure electric SUV, the Titanium 3, will debut in the first half of next year.

As FANGCHENGBAO's focus and flagship product this year, the Leopard 8 can be considered a "budget alternative" to the NIO U8. While it cannot achieve the "Easy Four-Wheel Parking" feature of the NIO U8, it retains the "Leopard-style" turn of the Leopard 5. Additionally, the introduction of the Violent Mode, Cloud Ride-P system, and Huawei Kunlun Intelligent Driving ADS 3.0 elevates the Leopard 8's capabilities by at least one level compared to the Leopard 5.

Perhaps due to its initial foray into the personalized off-road segment, the Leopard 5 did not initially perform impressively after its launch. Therefore, the official price of the Leopard 5 was reduced by RMB 50,000 in August. The price reduction was effective, with monthly sales increasing from around 2,000 units before August to over 4,000 units in August and reaching 8,521 units in November.

It should be noted that the "price change" of the Leopard 5 did indeed trigger complaints from some early adopters. In the view of Electric Car News, while controversy is predictable, price reductions have been a prominent theme this year, with many products experiencing significant price cuts. The Leopard 5 simply reflected terminal discounts directly in its selling price, and FANGCHENGBAO indeed needed this price reduction to boost market share.

This also serves as a caution for the upcoming Titanium 3, which should carefully determine its price range and launch benefits.

Source: Electric Car News Photography

NIO only launched two models this year: the NIO U9 and the NIO U8 Off-Road Player Edition. The former was unveiled last year with corresponding parameters, so Electric Car News will not elaborate on its technical highlights. The only noteworthy aspect is the pricing. However, given that the Aion SSR, launched last year, has a price range of RMB 1.286 million to RMB 1.686 million, the NIO U9's pricing of RMB 1.68 million is not entirely surprising.

The core technology of the NIO U8 Off-Road Player Edition is the same as that of the NIO U8 Luxury Edition. While the Off-Road Player Edition omits high-end intelligent driving systems, automatic parking, and openable panoramic sunroofs for comfort, it enhances the vehicle's passability with off-road kits, onboard drones, satellite communication, night vision systems, and other configurations to meet users' high demands for outdoor entertainment and off-roading.

Source: BYD

For these two million-yuan new energy vehicles, their technology and configurations are worthy of their price tags. Moreover, the NIO U8 has achieved a monthly sales peak of over 1,000 units, indicating that it has gained market recognition. The more awkward performance may be that of the NIO U9, with monthly sales of less than 30 units (as of December 2024).

Electric Car News believes that the audience for million-yuan sports cars still prefers classic sports cars. NIO U9 needs to intensify its marketing efforts. Perhaps the launch of the NIO U7 next year could change NIO's sluggish performance in the sports car segment.

The Second Half is All About Intelligence, Embracing the Concept of "Intelligent Vehicle" First

Brands like XPeng and HarmonyOS Auto have already implemented "high-level intelligent driving without maps" technology in 2023. As the first brand to proclaim that "intelligence is the second half of the automotive game," BYD proposed an intelligent vehicle development strategy at the beginning of this year, fundamentally differing from brands that emphasize only "automotive intelligence = intelligent cockpit + intelligent driving."

In BYD's view, as long as the transmission speed is not an issue, the intelligent vehicle concept can capture internal and external environmental changes, aggregate more information to the "brain" for decision-making, and quickly adjust the vehicle's state.

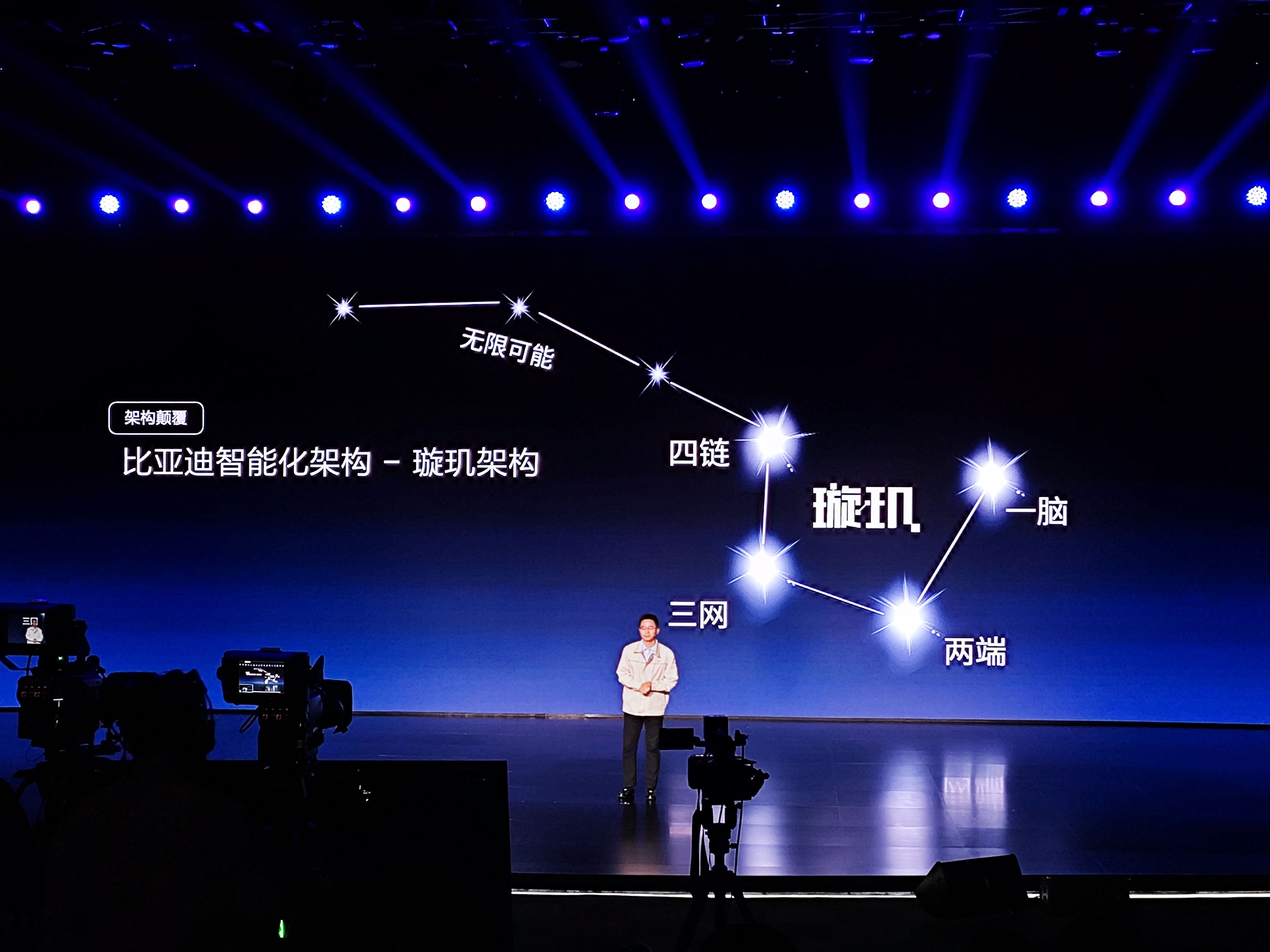

To this end, BYD released the industry's first intelligent architecture integrating intelligent and electric technologies—the Xuanji architecture, which integrates electrification (focused on the trinity, chassis, and body systems) and intelligence (focused on intelligent driving and intelligent cockpits), breaking down barriers between different systems. Technologies such as Easy Four-Wheel Drive, Cloud Ride, DMO platform, and e-platform are functions under the Xuanji architecture.

Source: Electric Car News Photography

BYD also introduced the dual-cycle multimodal AI—the Xuanji AI large model, applying artificial intelligence to all areas of the vehicle for the first time. The AI large model is no longer a simple "in-car assistant" but also plays a pivotal role in making the vehicle more comfortable and energy-efficient.

After establishing the intelligent vehicle strategy, BYD further increased its investments in the intelligent cockpit and intelligent driving domains. First, for the intelligent cockpit domain, BYD introduced the concept of benchmarking from the tech industry to the automotive industry and launched the new DiLink cockpit platform, with the DiLink 150 platform scoring between 100-150W in benchmarking tests. Higher-scoring cockpit platforms will be introduced in the future.

Source: Electric Car News Photography

Additionally, BYD released the 4nm custom chip BYD 9000 at the end of this year, which integrates a 5G baseband, supports the latest 5G networks, and enables intelligent voice control through the AI large model. This chip has already been applied in the FANGCHENGBAO Leopard 8.

In the realm of intelligent driving, BYD kicked off the year by unveiling its "Divine Eye" L2+ high-level intelligent driving assistance system, and later introduced the "BAS 3.0+", an end-to-end, pure vision-based solution, with the Denza Z9GT's pre-sale. When combined with the Xuanji architecture, this system enables functions like Easy Three-Party Parking and intelligent toll passage on highways, capabilities unattainable by other automakers.

Currently, the "BAS 3.0+" is exclusive to the Denza Z9GT, while the "Divine Eye" remains the mainstay for high-volume models like those in the Dynasty series and the Ocean Network. Electric Car News reports that from December 24th of this year, BYD's "Divine Eye" has enabled the City Nomad Autonomous (CNOA) function nationwide, marking a significant milestone in BYD's intelligent driving advancements.

Regarding BYD's intelligent driving strategy, one might ask about the FANGCHENGBAO Leopard 8, which utilizes Huawei's Kunlun Intelligent Driving ADS 3.0. Despite BYD already having its own intelligent driving system, it chose to collaborate with Huawei. Why? Huawei's Kunlun Intelligent Driving ADS 3.0 excels in intelligent parking, urban navigation, and highway navigation, and for BYD, this partnership can further enhance its own intelligent driving capabilities.

Photo Source: Dianchetong Production

Photo Source: Dianchetong Production

BYD's intelligent concept revolves around "whole-vehicle intelligence," with BAS 3.0+ utilizing more chassis capabilities and powertrains compared to other intelligent driving systems. Prior to the full rollout of BAS 3.0+'s official version, BYD relied on its partner's intelligent driving system for reference.

Furthermore, BYD continues to promote the widespread adoption of intelligent driving systems. During the "BYD Dream Day" earlier this year, the company mentioned that the latest advanced intelligent driving system would initially be available only on models priced above 300,000 yuan, with optional availability for models priced between 200,000 and 300,000 yuan. However, in the latter half of this year, multiple models priced below 200,000 yuan have been equipped with advanced intelligent driving capabilities. To ensure its competitive edge, Zhang Zhuo, General Manager of BYD's Marine Network Sales Division, revealed in November that advanced intelligent driving systems would soon be applied to models priced at 150,000 yuan or less.

Photo Source: Dianchetong Production

Photo Source: Dianchetong Production

According to the latest application drawings, BYD's new Qin PLUS, Sea Lion 05 EV, and other models are equipped with front-mounted trinocular cameras, hinting at the imminent large-scale adoption of intelligent driving technology. Regarding future technological roadmaps for intelligent driving, Dianchetong predicts that BYD's mid-to-high-end models will adopt lidar solutions to achieve widespread application of BAS 3.0+. For low-to-mid-end products, they may be equipped with the "Divine Eye" based on configuration, while entry-level products may adopt a pure vision-based intelligent driving solution.

Accelerating Overseas Expansion to Meet Tesla at the Pinnacle of the World Stage

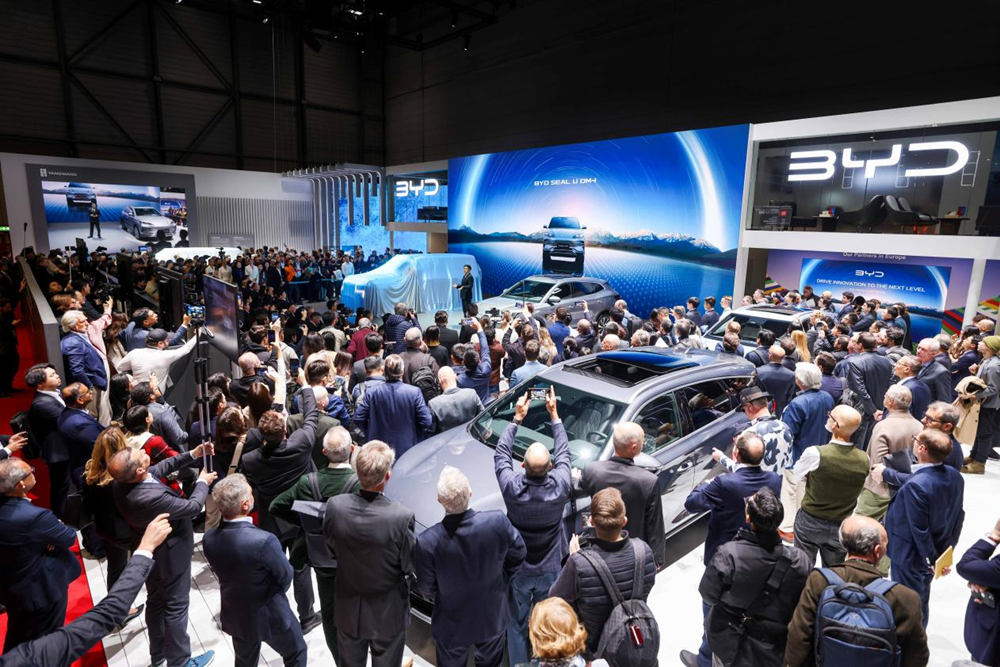

With no domestic competitors, BYD's next step is to accelerate its overseas expansion, aiming to become the "Chinese version of Tesla." This year, BYD has taken corresponding actions in Hungary, Uzbekistan, Mexico, and other overseas countries and regions, participating in major international exhibitions like the Geneva Motor Show and the Bangkok International Motor Show in Thailand.

Photo Source: BYD

Photo Source: BYD

Furthermore, BYD has signed memoranda of understanding with overseas brands such as ARVAL Group, international sustainable mobility service provider Ayvens, and Korean auto carrier (PCTC) giant Hyundai Glovis, paving the way for its overseas expansion.

BYD has also launched the electric pickup truck SHARK 6 in Mexico and Cambodia, marking the first time it has introduced a model overseas that is not available domestically, demonstrating the brand's emphasis on foreign markets.

Dianchetong has learned that to accelerate its overseas expansion, BYD has ventured into shipbuilding. The first vehicle carrier, the "BYD Explorer 1," with a capacity for up to 7,000 standard car spaces, was delivered and departed at the beginning of the year. The second ro-ro vessel departed from Yantai, Shandong, on November 29.

Photo Source: BYD

Photo Source: BYD

According to official data, BYD sold 30,977 passenger vehicles overseas in November. Overseas sales of new energy vehicles have exceeded 30,000 units for five consecutive months since July, with outstanding performance in multiple overseas markets. In the Thai market, BYD's ATTO 3 (domestic version: Yuan PLUS) has topped the sales chart of pure electric vehicles for eight consecutive months. In regions like New Zealand and Brazil, BYD models occupy top positions in various sales rankings.

To increase sales in overseas markets, BYD may need to reduce the cost of purchasing vehicles for overseas users, such as through joint ventures with local automakers or establishing factories. While these measures may not be achievable within three to five years, BYD has already embarked on this path, and success is imminent.

Enhancing the Charging Ecosystem with Both Self-construction and Collaboration

As the best-selling new energy vehicle company in China, BYD's energy replenishment system has been a point of contention for many netizens, with some claiming that as a leader in new energy, BYD lags behind other new forces like NIO in charging infrastructure.

However, this is not the case. Unlike other brands that quickly deploy supercharging stations, BYD's charging infrastructure layout is more diverse: on the one hand, it self-constructs charging stations. As early as 2019, it had already deployed 1,255 charging stations and 19,189 charging piles, covering more than 50 countries and regions. On the other hand, BYD is willing to collaborate with the State Grid or third-party companies like Shell to jointly deploy charging infrastructure.

According to blogger @yuanzhitou2018, the trademark for "BYD Supercharge" has been applied for registration, and the brand has established the "BYD Supercharge Operation Center" to oversee supercharging-related operations. Clearly, BYD has recognized the importance of the breadth and density of charging station deployment. Next year, we may see more actions from the brand in deploying supercharging stations.

Screenshot: Weibo @yuanzhitou2018

Screenshot: Weibo @yuanzhitou2018

Moreover, BYD's charging technology is on par with other new energy brands. BYD's 800V platform dates back nine years, and its dual-gun fast charging technology not only increases charging speed but also fully utilizes existing charging resources. In May of this year, BYD officially launched the e-platform 3.0 Evo, integrating intelligent terminal fast charging technology, full-scene intelligent pulse self-heating technology, and intelligent boost fast charging technology, further optimizing charging speed and improving charging efficiency in low-temperature environments.

While consumers have witnessed BYD's achievements in new energy products over the years, the official seems to have not made the charging system and technology more visible to consumers. Marketing is also a part of showcasing a car company's strength. However, with the registration of the "BYD Supercharge" trademark, Dianchetong believes that BYD may further intensify its technology marketing efforts. Next year, we may see BYD bringing its latest technology to the forefront as much as possible.

BYD's Comprehensive Development in 2024: A Resounding Success!

In 2024, BYD achieved "comprehensive development" with remarkable accomplishments in products, technology, and overseas expansion, successfully navigating the automotive market's off-season, something other automakers have struggled with. Of course, we must acknowledge that BYD still faces some challenges.

The primary issue is its intelligent driving capability. While BYD's "Divine Eye" mapless urban navigation has just become available nationwide, technically placing it in the first tier, its current intelligent driving user base lags behind top-tier brands. However, given the limitations of L2-level assisted driving, Dianchetong believes there is a technical ceiling for automakers' intelligent driving systems. With sufficient technology and funds, BYD can optimize its intelligent driving system. It is understood that BYD plans to equip at least 60% of its vehicles with intelligent driving systems capable of highway NOA and above next year, aiming to promote the popularization of intelligent driving. Catching up with the top tier is only a matter of time.

Another issue is the lack of popularity of a few models, such as the Warship series and Denza N8. BYD Group is believed to be aware of this issue and has halted innovation on these new models this year, reducing investment in their shortcomings.

Dianchetong has learned that BYD will launch multiple new models next year, including Han L, Tang L, Denza N9, Titan 3, and BYD Xia, while also upgrading and replacing existing models. The automotive market is dynamic, and no one can guarantee that BYD's upcoming new models will all be hits or that its current best-sellers will continue to perform well. However, what BYD can do is improve its layout in various market segments and closely follow market demand changes, thereby ensuring the company's leading position in the new energy market.

(Cover Photo Source: BYD)

Source: Leikeji