Xiaomi's First Extended-Range SUV Unveiled: A Nod to Li Xiang L, Eyeing the Global Market?

![]() 12/26 2024

12/26 2024

![]() 485

485

Drawn by the escalating market demand, new energy vehicle brands that initially focused solely on pure electric vehicles (EVs) are now embracing extended-range electric vehicles (EREVs), such as XPeng, IM Motors, and AITO. Even Xiaomi, with just one EV model currently on sale, has set its sights on EREVs.

Following the reveal of Xiaomi's first SUV, the YU7, spy shots of its second SUV have surfaced. From the spy shots, Xiaomi's new SUV exhibits a more traditional body shape, reminiscent of Li Xiang L series products, differing markedly from the Xiaomi YU7.

Image Source: Weibo @Lamian Shifu Design

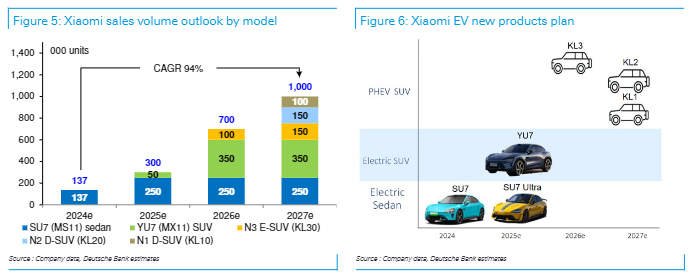

According to a research report by Deutsche Bank on Xiaomi, the company plans to launch a large plug-in hybrid SUV in 2026, rumored to have the internal codename "Kunlun," followed by two more plug-in hybrid SUVs in 2027. Coupled with job postings from Xiaomi, it's plausible to deduce that Xiaomi's second SUV will be an EREV.

Why is Lei Jun, known for his passion for driving enjoyment, introducing this moderately styled SUV?

First, build what you love; then, build what users want

During Lei Jun's 2024 annual speech, he revealed that Xiaomi's internal philosophy is to "first build a car that Xiaomi engineers want to buy," leading to the creation of the Xiaomi SU7, with its unique appearance and exceptional performance and handling.

The recently announced Xiaomi YU7, despite being an SUV, emphasizes aerodynamic optimization in its design details, similar to the Xiaomi SU7. With its dual-spoiler design and dual-motor system delivering over 500kW of total power, it's evident that the Xiaomi YU7 balances sportiness and driving experience.

Image Source: Ministry of Industry and Information Technology

The Xiaomi SU7 has been a success, but there are many domestic models that outperform it. Lei Jun proposed in 2023 that Xiaomi Automobile aims to become a global top-five automaker within 15 to 20 years. However, a monthly sales volume of over 20,000 hardly convinces global consumers of Xiaomi's strength as a top-tier automaker.

Lei Jun's goal necessitates that Xiaomi Automobile cannot solely focus on driving enjoyment. Cost-effective and moderately styled products must be part of Xiaomi Automobile's portfolio.

Therefore, Xiaomi's foray into EREVs is not surprising. Its development strategy is to "first build what you love, then build what users want," unlike other new energy brands that cater to consumers from the outset.

Now, the question arises: Does the Xiaomi EREV in the spy shots meet users' expectations?

Even if consumers tried to answer, they might not be clear about their preferred design or body shape. However, they can intuitively recognize a product's advantages in terms of configuration, space, power, and range.

Image Source: Weibo @SugarDesign

This explains why Xiaomi's EREV adopts a relatively boxy body shape: while it may increase drag coefficient, it maximizes rear passenger headroom and storage space, appealing to most family users.

The spy shots haven't revealed Xiaomi's EREV design details. It's speculated that the vehicle might continue using the family's "rice"-shaped headlight cluster, but until authoritative information from the Ministry of Industry and Information Technology or an official announcement, all analyses remain speculative.

In the domestic new energy SUV market, models like the minimalist Model Y, Li Xiang L series, and the Song and Tang series, adhering to the "Dragon Face" design language for years, suggest that as long as a family SUV isn't ugly and maintains a moderate style, it can be recognized based on product strength. Furthermore, internet users mainly criticize Xiaomi Automobile's design for resembling luxury vehicles, with few finding the Xiaomi SU7 or YU7 unattractive.

It's virtually confirmed that design and body shape won't hinder Xiaomi's EREV popularity.

To become a global top-five automaker, will Xiaomi conquer overseas users with EREVs?

Lei Jun once stated, "In the future, only five automakers will survive in the market, and annual sales of 10 million vehicles will be the threshold." However, only Toyota Group achieved this last year.

It's understandable why Toyota leads global sales among automakers. Models like the Prius, RAV4, and Corolla are affordable for most consumers. For Xiaomi Automobile to reach annual sales of 10 million vehicles, launching durable and affordable products is crucial.

The annual domestic demand for new energy vehicles is around 10 million. For Xiaomi to reach this sales target, besides captivating domestic consumers with more affordable products, expanding overseas is essential.

In Electric Car News' view, Xiaomi's development of EREV technology underscores its large-scale overseas expansion.

Screenshot: Xiaomi Job Postings

The Xiaomi SU7 is already sold in overseas markets like Russia, priced at up to 7.9 million rubles (approximately RMB 539,500 after discounts). In contrast, the domestic SU7 Four-Wheel Drive Ultra-Long Range High-End Intelligent Driving Max version retails for RMB 299,900. This price disparity isn't surprising, as automakers must pay taxes like customs duties, VAT, and consumption tax, balancing costs by increasing prices, which isn't conducive to brand development.

Moreover, the EU's new tariff policy imposes higher tariffs on Chinese-imported EVs. If Xiaomi enters overseas markets solely as an EV company, it won't have a price advantage. To break this, Xiaomi Automobile needs to consider hybrid models eligible for tax exemption policies.

According to Reuters, NIO plans to launch its first hybrid model in 2026, exclusive to overseas markets like the Middle East, North Africa, and the EU, influenced partly by policy considerations.

Screenshot: Reuters

Of course, policies are susceptible to environmental changes, and the overseas market reality is the fundamental reason "pure electric brands" are launching hybrids.

Compared to the domestic market, overseas charging infrastructure is less developed. Consumers are less receptive to EVs, and fuel resources are abundant with lower fuel costs. There's growing enthusiasm for hybrids that don't rely on charging stations.

According to the European Automobile Manufacturers Association, in November this year, new car sales in the EU were about 1.06 million, down 1.9% year-on-year. The only vehicle type showing consistent growth was hybrids, with market share increasing from 27.5% in November 2022 to 33.2%. Sales of EVs, gasoline, and diesel vehicles declined significantly, with EV market share falling from 16.3% to 15%.

The European market is one of the few overseas markets open to new energy. The lack of significant EV growth in Europe indicates that fuel-powered vehicles still dominate overseas markets. Xiaomi's focus on the hybrid market has more potential than an all-in approach on EVs.

Image Source: Electric Car News Production

If Xiaomi Automobile's plans unfold, it will have three EVs and three hybrids by 2027, with ample resources and time to enter the European market by 2030.

Image Source: Deutsche Bank

Of course, grandiose slogans are meaningless. Xiaomi's entry into the extended-range market is inevitable, and its primary task is to compete with brands promoting hybrid family SUVs, like Li Xiang and HONGMENG ZHIHANG.

Currently, there's limited information on Xiaomi's first EREV. Electric Car News speculates that the new car might target large SUVs like the Li Xiang L9 or AITO M9, both marketed as "comfortable" and "luxurious." Additionally, the Tengshi N9, unveiled at this year's Guangzhou Auto Show, could be a key competitor.

Moreover, Xiaomi's EREV technology is still in development, slightly lagging behind other new energy brands. However, as long as the product is robust, it's never too late to enter the market. Furthermore, Xiaomi Automobile boasts the "human-vehicle-home ecosystem" system advantage, hard for other brands to replicate.

To conclude, Electric Car News borrows Lei Jun's words: The automotive market is no fairy tale. Xiaomi's journey to the global market is long. Come on!

(Cover Image Source: Electric Car News Production)

Source: LeiKeJi