How to Avoid Becoming the Next HiPhi or Weltmeister

![]() 12/26 2024

12/26 2024

![]() 489

489

Introduction

For ordinary players, the only option is to fight for survival and growth, as any lapse could lead to dire consequences.

December 25th was an unassuming Wednesday, with few automotive-related topics trending on social media. However, this day held special significance for IM Motors, marking the fourth anniversary of its inception on December 25th, 2020.

On the same day, IM Motors announced the successful completion of its Series B1 equity funding round, raising a total of 9.4 billion yuan for the entire Series B. This funding injection is undoubtedly good news for the nascent electric vehicle (EV) startup, especially considering that several other automakers, such as HiPhi, Weltmeister, and Jiyue, have faced termination due to financial constraints this year.

The successful funding somewhat reflects the capital market's optimism about IM Motors' long-term growth potential and prospects.

Furthermore, including the 10 billion yuan raised in the angel round, 3 billion yuan in Series A, and 9.4 billion yuan in Series B, IM Motors has now amassed a total of 22.4 billion yuan since its inception.

Is this amount substantial? In the cash-intensive world of EV startups, no funding sum can be deemed excessive. Is it insignificant? Compared to those who failed to secure funding, every penny here is crucial. As the EV market enters a reshuffling phase and startups face unprecedented pressure, every additional funding round represents an increased likelihood of success.

However, this does not imply that IM Motors has crossed the "make-or-break threshold."

Not Yet Over the "Make-or-Break Threshold"

Regarding the "make-or-break threshold" for annual EV sales, several founders, including Li Bin of NIO, have stated that "at least 100,000 vehicles need to be sold." With the EV market share still below 30%, annual sales of 100,000 vehicles have become the "make-or-break threshold" for EV startups, as only surpassing this mark ensures survival.

However, the 100,000-vehicle threshold was set a few years ago.

With the rapid growth of the EV market, the annual market share is now nearing 40%, and the monthly share has consistently surpassed 50%. Consequently, EV startup sales have soared. For instance, monthly sales of Lixiang and Wenjie have exceeded 30,000 units and are approaching 40,000 units.

Therefore, He Xiaopeng remarked that "the automotive industry's elimination round has just begun, and an annual sales volume of 3 million vehicles over the next five years will merely be an entry ticket for automotive companies." Li Bin also said in a media briefing, "If NIO continues to sell only 10,000 vehicles per month, Qin Lihong and I will have to seek new employment."

From monthly sales of 10,000 to 20,000, 30,000, and even 40,000 vehicles, these leading EV startups are undoubtedly the darlings of the current automotive market. While vying for higher peaks, they also guide the development of China's EV market to a certain extent.

In contrast, mid-tier companies like IM Motors find themselves in a somewhat awkward position. While their sales have improved compared to past performance, they still lack the strength to compete with leading EV startups and have not yet reached a critical mass to stand out.

Taking IM Motors as an example, it took the company four years to achieve cumulative sales exceeding 100,000 vehicles since its inception. However, sales data for this year reveals that approximately 10 EV startups have successfully surpassed the annual sales threshold of 100,000 vehicles. In this context, IM Motors still has a long way to go before it can claim to have revolutionized the industry.

From a product perspective, IM Motors currently offers four pure electric models: L6, LS6, L7, and LS7, spanning sedans, SUVs, and coupe SUVs. The primary sales drivers are LS6 and L6. In November, LS6 sold 5,000 units, ranking in the top ten among mid-to-large pure electric SUVs, while the leading Lixiang L6 sold over 24,000 units per month.

Expanding the market segment, Tesla Model Y sold 45,000 units in November among pure electric SUVs. This means that IM Motors' best-selling model, LS6, is only in the middle tier of market competition. Other models like L7 and LS7 are even less competitive when compared to mainstream rivals.

Currently, the era of a single hit product dominating the market is long gone. Multiple hit products, including twin hits, are essential to support a brand's steady progress. For IM Motors, only LS6 ranks high in its market segment, which is one reason the author believes IM Motors has not yet crossed the make-or-break threshold.

The Struggle of Ordinary Players

Of course, funding brings hope.

IM Motors stated that the raised funds will be allocated to research and development in core technologies such as digital intelligent chassis, steer-by-wire, and intelligent driving, as well as to accelerate the launch of new products.

If IM Motors' competitiveness over the past four years has been lacking, the utilization of these funds and the resulting output will determine its future competitiveness.

In its latest product roadmap, IM Motors intends to introduce two pure electric vehicles and two extended-range electric vehicles (EREVs) in 2025, totaling four new products to tap into broader markets. The addition of two EREVs also confirms IM Motors' previously announced plan to enter the EREV market.

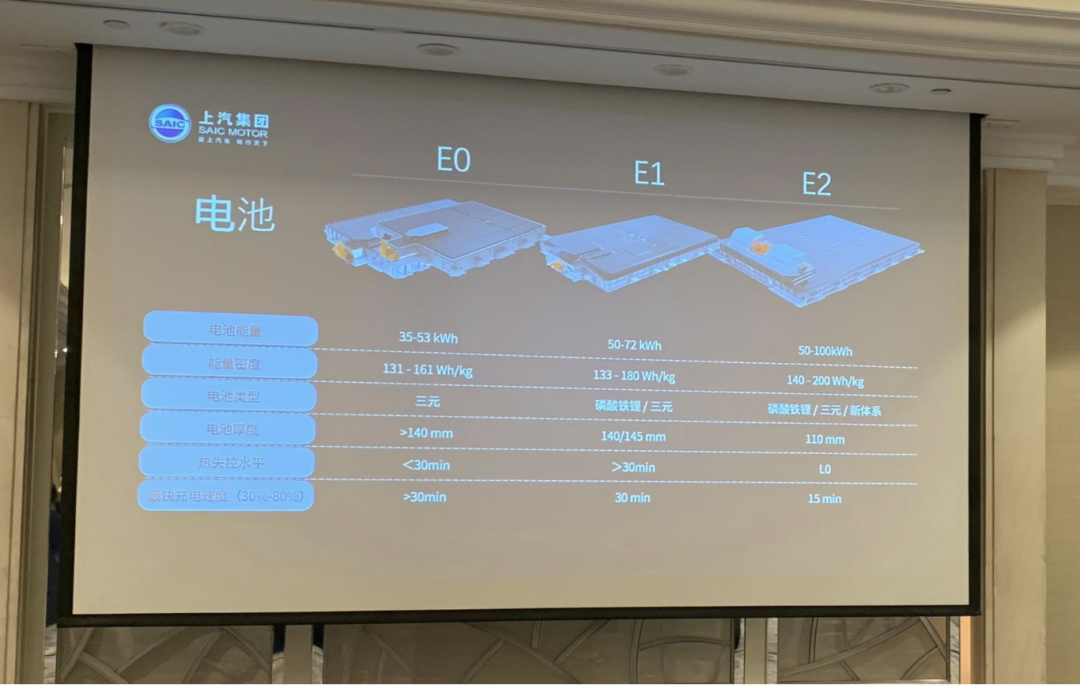

According to previous reports, IM Motors' first EREV model, positioned as an SUV, is scheduled for release in the first quarter of next year. This EREV product will be derived from SAIC Motor's internal platform architecture codenamed E1.

From a branding perspective, considering the popularity of plug-in hybrid vehicles and EREVs among consumers in the current EV market, the arrival of EREVs represents another opportunity for IM Motors. However, examining the prospects for these new models, other brands are also poised to unveil their EREV SUVs next year, including Xiaopeng's Super EREV, Chery Fengyun T11, Changan Qiyuan C798, GAC Trumpchi S7, Aion HL, and Hongmeng Zhixing M8. As IM Motors aims to compete with Lixiang L7, how much market share can its EREVs capture from these formidable competitors?

Furthermore, during the past four years of rapid development in the EV sector, IM Motors has been in a state of exploration and trial-and-error, with its brand identity still in the process of being established. This is a critical flaw for any brand.

From the sporty focus of the first product, the IM L7, to the comfort of the zero-gravity seats in the second product, the IM LS7; from the balanced sports and comfort provided by the Lingxi digital chassis in the third product, the IM LS6, to the intelligence and safety of the fourth product, the IM L6, IM Motors has continuously sought its brand positioning but has yet to find a definitive fit.

What about the next EREV SUV? Since it aims to compete with Lixiang L7, it will likely emphasize family-friendliness, spaciousness, long range, and intelligence. But is this the right path for IM Motors? Can it compete with Lixiang by following a similar strategy? Can it realize its aspirations? The answers to these questions remain largely unknown and somewhat pessimistic.

However, IM Motors has no choice but to try again.

On one hand, it is worthwhile for IM Motors to propose its solutions in battery capacity, voltage power, and other aspects in the EREV market. On the other hand, IM Motors is a representative mid-tier EV startup. Unlike HiPhi, Weltmeister, and Jiyue, which have already fallen by the wayside in this marathon, nor like leading companies such as NIO, Xpeng, and Li Auto, which continue to expand and encroach on market share, IM Motors and other mid-tier companies have been lukewarm in the past, are desperately catching up in the present, and still have opportunities in the future.

They are the overlooked ordinary players in the EV market's development. While the hustle and bustle are the spoils of the big players, the ordinary players can only find it noisy.

For ordinary players, the only option is to fight for survival and growth, as any lapse could lead to dire consequences.

Nevertheless, compared to those who have already been eliminated, these ordinary players still have a chance to succeed. Although the opportunity is slim and may not last forever, at least it is currently within their grasp.