Can Lexus Emerge as the Next Tesla?

![]() 12/26 2024

12/26 2024

![]() 612

612

Recently, media reports have surfaced revealing that "Toyota Motor has decided to establish a new electric vehicle factory in Shanghai, primarily focused on producing models under its luxury brand, Lexus."

It is understood that Toyota Motor will deviate from its long-standing joint venture production model with local Chinese automakers, choosing instead to independently construct and operate this new electric vehicle factory in China. Multiple insiders have revealed, "Toyota Motor has identified a site in Shanghai for the factory, which is anticipated to commence operations around 2027." This signifies that Toyota Motor has become the first Japanese automaker to independently establish a factory in China.

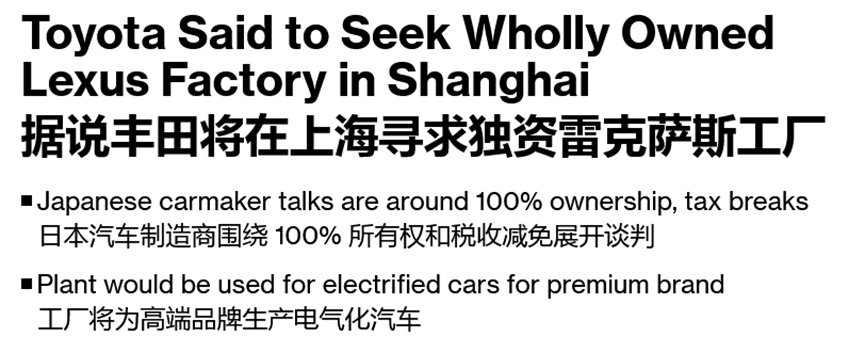

In response to the news of "Lexus establishing a wholly-owned factory in Shanghai in 2027," Lexus China stated, "This is not an official announcement, and we have no comment." Judging from Lexus China's statement, its response is ambiguous, neither confirming nor denying the news. In fact, this is not the first time similar news about Lexus has emerged. In July 2024, Bloomberg reported that "Toyota Motor is seeking to establish a wholly-owned Lexus factory in Shanghai to produce high-end electric vehicles. Concurrently, Toyota Motor also hopes to receive treatment similar to Tesla, including tax breaks, policy support, land subsidies, and the ability to operate directly without a local joint venture partner."

At that time, the attitude of the relevant person in charge of Toyota China mirrored that of Lexus China. However, in the eyes of industry insiders, this time the news of Lexus' plan to build a factory in China is highly likely to be true. Multiple sources close to Lexus revealed, "The intention behind localizing Lexus production is not merely about localization but about electrification, and even about tapping into the global electrified market from China." This rationale is sound. Currently, China is a global leader in automotive electrification and boasts the strongest growth in the share of new energy vehicles. After years of development, China's automotive electrification supply chain has significantly matured.

Furthermore, the burgeoning demand for new energy vehicles among Chinese consumers is also a significant factor favoring Lexus' decision to build a factory in China. In 2023, China's new energy vehicle fleet surpassed 20 million. Among them, the number of pure electric vehicles reached 15.52 million, accounting for over 76%. Li Chao, spokesman for the National Development and Reform Commission, stated, "The demand for new energy vehicles among Chinese consumers will continue to rise, especially for electric vehicles, which are still growing rapidly." In comparison to local Chinese automakers, Lexus' sales in China have been somewhat sluggish. Public data shows that in 2022, Lexus sold 176,000 units in the Chinese market, a year-on-year decrease of 22.4%. In 2023, Lexus sold 181,400 units in the Chinese market, a year-on-year increase of 3%. Notably, despite the sales growth, the Chinese market has become the smallest growth market for Lexus globally. Moreover, the rebound in Lexus sales was achieved through "trading price for volume."

Hence, establishing a factory in China is the optimal choice for Lexus to catch up in the automotive electrification race.

Nevertheless, even though establishing a factory in China allows Lexus to leverage the advantages of the automotive industry chain to accelerate electrification, it does not imply that there are no challenges in the domestic market. In recent years, China's electric vehicle industry has flourished, with new energy vehicle sales continuously increasing and gasoline vehicles gradually losing favor with consumers. Amidst such market changes, local luxury automakers led by Li Auto, AITO, and Zeekr have flourished due to the rise of new energy vehicles. In contrast, traditional luxury automakers have lagged behind in electrification transformation and still heavily rely on gasoline vehicles. As the gasoline vehicle market shrinks, the overall sales of traditional luxury automakers have also shown signs of weakness. It should also be noted that, with the irreversible trend of automotive electrification and intelligence, a multitude of local Chinese premium brands are gaining increasingly significant discourse power. Their lackluster market performance indicates that the market appeal of traditional luxury brands has diminished significantly. A localized Lexus will also need to overcome such challenges.

Therefore, it is uncertain how much favor Lexus will gain from consumers after localization.

However, it is certain that Toyota is actively aligning with the mainstream trends in China's automotive market. As for whether Lexus can overcome the aforementioned challenges, time will tell.

(Images sourced from the internet. Please remove if there is any infringement.)