Can Firefly Illuminate NIO's Path Forward?

![]() 12/27 2024

12/27 2024

![]() 650

650

At the 2024 NIO DAY, NIO's third brand, Firefly, made its official debut, garnering substantial attention alongside some controversy.

Beyond the design, what truly merits closer scrutiny is Firefly's market positioning.

Li Bin, CEO of NIO, stated at the event, "Firefly is smarter than MINI and smaller than smart." As NIO's most affordable model, Firefly's product positioning remains ambitious, with a starting price of 148,800 yuan, positioning it directly against MINI and smart. This market positioning has sparked debate among the public. Admittedly, while the compact car market isn't new, it remains relatively untapped, with MINI and smart being the primary competitors. This niche does cater to a group that values both vehicle performance and brand value, alongside driving experience and emotional attachment to their cars.

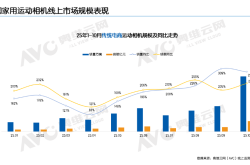

It's important to note that this group constitutes a minority. MINI and smart, deeply entrenched in this market for decades, sell approximately 3,000 to 4,000 units per month in China, figures achieved despite price reductions. In the domestic market, most consumers prefer larger vehicles over smaller ones, prioritizing cost-effectiveness. Within the 150,000 to 200,000 yuan price range, consumers have numerous options, enabling them to purchase almost any desired model. Cars like Xpeng's Mona M03, Deep Blue's L07, Leapmotor's C01, BYD's Han, Geely's Galaxy E8, and Dongfeng's eπ007 are all viable choices. For the same budget, consumers can opt for a B-class or even a C-class car, offering unmatched size and comfort.

If sedan functionality falls short, numerous SUV options are available. Models such as Deep Blue's S07, Leapmotor's C10, Lynk & Co's Z20, and Dongfeng's eπ008 span from compact to mid-to-large SUVs. For those inclined towards sportier, stylish vehicles, the Nezha GT sports car is another option.

Notably, Firefly also offers a BaaS (Battery as a Service) solution, potentially lowering the price to the 100,000 yuan range. However, in this market, Firefly will still compete with models like Volkswagen's ID.3, Deep Blue's S05, and Chery's iCAR V23. In terms of product positioning, Firefly faces even more potential substitutes. Therefore, while Firefly's positioning seems precise, its ability to stand out among numerous competitors remains uncertain.

Over the past decade, NIO has established three brands: the premium main brand NIO targeting the above 300,000 yuan market; the family-oriented second brand Ledao, aimed at the 200,000 yuan segment; and the third brand Firefly, positioning itself as a premium compact car for the 150,000 yuan market. On the surface, NIO's multi-tier product strategy spanning high, mid, and low segments seems complete. However, a closer look reveals that Ledao's potential remains untapped due to production capacity constraints and uncertain delivery timelines. NIO's main brand's development has also hit a plateau, with monthly sales stabilizing around 20,000 units, making significant short-term growth unlikely. NIO needs a breakthrough to overcome its current sales challenges, and Firefly, as a newcomer, should undoubtedly step up. Nonetheless, its positioning as a premium compact car competitor inadvertently introduces uncertainty. Its market performance remains to be seen. Notably, Firefly is more focused on the overseas market, with China not being its primary battleground. It's reported that Firefly will launch its first model in the European market next year and expand into more international markets with subsequent models. Whether Firefly can illuminate NIO's future will become evident in the next two years.

(Images sourced from the internet. Please remove if there is any infringement.)