New Energy MPV Market Kicks Off a New Round of Competition

![]() 12/27 2024

12/27 2024

![]() 461

461

Introduction

The Denza D9's 25 variants embody an internal-to-external innovation, signaling a fresh wave of advancements in China's premium MPV market.

As 2024 draws to a close, the Chinese automotive landscape has been replete with unpredictable twists and turns. The year-long price war has pushed automakers to their limits, with sales taking precedence over dignity. Joint ventures, independent brands, traditional automakers, and newcomers alike have engaged in fierce competition.

In niche markets, the shuffle between old and new is a common sight. The green energy transformation has gradually permeated the sedan and SUV segments, causing many traditional models and brands to fade from consumer radar.

Some argue that such intense competition leaves no clear winner. However, BYD, as an industry trailblazer, has undeniably ushered in a prosperous era. Its Dynasty and Ocean networks dominate various niche markets, while Denza, FANGCHENGBAO, and NIO Look up, despite their late entry, have secured top positions in industry rankings.

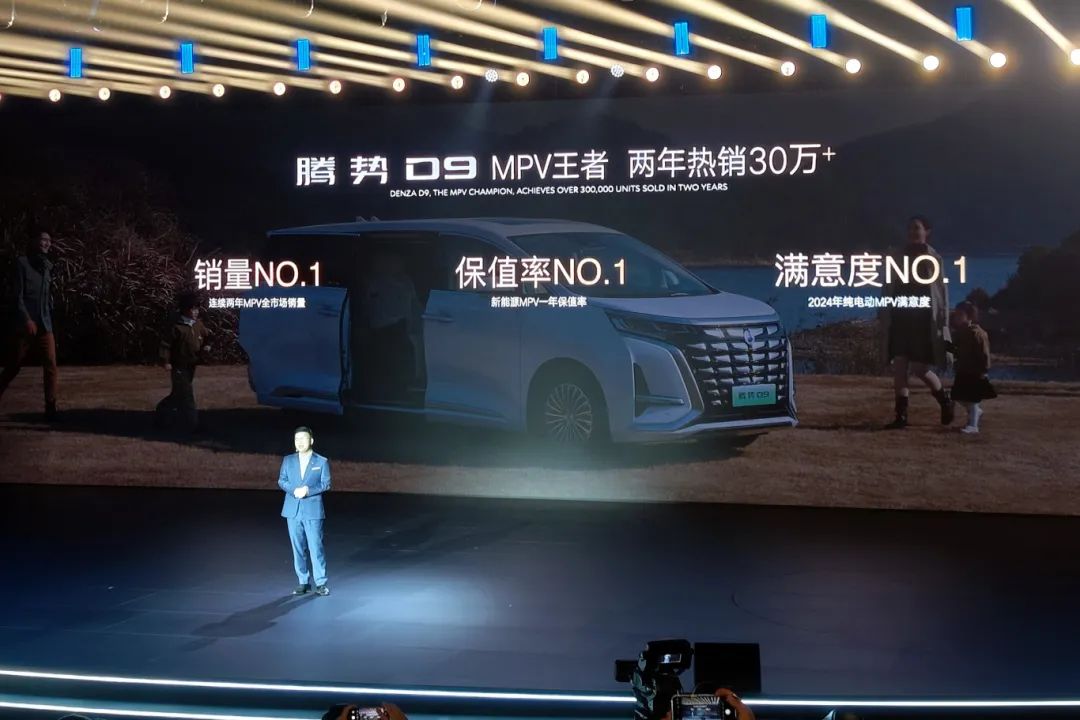

Particularly impressive is Denza, which, in just two years, has significantly encroached on Buick GL8's 20-year market dominance with a single Denza D9 model, showcasing the brand's prowess.

With the market's rapid evolution this year, the MPV segment has also entered a new phase of competition. Models like the Xiaopeng X9, Lixiang MEGA, LEVC L380, and Zeekr MIX will undoubtedly exert pressure on their predecessors. For Denza D9, expediting product iterations is paramount.

The year-end launch of Denza D9's 25 variants underscores the brand's commitment to the MPV market. Amidst fierce competition, rapid product innovation is Denza's best strategy to maintain its market stance.

Defending the Market: The Imperative of Product Innovation

One of the defining features of China's auto market this year has been the "price war"-centered product competition. The relentless race for innovation, overt and covert marketing battles, and ruthless market share scrambles reflect automakers' desperation to stay ahead amidst industry turbulence.

Forecasting future trends based on this dynamic, it's unlikely that any automaker will opt for a gradual, step-by-step strategy. Yet, reflecting on the past year's disputes, it's unclear whether those leading the market transformation will ultimately emerge victorious.

Since its launch, Denza D9 has amassed over 300,000 sales, earning a reputation for the highest resale value among peer MPVs. Its average retail price exceeding 400,000 yuan is even more significant, as China's auto market has never witnessed a product that could reshape the premium MPV landscape.

However, as competition intensifies, the MPV market's future remains uncertain. While Denza D9 currently stands out, who's to say another highly competitive model won't emerge? Hence, the comprehensive refresh of Denza D9's 25 variants is both a product enhancement and a preemptive move against formidable competitors.

The product itself speaks volumes. Amidst BYD's technological explosion, even MPVs like Denza D9, emphasizing ride comfort, have achieved the maximum degree of technological iteration.

From the inside out, Denza D9's 25 variants come standard with an 800V high-voltage platform, BYD's fifth-generation DM technology, Devialet theater-grade sound, a 7.5L intelligent cooling and heating refrigerator, silent electric suction doors, etc. Compared to similar products, their advantages are evident.

Moreover, as consumer demand for intelligent vehicles soars, the new models include the "Tian Shen Zhi Yan" (Heavenly God's Eye), a high-level intelligent driving assistance system, as standard across all trims.

What should a premium MPV, priced between 300,000 and 400,000 yuan, embody? For over two decades, Buick GL8 has set the gold standard: an elegant exterior matched with a luxurious interior, spacious seating areas supported by a smooth chassis, and premium materials and configurations. This formula has fueled GL8's "Land Business Class" success.

However, market changes over the past two years reveal that while products like the Toyota Sienna maximize household utility and have market-changing potential, Denza D9's immediate dominance in the over-400,000-yuan MPV segment signals a loosening of the rigid market structure.

Judging by the degree of product innovation, Denza D9 aims to reinforce this market perception.

Denza D9's Mission Transcends Market Reshaping

Initially, 2023 was anticipated as the rebirth year for China's MPV market, with models like the Maxus MIFA9, WEY MOUNTAIN, and Besturn M9 debuting. However, market trends diverged from expectations, with these brand transformation aspirants falling short.

Amidst consumer trend shifts and niche market reignition, MPVs, initially sidelined, experienced a resurgence. In the electrification wave, automakers aspire to tap into market potential.

However, considering the MPV market landscape and newcomers' prospects, it's uncertain if public acclaim will crack the rigid structure. Denza D9 stands out amidst the crowd.

How large is the market for mid-to-high-end MPVs? With mid-to-large SUVs dominating, what room remains for similarly priced MPVs focusing on space? How many potential buyers can afford 300,000 to 500,000 yuan vehicles and have suitable environments for large cars?

Chinese automakers are acutely aware of these challenges. Denza D9's prominence in this anxious year may stem from its adept grasp of the MPV market's development path amidst evolving consumer trends.

As the economic environment shifts and vehicle usage cost becomes a priority, coupled with China's burgeoning premium brands, Denza D9's home-business dual-use approach, combined with robust product strength and brand image, creates unstoppable momentum.

With Denza D9 setting the MPV benchmark over the past two years, its timely refresh is essential regardless of new entrants.

Where does Denza Automobile envision Denza D9's future? Based on current performance, rewriting Buick GL8's era seems plausible. However, from an industry transformation perspective, Denza D9 aims to redefine China's MPV market development and set an example for peers.

"In China, premium MPVs must have a unique identity," transcending the "business vehicle" or "multi-purpose van" labels. As Denza D9's 25 variants enhance driving comfort, redefine luxury, and embrace intelligence, their rationale becomes clear. While China's auto market faces uncertainties, Chinese automakers must seize the initiative to set new rules.