Jiyue's Struggles: A Case of Environmental Blame or Internal Reflection?

![]() 12/27 2024

12/27 2024

![]() 640

640

In the recent spate of controversies surrounding Jiyue Automobile, public opinion and the market often lay the blame on the "general environment": In a declining industry cycle, the Jiyue incident is viewed as neither the first nor the last.

This perspective is so prevalent that every conversation about Jiyue inevitably ends up pointing fingers at the "general environment." While there is internal condemnation directed at Xia Yiping, the sentiment often defaults to lamenting the external circumstances.

So, is the Jiyue incident solely the fault of the general environment? We offer our perspective:

Firstly, the general environment should not serve as a blanket excuse; Jiyue's troubles cannot be solely attributed to it.

Secondly, Jiyue's unique governance model is the root of all its problems. The decline of Baidu's core business served as the catalyst, and subsequent prudent financial management proved to be the final straw that broke the camel's back.

Thirdly, computing power will be a crucial dimension in future industry competition. Traditional automakers lag behind in this area and will face immense pressure in the future. The resulting price competition will continue to impact the industry, likely becoming a major topic in the automotive sector in 2025. Simultaneously, this presents a competitive advantage for companies prioritizing intelligent driving. Divergences in industry perceptions will also intensify.

The General Environment is Not to Blame

What cycle are new energy vehicles currently in? Opinions may vary, but let the data speak for itself.

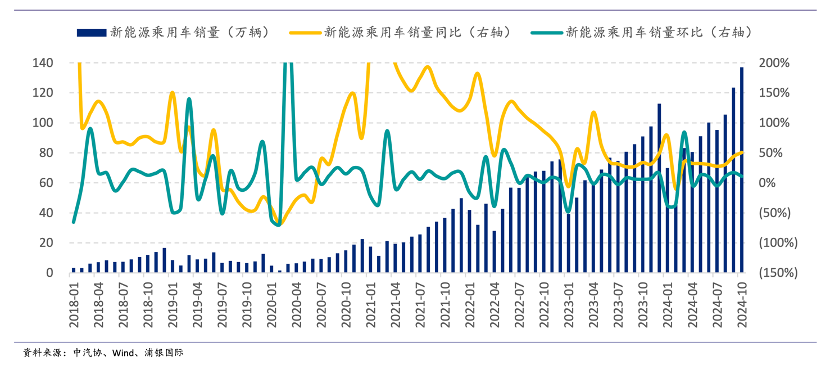

The chart above depicts new energy vehicle sales in China, compiled by ICBC International, along with their year-on-year and month-on-month growth rates. Contrary to perceptions of stagnation, the year-on-year and month-on-month growth rates of the new energy vehicle sector remain high. Especially after the intensification of the "trade-in" policy in July 2024, industry sentiment has notably improved.

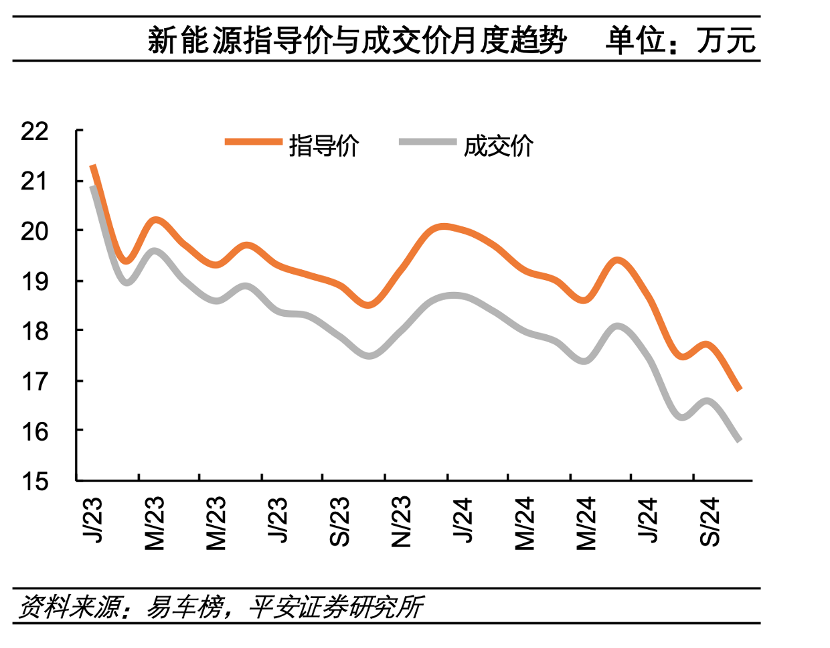

The difference lies in the continuous decline in the price center of new energy vehicles (largely in line with external perceptions), particularly after the intensification of the "trade-in" policy. On one hand, overall industry sales growth remains high, with strong overall demand. On the other hand, the industry's pricing center continues to decline, presenting a contradictory scenario where indicators conflict.

In industry analysis, new energy vehicles shine brightly, while fuel vehicles receive less attention. The root of this contradiction lies in overlooked fuel vehicles.

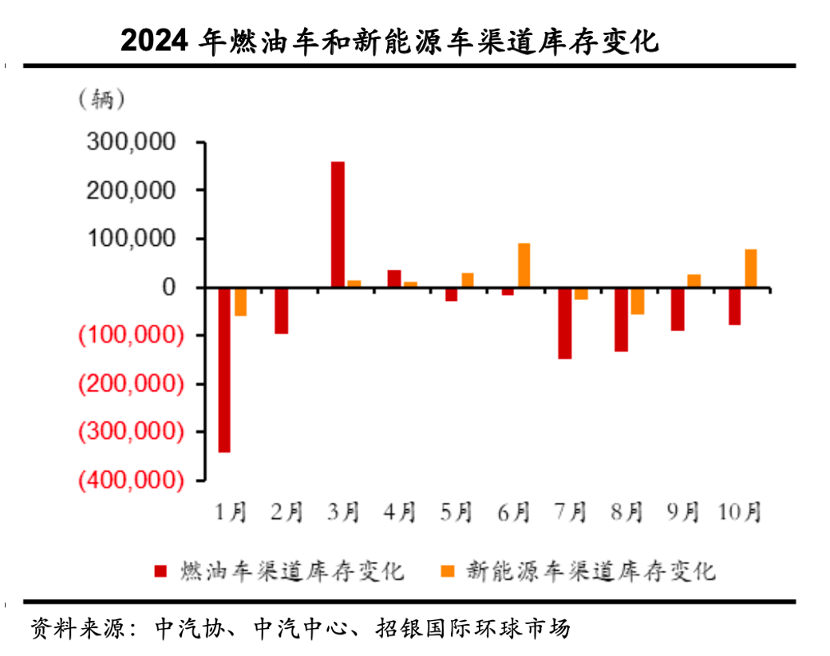

Inventory changes are a crucial indicator for describing industry sentiment and operator confidence. If sentiment is positive and confidence is high, practitioners will naturally expand inventory reserves. Conversely, declining confidence necessitates destocking to reduce the risk of backlog.

Before July 2024 (prior to the intensification of the "trade-in" policy), inventories of both fuel and new energy vehicles were declining, indicating industry downturn. Subsequently, the policy boosted demand, leading to a gradual increase in new energy vehicle inventories, while fuel vehicle inventories remained low.

This leads to:

Firstly, the two types of enterprises have vastly different attitudes towards the "trade-in" policy. Fuel vehicle manufacturers aim to accelerate destocking and adopt a defensive stance, while new energy vehicle manufacturers see it as an opportunity to increase market share and actively stock up.

Secondly, to improve destocking efficiency, fuel vehicle manufacturers offer discounts, which also compresses the price space for new energy vehicles, making the 150,000 to 300,000 yuan price range more crowded. In other words, new energy vehicle price reductions are coerced by fuel vehicles, which are in a "shrinking" cycle.

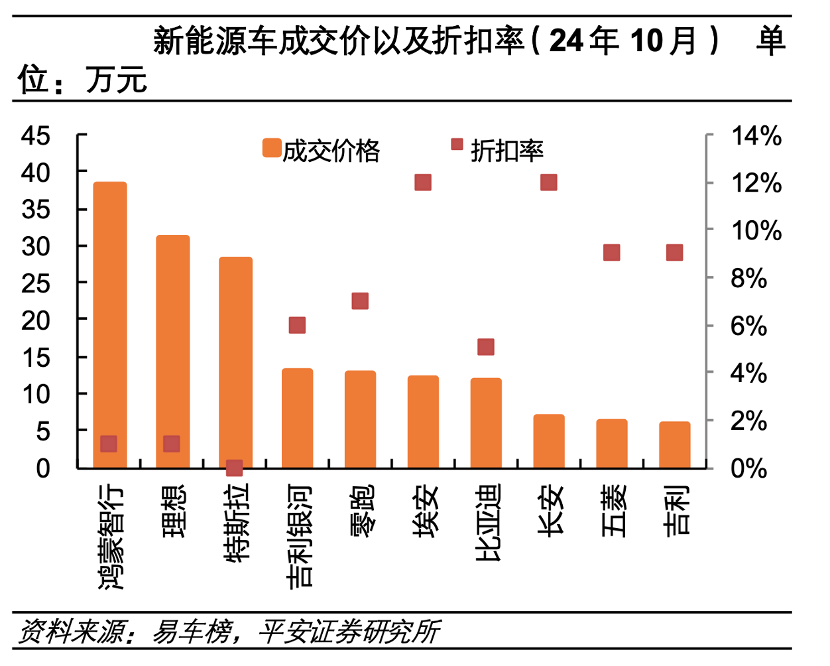

Thirdly, the new energy sector is also experiencing differentiation. Enterprises with mediocre brand power and R&D capabilities will feel the pressure (behind new energy is not just battery power, but also intelligence). The larger discounts offered by new energy vehicle brands derived from fuel vehicles, compared to pure new energy vehicle enterprises in the chart below, best illustrate this point.

Through this analysis, we gain an intuitive understanding of the so-called "general environment":

1) The general environment is not as weak as perceived. The "trade-in" policy's boost to overall demand is evident. Although there's potential pressure from prematurely exhausting 2025 demand, the industry remained highly buoyant in 2024. It's irresponsible to solely blame the general environment for Jiyue's troubles.

2) Within the automotive industry, some "sip the soup," while others "eat the meat." The former must offer greater concessions, potentially causing significant industry disturbances. However, enterprises that "eat the meat" remain in a highly buoyant cycle.

Computing Power Determines the Future; Jiyue Has No Future

With a clearer understanding of the general environment, let's analyze the specific reasons behind Jiyue's downfall.

As the industry's development path becomes increasingly clear, the new energy vehicle sector is demonstrating "long slopes and thick snow" characteristics. For enterprises to maintain a firm foothold, they need long-term competitive advantages. The early approach of capital entering through subsidies, quickly gaining market share, and then pursuing profitability is no longer viable. The industry now has the dual characteristics of high investment and long-term nature.

Taking intelligence as an example, it's a key area of competition among new energy vehicle enterprises. The technical route is dominated by the BEV+Transformer combination proposed by Tesla in 2022, supplemented later by Occupancy Grid for enhanced 3D spatial recognition.

The battle for end-to-end technology and computing resources has become the new rule for intelligent driving victory. Automakers need additional computing power and technology investments, a long-term, high-investment endeavor. An enterprise's success depends on technology and its "money-burning" capabilities.

For automakers, their operational focus lies in:

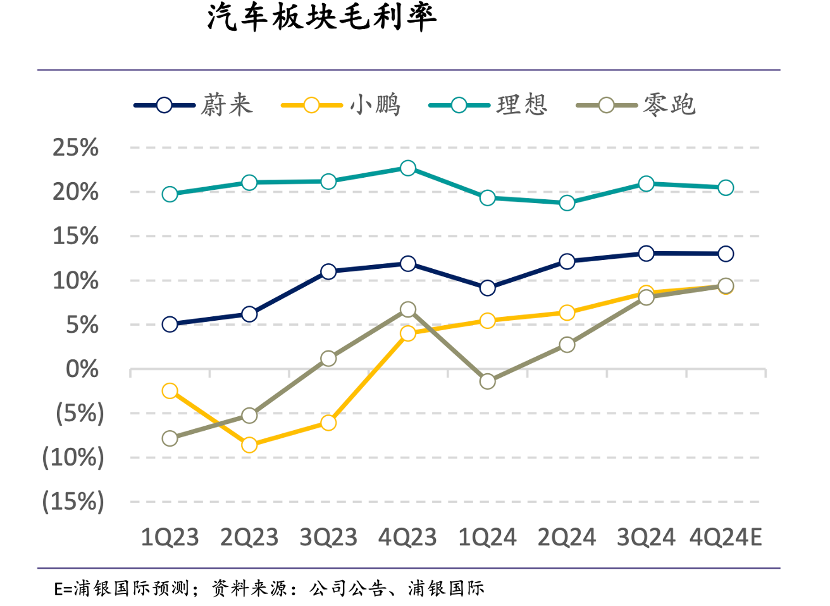

1) Achieving profitability as soon as possible to minimize financial pressure. The market generally believes the break-even point for new energy vehicle enterprises is between 30,000 and 40,000 monthly deliveries, considered the automakers' life red line. Those exceeding this indicator generally saw positive gross margins in 2024.

2) While automakers aspire to gain capital favor, industry characteristics require "patient capital."

Looking back at Jiyue's development, deliveries in the first 11 months of 2024 exceeded only 14,000 units, far from the break-even point. Medium to long-term, Jiyue's losses will directly impact Baidu and Geely's financial statements.

Do Baidu and Geely possess the potential to be "patient capital"? According to media reports, since Jidu was renamed Jiyue (with the majority shareholder shifting from Baidu to Geely), Jiyue nominally shares many conveniences from its shareholders, like Baidu's technology and Geely's supply chain. However, in essence, the three companies maintain a B2B "clear accounting among close relatives" relationship. Baidu sells its Apollo intelligent driving solutions to Jiyue (with an annual cooperation scale of hundreds of millions of yuan), while Geely hopes to do good business with Jiyue in the supply chain. Xia Yiping is nominally a shareholder-hired professional manager but essentially performs the role of a founder. There's a complete mismatch between shareholders' and management team's responsibilities and rights, leading to a chaotic corporate governance system.

Due to space constraints, we'll use intelligent driving's computing power requirements as an example.

As of August 2024, Lixiang's cloud computing power reached 4.5 EFlops, with an annual rental cost of approximately 1 billion yuan. According to Lang Xianpeng, Vice President of Lixiang Intelligent Driving, supporting VLM and end-to-end training requires a reserve of tens of EFlops. If L3 and L4 autonomous driving are achieved, the annual expenditure on training computing power alone will be approximately 1 billion USD.

The capital investment behind computing power is growing exponentially, and the arms race is intense. For instance, in July 2024, Lixiang's cloud computing power was 2.4 EFLOPS, surging to 5.39 EFLOPS by August's end. XPeng Automobile also announced that its cloud computing power will increase from the current 2.51 EFLOPS to 10 EFLOPS by 2025 (with an annual investment of 3.5 billion yuan for intelligent driving, of which 700 million yuan will be for computing power training).

In contrast, Jiyue Automobile's current cloud computing power is 5.5 EFLOPS (shared with Baidu Apollo). This figure was advantageous half a year ago but will be unremarkable by 2025. Cloud-based training computing power is crucial for improving intelligent driving. If Jiyue cannot ensure long-term investment in this area, its products' future prospects will undoubtedly be uncertain.

Under the current governance model, Jiyue's management finds it difficult to have the final say. Regarding the significant decision of computing power, crucial for future sustainability, Jiyue relies on Baidu Apollo. However, it's unclear whether Baidu Apollo's computing power matches Jiyue's needs and industry growth. Jiyue's excessive reliance on its shareholders and lack of full control over core technologies are likely the fundamental reasons behind recent controversies.

Why don't shareholders support long-term investment? Besides low shipment volumes, are there other hidden factors? We'll again use computing power investment as an example.

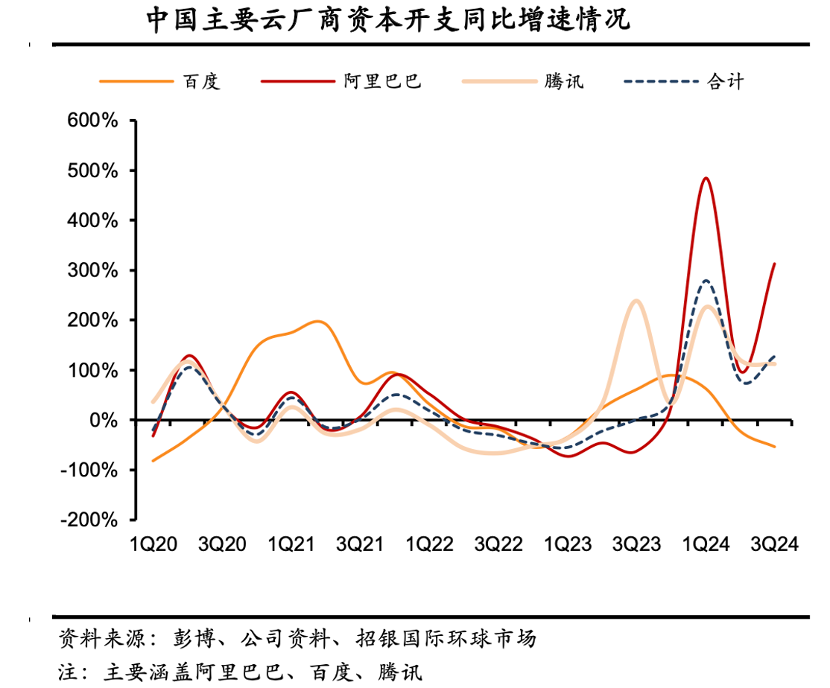

As mentioned, intelligent driving in automobiles requires high computing power investment (e.g., NIO stated that building an end-to-end large model requires a computing power cluster of at least tens of thousands of cards. Xiaomi recently disclosed similar plans). From Huawei, NIO, Lixiang to XPeng, the intelligent driving capabilities of top-tier new energy vehicle enterprises are accompanied by rapid capital investment growth. Theoretically, if Jiyue wants to maintain its leading position (positioning itself as an automotive robot), its computing power supplier, Baidu, needs to increase investment. Moreover, Baidu itself is entering the AIGC market with ERNIE Bot, requiring capital expenditure matching its business development.

To embrace the AI wave, mainstream Chinese cloud computing vendors have increased capital expenditure (e.g., Alibaba and Tencent). In contrast, Baidu has been cautious. Currently, Baidu has considerable cash reserves (accounting for over 65% of its market value). However, this cash is neither used for short-term shareholder returns nor long-term capital expenditure, which is peculiar.

This reveals Baidu's conservative financial management. When cornerstone business marketing revenue is significantly impacted, hastily increasing capital expenditure may affect key indicators like free cash flow. Therefore, Baidu adjusts or reduces capital expenditure to maintain normalization.

Baidu's tightened purse strings inevitably affect Jiyue. On one hand, Jiyue's low sales volumes proportionally record losses in Baidu's financial statements. On the other hand, prudent capital expenditure prioritizes Baidu's self-use of computing power, leaving Jiyue unable to build a large computing power cluster like others. This plunges Jiyue into a vicious cycle of "lack of computing power support - inability to ensure product advantages - weak long-term competitiveness - continuous losses," nearly impossible to reverse.

In Jiyue's free-fall, environmental factors play a minimal role. Xia Yiping bears undeniable responsibility, but what can he actually control?