Balancing Pressure and Support: A Crucial Examination of the New Energy Vehicle Supply Chain

![]() 12/30 2024

12/30 2024

![]() 445

445

Original by New Energy Outlook (ID: xinnengyuanqianzhan)

Full text: 2779 words, reading time: 7 minutes

2024 has proven to be a challenging year for both the global and Chinese new energy vehicle industries.

Despite significant advancements in technology, material management, and supply chain efficiency, the industry is grappling with severe challenges posed by price wars, broken capital chains due to individual bankruptcies, and uncertainties stemming from international trade frictions. BYD's mass email requesting suppliers to reduce prices by 10% sent shockwaves through the industry, sparking widespread discussions on the survival of upstream and downstream players in the new energy vehicle sector.

Is the new energy vehicle supply chain on the brink of collapse? Is this fear-mongering or well-intentioned advice? Perhaps examining the "gains" and "losses" of the supply chain this year can offer a clearer understanding of its precarious situation. As the industry braces for a new round of reshuffling, the question of how to build a more resilient supply chain system has become a common concern for all stakeholders.

In this context, some actors continue to push the supply chain to its limits, exacerbating its fragility, while others step forward to offer timely help and support, standing shoulder to shoulder with suppliers through thick and thin.

The contrast is striking. Compare the two approaches, and you'll see the difference.

1. The Price War's Unwanted Companion: The Strained Supply Chain

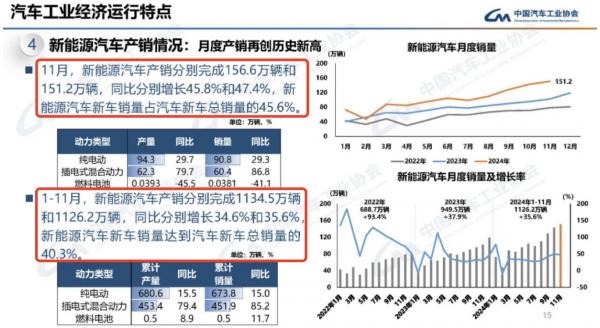

The Chinese new energy vehicle industry continued its rapid advance in 2024. Statistics reveal that domestic production and sales of new energy vehicles reached 11.345 million and 11.262 million units, respectively, in the first 11 months, marking year-on-year increases of 34.6% and 35.6%.

Image/New energy vehicle production and sales data for the first 11 months

Source/Internet screenshot from New Energy Outlook

While automakers bask in the limelight with their impressive achievements, the behind-the-scenes role of the supply chain is indispensable. Take battery technology as an example; the development of solid-state batteries has gradually replaced traditional lithium-ion batteries in recent years, thanks to the concerted efforts of numerous research institutions and enterprises. The supply chain serves as the vital link connecting these innovative elements.

A robust supply chain can help automakers effectively mitigate risks. For instance, Tesla successfully minimized the impact of the global chip shortage and maintained high capacity utilization thanks to its strong supply chain management and diversified supplier base.

Tao Lin, Tesla's Vice President, once stated that only by working collaboratively with suppliers for mutual benefit, enhancing efficiency, and reducing costs through technological innovation can enterprises thrive in the long run. It is reported that over 95% of Tesla's components are locally sourced in China, and its achievements in China and globally are inseparable from these supply chain partners.

However, despite the thriving new energy vehicle consumer market, turbulent undercurrents persist. As market competition intensifies, some automakers aim to control costs by targeting upstream suppliers.

The domestic price war intensifies, and cost competition reaches a fever pitch, leading to frequent brand crises. Suppliers in the supply chain find themselves caught in the middle, enduring the pain before reshuffling. If they cannot withstand the harsh winter, they may not survive.

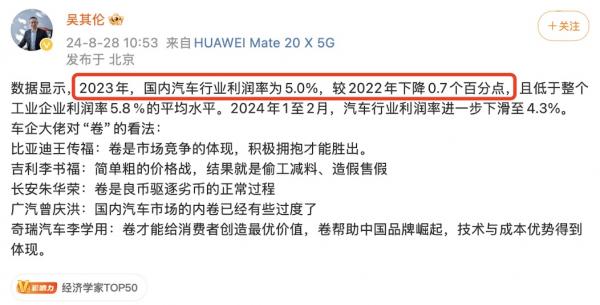

Therefore, automakers continuously pressure suppliers, reflecting the extreme compression of profit margins amid fierce market competition. Data shows that the average profit margin of China's automotive industry fell to 5.0% in 2023, a decrease of 0.7 percentage points from the previous year and failing to meet the average profit margin of industrial enterprises. Although the situation improved slightly in 2024 with a rebound in profit margins, the new energy vehicle sector remains mired in losses.

Image/Economist Wu Qilun releases 2023 automotive industry data

Source/Wu Qilun's Weibo screenshot from New Energy Outlook

This cost reduction pressure is transmitted upstream through automakers, chaining one link to another. Just like the chained warships in Cao Cao's camp, once a fire breaks out with the east wind, who can escape? The fragility of the supply chain exacerbates the systemic risks across the industry. Suppliers are enduring the coldest winter ever, bearing an unbearable weight.

2. Gritting Teeth and Holding On: The Supply Chain's Cry for Support

Speaking of cost reduction by automakers, the recent BYD email incident cannot be overlooked. Last month, an email from BYD to suppliers was exposed, requesting a 10% price reduction for supplies in 2025, sparking an uproar and industry shockwaves.

To better understand the concept of a 10% cost reduction, here's a set of data for reference:

According to the "2024 Global Automotive Supply Chain Core Enterprise Competitiveness White Paper" jointly compiled by China Automotive News and Roland Berger, a top global strategic management consulting firm, the overall profit margin of global auto parts suppliers was 6.1% in 2023, while that of China's top 100 auto parts enterprises was 7.2%, with an electronic sector profit margin of only 4%.

Image/Profit margins of the top 100 global auto parts suppliers

Source/Internet screenshot from New Energy Outlook

As another specific reference, the net profit margin of Lizhong Group, which specializes in wheel hubs and tires, was only 3.13% in the first half of 2024.

Industry insiders comment that if suppliers are forced to reduce their supply prices by another 10%, they will be on the brink of bankruptcy.

A BYD supplier management executive, who wished to remain anonymous, stated that the company's current size and cash flow can only sustain normal operations. If BYD forcibly demands a 10% price reduction, the company will incur losses and may consider withdrawing from the BYD supply chain or attempting to halt supplies to force negotiations.

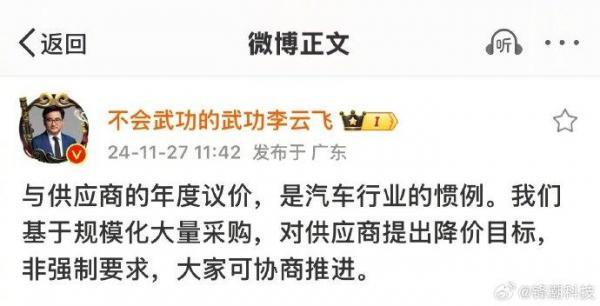

In response to the cost reduction email, BYD stated: "It is not a mandatory requirement; negotiation is possible." Let's see if suppliers can negotiate with BYD.

Image/BYD's response

Source/Internet screenshot from New Energy Outlook

A supplier to emerging automakers said that small and medium-sized suppliers are like weak lambs shivering in the cold winter of the price war. They must endure pressure from automakers while facing long payment cycles, increasing the pressure on their survival. When pushed to the brink, they have to resort to layoffs, pay cuts, or even production halts to barely survive.

In addition to pressure from automakers, escalating international trade frictions add uncertainty to the supply chain, especially restrictive measures imposed by the West against Chinese new energy vehicles. Any slight disturbance stirs the sensitive nerves of supply chain enterprises. These factors collectively make the new energy vehicle supply chain even more fragile.

The new energy vehicle industry is a systematic project where one link is connected to another, and one ring fits into another. The so-called "all rise and fall together" applies here. Suppliers hope that leading enterprises in the chain will offer a warm embrace, share development risks, and enjoy the benefits of development together. Instead of relentlessly squeezing the bottom line, forcing people into cutting corners or substituting inferior products. In the long run, the new energy vehicle industry will inevitably suffer from a "quality" backlash.

3. Seeking Win-Win Solutions: Avoiding Internal Competition and Working Together

Building a more robust and resilient new energy vehicle supply chain is a systematic project. In this rapidly evolving industry, every participant is an indispensable part of the chain. Closer cooperation is essential. Instead of consuming each other, we must move forward together to create a brighter future.

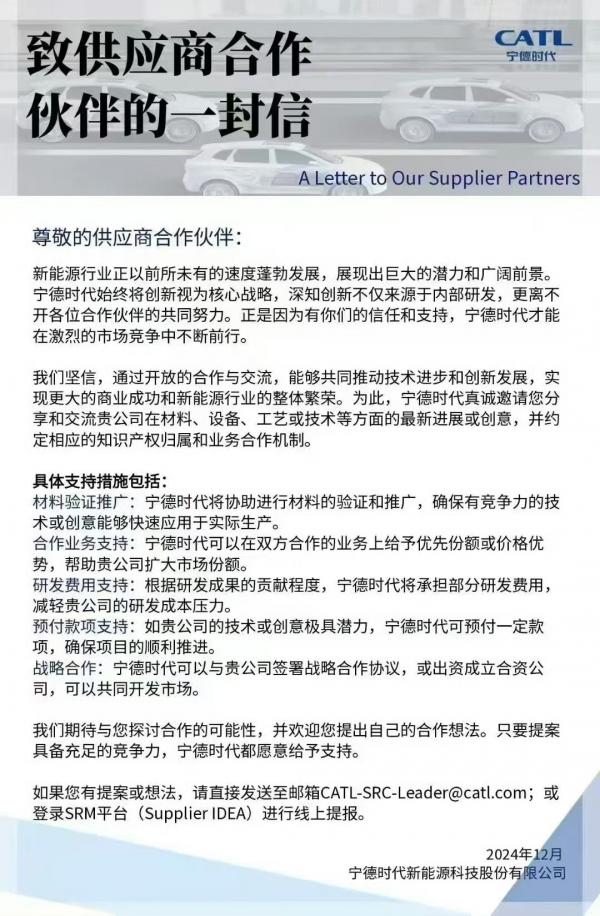

A letter from another leading enterprise in the new energy industry to its suppliers, as exposed by the media, seems to be more welcomed by suppliers.

"We firmly believe that through open cooperation and exchange, we can jointly promote technological progress and innovative development, achieving greater business success and the overall prosperity of the new energy industry," stated in CATL's "A Letter to Supplier Partners," earning widespread praise within the industry for its vision and sincerity.

Image/CATL's email to suppliers

Source/Internet screenshot from New Energy Outlook

It is reported that CATL not only provides financial support to its partners but also actively shares its technological resources, assisting partners in expanding markets through strategic cooperation agreements and promoting the growth and development of small and medium-sized enterprises.

As we all know, capital is the "source of vitality" for the transformation of scientific and technological achievements of technology-based enterprises. Many specialized and innovative small and medium-sized enterprises fail due to a lack of funds. The new energy industry is also "capital-intensive." Lack of financial support may make it difficult to achieve mass production, and without expanding market share, profitability becomes challenging.

Jiangxi Shenghua New Materials Co., Ltd., a national high-tech enterprise specializing in the research, development, production, and sales of lithium battery cathode materials, successfully launched the ignition test production of its first lithium iron phosphate cathode material production line this September with the support of advance payments from CATL. The project has now officially entered the production and operation phase.

Image/Ignition test production of Jiangxi Shenghua's lithium iron phosphate production line

Source/Internet screenshot from New Energy Outlook

This win-win cooperation model sets an example, not only helping suppliers navigate the path of technological innovation and accelerate the application and production of new battery materials but also contributing to building a more stable supply chain system for CATL itself. This is of great significance for maintaining and developing the new energy vehicle supply chain.

Currently, CATL has conducted in-depth cooperation with high-quality suppliers in upstream key areas such as cathode materials, anode materials, separators, electrolytes, and equipment through technology licensing, long-term agreements, joint ventures, and other methods.

Facing the upcoming new round of reshuffling, supply chain enterprises need to unite and overcome difficulties together. We call on all relevant parties to work together to strengthen cooperation along the supply chain and reject vicious internal competition.

Only in this way can China secure a more favorable position in the global new energy vehicle sector and jointly embrace future challenges and opportunities. This is not only the responsibility of the industry but also the mission of every participant.