Union and Transformation: Can Honda and Nissan Buck the Trend of Japanese Mergers?

![]() 12/30 2024

12/30 2024

![]() 534

534

Recently, there was a significant announcement that two prominent Japanese automakers, Honda and Nissan, plan to merge. Rumors also suggest that Mitsubishi might join in this collaboration.

Under the current blueprint, Honda and Nissan will jointly fund the establishment of a holding company, with both automakers merging as subsidiaries. The president of the holding company will be appointed by Honda, and the new entity will be listed independently, followed by the delisting of Honda and Nissan.

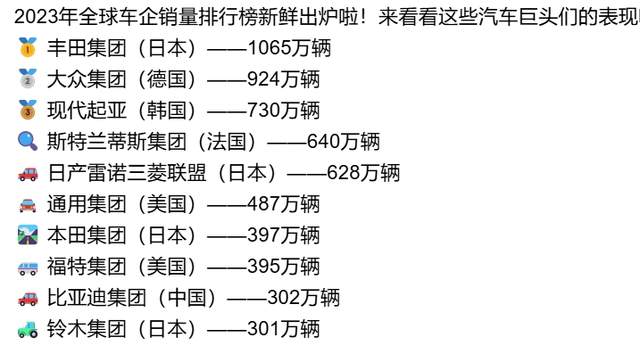

Honda and Nissan are well-known names among the top 10 global automakers.

Based on 2023 data, Nissan ranks fifth globally with sales of 6.28 million vehicles, while Honda is seventh with sales of 3.97 million vehicles. A merger between the two could potentially propel them into the top three, possibly even second, surpassing Volkswagen.

The rationale behind their merger is rooted in the current challenging environment, particularly in the transition to electric vehicles (EVs), where both Nissan and Honda have struggled. Additionally, both companies have witnessed a significant decline in sales in the Chinese market. Thus, Honda and Nissan have decided to merge their resources and avoid internal competition, aiming to turn the tide.

However, observers of Japanese industrial development may have noticed a recurring pattern: many Japanese companies tend to merge before their eventual decline, with the merger often signaling the beginning of a downturn.

For instance, in 2010, Fujitsu and Toshiba merged, only to see their mobile phone and computer businesses collapse shortly after. Today, Japan's PC and mobile phone industries are virtually non-existent on the global stage.

Another example is the major consolidation in Japan's panel industry in 2012, involving Sony, Toshiba, and Hitachi. Today, Japan's screen business holds little relevance in the global market.

Similarly, Japan's shipbuilding industry and storage chip sector also underwent mergers, but both sectors have since declined, failing to achieve improvement through consolidation.

Now, with the consolidation in Japan's automotive industry, will it repeat this pattern? Will the automotive business, instead of improving, continue to decline after the merger, ultimately leading to collapse?

Regardless, although Japan's approach to mergers may not always yield positive outcomes, its attitude is commendable. It demonstrates that mergers are a viable option, and during critical times, it is crucial to avoid internal competition and instead focus on integrating resources to face external challenges collectively rather than individually.