Can Huawei Help SAIC Reclaim Its Domestic Throne?

![]() 12/30 2024

12/30 2024

![]() 634

634

Introduction

Partnering with Huawei undoubtedly raises market expectations, yet for SAIC to reclaim its domestic top spot, self-reliance remains paramount.

The Chinese automotive market is undergoing significant transformations amidst advancements in the new energy sector.

From an energy and technology perspective, new energy vehicles are encroaching on traditional gasoline vehicles; domestic brands are challenging joint ventures; and automakers' rankings and market structures are quietly shifting.

Even SAIC Motor, which held the top domestic sales position for 18 consecutive years, has been impacted, losing its leading spot.

Data shows that in the first 11 months of this year, SAIC Motor sold 3.53 million vehicles, a 19.48% year-on-year decrease. In contrast, BYD sold 3.7573 million vehicles, a 40.02% increase, surpassing SAIC by nearly 230,000 vehicles.

Moreover, since April, SAIC's monthly sales have declined steadily for eight months. Conversely, BYD's sales and growth momentum have surged. With this seesaw effect, BYD surpassed SAIC in both monthly and annual sales in September.

If current trends persist, SAIC's annual sales may reach around 4 million vehicles, while BYD's are expected to hit 4.25 million. Thus, SAIC, which led the domestic market for 18 years, may be dethroned by BYD.

There are no permanent successes; only enterprises of the times thrive.

While it's natural for market leaders to change, SAIC won't stand idly by, especially after a major personnel shakeup this year. The new management won't accept losing the domestic top spot. Thus, finding a solution is paramount.

Hence, media reports surfaced of SAIC's close contact with Huawei. Led personally by SAIC President Jia Jianxu, the project reportedly didn't receive an official confirmation from either party but sparked market speculation.

As December nears, new details on SAIC and Huawei's cooperation have emerged. Rumors suggest a novel cooperation model where Huawei will assist SAIC in product definition and marketing for mainstream models, with the Feifan RC7 being the first model sold through Huawei channels.

Many are optimistic, stating that with Huawei's help, SAIC could reclaim its top spot.

Certainly, partnering with Huawei raises market expectations for SAIC, but reclaiming the top spot ultimately depends on SAIC itself.

A Novel Cooperation Model Attracts Attention

Huawei, despite not manufacturing cars, has become a sought-after partner in the automotive industry since establishing its Automotive Business Unit in 2019.

Huawei has collaborated with multiple automakers, integrating its advanced intelligent driving technology into 18 models across over ten brands, including state-owned enterprises like FAW, Dongfeng, and Changan.

Huawei's collaboration models include HarmonyOS Intelligent Driving, HI mode, and component supply. The HarmonyOS Intelligent Driving mode involves deep involvement in vehicle manufacturing and sales, while the HI mode provides overall intelligent vehicle solutions, giving automakers more control compared to HarmonyOS.

Currently, Huawei's "Four Realms" — AITO (Huawei-Thalys), Enjoy (Huawei-BAIC), Wisdom (Huawei-Chery), and Zenith (Huawei-JAC) — adopt the HarmonyOS Intelligent Driving mode, covering sedans, SUVs, and MPVs.

Netizens have already coined the name "Shang Realm" for a potential SAIC-Huawei collaboration. However, reports suggest a novel cooperation model rather than HarmonyOS or HI.

In this model, Huawei will focus on assisting SAIC in product definition and marketing for mainstream models. The official announcement is rumored for January 2025, with the Feifan RC7, launching mid-2025, as the first model to be sold through Huawei channels.

Before this news, reports surfaced that Feifan planned to adopt Huawei solutions, restarting the ES37 project (the Feifan RC7, originally slated for 2023 launch but shelved due to brand integration).

With Huawei's technology and channel support, anticipation for the Feifan RC7 is high. Industry insiders expressed that had Feifan adopted Huawei's solutions earlier, its popularity would be unimaginable.

Latest reports also indicate that future cooperation won't be limited to autonomous and joint venture brands, with potential new models. This suggests that SAIC's major subsidiaries may collaborate with Huawei, even developing new models jointly.

If true, this cooperation could be strategic, with future news of SAIC subsidiaries partnering with Huawei likely.

Taking SAIC Volkswagen as an example, since 2022, it has collaborated with Huawei in smart mobility, successfully launching models equipped with Huawei HiCar.

If SAIC successfully partners with Huawei, who's to say SAIC Volkswagen won't embark on new collaborations?

Be Your Own "White Knight"

Whether in autonomous or joint venture segments, Huawei's involvement significantly amplifies SAIC's voice, crucial for its current situation.

When SAIC announced its 2023 sales, annual figures had declined to 5 million vehicles, far from its 2018 peak of 7.05 million, yet maintaining its domestic lead for 18 years. BYD, with 3 million annual sales then, posed no threat.

However, since June, BYD's sales surpassed SAIC's, maintaining rapid growth while SAIC's decline persisted, widening the gap. In September, BYD surpassed SAIC in both monthly and annual sales; by November, BYD led by nearly 230,000 vehicles.

This market performance disparity reflects in their financial reports.

Data shows that in Q1-Q3 2023, SAIC's total operating income was 145.796 billion yuan, a 25.91% year-on-year decrease; net profit attributable to shareholders was 280 million yuan, a 93.53% decrease; and net profit after non-recurring gains/losses decreased by 99.23% to 29 million yuan.

This was SAIC's fifth consecutive quarter of year-on-year net profit decline for shareholders, with respective declines of 24.7%, 22.2%, 2.5%, 9%, and 93.53%.

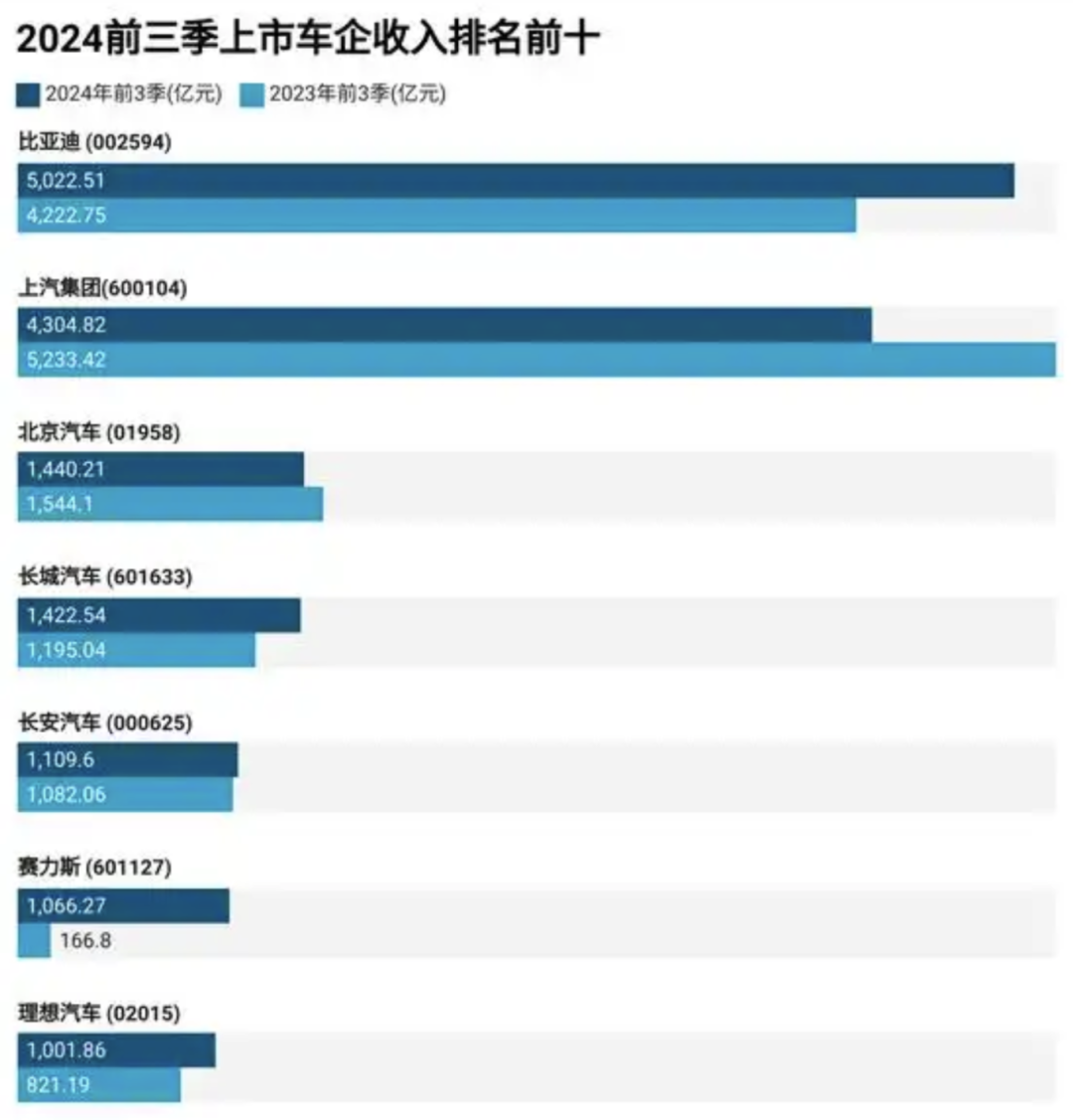

In contrast, BYD reported revenue of 502.25 billion yuan, a 18.9% increase, becoming the largest domestic automaker by revenue.

If Huawei steps in as a "white knight" and influences the outcome, it would be a wonderful story SAIC hopes to see.

Some may recall former SAIC Chairman Chen Hong's "soul theory" at a shareholders' meeting three years ago.

Chen stated, "SAIC cannot accept cooperating with a third-party like Huawei on autonomous driving. It would be like having a company provide an overall solution, making it the soul while SAIC becomes the body. SAIC cannot accept such an outcome; we must keep the soul in our own hands."

This remark sparked mixed reactions. When news of a potential SAIC-Huawei partnership surfaced, it triggered online discussions about "SAIC abandoning its soul."

However, Huawei's collaboration track record speaks for itself, with Thalys being the most notable beneficiary, experiencing a resurgence.

The AITO brand, a Huawei-Thalys collaboration, sold 94,400 vehicles in 2023, a 23.89% increase. In H1 2024, driven by the AITO M7 and M9, Thalys' cumulative new energy vehicle sales exceeded 200,000, a 348.55% increase. In the first nine months, Thalys sold 316,700 vehicles, a 364.23% increase.

Financially, Thalys reported H1 2024 revenue of 65.044 billion yuan, a 489.58% increase; net profit attributable to shareholders reached 1.625 billion yuan, achieving profitability. In Q3, Thalys reported revenue of 41.582 billion yuan, a 636.25% increase; net profit attributable to shareholders reached 2.413 billion yuan, compared to a loss of 3.451 billion yuan the previous year.

With Thalys' success as an example, other automakers are tempted, and SAIC is no exception.

Facing industry changes, Japanese automakers, somewhat retreating from the Chinese market, have chosen to collaborate, mirroring earlier Stellantis mergers. For international giants, mergers and reorganizations enhance competitiveness and risk-sharing. In China, a new model of mutual benefit is emerging — creating an "automotive circle of friends."

SAIC's choice to embrace this trend is brave and correct. However, partnering with Huawei is just one of many adjustments SAIC is making to reclaim its top spot, including management team changes, product lineup reorganizations, brand strategy reshaping, intelligence efforts intensification, manufacturing system integration, and overseas expansion pursuits. After all, being one's own "white knight" is the most reliable approach.