2025: Will Responsible Auto Companies Be the First to Falter?

![]() 12/30 2024

12/30 2024

![]() 555

555

The harsh winter of 2024 has already claimed the downfall of poorly managed auto companies, and the year 2025 promises to be a severe test for conscientious automakers.

Eric (pseudonym), a veteran of a parts company, has recently been frustrated by a "cost reduction" request from an automaker. The other party's stance was uncompromising: "If you don't lower your prices, we'll find other suppliers." Reluctantly, Eric's team opted to replace the automotive-grade chips costing over 40 yuan each with an inferior brand, immediately halving the chip cost.

These chips are used in the core electric systems of new energy vehicles. "The functionality won't be drastically affected, but the chip quality differs," Eric lamented. "No one can predict the long-term impact for sure." "We still have a conscience," he continued. "When changing solutions, we stick to automotive-grade chips. Some automakers only use them in exported cars, not domestic ones, to save costs..." Over the past two years, Eric has often mourned the demise of friends in the auto parts industry. "Everyone is competing on cost, squeezing profits to the extreme."

Since July 2024, the authorities have mentioned preventing vicious internal competition three times, yet there's no sign of the auto market's price war abating. Many industry leaders view 2025 as pivotal. In other words, survival hinges on 2025.

In 2025, automakers will employ various tactics to stay afloat, each with its unique strategy. The market below 200,000 or even 150,000 yuan is poised for fiercer competition. Car buyers must scrutinize their choices carefully, as any automaker could suddenly cease operations, like Geely Xinyue.

Testing the Conscience of Automakers

'Automotive-grade chips aren't mandatory, and cheaper alternatives offer similar functionality but with higher failure rates and instability,' Eric explained. Initially, there might be no noticeable difference, but faults will emerge after three to five years.

A car comprises tens of thousands of parts, and chip quality reduction is just one example. 'Fortunately, my project doesn't involve safety components; otherwise, it would be a moral dilemma,' Eric sighed. Consumers love cheaper new cars, but these prices are supported by numerous 'bleeding' suppliers.

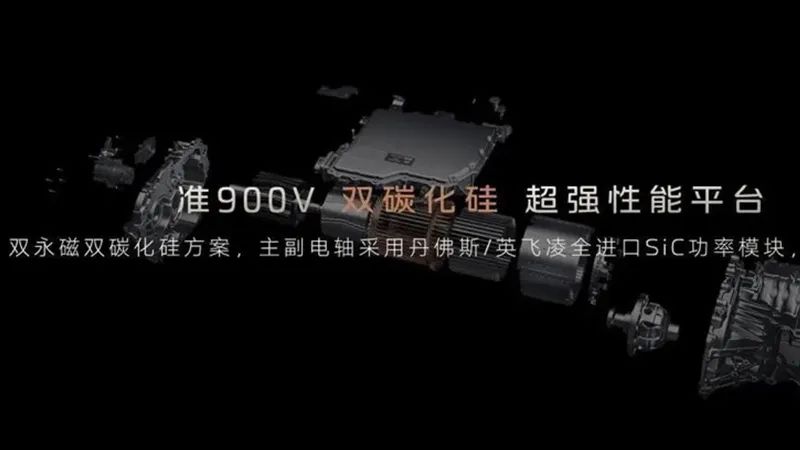

Many automaker executives attribute the decline in new energy vehicle prices to lower battery costs. An engineer from a domestic battery manufacturer revealed that although battery raw material prices have declined, cost reductions often stem from human factors. He cited an example: charging technology has advanced from 200V to 800V, but connectors now rarely use gold-plated conductors; tin-plated ones suffice. 'Simple logic: higher voltage with poorer connectors leads to battery failure, ultimately passing costs to consumers.'

Consumers often overlook these factors when buying cars as they don't directly affect performance. However, due to cost reductions, consumers can buy higher configurations with less money. Automakers rely on cost compression to lower prices and increase competitiveness, gaining market share. Unscrupulous companies thrive, forcing conscientious ones to join in for survival, leading to similar outcomes.

We foresee that in 2025, automakers lacking cost control will further decline. BYD offers the Qin PLUS at 79,800 yuan, and Geely prepares to launch two hybrid models below 80,000 yuan. If a third automaker, domestic or foreign, still sells hybrid cars above 100,000 yuan in the same segment, it essentially surrenders that market.

Cars Without Advanced Intelligent Driving Are Harder to Sell

Four months ago, the Xiaopeng MONA M03, starting at 119,800 yuan, propelled Xiaopeng into the 20,000-vehicle monthly sales club. Its success confirms the power of 'low price + AI' in the consumer market. Earlier, the Deep Blue S07, starting at 159,900 yuan, featured Huawei's Kunpeng Intelligent Driving ADS SE, introducing advanced intelligent driving to cars below 200,000 yuan.

High-configuration cars purchased in 2024 offer L2++++ autonomous driving. By 2025, consumers will enjoy higher configurations at the same price or similar configurations at lower prices.

As He Xiaopeng noted, cars without advanced autonomous driving are becoming harder to sell. By 2025, if an automaker can't offer advanced intelligent driving in 150,000 yuan models, it may bid farewell to the mainstream market.

The same applies to fuel vehicles. SAIC Volkswagen's main models, the Tiguan L Pro and Passat Pro, feature advanced intelligent driving solutions integrated with DJI Auto, promoting 'same intelligence for both fuel and electric vehicles.' Intelligence is crucial for consumers regardless of power form.

Popularizing advanced intelligent driving at lower prices across more models is a clear trend. Roadshow Auto recently reported that SAIC's Feifan Automobile plans to revive the ES37 project using Huawei's solution. This medium-sized pure electric SUV, named Feifan RC7, was announced in May. With Huawei's solution, to avoid conflicts with other SAIC sub-brand models, the price is likely between 150,000 and 200,000 yuan.

Radical players like BYD aim to bring L2 to models below 100,000 yuan. Various signs indicate that, regardless of independent research or external collaboration, if an automaker can't offer advanced intelligent driving in the mainstream price range, it will struggle in 2025.

2025: Product Definition is King

Falling automakers have diverse misfortunes, but those that endure share similarities.

In 2024 alone, companies like HiPhi, NIOZ, and Geely Xinyue faced setbacks, halting operations or facing an uncertain future. Regrettably, NIOZ once ranked among the top three new forces in sales.

As the saying goes, there are no unsellable cars, only unsellable prices. Failed cases often reveal mistakes in pricing and product definition.

Xia Yiping of Geely Xinyue once compared the Geely Xinyue 07 to the unreleased Tesla Model 5, describing it as a 'comprehensive innovation' that violated traditional driving habits. This led to criticism, with insiders deeming it a 'car assembled by someone who doesn't understand automotive engineering.'

Meanwhile, more traditional automakers redefine next-gen products with Huawei's help.

Recently, GAC and Huawei announced their cooperation to create a new high-end new energy vehicle brand, adopting Huawei's intelligent solutions and deepening product definition collaboration. Rumors also surfaced about Feifan and Huawei's cooperation mode, where Huawei will focus on product definition and marketing for SAIC's mainstream models.

Automakers don't necessarily need Huawei for product definition, but Huawei's success in the HarmonyOS Intelligent Driving mode proves its capabilities. Recently, AITO announced an upgrade from HI to HI PLUS in its collaboration with Huawei, deepening cooperation in branding, technology, products, channels, and services.

Like advanced intelligent driving, capable automakers insist on independent research, while others introduce external suppliers. In fierce competition, results matter more than processes. Consumers care about the final product. Like fallen HiPhi and Geely Xinyue, the market has no patience for new brands to grow; options abound.

Final Thoughts

In 2025, the domestic auto market will likely continue to grapple with 'internal competition,' and conscientious automakers will struggle between 'bottom line' and 'survival.' Such sentiments aren't a good sign. 'I often interact with frontline employees. If they don't identify with the company, they'll make 'unintentional' moves on the production line,' revealed a senior engineer from a joint venture automaker.

Rather than wondering who will fall after Geely Xinyue, the world should focus on how China's auto industry can evolve naturally, avoiding a vicious cycle of internal competition.