NIO Sustains Heavy Losses per Car Sold: Is It Time for Li Bin to Confront Reality?

![]() 12/30 2024

12/30 2024

![]() 607

607

Is there still a future for NIO? This question has been persistently raised by the outside world. After all, in 2019, NIO was on the brink of bankruptcy, and Li Bin was labeled by the media as "the unluckiest person of 2019".

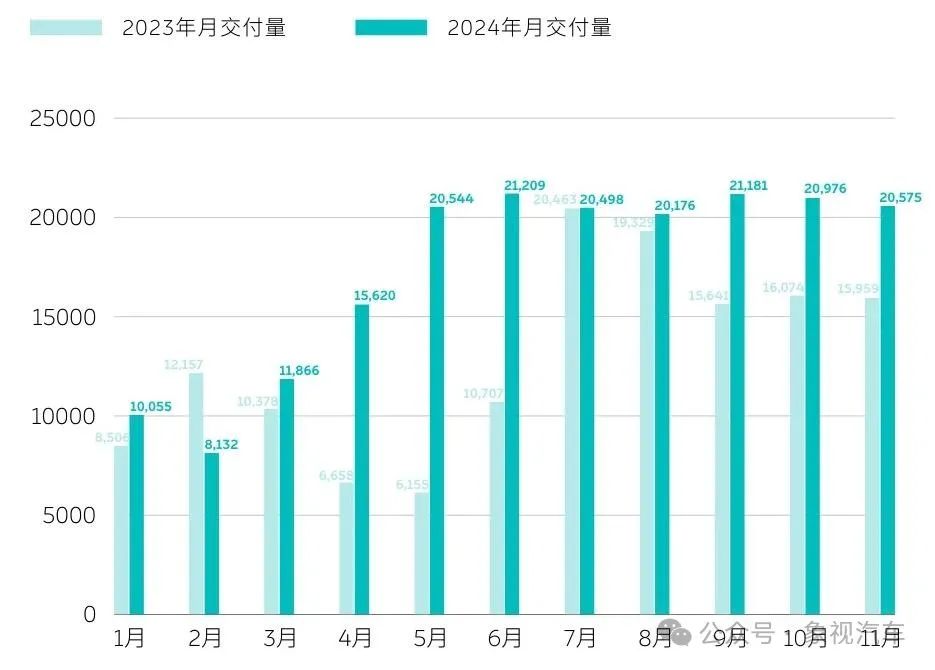

Li Bin has been in the automotive industry for a decade, with NIO's monthly deliveries hovering around 20,000 units, each resulting in a loss of over RMB 100,000. Both the media and NIO's loyal fans are clamoring loudly, urging Li Bin to confront the harsh realities he seems to be ignoring.

1. Loss of RMB 100,000 per Car Sold

At NIO Day 2024 on December 21st, NIO unveiled the flagship model ET9 with a starting price of RMB 788,000 and the Firefly, a boutique compact car, with a starting price of only RMB 148,800.

With these two models representing the cheapest and most expensive offerings, NIO is striving to complete its product lineup.

Having crossed the ten-year threshold in the automotive industry, Li Bin aims to lead NIO into the next stage of development.

However, none of this can overshadow the gloom facing NIO. The night before NIO Day 2024, NIO released its latest financial performance data, which was quite disappointing.

In the third quarter of this year, NIO generated revenue of RMB 18.67 billion, a year-on-year decrease of 2%, with a net loss of RMB 5.14 billion, still mired in losses.

For the first three quarters of this year, NIO's cumulative net loss was RMB 15.53 billion, roughly the same as the same period last year. During the same period, NIO sold a total of 149,281 vehicles.

Based on these figures, NIO suffers an astonishing loss of approximately RMB 104,000 per vehicle sold, which is remarkable.

From 2018 to 2023, NIO's cumulative losses totaled RMB 86.63 billion. Combined with the first three quarters of this year, NIO's cumulative losses in less than seven years have exceeded RMB 100 billion, reaching RMB 102.16 billion.

2. Excessive Spending by NIO

There are multiple reasons for NIO's severe losses, such as sluggish sales and poor revenue. However, NIO's excessive spending is widely criticized and a significant factor contributing to its deep financial troubles.

While the Battery Swap Stations have earned NIO some consumer praise for their rapid energy replenishment, the heavy asset model of these stations has imposed high costs on NIO, placing a significant burden on the company.

To date, NIO has built approximately 2,700 Battery Swap Stations nationwide, with estimated construction costs exceeding RMB 10 billion. When operational costs are considered, the burden on NIO becomes even heavier.

Furthermore, NIO has invested heavily in constructing and operating NIO Houses in the most prosperous areas of megacities like Wangfujing in Beijing, Shanghai Tower, and Ping An International Finance Center in Shenzhen, paying exorbitant rents.

It has been observed that the coffee machines in NIO Houses are from the Italian brand Kimberly, priced between RMB 40,000 and RMB 100,000, and even the hand sanitizers cost over RMB 300.

Some netizens have joked that while NIO Spaces are responsible for making money, NIO Houses are responsible for looking good. In other words, NIO Houses spend too much money.

Additionally, NIO's aggressive expansion into Europe without a solid footing in China, replicating the heavy asset model of Battery Swap Stations and NIO Houses there, has been excessively extravagant.

3. Is It Time for Li Bin to Confront Reality?

In an interview with Chinese Entrepreneur magazine last year, Li Xiang, the founder of Li Auto, said,

"I believe Li Bin's characteristic is to construct a grand vision and validate it through corporate operations. These traits are related to his academic background and life experiences, and he consistently acts in accordance with his words. His team genuinely believes in these ideas."

In other words, Li Bin and the NIO team he leads are a group of idealists.

Li Bin adheres to a long-term perspective in car manufacturing, treating automobiles, a consumer good, as a high-end service industry.

Some netizens believe that NIO's business framework and corporate vision represent a romantic dream, like the stars and the sea, that can only exist in prosperous times.

Li Bin's adherence to NIO's vision shows that this is not a childlike fantasy but a pursuit undertaken by adults with sincere efforts.

However, there are also concerns about NIO. It may ultimately have only two outcomes: either becoming a world-class national automaker or collapsing due to exhaustion of funds and resources before achieving greatness.

These outside concerns are not unfounded. After its listing, NIO's deliveries have remained just above 20,000 units, and losses remain severe.

Recently, an article titled "Does NIO Still Have a Future? Six Soul-Searching Questions from a Die-Hard Fan" sparked over 2,000 discussions in the NIO community.

The die-hard fan posed six thought-provoking reminders and questions about NIO.

Li Bin responded, saying, "Thank you for your sincere words. NIO is indeed imperfect and has many areas for improvement. We will continue to work hard."

Idealism and long-termism cannot serve as fig leaves to cover up continuous corporate losses and management chaos.

If Li Bin does not quickly awaken from his self-satisfaction and confront the harsh realities, NIO may gradually slide towards collapse.