Xiaomi Nears BYD in Market Value Amid Renewed Financing Surge in New Energy Market

![]() 12/30 2024

12/30 2024

![]() 709

709

Reflecting on the week's automotive stock market dynamics, we observe the sector's diverse conditions.

As the year 2024 draws to a close, with only two trading days left, the Shanghai and Shenzhen stock exchanges exhibited mixed results on Friday. The Shanghai Composite Index nudged up 0.06% to 3,400.14 points, whereas the Shenzhen Component Index dipped 0.13% to 10,659.98 points, and the ChiNext Index declined 0.22% to 2,204.90 points. Total trading volume surpassed 1.4339 trillion yuan, a 12.6% increase from the previous day. More than 3,500 stocks advanced, with 79 stocks hitting their daily price limits, signaling a robust foundation for a positive market trend.

Amidst market fluctuations, mainstream funds sought stability by flowing out, recording a net outflow of 41.796 billion yuan. Conversely, northbound funds remained active in supporting the market, purchasing 19.339 billion yuan worth of shares, heavily investing in CATL, ZTE Corporation, and East Money Information Co., Ltd., barely sustaining the overall market.

As the year-end nears, stock fluctuations in the new energy vehicle sector have become pronounced. On one hand, delivery volumes have largely been confirmed; on the other, 2025 development plans are also in place. Information released by automakers is often magnified by the capital market.

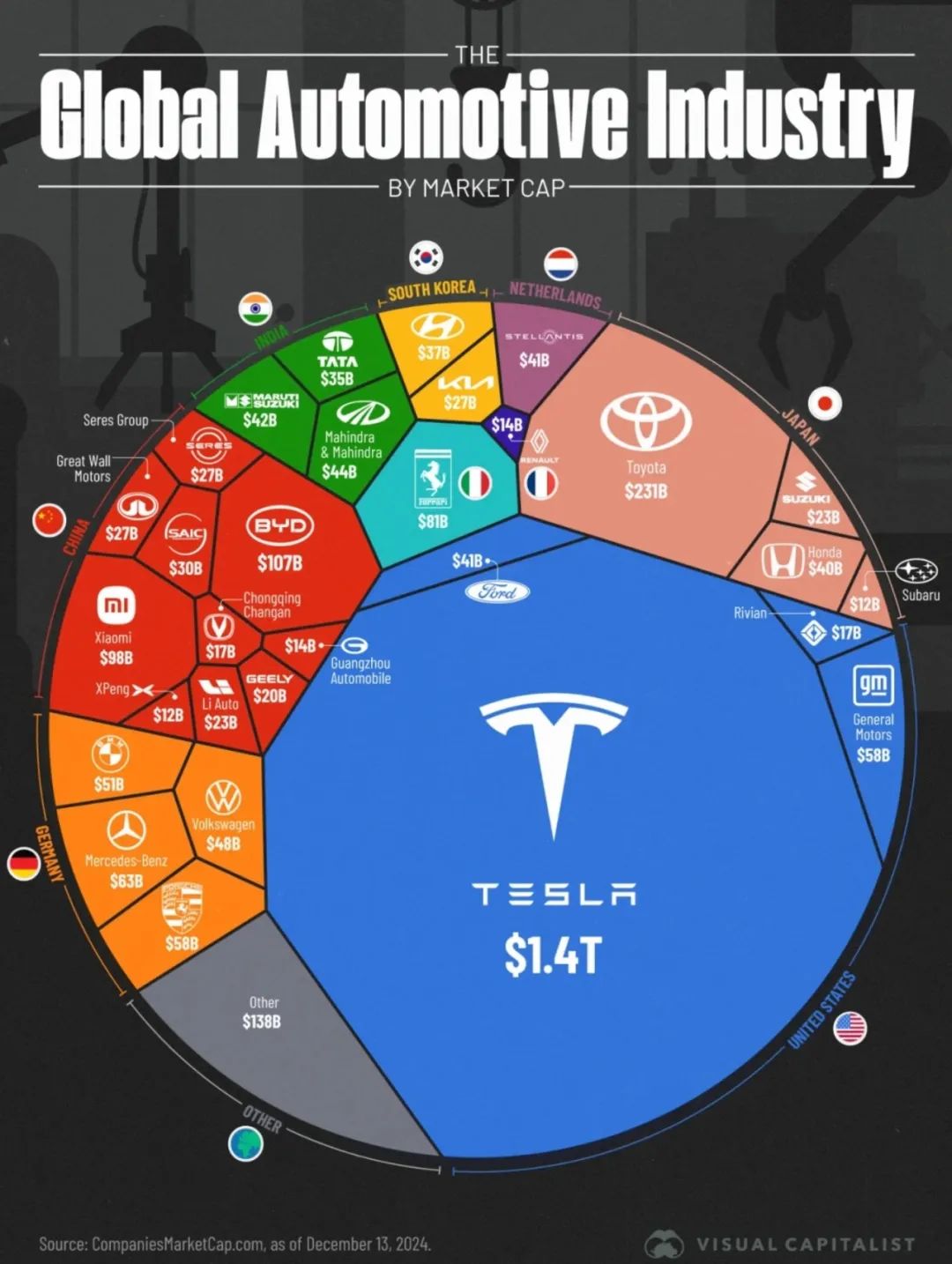

Tesla retains its status as the world's most valuable automaker in terms of market value. Following Elon Musk's successful bet on Donald Trump, Tesla's share price has continued to climb, pushing its market value beyond $1.4 trillion. Investors have now revised upwards their market value forecast for Tesla to $1.5 trillion.

What does a $1.4 trillion market value signify? It approximates half the combined market value of all publicly listed automakers globally. Even before Donald Trump fulfilled his pledge to make America great again, Musk had already propelled Tesla to the pinnacle of the global automotive manufacturing industry.

However, this fact also holds an element of irony. American-made cars account for merely 11.3% of global automobile production, yet their collective market value surpasses half of the global total. The so-called resurgence of manufacturing has largely remained a slogan over the years, with funds ultimately flowing to Wall Street.

Yet, Tesla is not the sole example of this mismatch between sales and market value. A similar, seemingly irrational scenario is also unfolding in the domestic market.

Closing on Friday, Xiaomi's share price surged 4.27% to HK$34.15 per share, elevating its market value above 800 billion yuan. This figure trails BYD's market value of 830 billion yuan by only 30 billion yuan, surpassing numerous established new energy vehicle makers and ranking fourth globally.

With a market value of 800 billion yuan, Xiaomi now nears double that of Porsche and vastly exceeds the market values of NIO, XPeng, and Li Auto. Xiaomi's share price took off post the unveiling of its new car model, soaring ever since.

At the start of the year, Xiaomi's share price hovered at HK$15 per share, plummeting to HK$11 per share in February. Following the launch of its first car, Xiaomi's share price recovered from its slump, rebounding to HK$15. Especially since August, when Xiaomi's monthly car deliveries surpassed 10,000 units, Xiaomi Group's share price skyrocketed.

Xiaomi's current share price stands at its highest in nearly two years, narrowly missing its all-time high of HK$35.9. It can be argued that through automobile manufacturing, Xiaomi has returned to its best historical state. Through new energy vehicles, Lei Jun has guided Xiaomi towards a second takeoff.

Xiaomi's success has once again showcased the development potential of new energy vehicles to the market. Meanwhile, Lei Jun's frequent appearances have rendered the once active Li Xiang, known as "Li the Factory Director" on social media, much quieter. Only Yu Chengdong, a former competitor, can now rival Lei Jun online.

With Yu Chengdong's backing, HarmonyOS Intelligent Connectivity finally united the "Four Circles" in 2024. Among them, AITO, which has witnessed the best development, has transformed Thalys, not only boosting sales growth rapidly but also doubling its market value in 2024.

From less than 100 billion yuan at the beginning of the year to 203.9 billion yuan by Friday, Thalys, empowered by Huawei, has swiftly grown from a small car manufacturer in Chongqing to a significant player in the new energy vehicle market.

Thalys' success has made Chinese automakers recognize Huawei's importance in the new energy vehicle market. Huawei has spun off its automotive business into a separate subsidiary called Yinwang and embarked on a financing path. AITO, as the first automaker to invest, acquired a 10% stake for 11.5 billion yuan.

Subsequently, Thalys also announced it would pay 11.5 billion yuan for a 10% stake in Yinwang. Observing other automakers deepening their cooperation with Huawei, BAIC BJEV, an early collaborator, issued an announcement on December 24 regarding capital increase and share expansion, raising 8.15 billion yuan from external sources. Combined with the previous 2 billion yuan invested by BAIC, it raised over 10 billion yuan in a short period.

According to previous information from BAIC BJEV's management, the company has now fully committed to cooperation with Huawei. As one of the "Four Circles," the collaboration between the two parties will deepen further.

Based on this, it can be inferred that BAIC BJEV's capital increase is likely preparing funds to purchase shares in Yinwang.

Although domestic automakers have yet to form automotive alliances akin to Honda and Nissan, under Huawei's influence, Yinwang has the potential to become a pivotal link in a future large alliance of domestic automakers. As Huawei's automotive network expands, an automotive industry alliance involving multiple automakers is taking shape.

Apart from the heated financing in the new energy sector, CATL, as a major supplier, is also preparing for its future growth. On December 26, CATL announced its plan to list on the Hong Kong stock exchange, responding to earlier rumors. The announcement also stated that this move aims to better propel the company's globalization strategy and establish an international capital operation platform.

To facilitate the Hong Kong listing process, CATL also decided to convene an extraordinary general meeting on January 17, 2025, to deliberate on the "Proposal on the Company's Issuance of H Shares and Listing on The Stock Exchange of Hong Kong Limited," indicating CATL's urgency regarding the timing of its Hong Kong listing.

Following this announcement, CATL's share price finally rose on the 27th, ending two consecutive days of decline. The urgency to list in Hong Kong and expand the market stems from the pressure brought by CATL's revenue decline in the second half of the year. According to the third-quarter financial report, CATL's revenue declined by 12.48% in the third quarter and by 12.09% in the first three quarters.

This suggests that under the influence of the new energy vehicle price war in the second half of the year, CATL, as the largest battery supplier, was the first to be impacted. Currently, the price war only affects revenue. If strategies are not promptly adjusted, profits may also be affected in the future.

As the most investment-worthy industry in China, the new energy vehicle sector not only replaced the real estate industry as the primary pillar industry in 2024 but also became a new business card for Chinese manufacturing.

Xiaomi's ability to rank fourth globally in terms of market value with just one car model demonstrates that new energy vehicles will continue to generate wealth in the future. Capital will inevitably flow towards industries with value.

Note: Some images are sourced from the internet. Please contact us for removal if there is any infringement.