Xiaomi Partners with NIO, XPeng, and Li Auto: Intense EV Charging Competition, Energy Companies Rise as Ultimate Winners

![]() 12/30 2024

12/30 2024

![]() 688

688

2024 marks a pivotal year for AI hardware innovation.

The industry consensus now is: "It's no longer about competition on parameters, but on applications." On one hand, AI capabilities are rapidly integrating into hardware, leading to an explosion of AI-enabled devices across industries such as smartphones, PCs, home appliances, automobiles, cleaning robots, smart homes, headphones, cameras, and storage solutions. On the other hand, AI is deeply transforming software, with native AI applications like Wenxiaoyan and Doubao gaining popularity, while search engines, input methods, browsers, payment systems, office software, and e-commerce platforms are being reimagined by AI.

AI has emerged as a 'magic wand' for technological innovation, and this is merely the beginning.

In December, our 'Lei Technology · Annual' special series launched, featuring 'Focusing on 2024' to systematically review noteworthy companies, products, technologies, and individuals in the tech industry this year, and 'Looking Ahead to 2025' to preview exciting products and technologies poised to shape the future landscape of technology. This series honors innovation, records the times, and inspires the future.

Please subscribe and stay tuned.

Lei Jun speaks his mind and acts on it.

I vividly recall an earlier livestream where Xiaomi Auto executives visited NIO. Lei Jun suggested, "If necessary, Xiaomi can join NIO's charging network construction." Just half a year later, this vision became a reality as Lei Jun officially announced Xiaomi Auto's collaboration with NIO on charging networks, bringing along XPeng and Li Auto.

Screenshot: Weibo @Lei Jun

As a newcomer in the automotive market, Xiaomi Auto has swiftly gained market recognition for its product quality, a feat envied by other new players. However, catching up with the meticulously built charging infrastructure of established new energy automakers is challenging, even for Xiaomi's vast resources. This collaboration with NIO, XPeng, and Li Auto effectively grants Xiaomi Auto access to over 29,000 charging stations, alleviating potential buyers' concerns and fostering a more open and shared ecosystem, reducing charging resource waste.

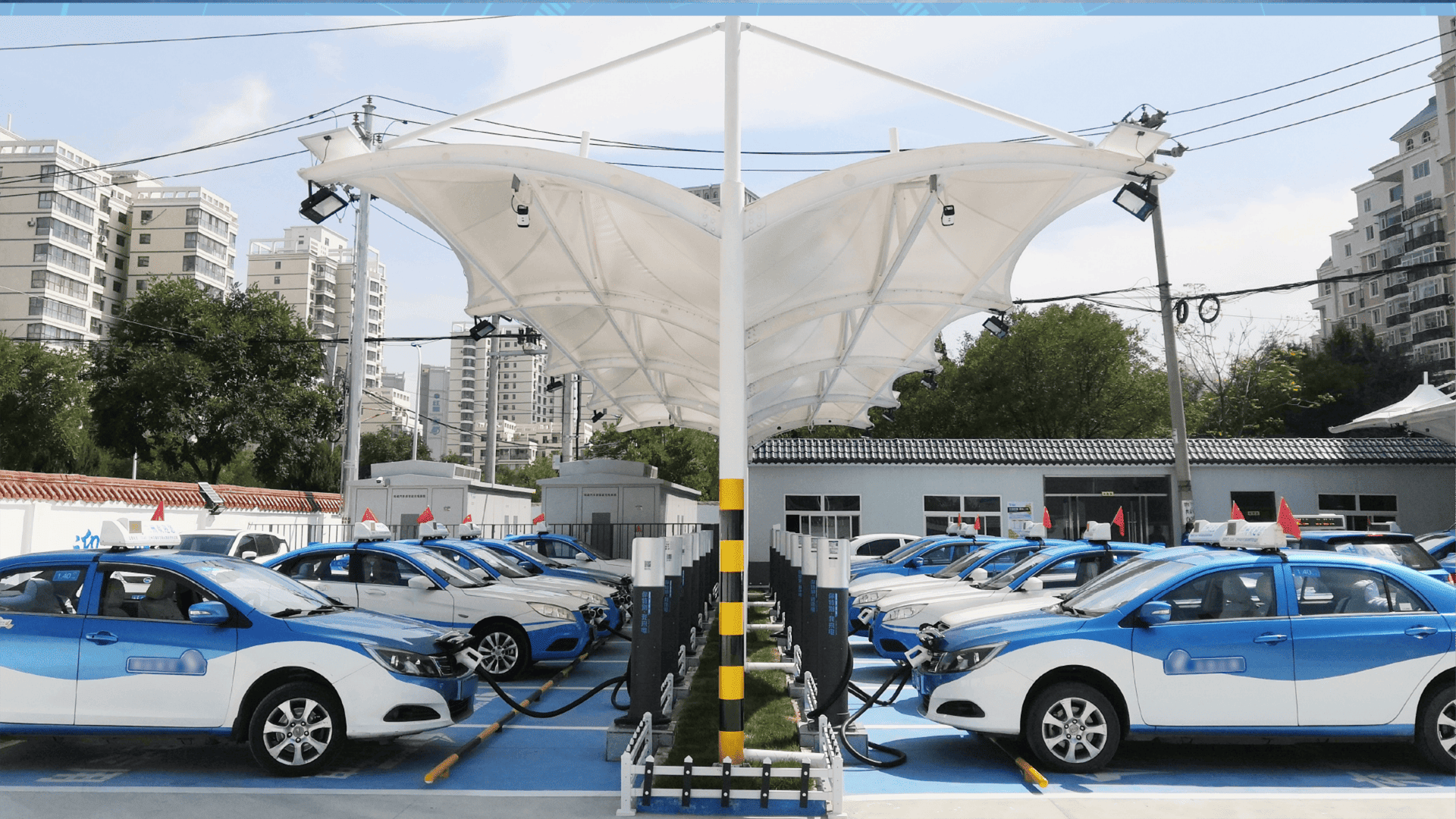

Charging infrastructure is crucial for the development of new energy vehicles. Consumers' willingness to choose electric vehicles heavily depends on the convenience of charging facilities, and a high-quality charging network necessitates the combined efforts of automakers and third-party companies. So, what steps have companies taken in 2024 to expand their charging networks?

Self-construction and collaboration - the charging infrastructure becomes the lifeblood of automakers

This year witnessed rapid growth in the new energy sector, with the monthly penetration rate of new energy vehicles exceeding 50% from July to November, making them the preferred choice for many. In my view, besides product quality, the improved convenience of charging facilities is also gaining recognition from a growing number of consumers.

The automotive market is thriving, with more viable new energy brands to choose from as new energy technologies evolve. To fully utilize brand charging resources, collaboration among companies becomes particularly essential.

BMW and Mercedes-Benz, which officially announced their collaboration on ultra-fast charging at the end of last year, finally launched their ultra-fast charging brand E'anQi after a year of exploration. As of December 20th, there are 103 E'anQi ultra-fast charging stations across 19 cities, with a total of 697 ultra-fast charging piles. While this figure lags behind new force brands, it represents steady progress, and currently, the service is exclusive to Mercedes-Benz and BMW users, with plans to expand to other brands in the future.

Image source: E'anQi

In contrast, domestic brands are more proactive in charging infrastructure. Besides the aforementioned collaboration between Xiaomi and NIO, XPeng, and Li Auto, NIO has attracted several automakers in 2024. Brands such as Changan, Geely, SAIC-GM, XPeng, and IM Motors have all collaborated with NIO on interconnectivity within the charging network, forming a vast 'NIO Charging Network.'

In the battery swapping sector, NIO's Battery as a Service (BaaS) alliance has attracted eight automakers, including traditional brands like FAW, Changan, GAC, JAC, Geely, and Chery, as well as energy and power companies like Sinopec, CNOOC, and Shell for in-depth battery swapping collaboration. Recently, NIO announced the completion of a nationwide high-speed battery swapping network with nine vertical and nine horizontal routes.

Image source: NIO

Coincidentally, in mid-to-late December, CATL announced its push for standardization of battery swapping, collaborating with automakers like Changan, GAC, Wuling, and FAW to launch multiple battery swapping products, forming a battery swapping alliance centered around CATL.

Both battery swapping alliances are promoting standardization. NIO is deeply involved in formulating industry standards for battery swapping, unifying battery specifications and interface standards. On the other hand, CATL uses standard battery swapping blocks of 20# and 25# to compete with 92# and 95# gasoline, allowing different vehicle models to replace batteries suitable for their power battery cells.

In my view, there are fundamental differences between the two battery swapping alliances. As an automaker, NIO promotes standardization of battery swapping technology to share costs with other automakers. In contrast, as a battery company, CATL introduces multiple standard battery swapping blocks to increase battery sales. Currently, the products collaborating with CATL include models like Hongqi E-QM5, AION S, and BAIC C66, initially focusing on the ride-hailing market before potentially transitioning to the personal market later.

Image source: CATL

Collaboration can maximize charging resources, but it is optimal only when the charging network is already well-established. China's vast territory means the domestic charging network is far from being sufficiently developed, so the construction of ultra-fast charging stations and battery swapping stations remains a long and arduous task.

I've noticed that expanding charging networks has been a primary focus for domestic brands this year. As the automaker most active in building charging infrastructure among new forces, NIO has established 4,213 charging stations and 2,887 battery swapping stations (as of December 28, 2024). Notably, NIO also launched the 'County-Level Charging Access' program this year, aiming to cover all county-level administrative regions in China (except Taiwan and Hong Kong) with charging piles and deploy battery swapping stations in 14 provincial administrative regions by the first half of next year.

Screenshot: NIO live video stream

To establish a strong presence in the pure electric vehicle market, brands like HarmonyOS Intelligent Driving, Li Auto, Hozon Auto, and XPeng are also actively expanding their charging networks. As of December 26, 2024, XPeng operates over 1,880 self-operated stations covering more than 420 cities. As of December 22, 2024, Huawei's ultra-fast charging network comprises 510 stations across 120 cities. Li Auto has established 1,324 ultra-fast charging stations in 196 cities.

Although XPeng has officially announced the development of extended-range technology, pure electric products still dominate its sales at this stage. XPeng has been investing in expanding its charging network for a long time, accumulating rich resources. HarmonyOS Intelligent Driving and Li Ideal initially relied on extended-range hybrid technology but have had to catch up this year in building charging infrastructure to meet future pure electric vehicle charging needs.

Image source: Li Auto

Li Auto and HarmonyOS Intelligent Driving have shown early strategic foresight, while Hozon Auto only announced its energy solution after launching the pure electric SUV Voyah Free, with only one smart ultra-fast charging station each in six cities like Wuhan and Shanghai, far behind the leading tier. Sales figures show that Voyah Free sells around a thousand units per month and is still in the growth phase, so Hozon Auto must accelerate the construction of its ultra-fast charging network.

Providing users with a seamless driving experience is why more and more new energy brands are willing to invest in charging infrastructure, even if some have not yet achieved profitability. Traditional brands like BYD and Chery are also building their own ultra-fast charging networks but generally prioritize collaboration over independent construction, showing less emphasis on this area.

I believe that since ultra-fast charging is confirmed as one of the primary charging methods for the new energy vehicle industry in the future, automakers should invest boldly without hesitation to gain more influence in the market.

Are third-party energy companies the ultimate winners?

Expanding charging networks is just one aspect of automakers' businesses. For energy companies heavily reliant on charging networks for profit, forming scale as soon as possible is crucial for faster capital recovery. According to the latest data from the China Electric Vehicle Charging Infrastructure Promotion Alliance, the number of newly added charging infrastructure in the first eleven months of this year was 3.756 million, a year-on-year increase of 23%, bringing the cumulative number of charging infrastructure nationwide to 12.352 million, a year-on-year increase of 49.5%, indicating strong growth momentum and more opportunities for energy companies.

After reviewing the actions of energy companies in 2024, I found that their investments in energy far exceed those of automakers, such as Nalian Zhidian, Star Charge, Sunrun, and Nengxiao Dianqi.

Among them, Nalian Zhidian has continuously expanded its charging network this year. According to its official Q3 financial report, Nalian Zhidian has cumulatively built 96,000 charging stations, a year-on-year increase of 40%, and connected approximately 1.15 million public charging guns, a 31.2% increase from the end of 2023, with over 70% being DC fast-charging guns. Simultaneously, Nalian Zhidian has collaborated with State Grid Hebei Electric Vehicle Charging Service Company on charging interconnectivity, integrating over 2,800 charging guns into the Kuadian App charging service network, enhancing charging pile supply capabilities in regions like Shijiazhuang and Baoding.

Image source: Nalian Zhidian

I believe that Nalian Zhidian's focus on demand-side ecosystem construction is key to increasing revenue. The company has increased interconnectivity with automakers like BYD, FAW-Volkswagen, and IM Motors, pre-installing its services on over 170 new energy vehicle models' infotainment systems and integrating with third-party channels in fields like digital maps to create a user-centric charging service network. This allows drivers to find Nalian Zhidian's charging piles more promptly when needing to charge, positively impacting consumers, Nalian Zhidian, and the reputation of automobiles.

Due to its continuous efforts on both supply and demand sides, Nalian Zhidian achieved its first quarterly operating profit in Q3, with charging service revenue increasing by 36% year-on-year and gross margin rising from 38% in the previous quarter to a record high of 57%, continuously expanding its market share and influence in the charging service market.

Let's look at Nalian Zhidian's competitor, TGOOD. As of the end of November this year, TGOOD's TELD platform operated over 660,000 charging piles and had deployed over 1,000 liquid-cooled ultra-fast charging terminals nationwide.

Image source: TELD

Sunrun, specializing in charging operating vehicles, initiated a collaborative charging station construction model this year, opening up collaboration to the entire society. Sunrun is responsible for resource integration in products, site selection, design, technology, and operations, while partners handle site preparation and construction, rapidly expanding the charging station network.

With the efforts of multiple energy companies, the density and breadth of public charging piles have increased significantly, even alleviating the issue of queuing for charging on highways during holidays. Li Yang, the Vice Minister of Transport, revealed that as of the end of November this year, there were 33,000 charging piles and 49,000 charging parking spaces in national highway service areas, an increase of 12,000 charging piles and 17,000 charging parking spaces compared to the end of last year. Except for some high-altitude areas, over 5,800 of the country's over 6,000 service areas have charging pile coverage, with a coverage rate of 97%.

I've observed that many potential buyers of pure electric vehicles are discouraged by the complexities involved in installing private charging stations. According to the most recent figures from the China Electric Vehicle Charging Infrastructure Promotion Alliance, the number of newly installed private charging stations accompanying vehicle sales surged by 3.022 million in the first eleven months of this year, marking a significant annual increase of 35.7%. This trend underscores the burgeoning market for private charging stations. Consequently, energy companies are redirecting their focus from the B-end market to C-end consumers.

On November 14th, Wang Lei, co-founder of Star Charge, disclosed that the brand has installed over 1.5 million home charging stations nationwide and manages nearly 600,000 public charging stations, positioning it as the global leader in charging station sales.

Image source: Star Charge

Amidst this market backdrop, Nengxiao Dianqi, which specializes in the distributed charging and discharging sector, confronts substantial challenges. To address these, Nengxiao Dianqi introduced the 'Shared Charging Partner' program this year. This initiative allows owners to provide charging services to other vehicles while their own vehicle is charging, enabling power sharing. Initially, revenue is shared equally between Nengxiao Dianqi and the car owner. However, once the purchase cost of the charging station is recovered, all subsequent revenue is retained by the car owner.

Array

Array

Array

Array

Array

Array

Array

Array

Array