Has BAIC BJEV Undergone a Transformation? (Part 1)

![]() 12/31 2024

12/31 2024

![]() 451

451

A brand backed by state-owned assets is also beginning to prioritize substance over mere appearances.

ARCFOX, once positioned as a high-end brand, liberated BAIC BJEV from its mid-to-low-end image but also contributed to a sales downturn for the latter, a former market leader in the new energy vehicle sector, over the past four years.

Now, BAIC BJEV is finally letting go of its fixation on maintaining a high-end brand image, striving to align more closely with the market and users in terms of product definition, pricing, and drivetrain options.

Abandoning High-End Positioning, Returning to Monthly Sales of Over 10,000 Units

ARCFOX has experienced a string of positive developments this year, marked by improved overall sales and a substantial capital increase. On December 17, BAIC BluePark, ARCFOX's parent company, announced that its shareholder Beijing Automotive Group would invest an additional RMB 2 billion in its subsidiary Beijing Electric Vehicle through a private placement agreement.

As a direct subsidiary of one of the six major automotive groups and a sibling company to Beijing Benz Automotive, BAIC BJEV, often referred to as a "privileged second generation," is not strapped for cash. Even more encouraging is that sales have finally rebounded, exceeding 10,000 units per month. In November of this year, monthly sales reached 15,000 units, marking the fifth consecutive month that BAIC BJEV surpassed the 10,000-unit threshold.

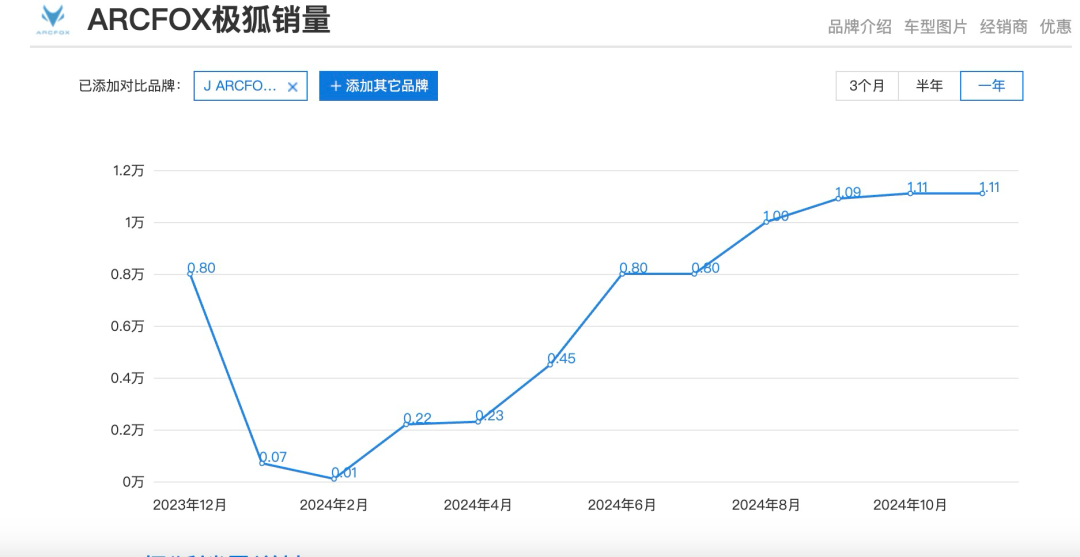

ARCFOX, once positioned as a high-end brand, has rapidly ramped up production, driving up BAIC BJEV's sales. In May of this year, ARCFOX sold only 4,500 units, rising to 8,000 in June and surpassing 10,000 units after August. BAIC BJEV is finally showing signs of regaining its former glory.

Qualitative changes follow quantitative changes, and no transformation happens overnight. From 2013 to 2019, BAIC BJEV followed a budget-friendly path, securing the domestic pure electric vehicle sales championship for seven consecutive years, with its EU5 model topping the pure electric vehicle sales charts for six straight years. In 2018 and 2019, BAIC BJEV averaged over 10,000 units sold per month.

A turning point emerged in 2017 with the introduction of ARCFOX, a BAIC BJEV brand focused on the high-end electric vehicle market. Since then, ARCFOX has partnered with Huawei, Magna, and other manufacturers. To this day, ARCFOX models are still produced at Magna's plant in Zhenjiang. Around the same time, the EU series models were nearing the end of their lifecycle, and ARCFOX failed to compensate for the sales shortfall, leading BAIC BJEV into a downturn.

After the launch of ARCFOX, BAIC BJEV seemed to prioritize maintaining a high-end brand image over expanding sales and meeting market demand. In 2021, it launched two models, the Alpha T and Alpha S, both with starting prices exceeding RMB 240,000, yet the company's total sales that year were less than 27,000 units.

More Affordable Pricing, No Longer Sticking to 'Pure Electric'

After the official launch of ARCFOX models, BAIC BJEV transitioned from being dominated by the EU series to being dominated by the ARCFOX brand. The success of ARCFOX directly determines whether BAIC BJEV will return to prosperity or decline.

The primary change for BAIC BJEV, which has returned to monthly sales of over 10,000 units, is the pricing of its models, which have become more affordable. Starting in 2021, BAIC began developing ARCFOX Kola, Alpha T5, Alpha S5, and other pure electric vehicles priced in the tens of thousands of yuan range.

Despite their lower prices, ARCFOX models still offer impressive configurations. For example, the Alpha S5 has a range of 708 km, is equipped with 800V high-voltage fast charging that can add 280 km of range in just 10 minutes, yet has a starting price of less than RMB 130,000.

Currently, with the exception of the Alpha T and Alpha S, which are priced above RMB 200,000, ARCFOX models are priced in the relatively affordable range of tens of thousands of yuan.

According to BAIC insiders, ARCFOX will also introduce extended-range versions in the future. These two changes indicate that BAIC BJEV, as a "privileged second generation," is no longer focused solely on maintaining a high-end brand image but is truly committed to acquiring users and expanding the market.

After all, due to shortcomings like range anxiety, the key areas of focus for pure electric vehicles are still the ride-hailing and commuting markets. No high-end pure electric brand, with the exception of Tesla, has truly succeeded.

For an automotive brand to increase sales, expanding offline channels is crucial. Addressing ARCFOX's long-standing issue of slow channel development, the new leadership team is also working to resolve it.

An ARCFOX after-sales representative told Car Circle Chronicles that there are currently between 160 and 200 service centers nationwide, with many offline stores still under construction. ARCFOX has also publicly stated that by 2025, it aims to cover more than 100 cities and have over 380 service outlets.

Stay tuned for the upcoming article, 'Has BAIC BJEV Undergone a Transformation? (Part 2)'.