Nissan and Honda Merge: Can Japanese Automakers Resist the Great Retreat?

![]() 12/31 2024

12/31 2024

![]() 563

563

A decade ago, the idea of the "three Japanese giants" merging would have seemed unfathomable. However, recent reports from multiple overseas media outlets indicate that Honda and Nissan are considering such a move. According to The Nikkei, Honda and Nissan plan to establish a holding company, with the possibility of Mitsubishi joining in the future.

If negotiations proceed smoothly, Honda, Nissan, and Mitsubishi could potentially merge into a new entity. Based on current sales projections, this combined "Honda-Nissan-Mitsubishi" would sell over 8 million vehicles annually, making it the third-largest automotive group globally after Toyota and Volkswagen.

In recent years, there have been periodic reports of declining Japanese car sales. Despite this, many still clung to the belief that "even a lean camel is bigger than a horse." It wasn't until Nissan teetered on the brink of bankruptcy that people truly realized the predicament facing Japanese automakers, once dominant players in the global market.

1. The Great Retreat of Japanese Cars

According to foreign media reports, Nissan is on the verge of bankruptcy. The Financial Times quoted two Nissan executives who revealed that the company has only 12-14 months left to survive. Without new investors, it may face bankruptcy liquidation due to a broken capital chain.

Looking back, Nissan's crisis didn't happen overnight. In 2018, Nissan was still a top-selling brand in China, with hits like the Sylphy and Teana, along with long-selling SUV models like the Qashqai and X-Trail.

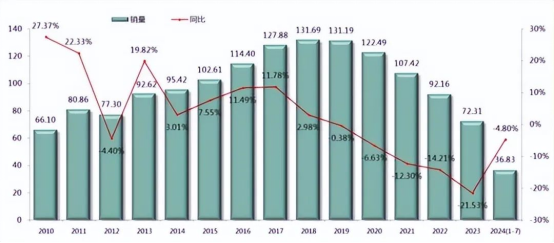

However, since 2020, Nissan has been on a downward trajectory. Taking Dongfeng Nissan as an example, its domestic sales fell from 1.31 million units in 2018 to 1.22 million in 2020; in 2022, it failed to maintain annual sales of over one million units; and in 2023, it sold only 720,000 units, almost half of its peak sales.

The situation remains grim in 2024. From January to November this year, Nissan's cumulative sales were 621,713 units, a year-on-year decrease of 10.5%. The Chinese market isn't the only one struggling; Nissan's global sales outlook is also bleak.

According to Nissan's financial report for the first half of fiscal year 2024 (April-September), its global total sales were 1.6 million units, a year-on-year decrease of nearly 4%; sales in the second fiscal quarter (July-September) were 810,000 units, marking an expansion of the decline compared to the first fiscal quarter's drop of 0.5%.

The deterioration in global sales has further impacted Nissan's profitability. During the first half of the fiscal year, Nissan's net revenue decreased by 1.3% year-on-year to 5.98 trillion yen; operating profit plummeted by 90.2% year-on-year to 32.908 billion yen.

It's not just Nissan that's cooling off in the Chinese market; Honda is facing similar challenges. From January to November this year, Honda's cumulative sales in China were 740,399 units, a year-on-year decrease of 30.70%.

In comparison, Toyota is the only one among the "three Japanese giants" that has maintained growth. However, even Toyota alone struggles to reverse the trend of Japanese cars gradually withdrawing from the Chinese market.

From 2021 to 2023, the market share of Japanese cars in China fell from 22.2% to 17%. The figure for November this year was only 12.4%, a year-on-year decrease of 3.1 percentage points.

The era of internal combustion engines is gradually coming to an end, a stark reality for the automotive industry. Not only are "Japanese cars" facing shrinking markets, but even Volkswagen, the world's second-largest auto group, has faced strikes and protests from over 100,000 employees due to factory closures and layoffs.

What have they missed, those who once dominated the automotive industry? Firstly, they missed the opportunity for transformation. Taking Nissan and Toyota as examples, although their global sales have also declined during the same period, Toyota's profitability remains relatively stable.

Industry insiders believe this is closely related to the new energy strategies chosen by each company. Compared to Honda and Toyota, Nissan was slower to explore hybrid technology, but it still launched a hybrid technology called e-Power in 2016.

In the same year, the cumulative global sales of Toyota hybrid models had exceeded 9 million units. That is, if Nissan had fully invested in the hybrid route at that time, it might have regained some ground in the hybrid market, similar to "the two Ts" when they faced disappointment in the fuel vehicle market.

Secondly, there's a lack of hit models. While the trend of "electric vehicles advancing and fuel vehicles retreating" is irreversible in the automotive industry in recent years, it's precisely because of the aggressive onslaught of new energy vehicles that fuel vehicles must come up with a rapid response strategy.

However, most Japanese automakers are still benefiting from mature product lines but lack new hit models. With similar models and unchanged sales pitches, it's difficult for marketing to find new topics, and consumers' attention will naturally shift elsewhere.

Finally, there's a lack of digital capabilities. Domestic new energy automakers' electrification and digitization capabilities are almost synchronously iterated. However, for European, American, and Japanese automakers, investing in the electrification transformation itself faces huge sunk costs, making it even more challenging to divert energy to digitization capabilities.

Taking Volkswagen as an example, its software department Cariad has been in a state of loss since its inception and lost over 2 billion euros in the first nine months of this year. Even with huge investments, it's difficult to change the lack of software development culture.

2. Former Rivals Become Allies

For various reasons, Japanese cars have had a tough time in recent years, and many automakers have tried to save themselves by reducing production and layoffs.

In November, Nissan announced plans to cut global production capacity by 20% and lay off 9,000 employees worldwide, with executives taking a 50% pay cut; previously, Guangqi Honda and Honda had already laid off over a thousand employees in China.

However, simple "cost reduction" can only delay the inevitable. Therefore, since last year, these former rivals have turned into allies and adopted a "pooling resources" approach to "reduce costs and increase efficiency."

In June this year, Toyota, Subaru, and Mazda announced their cooperation in research and development of alternative fuels for internal combustion engines; in November, Toyota, Honda, and Nissan will strengthen cooperation in automotive software development.

Nissan and Honda also reached a cooperation agreement in August this year, jointly signing a memorandum of understanding on deepening the framework of their strategic partnership to cooperate on joint procurement, joint development of power platforms, and parts standardization.

The benefits of "vertical and horizontal alliances" are evident. On the one hand, by sharing technical methods, automakers can improve the efficiency of capital allocation and reduce expenditures from management, procurement, production, and research and development.

On the other hand, joint research and development between automakers in areas such as automotive software and internal combustion engine technology can enhance research and development efficiency and accelerate the pace of practical application.

If the "Honda-Nissan-Mitsubishi" merger is successful, the three automakers will also be able to cooperate in more areas. For example, in terms of core components and automotive software standardization, their cooperation can extend to the supply chain, including the battery supply chain, which accounts for a significant portion of the cost of the entire vehicle, helping automakers further reduce production and research and development costs through economies of scale.

Previously, Nissan mentioned that it would launch multiple new energy vehicle models in the coming years and integrate the power system through a "family-style" model to reduce the cost of the next generation of pure electric vehicle models by 30%.

Additionally, after the merger, both parties can share channels and after-sales services, which can not only save expenses but also connect market data to achieve more efficient sales management.

In fact, in response to the transformation of the automotive industry, Japanese automakers have already abandoned their former hostility and begun to cooperate. Moreover, the Japanese government has also used its "visible hand" to integrate the Japanese automotive industry.

In May this year, Japan's Ministry of Economy, Trade, and Industry announced a strategic plan for the digital transformation of the Japanese automotive industry, setting targets for "software-defined vehicles" (i.e., enhancing vehicle functions through software rather than traditional hardware) and hoping to maintain competitiveness in the automotive market by promoting joint development of related technologies among manufacturers.

3. Is the Era of Pooling Resources Upon Us?

It's worth mentioning that in addition to "Honda-Nissan-Mitsubishi" potentially becoming the third-largest auto group in the world, the world's largest auto group, Toyota, has also been developing its own alliance, cooperating with Mazda, Suzuki, Subaru, and others on technology to form an alliance with a global scale of over 16 million vehicles.

However, compared to the "pooling resources" approach of Japanese automakers, Chinese automakers seem to prefer going it alone. Whether it's the larger BYD and Geely or the new force automakers NIO, Xpeng, Li Auto, and Zero Running, Chinese automakers are more adept at "self-research" in areas such as vehicle platforms, intelligent architectures, intelligent cockpit systems, and even intelligent driving chips.

Of course, in recent years, there have been more cases of cooperation among domestic automaker alliances, particularly in intelligent driving. However, most of these are also through investments, incubations, and other forms of cooperation. For example, BYD invested in DJI's subsidiary, Joyway Technology; Great Wall invested in WeRide.ai, etc.

One reason is that domestic automakers are moving faster in the electrification process and have stronger overall research and development capabilities. Currently, everyone is still in the "land grab" stage and is more inclined to create differentiated product systems through self-research. However, from another perspective, this also accelerates internal competition in the domestic automotive circle.

In contrast, "pooling resources" has the advantages of reducing costs and increasing efficiency, but it's not without concerns for cooperating automakers. Firstly, the "three Japanese giants" already have deep accumulations in their respective technical routes. After the merger, it will be a challenge to smoothly achieve technical integration, cultural fusion, and structural reorganization.

Secondly, automaker cooperation has the potential for complementarity, but similar products may also compete for the market. It remains to be seen whether "Honda-Nissan-Mitsubishi" can recreate a brand that is distinct from existing market players and from Honda, Nissan, and Mitsubishi after the three-way merger. This also poses a significant test to the new company's product strategy and brand marketing.

Of course, every business decision has pros and cons. For current Japanese automakers, if they continue to go it alone, they are doomed to struggle to keep up with the mainstream level of the new energy automotive industry. In that case, taking a chance on mergers might be a viable option.

However, for domestic automakers, they should also be mindful of the combat effectiveness brought about by the "vertical and horizontal alliances" of overseas automotive groups. After all, these automakers have a profound technological foundation, and what they lack may just be the right timing.

As the domestic automotive circle elimination game enters the second half, perhaps domestic automakers should also consider how to find a new development path for everyone beyond "internal competition." Otherwise, turning competition into internal consumption will only deplete the future of the Chinese automotive industry.

The year 2025 is approaching, and it's hoped that in the new year, in addition to price competition, the domestic automotive circle can also bring more innovations and breakthroughs.