Honda and Nissan Officially Announce Merger, Targeting Annual Profits Over RMB 100 Billion! Former CEO Ghosn Calls It a Desperate Move

![]() 12/31 2024

12/31 2024

![]() 495

495

"Today, we have decided to embark on exploring business integration. If successful, this endeavor will harness the combined strengths of both companies, a feat neither could achieve alone," stated Makoto Uchida, Representative Director, President, and CEO of Nissan Motor Co., Ltd., at a joint press conference held by Honda, Nissan, and Mitsubishi in Tokyo on December 23. He added that the collaboration between the two companies would result in a synergy where 1+1 equals more than 2.

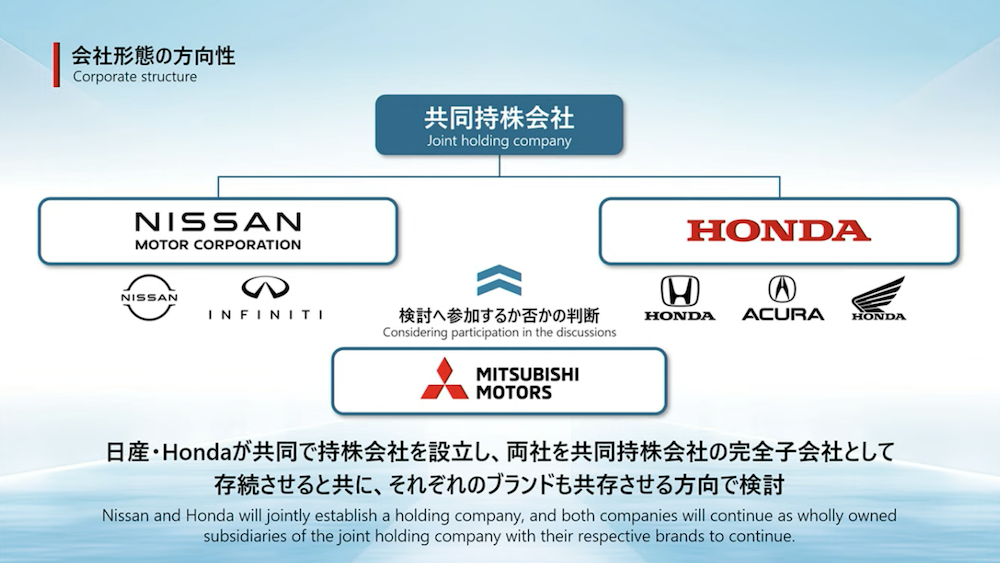

On the same day, Honda and Nissan signed a foundational agreement for business integration, contemplating the establishment of a joint holding company. Under the terms of the agreement, Honda and Nissan will jointly invest in creating a holding company through share transfers, making both entities wholly-owned subsidiaries of the new joint holding company. Concurrently, the Honda and Nissan brands will coexist and grow equally within this structure.

It is reported that Honda and Nissan will establish an integration preparation committee dedicated to consultations to ensure a seamless transition. Within the new holding company, Honda will assume a leadership role. According to the agreement, Honda plans to nominate a majority of both internal and external directors for the joint holding company, with the chairman or CEO also expected to be chosen from among Honda's nominated directors. The joint holding company's name, headquarters location, representative, board composition, and organizational structure will be discussed and negotiated by the integration preparation committee.

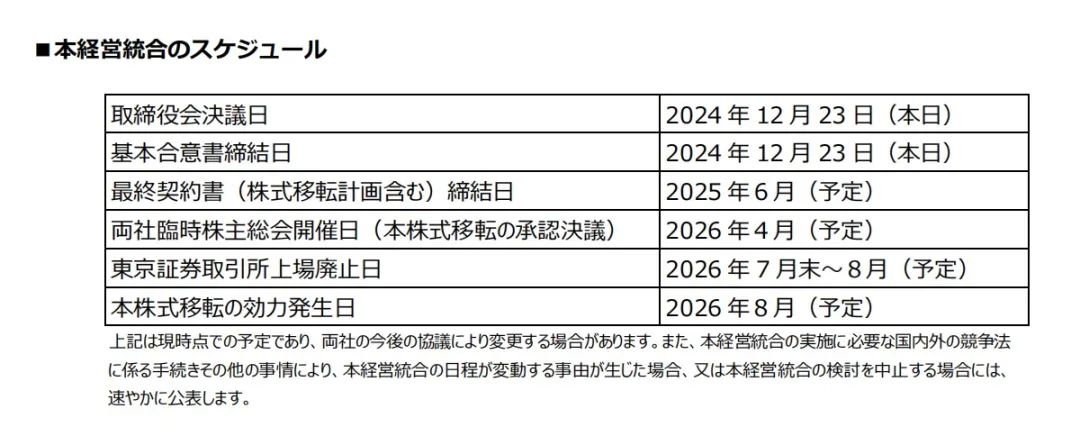

Honda and Nissan aspire to become a "globally leading mobility company" through the synergies gained from their merged operations, targeting annual sales exceeding JPY 30 trillion (approximately RMB 1.4 trillion) and annual operating profits surpassing JPY 3 trillion (approximately RMB 139.85 billion). According to the plan, the parties aim to reach a final agreement in June 2025, followed by an extraordinary shareholders' meeting in April 2026. The new company intends to go public in August 2026, with Honda and Nissan subsequently delisting. However, negotiations are ongoing, and there may still be variables in the cooperation direction between the two parties prior to the official merger.

Furthermore, Honda, Nissan, and Mitsubishi announced that they have signed a memorandum of understanding, exploring the possibility of Mitsubishi joining the Honda-Nissan merger. According to the plan, Mitsubishi will submit a study on its potential participation in the management integration between Honda and Nissan by the end of January next year.

01

Seven Key Cost-Saving Synergies

At the press conference, Makoto Uchida acknowledged that Nissan is currently facing severe challenges. Large enterprises, constrained by traditional concepts, may exhibit slow decision-making or a conservative attitude towards change. He hopes to rejuvenate employee confidence through the merger and strive to create a better Nissan. Currently, Nissan is grappling with a severe operating crisis, while Honda is also experiencing a decline in profitability. From July to September 2024, Nissan reported a net loss of JPY 9.3 billion, compared to a net profit of JPY 190.7 billion in the same period last year. Honda, meanwhile, recorded a net profit of approximately JPY 100 billion for the same period, a year-on-year decrease of 62%.

"To navigate the severe environmental changes facing the automotive industry, we believe Honda and Nissan must integrate their years of accumulated knowledge, human resources, technology, and other operational resources to create new mobile value," said Toshihiro Mibe, Representative Director and President of Honda Motor Co., Ltd. Through business integration, Honda and Nissan aim to enhance their ability to adapt to changing market conditions.

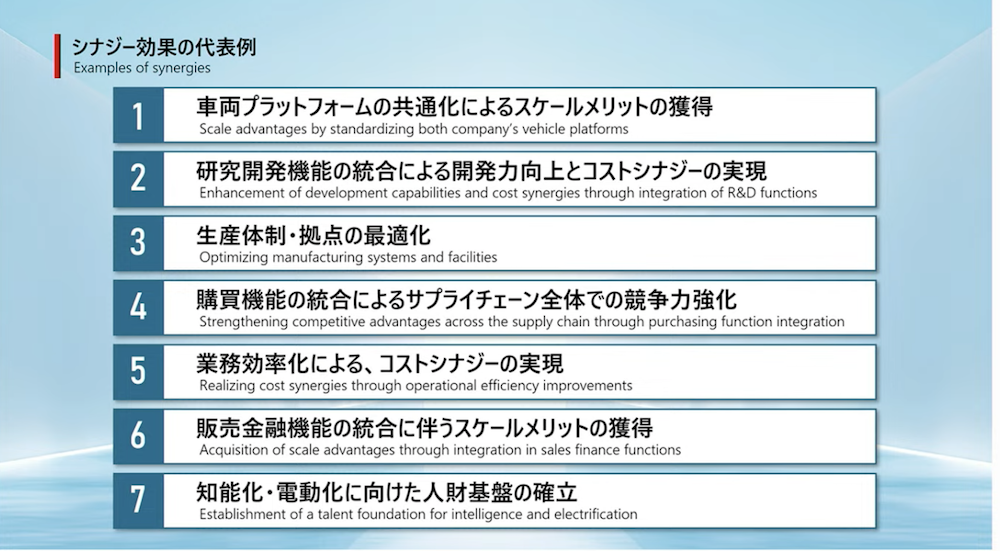

According to the current vision of Honda and Nissan, their collaboration will yield seven significant synergies. Firstly, platform generalization will achieve economies of scale. By generalizing various product segments across the vehicle platforms owned by both companies, Honda and Nissan aim to improve product competitiveness, development efficiency, and investment efficiency, while reducing costs. Additionally, by increasing sales volume and lowering per-unit development costs, revenue maximization can be achieved. For the ICE/HEV/PHEV/EV models sold globally by both companies, vehicle complementarity will be accelerated in the short to medium term to meet diverse global needs.

Secondly, R&D capabilities will be bolstered through the integration of R&D functions, achieving cost synergies. Honda and Nissan are conducting joint research on basic element technologies in the field of the next-generation SDV platform and the development of key EV components, striving for common specifications and mutual supply of major components like batteries and e-Axles, anticipated to be installed in the next generation of electric vehicles. Thirdly, the production system and bases will be optimized. By optimizing production and energy service bases, promoting mutual factory utilization, and increasing factory utilization rates, fixed costs will be significantly reduced.

Fourthly, the competitiveness of the entire supply chain will be enhanced through the integration of procurement functions. Fifthly, cost synergies will be achieved by improving operational efficiency. It is anticipated that the integration of business-related systems and indirect businesses of both companies, along with a high level of functional balance, will substantially reduce expenses. Sixthly, scale economies will be realized through the integration of sales and financial functions. By merging these functions and expanding business scale, a variety of mobility options, including new financial services throughout the automobile lifecycle, will be provided to automobile users of both companies.

Seventhly, an intelligent and electrified human resource base will be established. Honda and Nissan emphasized that the human resources of both companies are irreplaceable assets. To realize the changes brought about by business integration, personnel and technical exchanges between the two companies will be strengthened. However, due to some overlap in product businesses between Honda and Nissan, there are concerns about potential large-scale layoffs as a result of the merger.

In fact, prior to this, Honda, Nissan, and Mitsubishi have frequently collaborated. For instance, in March this year, Nissan and Honda signed a memorandum of understanding for comprehensive cooperation in electric vehicle businesses, including joint procurement, joint development of power platforms, and parts generalization. In July, Mitsubishi joined the Honda-Nissan alliance, and in August, the three companies signed a strategic cooperation memorandum, announcing cooperation in pure electric vehicles and intelligence to share R&D costs and compete against Chinese automakers. In November, Mitsubishi and Nissan announced the establishment of a joint venture to provide services related to autonomous driving and the use of electric vehicle batteries as storage batteries. If these three automakers complete the merger, they will become the world's third-largest automaker after Toyota Motor and the Volkswagen Group.

02

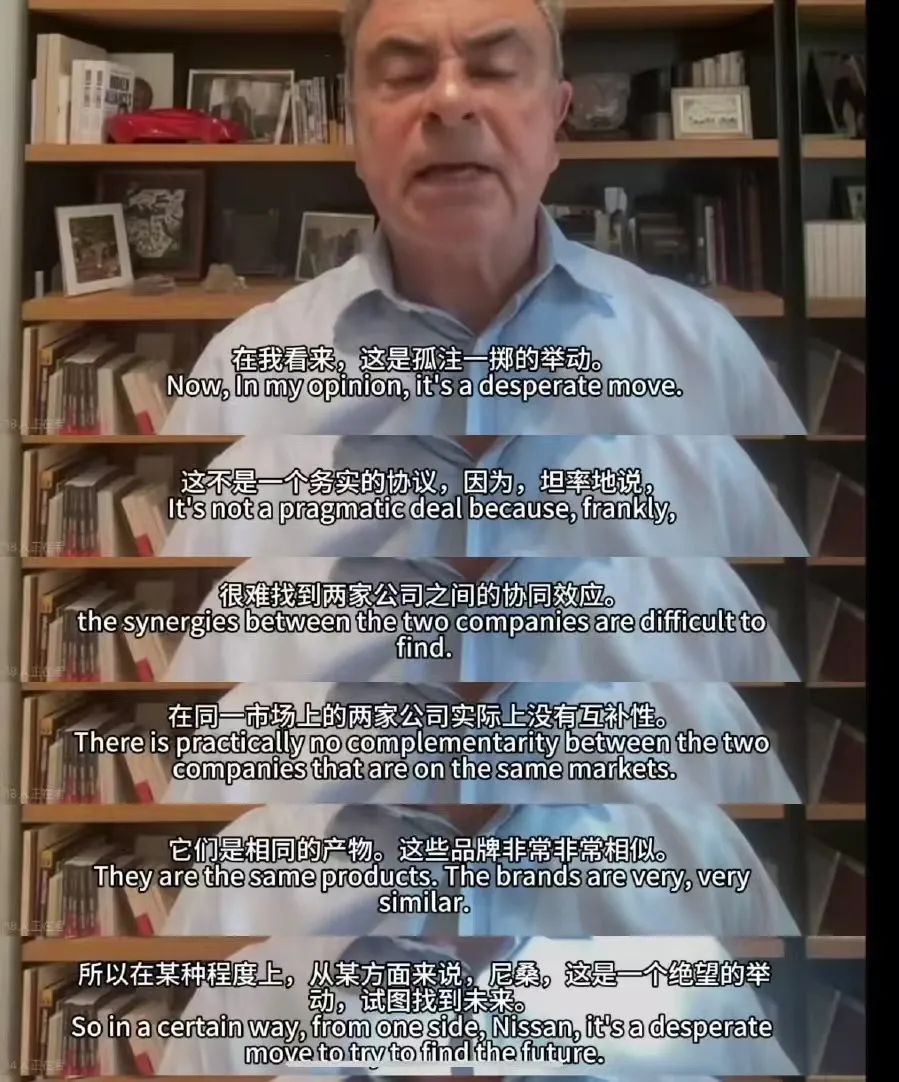

Former Nissan CEO: The Merger is a Desperate Move

Regarding the prospects of the Honda and Nissan merger, Carlos Ghosn, former Chairman and CEO of Nissan, is not optimistic. After Renault acquired a partial stake in Nissan in 1998, Ghosn became Nissan's CEO in 2000 and introduced the "Nissan Revival Plan," turning Nissan's losses into profits and making it one of the most profitable automakers globally. In 2016, after Nissan acquired a 34% stake in Mitsubishi Motors, becoming its largest shareholder, Ghosn also served as Chairman and CEO of Mitsubishi.

He believes that Nissan is currently in disarray, and discussing a merger with Honda is a desperate and impractical move. "Honestly, it's challenging to find synergies between the two companies, and there's almost no complementarity. They operate in the same market, with nearly identical products and very similar brands," Ghosn remarked.

This is also a concern among outsiders. Honda and Nissan indeed have significant overlap in brand positioning and products. Both brands are renowned for their reliability, durability, and low fuel consumption. For instance, in the Chinese market, the Civic and Sylphy, as well as the CR-V and X-Trail, have been competing for years in the compact car and SUV segments, respectively. Post-merger, how the brands will differentiate and how competing models will establish distinct competitive advantages are critical issues to address.

Ghosn believes Honda is a formidable automotive engineering company, and Nissan prides itself on its technology. A merger between the two companies could lead to disagreements among engineers from both sides. Ghosn stated, "If the two companies merge or form an alliance, deciding which technologies the new company will adopt will be a very difficult decision, posing the most acute challenge for the merged entity."

Ghosn further asserted that the so-called "merger" between Honda and Nissan is not a genuine fusion of the two brands but rather a push by the Japanese Ministry of Economy, Trade, and Industry to boost the Japanese economy. "Having lived in Japan for many years, I am well aware of the Ministry of Economy, Trade, and Industry's influence. While I don't see much industrial logic in this deal, sometimes one must choose between performance and control... Undoubtedly, the Ministry prefers control over performance. Therefore, they have no qualms about urging Honda to participate in this deal," Ghosn explained.

This implies that before the new company stabilizes, there will inevitably be a period of chaos during the integration and operation of the two automotive groups. If this period is navigated successfully, such a new super automotive group will significantly impact the global automotive industry. If not, 1+1 might end up being less than 2.