How to Encapsulate 2024 in One Word: 'Chaotic'?

![]() 01/02 2025

01/02 2025

![]() 650

650

As the sun dipped below the horizon on the final day of 2024, its warm rays still caressed the coastal town of Hangzhou Bay.

Dust-laden and weary, I turned back, filled with nostalgia for the year that was slipping away.

Here we are, riding the high-speed train of time, watching it fade into the distance, much like the fleeting moments of life that we can never reclaim.

Thank you for returning each year at this time, patiently awaiting my reflections on the automotive market of 2024.

If I had to encapsulate 2024's automotive market in a single phrase, it would be: "A kaleidoscope of chaos and color."

Why do I say this?

Because…

It was a year marked by waves of bankruptcy.

HiPhi vanished, Geely's Jiyue disbanded, and Nezha fell silent.

SAIC Motor merged Roewe with Flying Cars, Great Wall Motors integrated Ora with Haval, Geometry was absorbed into Geely's Yinhe brand, Radar joined Geely, and Zeekr acquired Lynk & Co. from Geely and Volvo.

It was a year of relentless price wars.

Prices such as 6.98, 7.98, 9.98, Champion Edition, and Glory Edition became commonplace. High-end features at rock-bottom prices defied imagination.

Even the luxury car market was not spared, with repeated fluctuations eroding its once unshakable confidence.

From news in July that BMW would exit the price war to rumors in September that it was re-entering, the luxury pricing system was thrown into disarray.

Preliminary data shows that the number of car models with price reductions from January to December 2024 totaled 195, far surpassing the 150 in 2023 and 95 in 2022.

This forced automakers' leaders, including Changan Automobile's Zhu Huarong, GAC Group's Zeng Qinghong, BYD's Wang Chuanfu, and Geely Holding Group's Li Shufu, among others, to engage in heated debates at the Chongqing Forum about the merits of price wars, with accusations flying thick and fast.

It was a year of massive layoffs.

Honda laid off, Volkswagen laid off, Toyota laid off, GM laid off, Porsche laid off, Li Auto laid off, HiPhi laid off, Nezha laid off—with or without compensation, the layoffs had to be accepted.

According to incomplete statistics from CheDongXi, in 2024, overseas automakers, local traditional automakers, and new forces alike reported massive layoffs. About 20 automakers planned to lay off approximately 70,000 employees. Overseas automakers were hit hardest, with the most significant layoffs. Moreover, the wave of layoffs spread directly from automakers to the supply chain, with layoffs in automotive supply chain companies exceeding 36,000, including major overseas automotive component giants like Bosch and Continental, as well as autonomous driving startups such as Qiangua Tech and Heduo Tech.

It's worth noting that layoffs in the automotive industry presented diverse scenarios. Some protested against layoffs and joined large-scale strikes; others were abruptly laid off and besieged the CEO at headquarters for explanations, or even emptied stores; still, others were rehired by the company after being laid off.

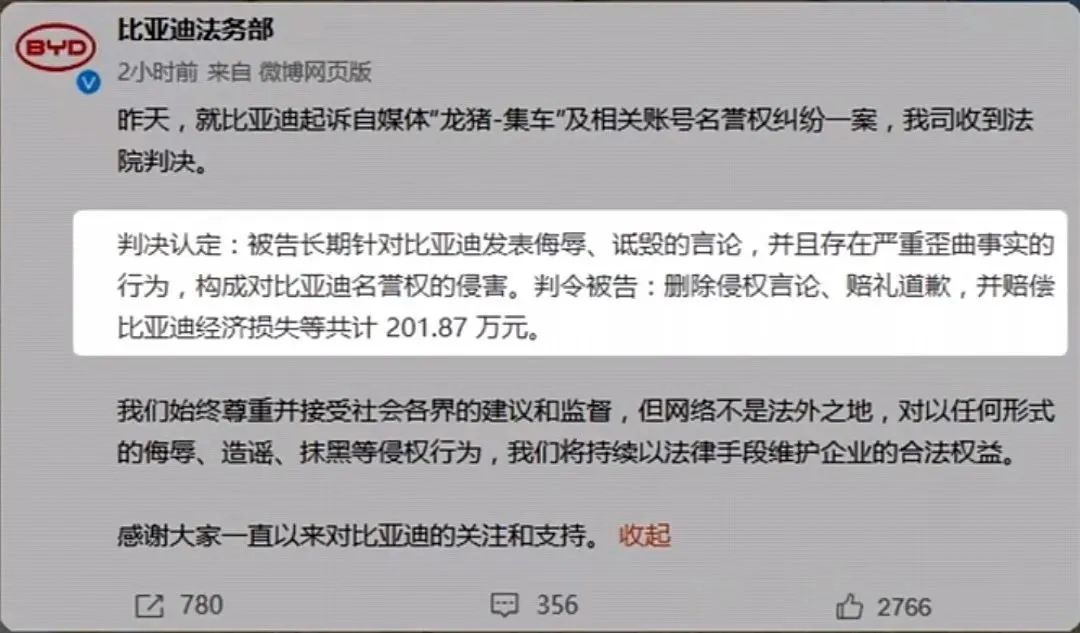

It was a year of grievances for car reviewers.

No base liquor at auto shows became increasingly common, with automakers and agencies defaulting on media advertising cooperation fees. Lawsuits between media and automakers became commonplace.

Not to mention the legal departments of automakers frequently naming and shaming and playing extortionate compensation games.

It was a year of the internet car manufacturing frenzy.

Huawei led the charge in the four-wheeled vehicle market; Xiaomi sold more cars in one year than many other brands; Xpeng's MONA and NIO's NIO Life launched their second brands, making inroads into the autonomous and joint venture heartlands, envied by many; Li Auto's extended-range vehicles garnered many followers… AITO, SL03, Dongfeng Yipai…

It was a year of joint venture collapse and autonomous rise.

BYD sold 500,000 cars per month, Geely's Yinhe, Zeekr, and Lynk & Co. flourished, and Chery exported to Europe, Africa, and Latin America.

SAIC, a joint venture, was forced to start anew, GAC left its prideful CBD after many years and embarked on the Panyu initiative, not to mention FAW, whose momentum was waning…

Truly, times change.

It was also a year of traffic dominance.

"New car circle aristocrat" Lei Jun transformed into a walking "traffic harvester." Wherever he went at auto shows, he was mobbed. He produced two to three social media videos daily, showering Xiaomi SU7 with immense popularity. With just the SU7 model, he achieved an annual production and sales volume of 130,000, "crushing" most new car brands.

This forced automaker chairmen and executives to flock to livestreaming rooms, transforming into the company's top salespeople, hoping to use catchphrases to quickly gain popularity and become the brand's most recognizable face.

It was also a year of battery competition, with CATL no longer dominant alone. Short-blade batteries, solid-state batteries, semi-solid-state batteries, and more emerged in an endless stream…

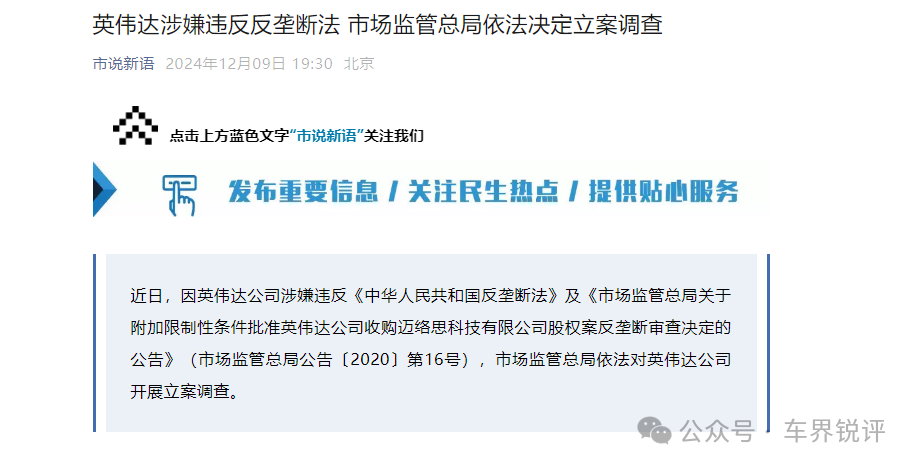

It was also a year that domestic chips were cornered. The US imposed chip restrictions and tariffs, and NVIDIA frequently discriminated against domestic enterprises, pushing the authorities to their limit.

It was also a year of mechanization decline.

What about torsion beams, multi-links, 8AT, 9AT, or zero-to-hundred acceleration? In an electrified and homogenized environment, they all seemed fragile and unappealing.

If an automaker still talks about these outdated demands, it indicates that the automaker has made no progress and can only reminisce about the past.

This year, the car market was filled with untold stories.

As for those automakers that perished in 2024, they will never see the first rays of dawn in 2025 like us.

Automakers born on this tumultuous Chinese land are all seeking their own fate in this era. How long they will last is a struggle only they can endure.

As the saying goes, "After great chaos, there must be great governance, and after great governance, there must be great stability." May the Chinese car market in 2025 present a whole new world.