Global Automotive Outlook 2025: Sales to Rise, Production to Dip Slightly Amid 'Uncertainty'

![]() 01/02 2025

01/02 2025

![]() 645

645

As the new year dawned, S&P Global Mobility offered a glimpse into the future of the global automotive market, forecasting a 1.7% year-on-year increase in new vehicle sales to reach 89.6 million units by 2025 (with 2024 sales estimated at 88.2 million units). However, global light vehicle production is projected to decline by 0.4% to 88.7 million units.

S&P Global Mobility's forecast incorporates multiple factors, including supply chain improvements, tariff impacts, persistently high interest rates, affordability challenges, rising new vehicle prices, mixed consumer confidence, energy prices and supply concerns, auto loan risks, and the challenges of electrification. In the United States, the incoming administration may swiftly implement a series of policy priorities, including across-the-board tariffs, deregulation, and fluctuating support for electric vehicles.

While the projected increase in global new vehicle sales in 2025 signals a cautious recovery and growth trend in the automotive industry, the forecast has been revised downwards due to uncertainties surrounding policy changes by the new U.S. administration. These policies are expected to significantly influence automotive demand, impacting interest rates, trade directions, new vehicle procurement, and electric vehicle adoption rates.

Colin Couchman, Executive Director of Global Light Vehicle Forecasts at S&P Global Mobility, commented: "2025 will be a challenging year for the automotive industry, as constrained consumer demand in key regions limits growth potential, and the new U.S. administration introduces new uncertainties from day one. As the government reconsiders support policies (especially incentives, subsidies, industrial policies, tariffs, and rapidly evolving OEM target setting), predicting electric vehicle demand becomes increasingly difficult."

▍European Market: Sales Remain Flat, with a Modest 0.1% Year-on-Year Increase

Specifically, in key regions, the European market is anticipated to see car sales in Western and Central Europe slightly below 15 million units in 2024, with a 1.1% year-on-year increase, influenced by consumer caution and automakers' evolving powertrain strategies. Moving into 2025, stricter emission regulations will further affect the market mix and overall sales. Additionally, factors such as the risk of a European recession, high car prices, reduced electric vehicle subsidies, electric vehicle tariffs, and political uncertainties in Germany and France are expected to keep European sales flat at around 15 million units in 2025, with a mere 0.1% year-on-year growth.

Couchman believes the key challenges facing the European market encompass the pace of electrification, the EU's tariff on Chinese-made electric vehicles, the risk of increased tariffs by the new U.S. administration, consumer hesitation towards electric vehicles, the policy direction of the new European Commission, and intense lobbying around EU emission targets.

▍U.S. Market: Sales to Increase by 1.2% Year-on-Year, with Affordability Remaining a Concern

S&P Global Mobility anticipates U.S. auto sales to reach 16.2 million units in 2025, a modest 1.2% increase from the estimated 2024 sales of 16 million units. With the new administration and policy proposals, the U.S. auto market in 2025 will present both opportunities and risks of uncertainty.

Chris Hopson, Manager of North American Light Vehicle Sales Forecasts at S&P Global Mobility, believes that the affordability issue that constrained auto demand growth in 2024 will persist in 2025. While new vehicle pricing has declined slightly, it remains high; interest rates may decrease further, but inflation levels will endure; and while new vehicle inventories are expected to rise, caution is warranted. These factors contribute to a moderate growth outlook for U.S. auto sales in 2025.

▍Chinese Market: Sales to Increase by 3.0% Year-on-Year, with New Energy Vehicles Continuing to Boom

Benefiting from incentives for new energy vehicles and trade-in subsidies, S&P Global Mobility forecasts China's auto sales to reach 25.8 million units in 2024, a 1.4% year-on-year increase. In 2025, alongside the continued effect of existing incentive policies, local government auto incentives, broader government stimulus measures, and auto price wars, China's auto sales are projected to surge to 26.6 million units, a 3.0% year-on-year increase.

Furthermore, the boom in new energy vehicles in the Chinese auto market is anticipated to continue in 2025. Cheaper battery costs will aid automakers in reducing electric vehicle prices, thereby stimulating demand. Coupled with the policy of exempting new energy vehicles from purchase taxes until the end of 2025, the penetration rate of new energy vehicles (as a percentage of passenger cars) in the region is expected to climb to 58% in 2025.

▍Japanese Market: Sales to Rebound by 5.4% Year-on-Year

The 2024 emission scandal involving Daihatsu adversely affected vehicle shipments, resulting in a subpar performance in the Japanese auto market in 2024, with annual sales forecast to be below 4.4 million units. Looking ahead to 2025, Japanese light vehicle sales are projected to regain momentum, with annual sales expected to reach 4.6 million units, marking a robust 5.4% year-on-year increase. However, as a significant auto exporter, Japan will face challenges in 2025 due to adjustments in U.S. import tariffs on automotive products and global economic weakness.

▍Global Light Vehicle Production to Decline in 2025 Amidst Rising Global Risks

It is predicted that global light vehicle production will reach 89.1 million units in 2024, a 1.6% decrease from 2023, with declines observed in all regions except China and South America.

With the new U.S. administration poised to implement a wide range of new tariff regimes, imposing various tariffs on imports from different countries, S&P Global Mobility assumes a 10% across-the-board tariff on goods entering the U.S. from countries other than Canada and Mexico, and a 30% tariff on goods from mainland China. Based on this tariff assumption, S&P Global Mobility forecasts global light vehicle production in 2025 to reach 88.7 million units, a slight 0.4% year-on-year decrease.

Mark Fulthorpe, Executive Director of Global Light Vehicle Forecasts at S&P Global Mobility, noted that the global automotive industry will continue to navigate an uncertain environment in 2025. Amidst the global trade slowdown and potential retaliatory measures stemming from new U.S. tariff policies, the automotive industry's production landscape is poised for significant changes.

Specifically, China's light vehicle production is anticipated to remain stable at 29.6 million units in 2025, supported by robust domestic demand for new energy vehicles and strong exports, marking a marginal 0.1% increase. In North America, the new administration signifies a return to unpredictable policies, which will influence overall demand and vehicle mix strategies. Total production is expected to reach 15.1 million units in 2025, a 2.4% year-on-year decrease. Meanwhile, Europe's production in 2025 is projected to reach 16.6 million units, a 2.6% decrease from the estimated 17 million units in 2024.

▍Electric Vehicles Continue to Show Significant Growth

In 2024, numerous automakers adjusted their electrification transformation targets for the next five to fifteen years. Outside of China, automakers confront a dual challenge: ramping up electric vehicle production and attracting customers willing to purchase these vehicles.

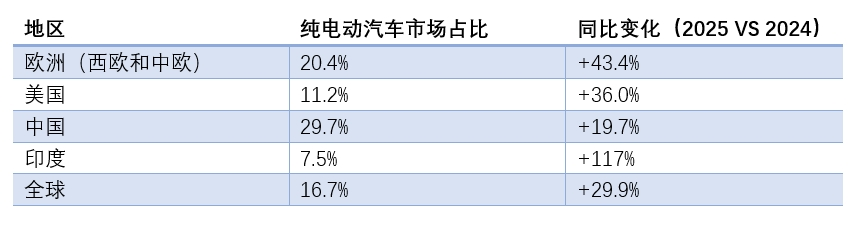

Despite the gloomy outlook for electrification in Europe and the U.S., electric vehicles remain a notable growth segment within the automotive sector. S&P Global Mobility predicts global sales of pure electric passenger vehicles to reach 15.1 million units in 2025, a substantial 30% year-on-year increase, accounting for approximately 16.7% of global light vehicle sales. For reference, global sales of pure electric vehicles are projected to hit 11.6 million units in 2024, with a market share of 13.2%. Regional performances in 2025 are as follows:

Beyond 2025, significant uncertainty surrounds the pace of global electrification, particularly in areas such as charging infrastructure development, grid power support, battery supply chains, global adoption trends, tariff and trade barriers, technological advancements, and policy support from various countries.

Typesetting by Zheng Li

Source: S&P Global Mobility

Image Source: Shutterstock, S&P Global Mobility