3-Year Valuation Soars 50 Times! MIT Team May Become OpenAI's Largest Acquisition

![]() 04/24 2025

04/24 2025

![]() 655

655

Author|Ivan

What Makes Codeium Attractive to OpenAI?

According to Bloomberg, OpenAI is in talks to acquire Codeium, a leading AI programming tool company, in a deal potentially worth $3 billion. If successful, this would mark OpenAI's largest acquisition to date and the most significant exit in the AI programming sector amid the generative AI wave, providing a substantial return for Codeium's investors.

Codeium's flagship product, Windsurf, has emerged as one of the fastest-growing developer tools in Silicon Valley over the past three years. Within just 10 months of its inception, Windsurf's annual recurring revenue (ARR) surpassed $10 million. After four funding rounds, its valuation soared 50 times, reaching $1.25 billion post-C round. Windsurf supports 70 programming languages and boasts a clientele that includes half of the Fortune 500 companies. Its founder, Varun Mohan, an MIT graduate, transitioned from autonomous driving to AI infrastructure before focusing on development tools, embodying the typical Silicon Valley entrepreneur narrative of seizing the window of large model iteration and building a technological moat through enterprise-level products.

The AI coding sector is both capital-rich and fiercely competitive. In this year's YC W25 program, 80% of the projects were AI-related. In March, Cursor's developer Anysphere was valued at $10 billion, a fourfold increase from just three months prior. Cursor's ARR stands at $200 million, making Windsurf's valuation less than a third of its competitor's. Nevertheless, the AI programming sector exhibits a clear head effect, with Microsoft GitHub Copilot's annual revenue exceeding $300 million, Cursor valued at $10 billion, and Cognition's Devin priced at $500 per month for "fully automated programming."

Investors and entrepreneurs alike acknowledge that while generative AI is transforming the AI coding sector at an unprecedented pace, real pain points persist. Users complain about frequent errors and omissions in AI tools, while the high cost and low compatibility of enterprise-level deployments test the resilience of emerging unicorns. This is what Anshul Ramachandran, Director of Corporate and Partner Relations at Codeium, refers to as a technological moat.

What makes Windsurf appealing to OpenAI? How did it achieve a valuation nearly 50 times its initial value in just three years and secure a place in the highly competitive AI coding sector? Silicon Rabbit delves into business models, founder stories, corporate risks, and other aspects to portray the entrepreneurial profile of this AI coding company favored by OpenAI.

Sales "Iron Army" Breaks Through GitHub's Defenses

In 2018, Varun, an MIT graduate, joined Nuro, an autonomous driving company. His experience at Nuro illuminated the transformative potential of deep learning across multiple industries. With Indian ancestry, Varun embodies the passion and talent of Indian engineers for IT and is open to sharing his entrepreneurial experiences through various interviews and social media platforms.

Initially, Mohan's entrepreneurial endeavors did not involve AI code tools. In 2020, he partnered with Douglas Chen, another MIT graduate and former Meta machine learning engineer, to found Exa Function, a company focused on optimizing deep learning workloads through GPU virtualization. Within a year, they expanded their revenue to millions of dollars and managed over 10,000 GPUs.

The generative AI tornado that swept the globe after 2020 revolutionized various industries more thoroughly and extensively. At the recent YC W25, 80% of the projects were AI-related, as mentioned in Silicon Rabbit's "[Frontline Insight] YC W25 Funding: Ice and Fire, 9 Charts to See Through Silicon Valley's Venture Capital Survival Game" (Join the group by adding Silicon Rabbit: usted9 to obtain exclusive YC project reports).

This shift also made Mohan realize a potential disruption in future business models: generative AI is enhancing productivity. Under the Transformer architecture, customized infrastructure breaks the commoditization of traditional infrastructure. "Becoming an infrastructure solution provider is not a viable strategy because either these model companies will optimize their models in-house, or competition will commoditize optimization techniques for these specific architectures. We won't solve problems for these new companies, and we will lose value," as explained in Windsurf's official article.

Based on this insight, Mohan and his team embarked on a strategic transformation, abandoning their role as infrastructure providers to become an application company, transitioning from "shovel sellers" to "gold diggers." Codeium, a developer of AI-driven software tools, "informed investors about the company's changing business philosophy and existing customers about discontinuing our previous products. We rolled up our sleeves and embarked on a new journey from scratch, without any guarantee of success."

From its inception, Codeium was grounded on two pillars: emphasizing sales and being enterprise-native.

Codeium's subsequent growth underscores the power of this strategy. Founded in 2022, a year when generative AI capabilities surged, spurring a wave of commercial applications, Codeium capitalized on this momentum. In 2021, OpenAI and GitHub jointly launched GitHub Copilot, which has since amassed over 1 million paid users, achieving an ARR of $300 million in three years.

Codeium's funding data also highlights the sector's popularity. Before news of OpenAI's potential acquisition broke, Codeium had completed four funding rounds, attracting notable investment institutions:

l Seed Round: Led by Greenoaks with a $3 million investment at a $26 million valuation;

l Series A: Led by Greenoaks with a $25 million investment at a $215 million valuation;

l Series B: Led by KP with a $65 million investment at a $510 million valuation;

l Series C: Led by General Catalyst with a $150 million investment at a $1.25 billion valuation;

Greenoaks, a San Francisco-based investment firm, has invested in SSI, an early co-founder of OpenAI. Meanwhile, Kleiner Perkins, known as the largest venture capital firm in the United States, has been an early investor in companies like Amazon, Google, and Twitter. Judging by its current valuation, Codeium has already generated substantial returns for its investors.

"Each of these engineers only needs to spend one day using Windsurf to complete projects, like they've strapped on a rocket booster," said YC CEO Garry Tan, evaluating Windsurf.

Windsurf's strength lies in its ability to support 70 programming languages and seamlessly integrate with popular development environments, offering a superior user interface, faster performance, and innovative writing patterns. Windsurf is a Flow = Agent + Copilot product, renowned for its context awareness, capable of automatically recognizing user needs and making adjustments, functioning like an assistant that handles complex tasks autonomously.

According to a July 2024 Gartner report, Codeium has surpassed GitHub Copilot in code generation, testing, modernization, interpretation, and other aspects.

Initially, Mohan and his team refrained from hiring traditional enterprise salespeople or representatives. Instead, the founders personally sold to 30-40 customers. "If the founders can't sell a $1 product, it wouldn't be wise to hire a sales team to sell a $100 product," said Mohan. This approach continued until Codeium developed a replicable sales process system, after which 10 Fortune 500 companies proactively reached out.

This hands-on approach revealed that many individuals outside Silicon Valley do not use GitHub, and even within Fortune 500 companies, GitHub's penetration rate is less than 10%. Moreover, the switching cost for GitHub's source code management tools is high, with many using GitLab, Bitbucket, Garrett, Perverse, CVS, Harvest, Mercurial, among others.

Codeium recruited deployment engineers who work closely with the sales team, "squatting" at customers' locations to assist with deployment and gather feedback unattainable from social media. "If Codeium has an expanding sales team but no one understands the technologies and tools, it can't be a good partner for customers," emphasized Mohan, who spends 5-6 hours weekly with his co-founder reflecting and reviewing.

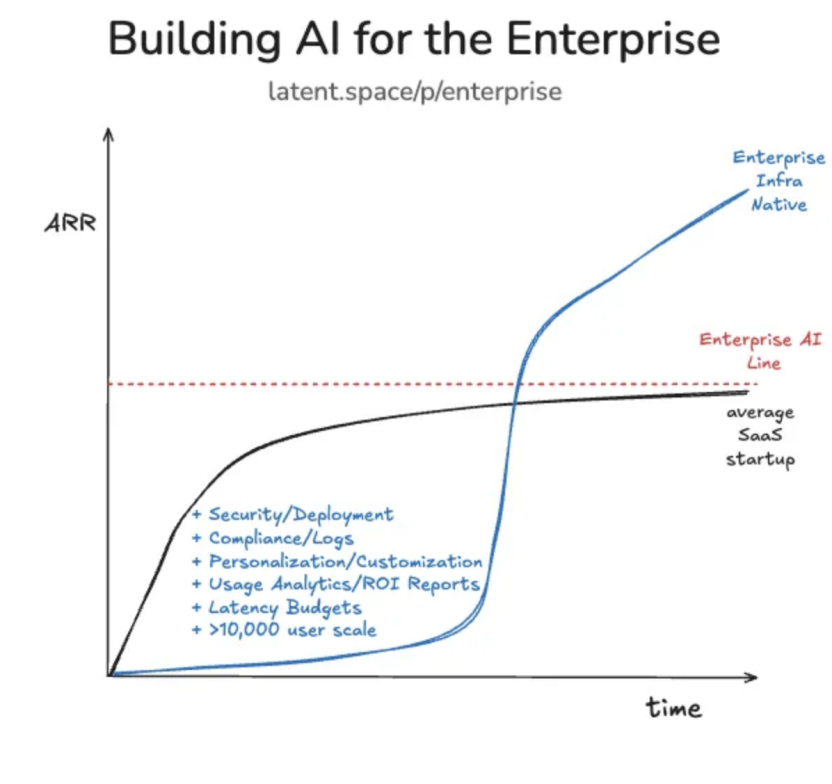

In addition to establishing a rigorous sales process, Codeium has always targeted enterprise users, offering products based on enterprise infrastructure, which entails more restrictions and stricter conditions. Although growth was initially slow, maintaining subsequent high-speed and sustainable growth is key to differentiation. "In AI programming, if you only iterate for individual developers, you'll never appreciate the importance of an advanced reasoning system that handles large, messy, and often outdated codebases," said Anshul.

Image Source: Anshul's Blog: The Most Dangerous Thing An AI Startup Can Do Is Build For Other AI Startups

In Anshul's view, starting from enterprise infrastructure engraves this consciousness into the company's DNA, distinct from achieving enterprise-level status through patching and improvement during product iteration. "It's tricky to gradually introduce enterprise-related restrictions later. When the industry evolves rapidly, someone might capture the potential market before you have a chance to iterate," said Anshul.

Another factor in Windsurf's success is rapid iteration. In a recent interview, Mohan expressed his hope that the company could consume the existing product state every 6 to 12 months, "making the current product look almost silly."

Free "Casting the Net" + Value-Based Pricing

While GitHub Copilot attracted developers with a $10/month threshold, Codeium adopted a counterintuitive strategy: bombarding individual users with a free model and binding enterprise customers through "code value sharing."

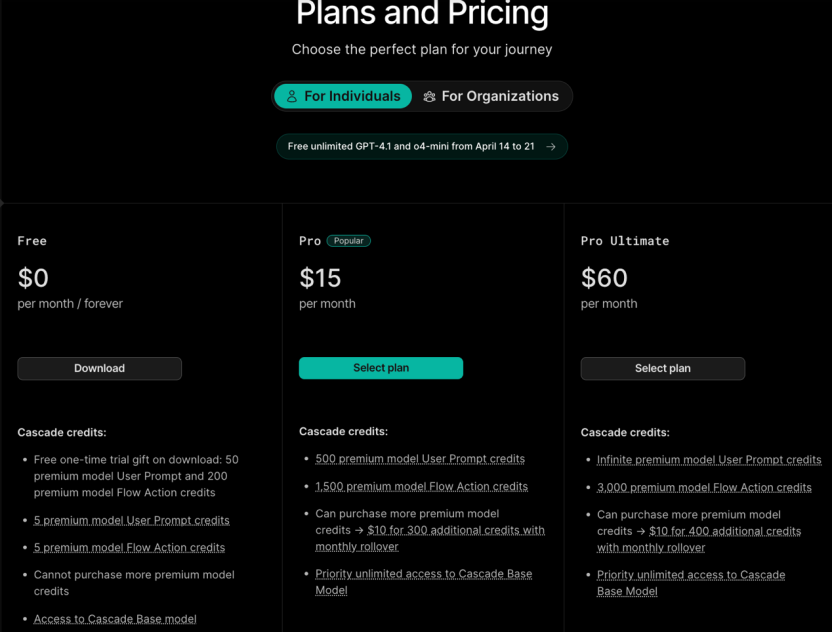

Windsurf's pricing system is designed like a precise traffic funnel. Currently, Windsurf offers several pricing models:

For individual users, Windsurf's free model grants hobbyists and students unlimited access to AI-driven workflows, with 5 user prompt credits and 5 process operation credits. The professional version costs $15 per month, offering 500 user prompt credits and 1,500 process operation credits. The ultimate professional level membership costs $60 per month, providing unlimited user prompt credits and 3,000 process action credits, with an additional 400 Flex credits costing $10, offering better value for heavy users.

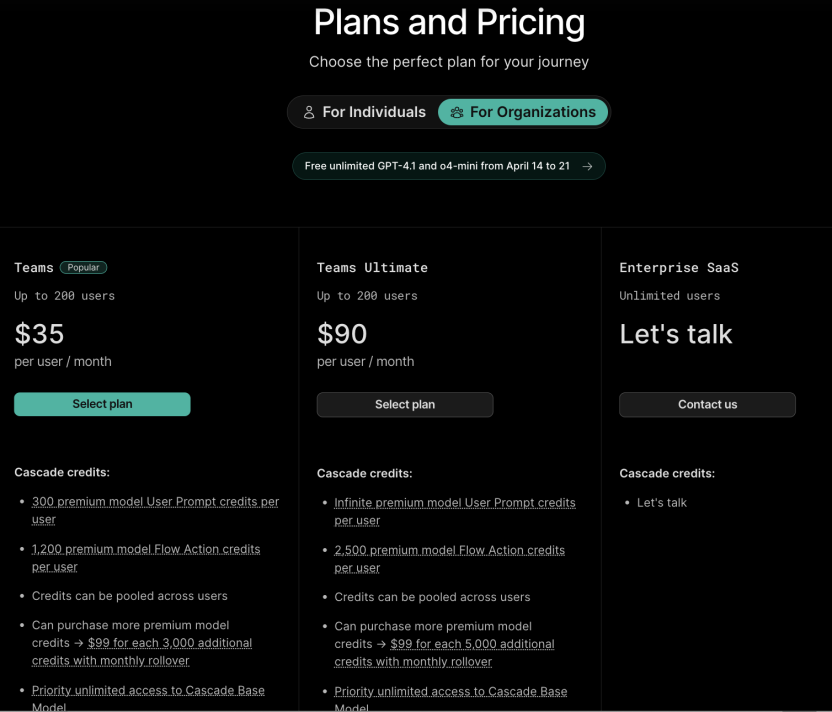

For enterprise users, Windsurf offers different pricing models, with general enterprise users paying $35/month and advanced enterprise users paying $90/month.

In terms of pricing logic, they initially adopted a permanently free model, then introduced a professional version for $10 per month, which later increased to $15 per month, followed by an upgraded version for $60 per month. Finally, there's the common "Enterprise Plan" with prices determined on a case-by-case basis.

Here's how Windsurf's credit system works:

Ø User Prompt Credits: Consumed when interacting with advanced models (e.g., GPT-4).

Ø User Action Credits: Used for code generation or chained actions for analysis.

Ø Flex Credits: Purchased separately and can be used for user prompts or process action credits. Unused Flex credits can be carried over indefinitely, providing flexibility for users managing variable workloads.

Windsurf offers services in two modes: Flows and Cascade. Flows, equivalent to Agents+Copilots, acts as an intelligent assistant, collaborating closely with users and independently handling complex tasks like an agent. This mode boasts powerful context awareness and adaptability. Cascade, on the other hand, senses the user's operational state in real-time, understanding and collaborating without the need for context for previous actions.

Windsurf supports natural language input, deep context understanding, and multi-model AI integration. Users can choose preferred models like Claude3.5, GPT-4, etc. It offers two modes:

Ø Chat Mode: Similar to an AI assistant, providing answers based on code.

Ø Write Mode: Comes with Agent functionality, enabling code writing, adding, and modifying files.

Anshul described the tiered pricing model as "financially prudent." He elaborated that while certain features, such as automated workflows and unlimited chatting on faster models, can be offered free of charge, the more advanced indexing and complex engineering workflows undertaken by Codieum incur genuine costs. Consequently, the $10 monthly professional plan is primarily intended to cover these expenses.

Regarding the payment structure for varying levels of expertise, Mohan drew an analogy with Office365. "A lawyer at Codeium utilizes Microsoft Word far more extensively than I do. Even though we pay the same fee, the value he derives from Office 365 could amount to tens of thousands of dollars." He further stressed that software is a collaborative effort. In a team of four, if just one individual can extract four times the value from the product, their payment effectively covers the costs for all.

During their startup's nascent stages, they initially opted for a free launch to rapidly acquire a substantial user base. Subsequent events affirmed the prudence of this risk. This free model fueled a surge in user adoption. "Although unconventional, we were able to expand our user base at an astonishing rate (now exceeding 700,000 developers), giving us ample reason to remain irrationally optimistic."

This rationale underpins our offering of free personal plans. It's unconventional, yet we've achieved remarkable user growth (now surpassing 700,000 developers), fueling our irrational optimism. This is precisely why we introduced self-hosted enterprise plans prior to SaaS plans.

Our confidence in offering free and low-cost plans stems from rigorous cost control. Codeium trains its own models, eschewing third-party platforms, thereby controlling the entire stack. This approach reduces costs and offers deployment flexibility. Anshul explained why Codeium avoids third-party APIs, noting that the associated costs would be prohibitively high.

In an article, he illustrated that developing a Copilot for X necessitates fine-tuning basic language models, similar to how code generation models are initially trained on vast natural language databases and subsequently fine-tuned on code, often requiring multiple stages. Using a third-party API for this fine-tuning and inference can be costly. For instance, Curie, a medium-to-large language model by OpenAI, costs $0.002 per 1,000 tokens. Assuming each query uses about 2,000 tokens (prompt + generation), this translates to $4 per user per day. If each user poses 1,000 queries daily, the annual cost per user exceeds $1,000. In the long run, such costs cannot be fully passed on to users.

Intense Market Competition and Emergence of Leading Companies

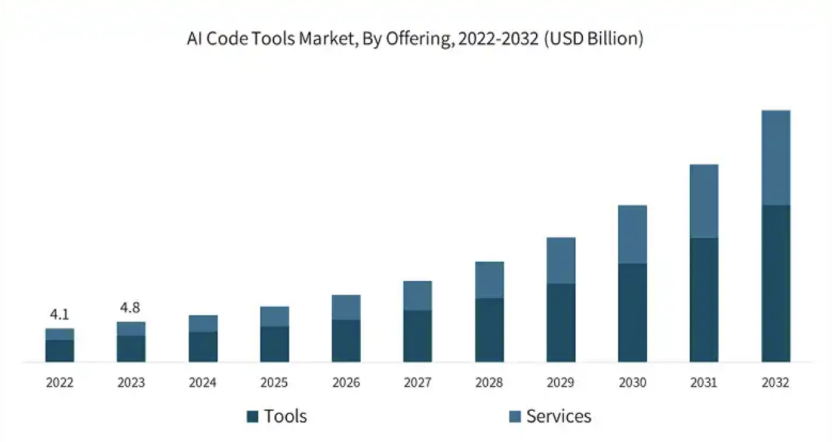

The AI coding market is fiercely competitive and continuously growing.

According to Global Market Insights, the AI code tools market was valued at $4.8 billion in 2023. Spherical Insights' latest forecast projects that by 2032, this market may exceed $29.5 billion, representing a more than fivefold increase over ten years.

Source: Global Market Insights

Several prominent players have emerged in this field.

GitHub Copilot was an early entrant. In 2021, GitHub announced its collaboration with OpenAI to develop the AI coding tool GitHub Copilot, which currently supports Claude3.5 Sonnet and GPT-4 models. Besides the free version, it's available to Pro/Business/Enterprise users at $10/19/39 per month, respectively. In October 2023, GitHub CEO Thomas Dohmke revealed that GitHub Copilot's ARR (Annual Recurring Revenue) surpassed $100 million. A year later, Microsoft's earnings call in July 2024 indicated that GitHub Copilot's revenue had exceeded the level when GitHub was acquired by Microsoft in 2018 ($2-300 million).

Cursor, another AI coding company launched in 2022, charges $20/40 per month for Pro/Business users, respectively. As per Sacra's estimates, Cursor's annual ARR reached $65 million in November 2024, and it has received investments from OpenAI Startup Fund, Thrive Capital, and other institutions.

Compared to Cursor, Windsurf's pricing model is relatively economical. Its free plan offers unrestricted access to the Cascade Base model, whereas Cursor requires a $20 monthly fee for full services. For users needing advanced models occasionally, purchasing Flex credits provides flexibility without excessive spending. In terms of target audience, Windsurf caters more to individual developers with tighter budgets, while Cursor suits larger and more complex project development.

Another AI coding product is Cognition's Devin. In December 2024, Cognition announced Devin's full commercialization, charging $500 per month for Team customers.

A senior investment analyst at UpHonest Capital told SiTuJun that Devin is ideal for those seeking AI to complete tasks with minimal human intervention, whereas Windsurf suits developers needing AI assistance while maintaining control. Devin's high automation level, while a strength, also poses weaknesses like limited adjustability and incomplete task execution. Currently, Devin's valuation stands at $4 billion.

Windsurf's founding team emphasizes a user-centric approach, which presents a challenge for future growth. Sustaining user loyalty by consistently delivering problem-solving products is crucial for AI coding companies to maintain growth, especially as market leaders emerge.

Some users have noted that while Windsurf excels in context reading, it can only process and analyze 50 lines of code at a time, leading to high data consumption and occasional errors, as opposed to handling over 200 lines.

If the rumor of OpenAI acquiring Windsurf proves true, it will directly compete with other AI coding providers, including Anysphere, funded by OpenAI's Startup Fund. This could potentially undermine the credibility of OpenAI's Startup Fund.

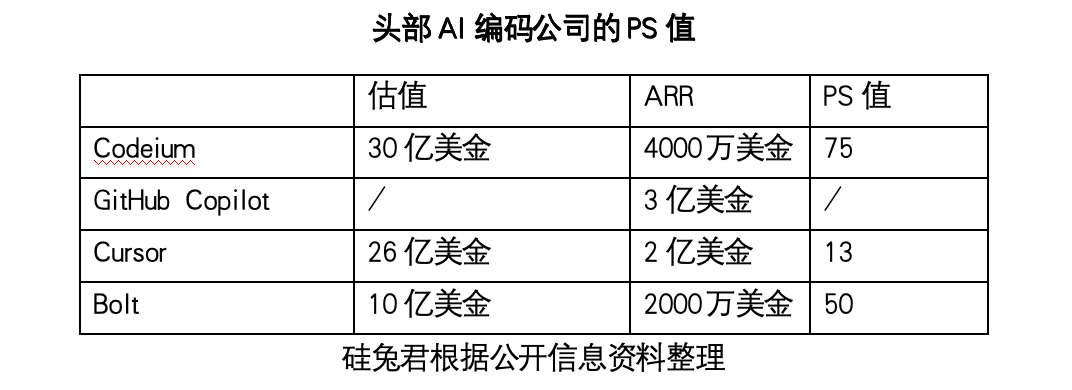

A higher PS value reflects the market's optimism about a company's growth potential. Based on publicly available information, SiTuJun compiled the PS values of leading AI coding companies, with Codeium ranking first. This might explain why OpenAI chose to acquire Codeium.

References:

1. Windsurf Official Website

2. Michael Amachree, Why Windsurf is the Best Free AI Code Editor You’ve Never Heard Of

3. Marina Temkin, Maxwell Zeff, Why OpenAI wanted to buy Cursor but opted for the fast-growing Windsurf, TechCrunch

4. Marina Temkin, OpenAI is reportedly in talks to buy Windsurf for $3B, with news expected later this week, TechCrunch

5. Anshul Ramachandran, The Most Dangerous Thing An AI Startup Can Do Is Build For Other AI Startups

6. Anshul Ramachandran, How to Make AI UX Your Moat

7. Swyx, Alessio, Anshul Ramachandran, What Building "Copilot for X" Really Takes

8. Antoine Tardif, Varun Mohan, Co-Founder & CEO of Codeium – Interview Series

9. Windsurf: How to Build an Enterprise-Grade AI IDE

10. Cursor vs Windsurf: Who is the Strongest AI Code Editor?