Tesla's Net Profit Dives 70%, Kicking Off 2025 with a Bang: Musk Returns to Car Manufacturing

![]() 04/24 2025

04/24 2025

![]() 501

501

Withdraws Full-Year Growth Outlook

"

Author | Zhang Ye

Editor | Qin Zhangyong

Tesla's 2025 began with a rocky first quarter.

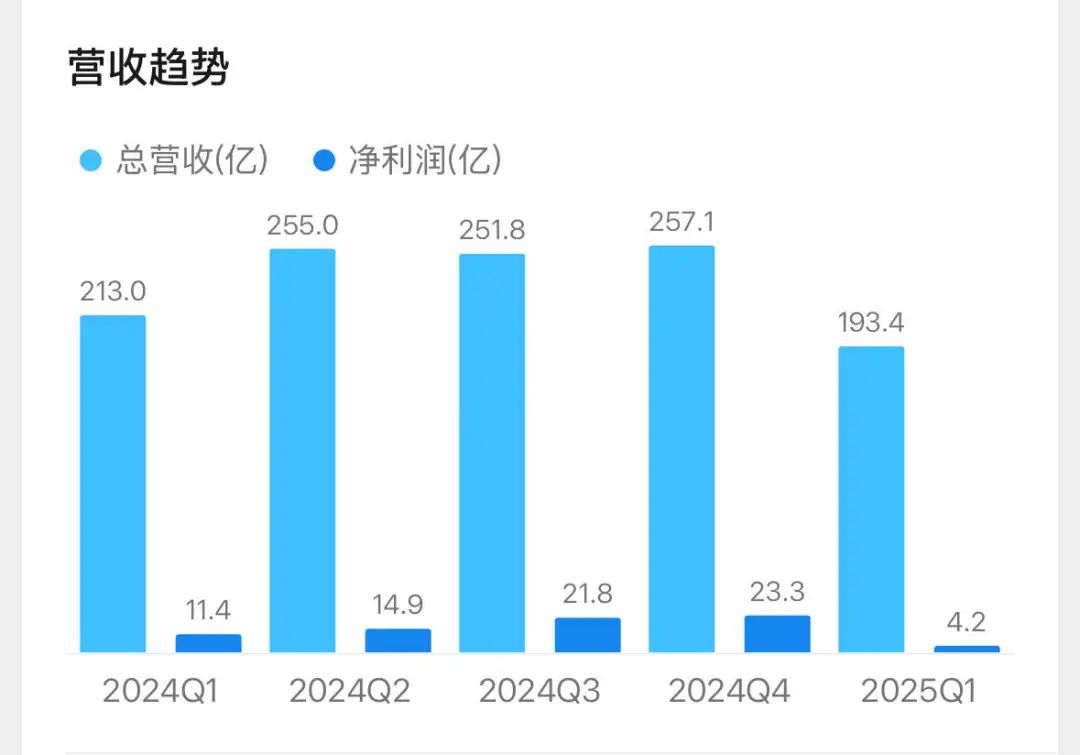

Quarterly deliveries declined 13% year-on-year to 336,681 units, marking Tesla's worst quarterly performance since 2022. Net profit stood at a mere $409 million, a 71% year-on-year drop, with other core financial indicators significantly underperforming expectations.

Even Tesla's Q1 financial report refrained from mentioning any expectations for a growth recovery in the automotive business, omitting the sentence "expects the automotive business to return to growth in 2025" from last year's Q4 report. Tesla cited difficulties in measuring the impact of global trade policy changes on the supply chain, cost structure, and demand.

Due to Tesla's "weak fundamentals and uncertain outlook" in Q1, British bank Barclays maintained its "sell" rating on Tesla and lowered its target price from $325 to $275.

Dan Ives, a long-time Tesla enthusiast and analyst at American investment bank Wedbush, has also started to waver, stating that due to Musk's political actions, Tesla's buyer base may permanently decrease by 15%-20%. Ives further noted, "We need to hear good news, and clearly, there will be no good news on the profitability front or financially for the rest of the year."

In response to Tesla's dismal performance, Gene Munster, managing partner of Deepwater Asset Management, even suggested that investors "best forget about 2025." He characterized this year's situation as "one-time" and anticipates it to set the stage for a significant rebound for Tesla in 2026 and beyond.

Indeed, in Tesla's growth journey, Musk has consistently demonstrated his ability to turn the tide at crucial moments. However, this time, faced with the lingering damage caused by the politicization of Tesla and the significant uncertainty shock triggered by the tariff war, the board must provide an account to all investors.

01

Losing Money Without Selling Carbon Credits

In Q1 of this year, Tesla's revenue declined 9% year-on-year to $19.335 billion, with automotive revenue falling 20% year-on-year to $13.967 billion.

Furthermore, the company's profitability significantly deteriorated. Q1 net profit was $420 million, a drop of over 70% from the same period last year. Adjusted earnings per share amounted to only $0.27, a 40% year-on-year decrease, significantly underperforming market expectations.

Notably, in Q1 of this year, Tesla generated $595 million in revenue from selling carbon credits, which became crucial in maintaining decent financial report data. Without this revenue, Tesla would have reported a loss-making quarter.

During the earnings call, Tesla explained that the first quarter of each year is typically the weakest, prompting Tesla to upgrade the Model Y, the world's best-selling car, in Q1. Four factories were shut down for several weeks, directly leading to a decrease in Q1 production, further impacting sales and revenue. Additionally, other promotional activities by Tesla also affected Q1 revenue and profits.

Of course, the most pivotal reason remains the "uncertainty" surrounding US government trade policies.

At the beginning of the financial report, Tesla emphasized that rapidly changing trade policies have adversely affected the global supply chain and Tesla's cost structure, with uncertainty in the automotive and energy markets continuously rising. Coupled with shifts in political sentiment, this is expected to significantly impact demand for Tesla products.

More critically, compared to other American manufacturers, Tesla, mired in the tariff quagmire, faces additional challenges. When Trump took office last year, Musk was his largest financial donor, and Musk has been one of his closest advisors since then.

Now, the politicization of Tesla poses a serious threat to the brand, evident in the first quarter of this year. Since the beginning of the year, violent and destructive acts against Tesla have occurred frequently, even sparking a global "Down with Tesla" protest movement.

This "close relationship" and dual identity create a challenging situation for Musk to navigate.

During the earnings call, Musk emphasized that lowering tariffs is generally a good idea to promote prosperity. He said he has always advocated for lower tariffs but cannot guarantee its effectiveness as "the decision on tariffs depends entirely on the President of the United States," Musk lamented.

However, there was also good news.

During the earnings call, Musk announced his plan to step down from the government efficiency department (DOGE) to focus on company affairs. Starting next month, he will devote more time to Tesla. Of course, if Trump needs him, he can still work on government duties for one or two days a week.

Influenced by this positive news, Tesla's share price subsequently rebounded, rising by over 5% at one point.

02

Autonomous Driving Fleet to Generate Revenue Next Year

Apart from political factors, the market's expectations for Tesla's long-term development stem primarily from its innovations in autonomous vehicles and other AI fields, such as humanoid robots and autonomous driving fleets, which constitute the core of Tesla's future growth.

Musk stated during the earnings call that the CyberCab project will commence trial operations in Austin, Texas, in June 2025, with the Model Y expected to be the model used.

A new low-cost model, potentially also used in the autonomous driving fleet, will commence production in the first half of 2025. It will combine features of the next-generation platform with the current platform and be produced on the same production line as the current model lineup.

Musk revealed that the initial size of Tesla's autonomous driving fleet will be "thousands of vehicles," with mass production officially commencing in 2026. By the second half of next year, the fleet size target will expand to millions of units, covering major cities across the United States.

Moreover, Tesla's autonomous taxis utilize a "general solution" rather than a "city-specific solution." This implies that once the fleet is implemented in a few cities, it can be swiftly promoted in all regions that have obtained regulatory approval.

However, the autonomous driving business will not materially impact the company's finances this year.

Tesla anticipates performance to start showing from the middle of 2026. By then, Tesla's hardware-related profits will accelerate alongside AI, software, and fleet-related profits, displaying an exponential growth trend, which can even be measured in weeks or months.

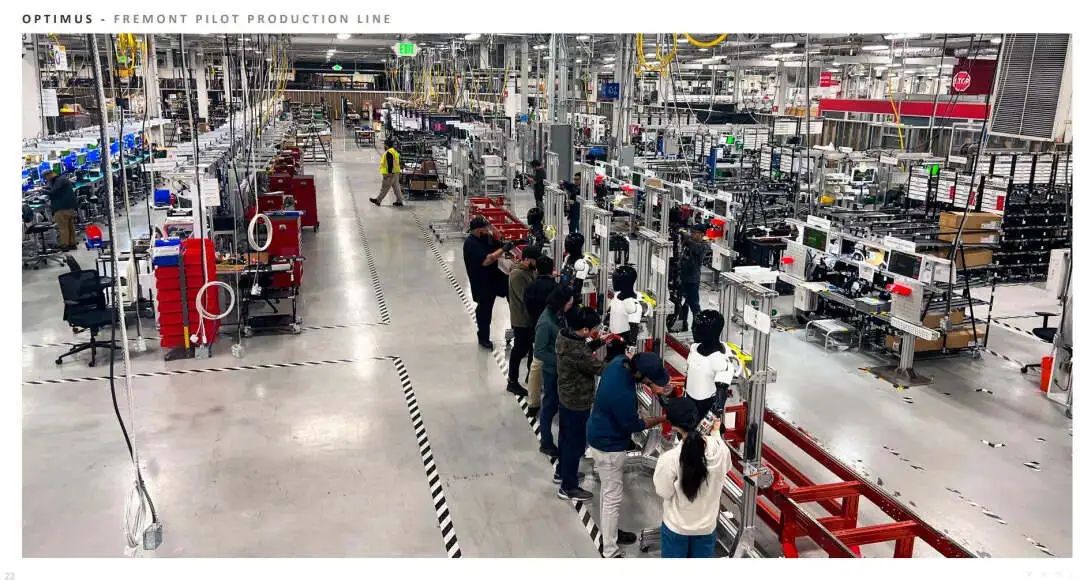

Regarding humanoid robots, Tesla commenced trial production of humanoid robots in Q1 of this year, with the first robot equipped with a 22-degree-of-freedom dexterous hand successfully rolling off the line at the Fremont factory.

It is anticipated that thousands of Optimus robots will be deployed in Tesla factories by the end of this year. Musk expressed confidence that within the next five years, the annual production of Optimus robots will reach millions of units.

As Musk noted, "A company that can produce truly useful autonomous humanoid robots and autonomous vehicles at low cost and on a large scale will have amazing value."

The ideal is enticing, yet there are numerous uncertainties. It remains to be seen how Musk will fulfill his promise.