Final Showdown: Monthly Sales of 30,000 Vehicles Set New Benchmark for Emerging Auto Brands

![]() 01/02 2025

01/02 2025

![]() 494

494

Happy New Year! Let's delve into the December 2024 sales figures and overall performance of various automakers, starting with the emerging players.

01 Xiaomi

Placing Xiaomi first is a testament to its success. Xiaomi Motors has indeed set a benchmark in the automotive industry, and its sales figures are equally impressive. From an initial sales target of 100,000 units to 120,000, and now to 130,000, Xiaomi has not only met but surpassed its goals. In December 2024, it delivered over 25,000 units, surpassing 20,000 units for three consecutive months, achieving sales of over 135,000 units in just nine months.

These are the fruits of Lei Jun's maiden voyage into automobile manufacturing. The company has set a benchmark in product development, marketing, production ramp-up, and supply chain management. For 2025, Xiaomi's delivery target is 300,000 units, averaging 25,000 units per month. Personally, I believe this target is conservative. The SU7, launched in March last year, remains popular, with a wait time exceeding four months. Additionally, the SU7's sibling model, the YU7, is set to launch this year. SUVs inherently sell better than sedans, and based on the prototypes released, the YU7's design is already captivating, suggesting a potential hit.

However, Xiaomi's biggest challenge is not orders but production capacity. The second phase of Xiaomi's automotive plant, with a total construction area of approximately 400,000 square meters, is under construction and expected to be completed in mid-June 2025, with production commencing as early as July or as late as August. By then, the combined annual production capacity of Xiaomi's Phase I and Phase II plants will reach 300,000 units. Again, 300,000 is not Xiaomi's limit but the plant's. I am confident Xiaomi will overcome this challenge.

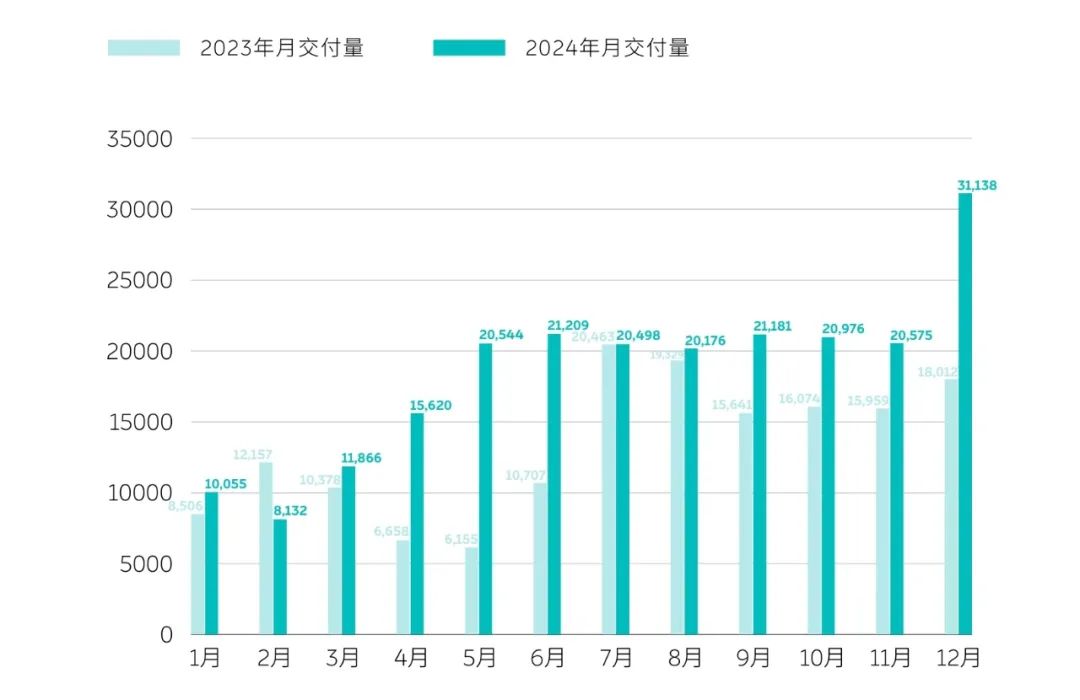

02 NIO

In December 2024, NIO delivered 31,138 vehicles, setting a new record. Among them, 20,610 were from the NIO brand and 10,528 from the Ledao brand. For the entire year of 2024, NIO delivered a total of 221,970 new vehicles, including 201,209 from the NIO brand and 20,761 from the Ledao brand. Achieving annual sales of over 220,000 units in 2024 was within NIO's expectations. The Ledao brand also delivered over 10,000 units this month, as scheduled. Overall, it was a satisfying end to the year.

With the unveiling of the ET9 and the first Firefly vehicle, NIO's product matrix is now complete, covering a price range from tens of thousands to 800,000 yuan. However, competition will intensify in 2025. Amidst growing internal competition, NIO must find ways to further boost sales, address the issue of ramping up Ledao's production capacity, and navigate the uncertainties posed by the unsuccessful launch of the Firefly. Chairman Li Bin has set a target of doubling NIO's total sales in 2025 to around 440,000 units and achieving profitability by 2026. NIO's performance in 2025 is worth anticipating.

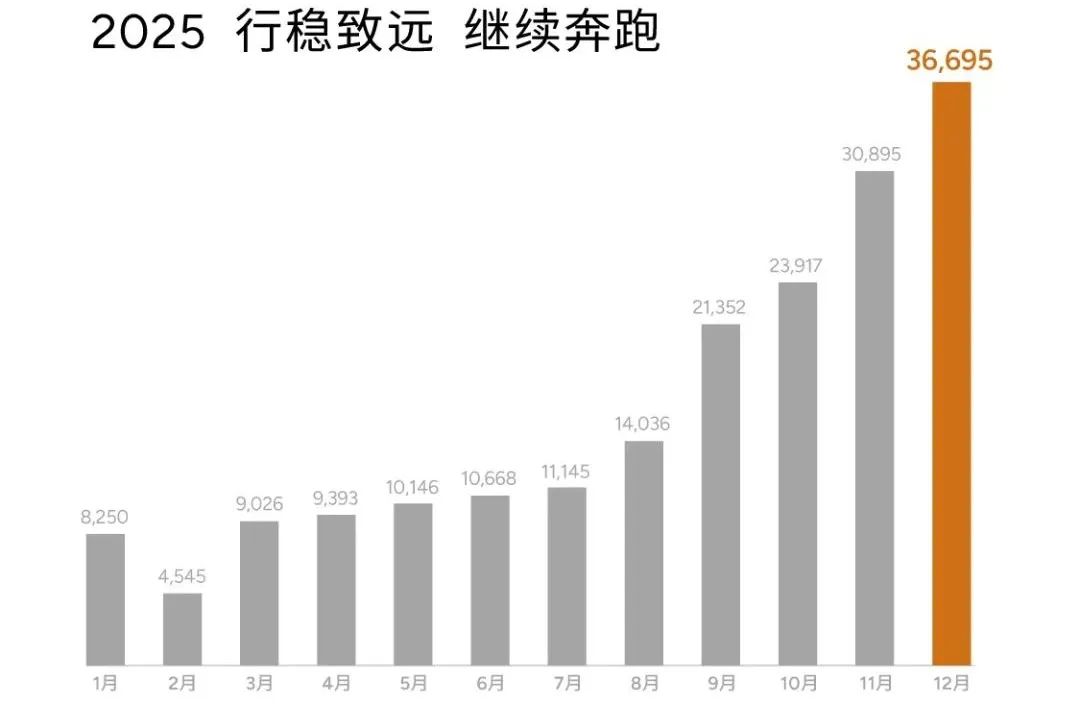

03 XPeng

XPeng delivered 36,695 vehicles in December 2024, setting a new company record. XPeng truly rebounded in the second half of 2024. It gained a deeper understanding of its products and established a unique approach. Additionally, it significantly improved its supply chain management and marketing strategies. The MONA M03 and P7+ are prime examples. The M03, launched on August 27, delivered over 10,000 units in September, reaching the 50,000-unit milestone just four months after its launch and delivering over 15,000 units in December. The P7+, launched on November 7, rolled off the production line with 10,000 units in just 20 days, delivering over 7,000 units in 23 days and over 10,000 units in December. XPeng can not only create hit products but also ensure their production and delivery. Competitors would do well to study XPeng's success.

XPeng delivered a total of 190,068 vehicles in 2024. While this number may not seem impressive, the momentum is strong, so I am optimistic about XPeng's prospects for 2025. In 2025, XPeng will launch multiple new models equipped with its AI system technology, with major new products and updates expected in almost every quarter. Additionally, 2025 will be a year of accelerated international expansion for XPeng. Currently, it has entered 30 countries and regions globally. Chairman He Xiaopeng has stated that the company aims to enter over 60 countries and regions by the end of next year. In the next ten years, half of XPeng's sales are expected to come from overseas, with the goal of becoming the leading Chinese mid-to-high-end new energy vehicle brand in overseas markets. According to media reports, XPeng's sales target for 2025 is 350,000 units, or an average of around 30,000 units per month. Considering XPeng's plans to refresh its existing product line, this target should be achievable, and perhaps even surpassed.

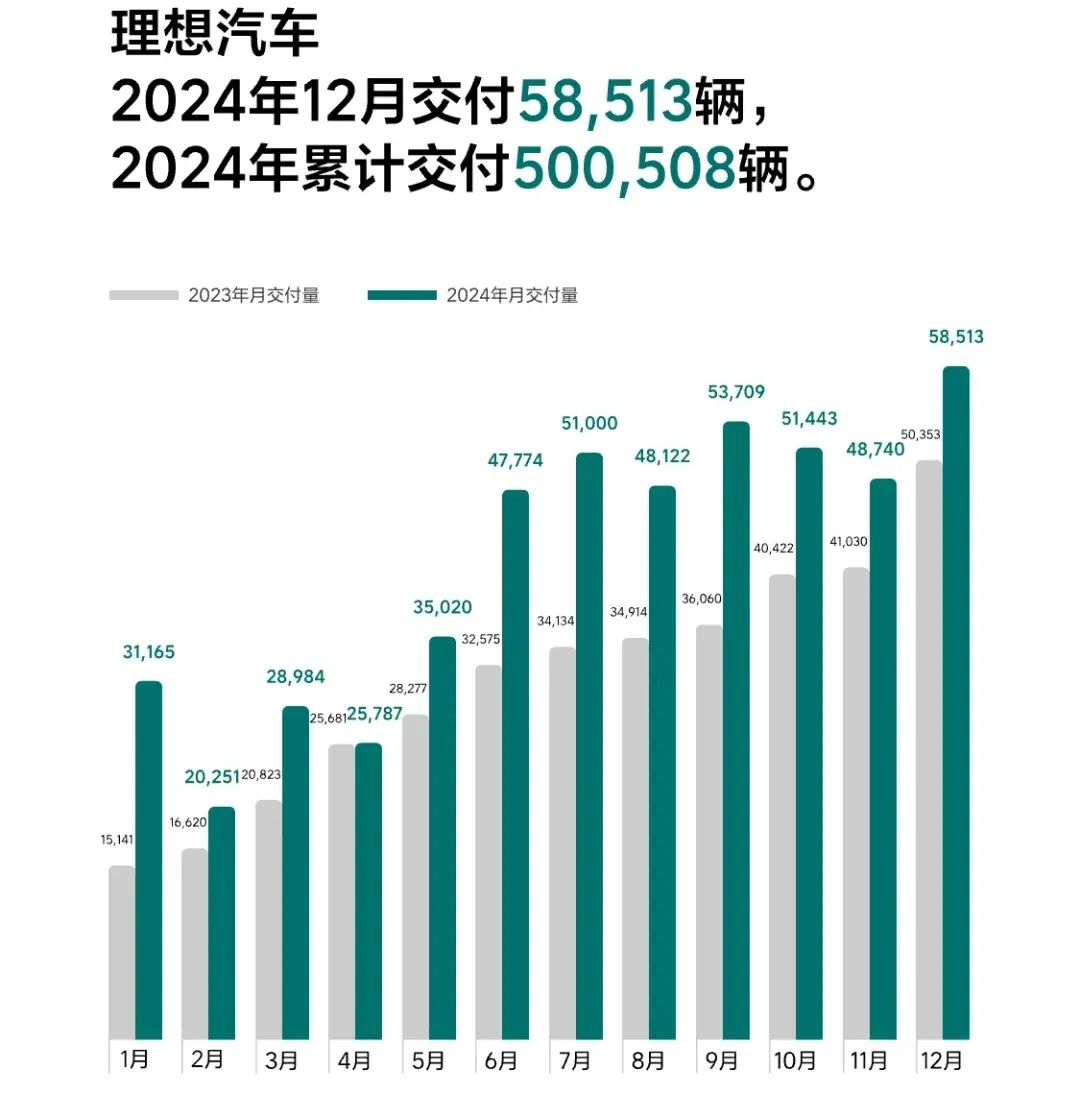

04 Li Auto

Li Auto continues to be the fastest-growing player. In December 2024, it delivered 58,513 vehicles, accumulating 500,508 vehicle deliveries for the year, successfully meeting its established target with remarkable stability. In just five years, Li Auto has set an industry record as the fastest luxury automotive brand to achieve annual sales of 500,000 units in the Chinese market. Li Auto's execution capabilities are truly trustworthy. For 2025, Li Auto projects sales of 700,000 units, slightly less than the 800,000-unit target set by Li Xiang in January 2024. This indicates that after the launch of the MEGA model, Li Auto has become more cautious in its future planning. Another significant achievement for Li Auto in 2024 was its transition from following to surpassing in intelligent driving, truly entering the top three in the industry. With its end-to-end approach, Li Auto has integrated high-speed NOA and urban NOA into its intelligent driving system, moving towards true "door-to-door" and "point-to-point" navigation.

Next year will be crucial for Li Auto. Internally, the company will directly launch its pure electric vehicle series, and its success will significantly impact Li Auto's future direction. Externally, more automakers are adopting extended-range technology, and others have already adopted the essence of Li Auto's "refrigerator, TV, and sofa" approach. In 2025, Li Auto's first-mover advantage in extended-range technology may diminish, and it will face intense competition. Of the 700,000-unit sales target for 2025, approximately 500,000 to 550,000 units are expected to come from extended-range vehicles, leaving the remaining 150,000 to 200,000 units for pure electric vehicles. Li Auto's pure electric vehicle series in 2025 must succeed; failure is not an option. I am eager to see how Li Auto will play its cards. Regarding charging infrastructure, Li Auto originally planned to install 2,000 supercharging stations and 10,000 charging piles by the end of 2024. However, as of December 2024, Li Auto had already put into use 1,727 supercharging stations with 9,100 charging piles nationwide. While the target was not fully met, the shortfall was minimal, and continued efforts in the coming year should suffice.

05 Leopaard

Leopaard was undoubtedly the dark horse of 2024. In December 2024, Leopaard delivered 42,517 vehicles in a single month, surpassing 40,000 units for two consecutive months and accumulating nearly 300,000 deliveries for the year, exceeding its annual target. Initially, no one could have predicted Leopaard's rapid rise. Leopaard has carved out a unique niche, offering products with the quality of vehicles priced at over 200,000 or even 300,000 yuan but at a price of just over 100,000 yuan. This pricing strategy makes Leopaard a true price disruptor. If compared to another industry, Leopaard would be the Redmi of the smartphone world. However, Leopaard's approach is not easily replicable by others, as it could lead to self-destruction.

Leopaard's biggest challenge currently lies in software and intelligent technology. In 2025, Leopaard should strive to improve its intelligence level, whether in the cabin or in intelligent driving, to match that of NIO, XPeng, and Li Auto. If Leopaard can align its capabilities in these areas, its competitiveness will increase significantly. Soon, Leopaard will unveil its new LEAP3.5 architecture, and the first global model from its new B series, based on this architecture, will go on sale in the first quarter of 2025. In 2025, Leopaard will aim for annual sales of 500,000 units, beginning its journey towards industry leadership.

06 Nezha

Sales figures not disclosed. End.