Will the Price War Continue in 2025?

![]() 01/03 2025

01/03 2025

![]() 456

456

Reflecting on and Bidding Farewell to 2024

Author | Wang Lei, Liu Yajie Editor | Qin Zhangyong

As 2024 draws to a close, the fierce competition among automakers has come to an end for the year.

Looking back at the year, the automotive industry has been rife with uncertainties. Some players exited early, while others fell short of expectations, and a few even dropped out of the race entirely.

However, in terms of sales, 2024 was a year of rapid progress. Lei Jun, with Xiaomi's all-in approach, created a domestic auto market miracle. NIO, XPeng, and Li Auto, once ridiculed for lagging behind, all achieved monthly sales of 30,000 vehicles and are gradually regaining momentum. The second-generation innovators from traditional automakers are also vying to break through, with sales on the rise.

BYD, the leader in new energy vehicles, surpassed 4 million sales, becoming the first global new energy automaker to achieve this milestone.

Yet, amidst the rising sales, some players have fallen by the wayside. Standing firm in 2025 will be more challenging than anticipated.

01 Monthly Sales of 30,000 Become a Watershed for New Auto Makers

To celebrate the end of the year, automakers typically push sales in the final quarter, with many new auto makers setting new highs.

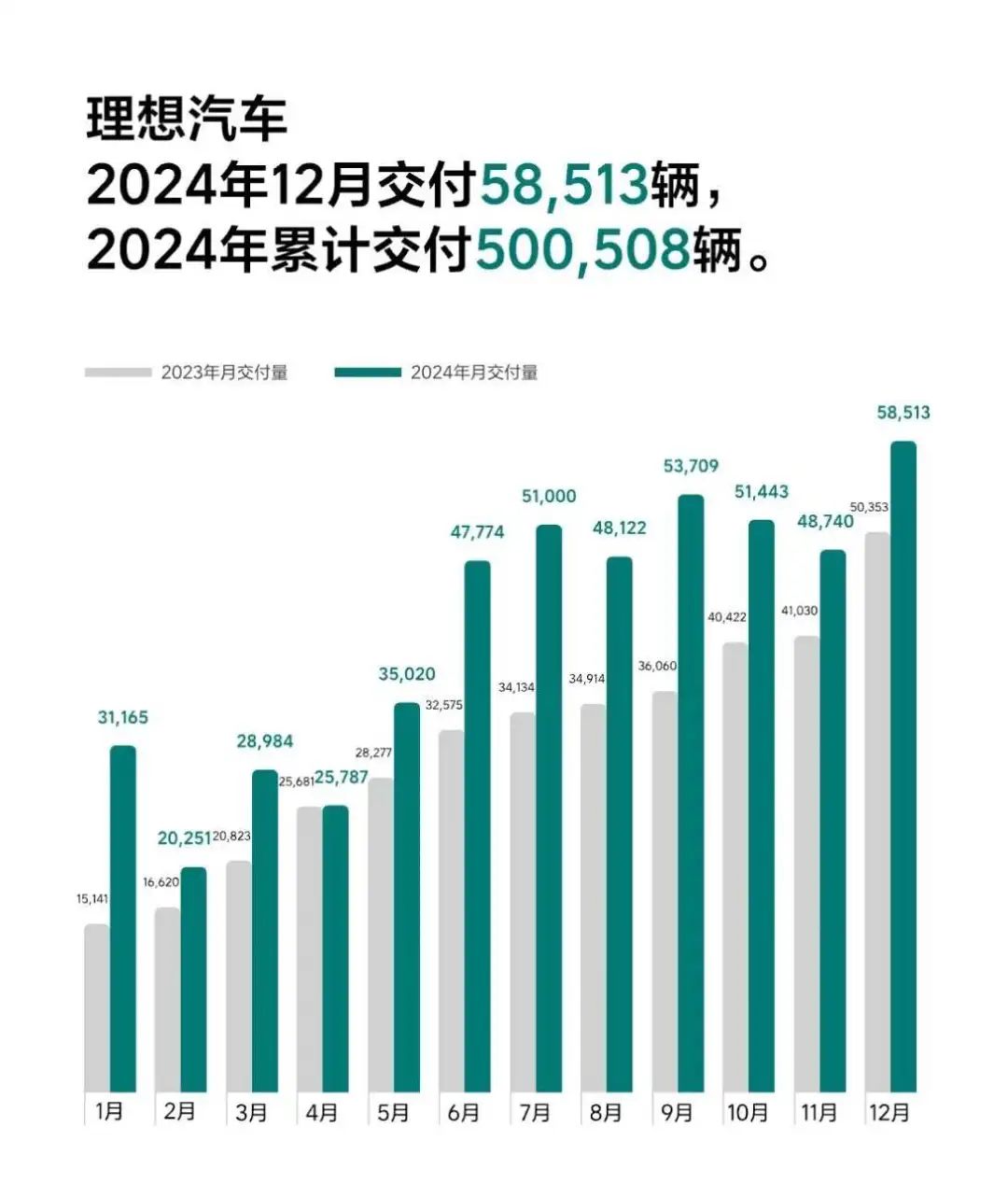

Li Auto was the first to act, submitting its 2024 results before the New Year's Eve bell, even holding a live stream to witness the delivery of the 500,000th vehicle.

On December 31, 2024, Li Auto announced that its annual cumulative deliveries reached 500,508 vehicles, a year-on-year increase of 33.1%, with a cumulative historical sales volume of 1,133,872 vehicles. Simultaneously, December deliveries set a new monthly high with 58,500 new vehicles delivered, up 16.2% year-on-year and 20.1% month-on-month.

Not only did Li Auto meet its annual sales target of 500,000 vehicles at the buzzer, but it also set an industry record as the fastest luxury car brand to achieve 500,000 annual sales in the Chinese market. With a KPI completion rate of 100.1% and an average monthly delivery volume of over 40,000 vehicles, Li Auto solidly holds the top spot in sales among new forces.

It's worth noting that this sales target was adjusted, down from 800,000 to 500,000, indicating that Li Auto faced considerable pressure in 2024. For example, the MEGA project got off to a rocky start, delaying the entire electric vehicle business.

Fortunately, the launch of Li L6 significantly boosted sales, leading to a rapid recovery in the second half of the year. In 2025, Li Auto's electric vehicle series is expected to be a major highlight.

Moreover, riding the wave of "extended-range" technology, Leapmotor has emerged as a dark horse in the auto market this year. As early as November 2024, Leapmotor announced that its total deliveries in 2024 exceeded 250,000 vehicles, achieving its annual sales target ahead of schedule. In December, Leapmotor delivered 42,517 vehicles in a single month, up 128% year-on-year, setting a new monthly delivery record for seven consecutive months.

This brought Leapmotor's annual deliveries close to 300,000 vehicles, doubling its 2023 sales and exceeding its 2024 sales target with a completion rate of 117.48%.

Leapmotor's popularity isn't just due to its correct direction; its "affordable and abundant" product strategy also gives it the confidence to enter the finals.

Leapmotor isn't the only dark horse in new auto manufacturing in 2024. With the super hit effect of Xiaomi SU7, Xiaomi has also become one of the few new players to "celebrate early," achieving its goal of delivering over 130,000 vehicles in a year three days ahead of schedule.

On January 1, Lei Jun announced Xiaomi's annual performance on social media: Xiaomi delivered over 135,000 vehicles in 2024, with a delivery target of 300,000 vehicles for 2025.

Reflecting on the emotional journey of vehicle deliveries over the past year, Lei Jun admitted that the pressure was immense in the early stages of car manufacturing. Initial research predicted monthly sales of only 2,000 vehicles, but Lei Jun still set an internal target of selling 70,000 vehicles in 2024, with material preparation for the supply chain set at 76,000 vehicles. "Thinking about this number today is quite exaggerated."

Indeed, Xiaomi achieved annual sales of 135,000 vehicles with just one model, the SU7, setting a new record for new force automakers. While this performance lags behind other new auto makers, it's well-known that Xiaomi lacks orders, not production capacity.

In 2025, Lei Jun still has a backlog of cars to deliver. Roughly calculated, as of December 31, 2024, there are still 130,000 Xiaomi SU7s awaiting production, a bittersweet situation.

Next, with Xiaomi's second model, the Xiaomi YU7, set to launch in the middle of this year, and the second phase of Xiaomi's factory set to come online, Lei Jun's 300,000-vehicle target may be modest.

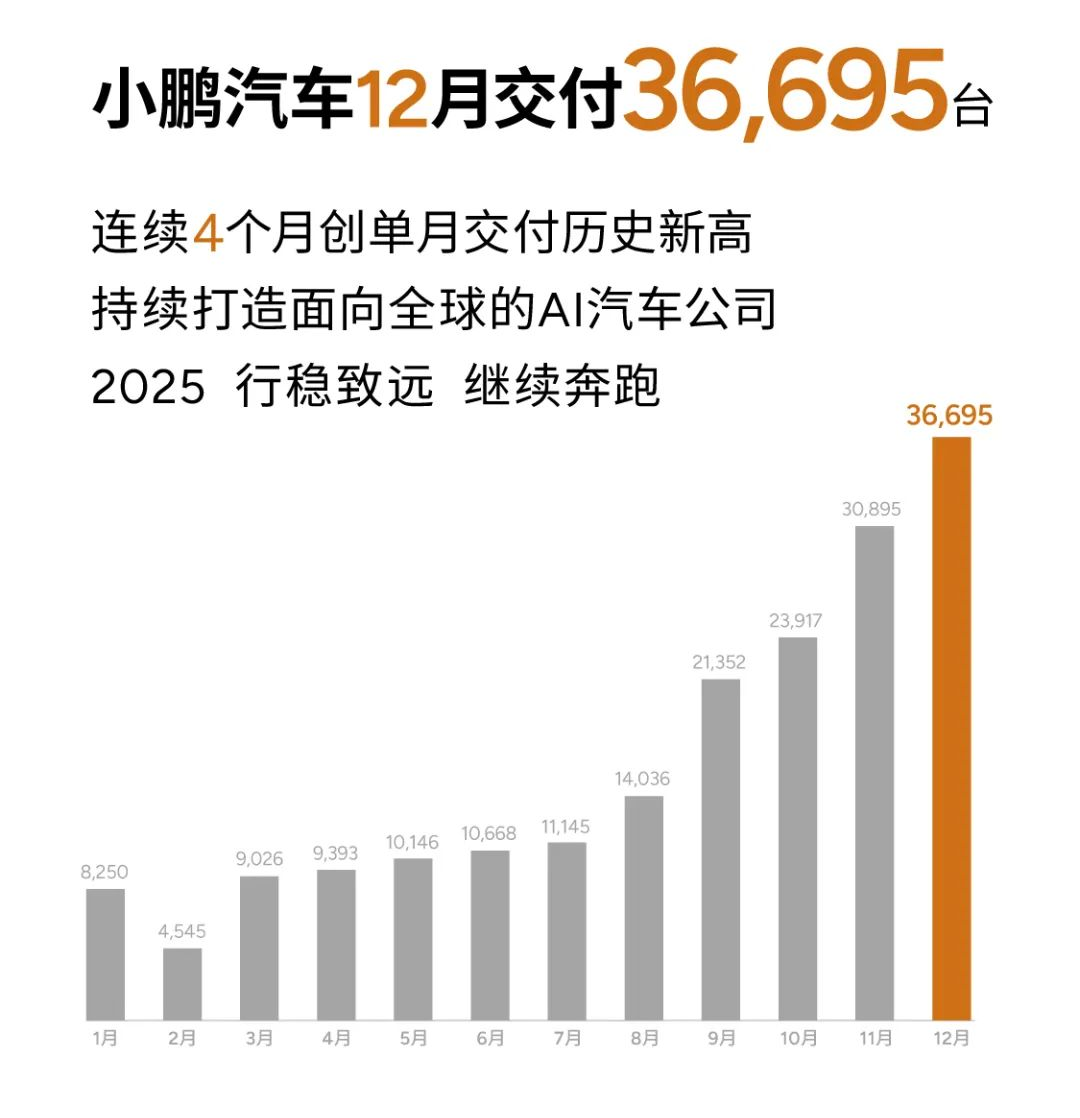

XPeng finally experienced a "bottoming out and rebound" in 2024. In the second half of the year, XPeng successively launched two hit models, the MONA M03 and P7+, with monthly deliveries reaching a peak of 30,000 vehicles.

In December, XPeng pushed further, with monthly deliveries reaching 36,695 vehicles, up 82% year-on-year and 19% month-on-month. Among them, sales of the MONA M03 exceeded 15,000 vehicles, and sales of the P7+ exceeded 10,000 vehicles. This marked a new monthly delivery record for four consecutive months, with cumulative annual deliveries exceeding 190,000 vehicles.

However, XPeng fell short of its annual sales target. Its 2024 sales target was 200,000 vehicles, aiming for double-digit growth, but the annual sales achievement rate was 95%.

Nonetheless, He Xiaopeng revealed in an internal letter that there will be new products and upgraded models every quarter in 2025, with extended-range models also on the horizon. It's certain that 2025 won't be worse than 2024.

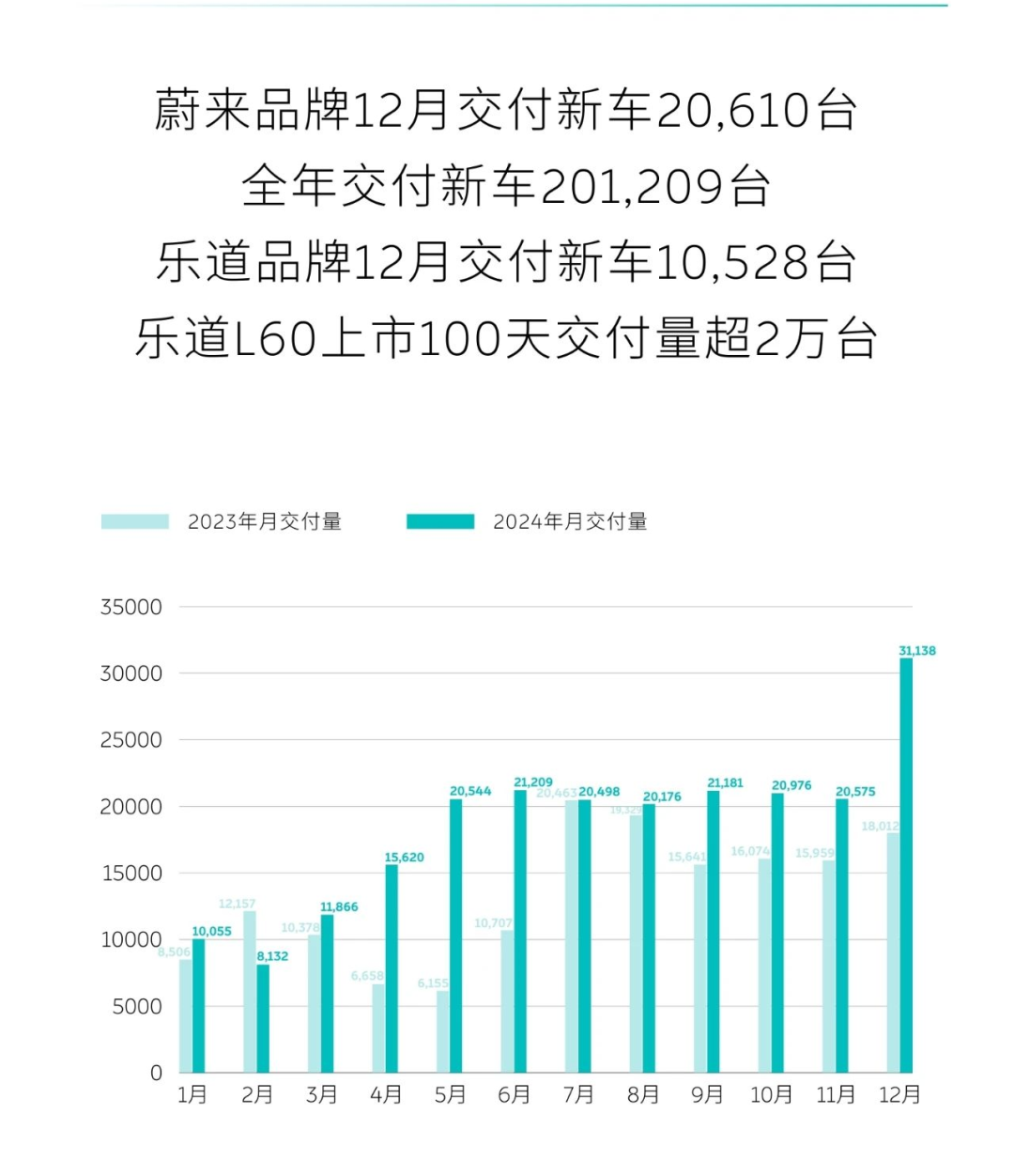

NIO has also made a comeback, finally joining the 30,000-vehicle club after years of being stuck at around 20,000 deliveries per month. In 2024, NIO experienced a curve of low sales in the first half and high sales in the second half.

The key to the sales increase from "20,000 NIOs" to "30,000 NIOs" was the accelerated delivery of Lextus, NIO's budget brand. In December 2024, NIO delivered 31,138 new vehicles, setting a new monthly high with over 30,000 vehicles delivered, up 51.3% month-on-month and 72.9% year-on-year. Lextus successfully fulfilled its promise of delivering over 10,000 vehicles per month, selling 10,500 vehicles.

For the full year 2024, NIO delivered a total of 221,970 new vehicles, up 38.7% year-on-year. Among them, the NIO brand delivered 201,209 new vehicles, up 25.7% year-on-year, while the Lextus brand delivered 20,761 new vehicles. To date, NIO has cumulatively delivered 671,564 new vehicles.

Compared to other new auto makers, NIO took a relatively difficult route by focusing on high-end electric vehicles. However, 2025 will be smoother for NIO, with Lextus starting to ramp up production and the third brand, Firefly, launching small cars, both of which will significantly increase sales.

At the annual media briefing, Li Bin stated that NIO's overall sales target for 2025 is to double sales to 440,000 vehicles.

02 Second-Generation Innovators Secure Funding and Prepare for 2025

While new forces maintain their momentum, the next generation of traditional automakers is also breaking through.

The most successful players are those partnered with Huawei. Official data shows that Hongmeng Zhixing delivered a cumulative total of 445,000 vehicles in 2024, with 49,474 vehicles delivered in December alone, setting a new monthly delivery record.

Not only are sales solid, but the average transaction price is also unmatched by ordinary automakers. Since April this year, the average transaction price of Hongmeng Zhixing has exceeded 360,000 yuan for eight consecutive months.

AITO, a collaboration between Huawei and Thalys, has been the most impressive performer across all sectors.

In just 12 months after its launch, the AITO M9 surpassed 200,000 bookings, maintaining its position as the monthly sales champion in the Chinese market for vehicles priced above 500,000 yuan for nine consecutive months. Yu Chengdong also revealed in a recent live stream that the sales volume of the AITO M9 not only ranks first but also exceeds the combined sales of the second to twentieth places, with sales approaching 20,000 vehicles per month.

The new AITO M7 series delivered 14,150 vehicles in December, with annual cumulative deliveries of 197,000 new vehicles. Thalys also benefited, with total new energy vehicle sales of 426,900 vehicles in 2024, a year-on-year increase of 182.84%. Thalys made over 4 billion yuan in profits in the first three quarters of 2024, with a gross margin of over 20%.

The other three sectors also performed well, with the Enjoy S9 series delivering 7,494 vehicles, maintaining its position as the monthly sales champion for luxury electric sedans priced above 400,000 yuan for five consecutive months. The ZHIJIE R7 series delivered a cumulative total of 28,969 vehicles. At the end of November, Huawei and JAC unveiled the luxury car ZunJie S800, which received 2,108 orders within 48 hours of its launch.

These achievements were made just one year after the establishment of Hongmeng Zhixing. Its success has inspired many traditional automakers to consider transformation, although the window of opportunity has now passed. Yu Chengdong said, "Many automakers want to collaborate with us, but I'm sorry, I don't have enough resources."

Unlike those seeking external assistance, some automakers have chosen to make internal changes to keep up with the trend of new energy vehicles.

In November, Geely's two brands, Zeekr and Lynk & Co., announced their merger, with the new company named "Zeekr Technology Group." The merged company plans to achieve annual sales of one million vehicles within two years.

The total sales of these two brands in 2024 were within expectations. Separately, Zeekr delivered 222,100 new vehicles, up 87% year-on-year. In December, it delivered 27,200 vehicles, up 102% year-on-year. Based on the previously announced annual sales target of 230,000 vehicles, Zeekr achieved a target completion rate of 96.5%.

Lynk & Co. delivered 285,400 new vehicles, up nearly 30% year-on-year. In December, it sold 26,000 vehicles across its entire lineup, with sales of new energy vehicles reaching 14,400, surpassing half of total sales.

To achieve the goal of one million annual sales, Lynk & Co. will launch three new plug-in hybrid models in 2025, while Zeekr will introduce a large vehicle based on the HAO architecture.

Compared to Zeekr, Avita has been somewhat sluggish. In 2024, Avita sold 73,606 vehicles, up about 100% year-on-year.

Since launching its extended-range model and the new Avita 07, Avita has achieved monthly sales of over 10,000 vehicles for three consecutive months. In the first nine months, Avita's average monthly sales were less than 5,000 vehicles. Naturally, it did not meet its sales target of 90,000 vehicles for 2024.

Although still incurring losses, Avita successfully completed its Series C funding round at the end of 2024, raising over 11 billion yuan. According to Tianyancha data, Avita's fundraising amount will be the largest in the new energy vehicle industry.

After the funding round, Avita President Chen Zhuo announced that the company had begun preparations for an IPO, aiming for a listing in 2026.

Having tasted the sweetness of extended-range models, Avita has set its sales target for 2025 at 220,

In December, BYD achieved a new sales milestone, selling 514,800 vehicles, including 509,400 passenger cars. Consequently, BYD's annual sales volume was solidified at an impressive 4.272 million vehicles, with 4.25 million being passenger cars. Notably, overseas sales surpassed 417,200 vehicles, accounting for approximately 10% of total sales.

BYD has cemented its position as the world's first new energy vehicle manufacturer to surpass 4 million annual sales, significantly outpacing Tesla.

Geely Auto also exceeded its annual sales target, recording a total sales volume of 2.1766 million vehicles, marking a 32% year-on-year increase and achieving 109% of its annual sales KPI. Among these, new energy vehicle sales reached 888,200, a staggering 92% increase compared to the previous year.

Breaking down Geely's sales by brand, the main Geely brand sold 1.669 million vehicles, Yinhe series sold 494,000, and Zhongguoxing series sold 448,000. Additionally, the Lynk & Co. brand sold 285,400 vehicles, Zeekr sold 222,100, and overseas exports totaled 403,900, representing a year-on-year increase of over 53%.

Changan Automobile was the first among the "traditional four" automakers to announce its sales figures. In 2024, its cumulative sales exceeded 2.68 million vehicles, marking five consecutive years of positive year-on-year growth and setting a new seven-year high. Notably, Changan's independent brand sales reached 2.23 million vehicles, ranking second only to BYD.

Furthermore, Changan Automobile sold 730,000 new energy vehicles, a year-on-year increase of over 50%, and exported 530,000 vehicles, up more than 47% compared to the previous year.

For 2025, Changan Automobile has set a clear "3311" target: achieving a total sales volume of 3 million vehicles, revenue of 300 billion yuan, selling 1 million independent new energy vehicles, and exporting 1 million vehicles.

Chery Automobile recorded annual sales of 2.6039 million vehicles in 2024, up 38.4% year-on-year. Among these, new energy vehicle sales reached 583,600, a remarkable 232.7% increase, while exports totaled 1.1446 million vehicles, a 21.4% year-on-year growth.

Moreover, Chery Group's annual revenue hit a new high of 480 billion yuan, up over 50% compared to the previous year, marking both revenue and sales growth in 2024.

SAIC Motor Group sold a total of 4.013 million vehicles wholesale and delivered 4.639 million vehicles to end customers in 2024. New energy vehicle sales reached 1.234 million, a 9.9% increase year-on-year, setting a new historical high.

Great Wall Motors maintained stable performance with annual sales of 1.2333 million vehicles in 2024, a modest 0.21% year-on-year increase. However, the proportion of new energy vehicle sales and overseas sales began to rise significantly.

Sales of new energy vehicles reached 321,800, up 22.82% year-on-year, while overseas sales totaled 453,100 vehicles, a 43.39% increase compared to the previous year, both setting new records. Sales of models priced above 200,000 yuan also surged, reaching 309,600, a 37.13% year-on-year increase.

The rise of Great Wall Motors' new energy vehicles can be attributed to significant advancements in intelligence in 2024. The WEY Blue Mountain, equipped with a cutting-edge intelligent driving system, emerged as a key sales driver. WEY sold 8,808 vehicles in December, a 150.8% year-on-year increase, with 8,057 being Blue Mountain vehicles, up 214.24%.

As sales in the Chinese automotive market continue to soar, industry competition trends are constantly evolving. The intensifying competition in intelligence is poised to escalate in 2025, potentially marking a historical turning point for the Chinese auto market this year.