Four New Energy Vehicle Companies Achieve 2024 Sales Targets: Who Will Set the New Year's Flag First?

![]() 01/03 2025

01/03 2025

![]() 588

588

Bianniushi News Today

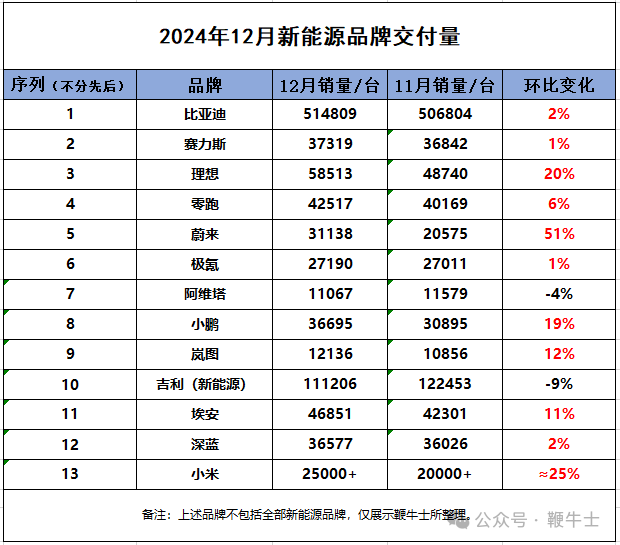

On January 2, news emerged that leading new energy vehicle companies have released their sales data for December 2024 and the entire year. Based on these figures, Bianniushi has compiled two key data tables for this issue: one detailing the month-on-month sales change in December to assess progress, regression, or stagnation compared to November; the other illustrating the completion rate of annual sales targets to see if the goals set at the beginning of the year were met.

First, let's delve into the month-on-month sales change in December.

It's important to note that IM Motors has only released its annual sales data, omitting the December figures.

Among the 13 automakers surveyed by Bianniushi, 11 recorded month-on-month growth, indicating a generally positive performance. However, Thalys, Zeekr, and Deep Blue saw relatively modest growth rates of only 1% or 2%. Whether these companies are satisfied with such performance is a matter of their own judgment, given the tumultuous year that saw several automakers on the brink of collapse, with some even declaring bankruptcy.

Due to BYD's substantial sales base, achieving growth is inherently more challenging, making it a unique case.

NIO stood out with a leapfrog growth in December, vaulting from the "20,000-unit club" to the "30,000-unit club," setting a new high with a 51% month-on-month increase. Notably, Ledao contributed one-third of this growth (10,528 units), doubling from the previous month and emerging as a new force.

Additionally, Li Auto, Xpeng, and Xiaomi also posted impressive results, with month-on-month growth rates hovering around 20%.

AITO and Geely, on the other hand, experienced varying degrees of month-on-month declines. AITO announced the completion of over RMB 11 billion in Series C funding in mid-December, positioning itself well for future growth.

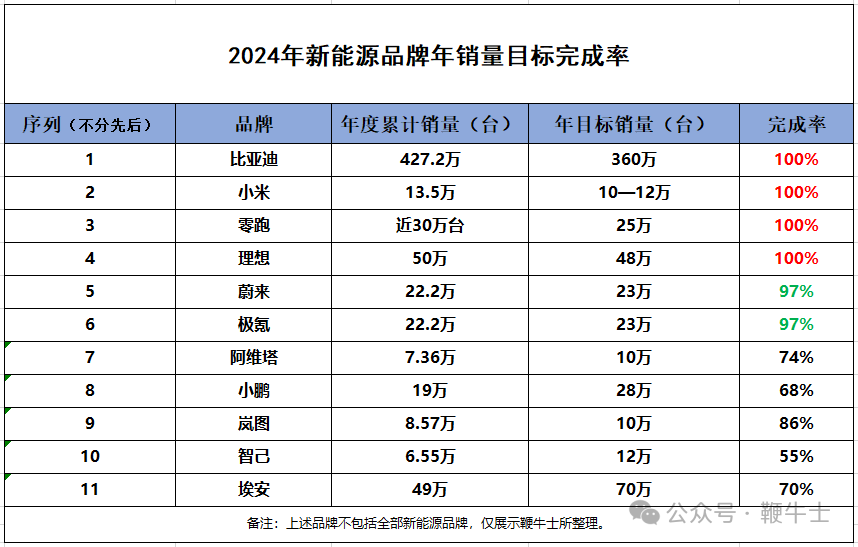

Now, let's examine how well automakers fulfilled their annual sales targets, who kept their promises, and who fell short.

Out of the 11 automakers surveyed, only four – BYD, Xiaomi, Leap Motor, and Li Auto – met their targets, demonstrating consistency between words and actions.

It's worth highlighting that BYD, Xiaomi, and Leap Motor had already achieved their targets in November. Li Auto adjusted its target multiple times in 2024, finally settling on 480,000 units, down from the initial 800,000 set at the beginning of the year.

NIO and Zeekr present an interesting case, sharing the same annual sales target and completion rate. After verification, the data proved accurate. Both companies achieved a completion rate of 97%, very close to their targets, which is acceptable.

The remaining five automakers are still far from their targets, suggesting they may have been overly optimistic in their market assessments at the start of the year.

As we move forward into the new year, it's time for automakers to set new goals. After a year of intense market competition, automakers in 2025 are expected to set more reasonable targets based on market trends and brand realities.

Finally, let's see which automakers have the confidence to announce their 2025 sales targets first and which are still in the planning stage.

Leap Motor: Announced an annual target of 500,000 units, double its previous target, showing absolute confidence.

Li Auto: Provided current delivery guidance of 700,000 units for 2025, reflecting a conservative approach.

AITO: Set a target of 220,000 units, more than doubling its previous target, demonstrating absolute confidence.

Xpeng: Initially forecasted 360,000 units, adopting a conservative approach.

NIO: Has not officially announced its target, but Li Bin has repeatedly stated that "NIO will double its sales by 2025," implying a target of no less than 440,000 units. If this plan remains unchanged, it signifies confidence.

Xiaomi: Set an annual target of 300,000 units, more than doubling its 2024 sales. However, considering Xiaomi only started deliveries in April 2024 and is still in a production ramp-up transition period, its 2025 target is relatively conservative.

Geely: Aimed for 2.71 million units, representing approximately 25% growth over 2024 sales, adopting a conservative approach.

Zeekr: Set a target of 320,000 units, also reflecting a conservative strategy.

BYD, IM Motors, Deep Blue, Hoval, Thalys, and Aion have not yet announced their 2025 sales targets.