Musk's Fortune Saved by the Chinese Market: Tesla's Survival and His Wealth Safeguarded

![]() 01/05 2025

01/05 2025

![]() 601

601

In 2024, numerous Chinese new energy vehicle companies announced encouraging growth rates. However, Tesla, the pioneering force in new energy vehicles, faced a challenging year, experiencing its first annual sales decline. Fortunately, Tesla's sales in the Chinese market grew, mitigating the impact of the global downturn; had it not been for this market, the decline would have been even more pronounced.

Tesla's performance in the Chinese market in 2024 was truly remarkable, particularly during the second half of the year when sales surged, reflecting the strong recognition among Chinese consumers.

Especially from September onwards, Tesla's weekly sales in China continued to rise, peaking at over 20,000 units, surpassing BBA in the luxury car market to claim the top spot.

This sustained growth propelled Tesla's monthly sales in the Chinese market to new heights. In December, Tesla achieved a record monthly sales figure of 94,000 units, ranking fifth in China's new energy vehicle market.

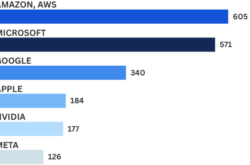

Overall, Tesla sold 657,200 units in the Chinese market, marking an increase of over 8% from the previous year's 604,000 units. In contrast, Tesla's global sales stood at 1.789 million units, a slight decline from the previous year's 1.808 million units. Clearly, without the growth in the Chinese market, Tesla's decline would have been more severe.

Among the top six new energy vehicle sales in China, with monthly sales exceeding 80,000 units, are BYD, Geely Automobile, SGMW, Chery Automobile, Tesla, and Changan Automobile. This data underscores the robust growth of traditional automakers like Geely, SAIC, Chery, and Changan in the new energy vehicle market, as consumers increasingly choose these established brands.

Among new auto manufacturers, Li Xiang stands out as the strongest performer. In December, Li Xiang achieved a monthly sales volume of 58,600 units, solidifying its leading position in the new auto manufacturer segment, with other competitors lagging behind.

It's worth noting that all models currently sold by Li Xiang are priced above 200,000 yuan, positioning it as the only new auto manufacturer that can compete directly with Tesla. Other automakers primarily rely on models priced below 100,000 yuan to drive sales, creating a significant pricing gap compared to Li Xiang and Tesla.

These data also highlight the challenging situation facing new auto manufacturers. Despite their relentless challenges to Tesla, they lag significantly in market competitiveness. Even Li Xiang, the most successful new auto manufacturer, has a considerable gap with Tesla and traditional automakers.

Traditional automakers and Tesla are fiercely competing for the new energy vehicle market, intensifying pressure on new auto manufacturers. Towards the end of 2024, two new auto manufacturers encountered difficulties, causing consumers to become more cautious about low-sales new auto brands. This year, consumers may further shun those with poor sales performance, potentially leading to bankruptcies among some new auto manufacturers.

Tesla's exceptional sales in the Chinese market have exacerbated the pressure on new auto manufacturers. To break the sales bottleneck, many new auto manufacturers plan to launch models priced above 100,000 yuan in the first half of this year, targeting the low- to mid-end market to boost sales. In the automotive industry, a substantial sales scale is crucial, and NIO serves as a model for others to emulate.

After years of development, the global new energy vehicle industry appears to have reached a pivotal point. Automakers must innovate to break through sales ceilings and avoid bankruptcy. As 2025 begins, many automakers have initiated a new round of price wars. Leaders aim to capitalize on the market, while laggards strive to survive. This year's price war is poised to be even more intense than last year's.