2024: Auto Companies Embrace Strategic Consolidation

![]() 01/09 2025

01/09 2025

![]() 703

703

As 2024 draws to a close, an increasing number of automotive companies are embracing a trend of "strategic consolidation."

Recently, Geely Group's premium brand Lynk & Co. was merged into Zeekr. This move was prompted by strategic adjustments necessitated by competition and overlap in pricing, operations, and investments between the two brands, as well as internal rivalry stemming from product planning conflicts.

Prior to this, SAIC Motor also undertook strategic realignments. Feifan, which initially targeted the high-end market, struggled to meet sales expectations for its independently launched models. Plagued by negative news such as layoffs, salary cuts, and the disbanding of its intelligent driving team, Feifan eventually returned to the Roewe brand after three tumultuous years. Earlier this year, Changan Automobile integrated its models, reclassifying Aoushang, the UNI series, and Changan Automobile under the Changan Yinli banner. Terminal dealership networks have also started merging sales operations, with rumors circulating about Great Wall Motor's Ora brand potentially being integrated into Haval, followed by news of Chevrolet and Buick merging their sales networks.

The veracity of these rumors remains unclear, but sales figures paint a clear picture. Data reveals that Great Wall Motor's Ora brand experienced a cumulative sales decline of 22.98% in 2022. After a slight uptick of 4.35% in 2023, sales plummeted by 42.08% in 2024. SAIC-GM's Chevrolet and Buick sales followed a similar trajectory, with Chevrolet sales declining by 34% in 2021, 27% in 2022, and annual sales dropping to 169,000 units in 2023. Cumulative sales in 2024 have yet to surpass 100,000 units. These sales performances, which often prioritize volume over price, have made it increasingly challenging for dealers to sell less popular models, making the merger of sales networks with Buick a cost-saving measure that makes sense.

These signs indicate that China's traditional automakers are initiating a fresh wave of strategic consolidation. Earlier, Li Shufu of Geely Group emphasized in the 'Taizhou Declaration' that independent brands have entered a new phase of strategic integration. Geely Group will spearhead this by establishing a platform-based R&D system to enhance efficiency and lighten the company's operational burden. He believes this is a strategic transformation tailored to Geely Group's realities, reflecting current global economic and automotive industry shifts. Notably, amidst the surge of new energy vehicles, China's auto market has also witnessed rapid growth. Auto brands have expanded swiftly, with numerous new automotive players emerging. To capture market share, companies have deployed widely across various segments. Statistics show that independent brands now hold over 50% market share.

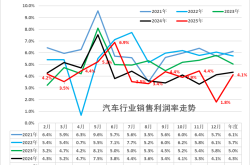

With the evolution of market demand, the industry has entered a phase of stock competition. The intensifying price war among automakers has exacerbated internal competition. Amidst this 'race to the bottom,' automakers have seen minimal returns. Most brands have failed to achieve the desired 'trading price for volume' effect, instead losing both volume and price. Data from the China Passenger Car Association reveals that from January to October 2024, the industry's single-vehicle profit stood at 15,000 yuan, with an industry profit rate of 4%, indicating an overall downward trend. Amidst the market's chilly winter, the advantage of 'having more children to fight better' no longer holds. Instead, it is followed by substantial investments in brand building, market development, and product R&D for sub-brands. Without market competitiveness and positive financial feedback, sub-brands will struggle to survive in the fierce market competition.

For automakers themselves, the prolonged price war has impacted profits, reduced cash reserves, and had repercussions on the stability of the supplier industry chain. Automakers are consolidating resources, abandoning inferior production lines to minimize internal consumption, and engaging in strategic consolidation and brand integration as necessary adjustment strategies. He Xiaopeng, in XPeng Motors' 'New Year Letter,' proposed that 2024 could be seen as the inaugural year of 'bloody' competition for Chinese auto brands and the start of the elimination round. Indeed, some smaller and less competitive automakers, such as WM Motor, HiPhi, and AITO, have already fallen. For the remaining players, the paramount concern is how to survive in this fiercely competitive market.

It is anticipated that more automakers will adopt similar strategies in the future, with mergers and closures becoming the norm. China's auto market will transition from a period of widespread growth to one focused on 'nurturing strength and gathering energy.' For automakers, navigating to the top tier in this new round of market reshuffling has emerged as the primary concern. Notably, the trend of automakers 'disconnecting, giving up, and letting go' has persisted from 2024 into 2025. Earlier this year, GAC Group fired the 'first shot' of strategic consolidation by announcing plans to integrate the marketing fields of Trumpchi and Aion under a newly established brand marketing department. This integrated department will oversee key account business for GAC Group's independent brands, including overall planning for brand marketing, vehicle sales, channel construction, after-sales service, and new media marketing. It is reasonable to speculate that 'disconnecting, giving up, and letting go' will become the automotive industry's latest 'annual keyword' in 2025.

(Images sourced from the internet, remove upon infringement)