2024 Automotive Market: Accelerated Market Transformation, Survival Unprecedentedly Challenging

![]() 01/13 2025

01/13 2025

![]() 482

482

2024 was destined to be a year of significant milestones.

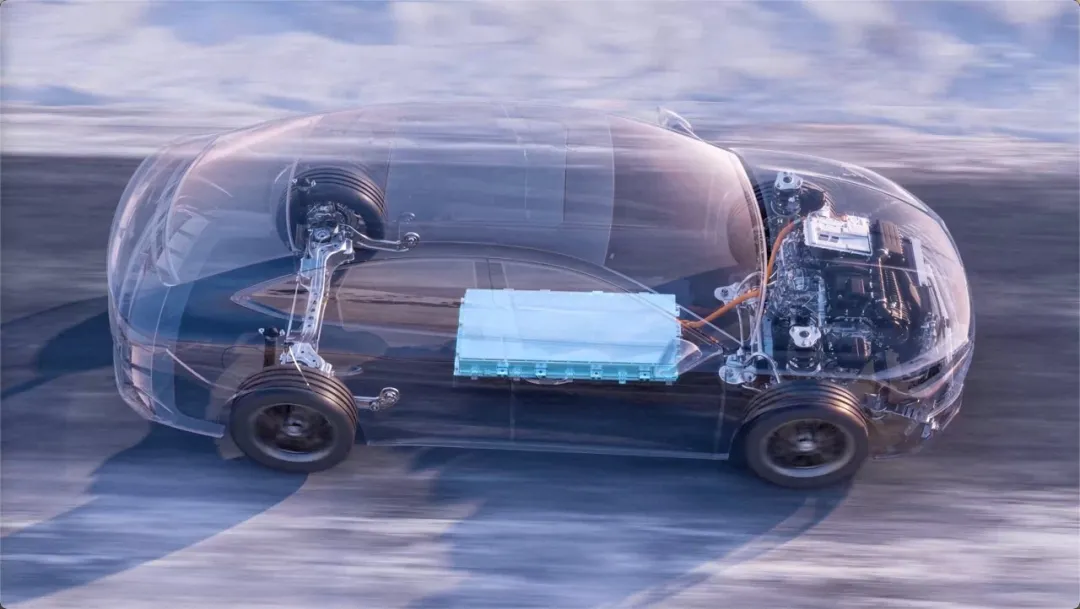

New energy vehicles (NEVs) witnessed robust growth, with a penetration rate surpassing 50%; price wars intensified, leading to a major market reshuffle; automakers employed diverse marketing tactics, transforming the automotive industry into a "fan-centric" landscape; rapid advancements in intelligence emerged as a dominant market trend; indigenous brands ascended, while traditional joint ventures faced difficulties;...

Undeniably, the automotive market in 2024 was a year of coexisting change and development, with competition heating up, and fierce rivalry remaining the central theme.

01 The Unrelenting "Price War"

Starting in 2023, price wars became a vital survival strategy for automakers. By 2024, price wars remained an inevitable buzzword in the automotive industry.

At the dawn of the new year, BYD proclaimed "Electricity is cheaper than oil" and lowered the starting price of the Qin PLUS to a remarkable RMB 79,800, firing the opening shot in the 2024 automotive price war. This move also hit the Achilles' heel of traditional luxury and joint venture brands.

Having experienced the baptism of the 2023 price war, everyone was aware that failing to actively participate would spell quicker demise.

Consequently, traditional luxury brands BBA also embarked on a price-slashing spree, with the BMW 3 Series dropping to RMB 150,000, and some models of the Mercedes-Benz EQ series selling at a 50-60% discount. Joint venture brands were not spared either, with the iconic B-class car Toyota Camry 24 initiating price reductions upon launch, lowering the starting price from RMB 179,800 to RMB 126,800. When SAIC Volkswagen introduced the 2025 Passat model, it even offered a limited-time "fixed price" deal. These substantial discounts garnered significant consumer attention, prompting other automakers to join the "fixed price" trend.

It is evident that amidst the intense price war, many joint venture brands abandoned price defense. However, despite these efforts, the sales boost was fleeting, primarily supported by models that had been on the market for years. For instance, models like Nissan Sylphy, Volkswagen Lavida, and Toyota Corolla, with their R&D costs already amortized, only incurred raw material and manufacturing costs.

Perhaps realizing that blindly engaging in the price war could backfire on the brand, the three luxury giants BBA chose to retreat from the fray to alleviate operational pressures on dealerships.

In reality, by continuously lowering prices, manufacturers must constantly compress costs, which implies a decline in vehicle quality. Ultimately, consumers bear the brunt of these consequences. However, the price war will persist as the fiercely competitive environment does not allow automakers to let their guard down, coupled with the "consumption downgrade" in the overall economic environment, making it a norm in the automotive industry.

The price war will continue in 2025, potentially claiming more casualties among automakers. Notably, to seize sales opportunities, BYD announced that until January 26 of next year, two models—the second-generation Song Pro DM-i and Qin PLUS EV Glory Edition—will offer promotional activities, with starting prices as low as RMB 99,800.

02 Everything Can Be "Intensely Competitive"

In fact, starting with the price war, we can discern that the automotive industry in 2024 was inextricably linked to "intense competition".

Whether it's smart cabins, high-level autonomous driving, or refrigerators, TVs, and large sofas, they all became standard features. BYD's fifth-generation DM technology, the "king of intense competition," even brought fuel consumption into the "2" range.

With the entry of newcomer Xiaomi and the penetration rate of NEVs exceeding 50%, the competition for market share in the 2024 automotive market also reached boiling point.

However, compared to price wars, configuration wars, and market wars, in 2024, automakers engaged more in marketing wars.

At the delivery ceremony of Xiaomi's SU7, Lei Jun personally handed over the car to the owner, bowed to open the car door, and took a photo, staging the annual heartwarming story of "a multibillionaire president personally opening the car door for me," directly adding emotional value and triggering widespread praise from netizens.

It was Lei Jun's attitude that made automotive leaders realize the importance of personally participating in marketing. Executives began engaging in various live streams, building personal IPs, and gradually becoming more visible to consumers.

Therefore, at this year's Beijing Auto Show, the spotlight was no longer on new cars but on "Red Shirt Brother" Zhou Hongyi sitting on the roof of a car and Lei Jun's high-profile exhibition visit. On social platforms, we saw Great Wall Chairman Wei Jianjun, usually low-key, live-testing Great Wall's intelligent driving, as well as NIO Chairman Li Bin's 10-hour live stream of battery swapping in Europe...

It is clear that everyone has invested heavily in marketing. However, this has gradually led the automotive industry to exhibit a trend towards "fan culture".

Admittedly, in the new era of automobiles, new marketing methods can inject new vitality into the market, and the "celebrity effect" can temporarily drive brand traffic. But in the end, in the era of "product supremacy," traffic is merely an auxiliary tool. If not used properly, one should be cautious about potential backlashes.

For example, during the IM L6 technology conference, when benchmarking Xiaomi's SU7, key parameters were incorrectly labeled, prompting Xiaomi to issue three consecutive Weibo posts requesting IM to publicly clarify and apologize. This shows that attempting to ride trends can backfire, and automakers' executives need to learn how to manage this balance.

03 From "Luobo Kuai Pao" to Universal Intelligent Driving

In 2024, Wuhan's driverless taxi service "Luobo Kuai Pao" garnered public attention, beloved by consumers for its ultra-low fares and clean, odorless interior environment. The topic of "Luobo Kuai Pao snatching drivers' jobs" also went viral on various social platforms, sparking heated discussions on the topic of autonomous driving technology.

It is evident that in the era of intelligence, autonomous driving technology has entered the public eye, and the intelligent driving capabilities of vehicles have become a key consideration for many consumers when purchasing cars.

In fact, throughout 2024, intelligent driving was in a state of "fierce competition" in the domestic market. Perhaps in 2023, when discussing intelligent driving, everyone could only think of Huawei and XPeng. But entering 2024, more automakers began showcasing their intelligent driving capabilities, and even BYD, traditionally weaker in this area, demonstrated its prowess in 2024.

L2-level assisted driving has become standard for automakers, with all major players promoting intelligent iteration and upgrades, accelerating the implementation of urban NOA.

This significant transformation in our local intelligent driving market is largely due to learning from Tesla's end-to-end technology route, eschewing LiDAR, and accelerating the popularization of high-level intelligent driving by reducing hardware costs. Consequently, many automakers have introduced intelligent driving to lower-priced models. For instance, XPeng uses a pure vision solution on the MONA M03, and NIO employs it on the Ledo L60.

Regardless, intelligent driving has become an essential path for automakers today. If any automaker fails to stabilize its intelligent driving capabilities above average in 2025, they are likely to be eliminated.

As for autonomous driving technology, let's give it some more time to develop.

04 Who Has Survived the Winter, and Who Is Seeking Shelter?

In a fiercely competitive market environment, one phenomenon is bound to arise: survival of the fittest.

At the beginning of the 24th year, news of HiPhi's explosion spread, and on the first day of work after the Lunar New Year, HiPhi Automobile announced it would suspend production for six months. After this suspension, HiPhi Automobile never recovered. HiPhi's collapse also served as a wake-up call for the automotive industry, signaling even more brutal competition ahead.

Coincidentally, Jiyue Automobile also faced rumors of an explosion, accompanied by negative buzz about "layoffs," "arrears to suppliers," and "disbandment in place" spreading towards the end of the year, causing widespread lamentation.

From WM Motor to HiPhi to Jiyue, we have witnessed the brutality of market competition. Therefore, throughout the year, automakers successively reduced salaries, laid off employees, and even closed factories. Cost reduction and efficiency enhancement became vital survival strategies for automakers.

This harsh living environment impacted not only weaker new force automakers but also traditional automakers.

At the end of 2024, Nissan, Honda, and Mitsubishi signed a memorandum of understanding on cooperation for business integration, planning to jointly invest and establish a holding company, potentially a way for them to regain confidence.

Entering 2025, more automakers will undoubtedly fall. For automakers, long-term reliance on financing to infuse capital is not a sustainable solution. Finding ways to turn losses into profits can enable healthy enterprise development.

It is worth mentioning that a few days ago, Nezha Automobile faced issues with its official website being inaccessible. In 2024, Nezha also grappled with the CEO's resignation, declining sales, and tight funds. So, will Nezha be the next to fall?

05 Brand Renewal, "Going Out" Becomes a New Strategy

Despite the intense competition in the market environment, automakers did not abandon hope but instead dedicated themselves to forging new paths.

In 2024, XPeng Motors launched its second brand MONA, while NIO introduced its second brand Ledo and third brand Firefly. Even traditional luxury brand Audi launched a new luxury electric brand AUDI.

Perhaps for automakers, new brands represent new hopes. And with one more hope, there is one more chance to survive.

In addition to establishing second brands, many automakers have also chosen to venture abroad in search of more opportunities. However, going abroad has long been a strategic layout, only becoming a focal point of competition in 2024.

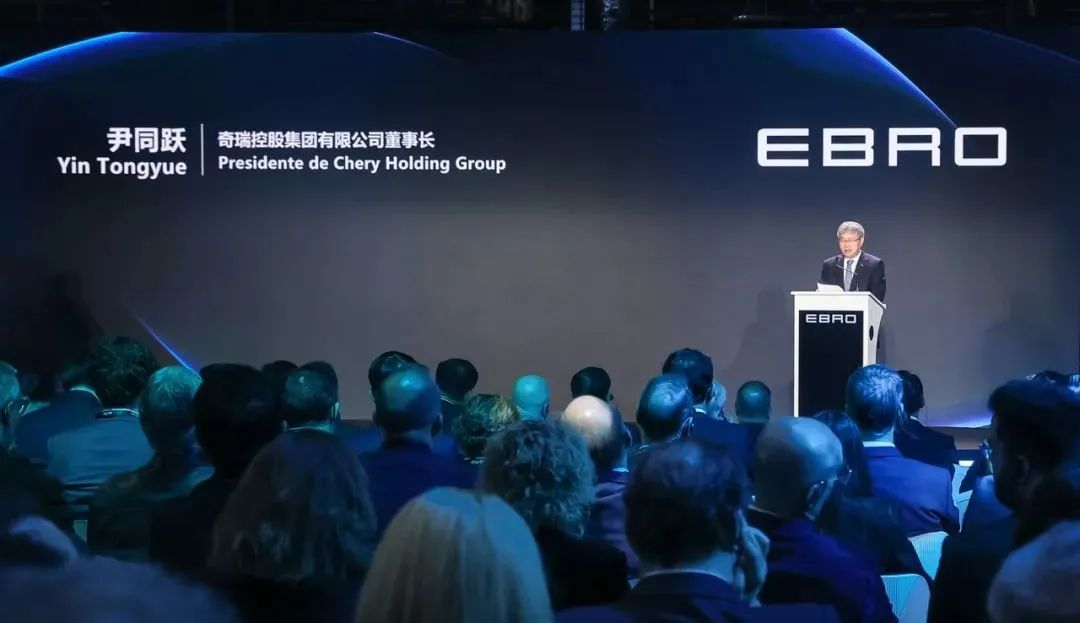

Due to China's first-mover advantage in the NEV field, Chinese automakers have firmly established themselves overseas and possess significant global competitiveness. Many foreign companies have opted to cooperate with Chinese automakers. For example, in April 2024, Chery signed an agreement with EV MOTORS, the parent company of EBRO, to establish a joint venture in Barcelona, Spain, leveraging their respective strengths. In May, the joint venture "Zero Run International" between Zero Run Automobile and the Stellantis Group was officially launched, marking the establishment of a sales business system centered around the overseas market.

However, precisely because of these obvious advantages, starting in 2023, the European Union announced it would impose tariffs on Chinese electric vehicles. By October 2024, the European Union finally decided to implement these tariffs. The imposition of tariffs increased costs, significantly weakening the advantages of Chinese electric vehicles in Europe and the United States.

Due to the impact of various European and American trade policies, export growth declined sharply. In July of this year, the penetration rate of NEVs exceeded 50% for the first time, but the primary driver behind this growth was not pure electric vehicles but plug-in hybrid vehicles. It is evident that there has been a notable structural shift, with plug-in hybrids growing rapidly and pure electrics lagging behind.

Therefore, it is undeniable that for a period in the future, the "going out" strategy of Chinese automakers will be impacted to a certain extent.

Final Thoughts

The phrase "intense competition" characterized the entire year of 2024 and will likely continue to define 2025. The competition is far from over. Who will endure and who will be eliminated? In 2025, let's wait and see.

- END - Luo Lin

× Dreams Still Need to Be Had, Just in Case They Come True