2024: Joint Venture Auto Companies Reach a Critical Juncture

![]() 01/14 2025

01/14 2025

![]() 652

652

Over the past few decades, traditional automakers have reaped substantial profits from their joint venture brands, basking in the glow of the times. However, by 2024, the luster of these joint ventures had dimmed, with their once-lucrative "cash cows" becoming increasingly lean. Layoffs, plant closures, capacity reductions, and dealer defections have painted a grim picture of the state of joint venture auto companies.

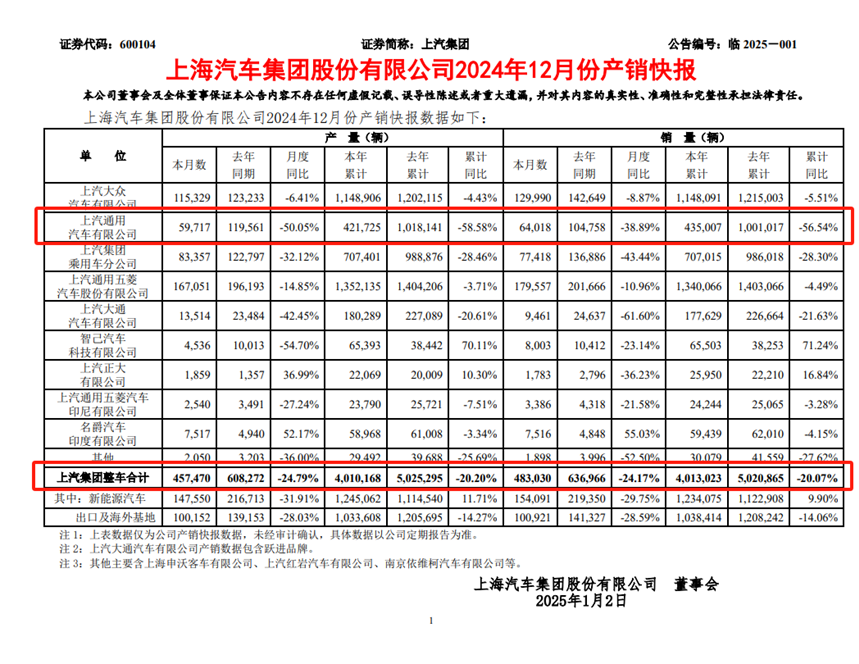

The domestic auto industry has seen a shift in leadership, with SAIC Motor's 18-year reign as the top-selling domestic automaker coming to an end. Recently, SAIC Motor officially announced its sales figures for 2024, revealing a cumulative sales total of 4.013 million vehicles, a year-on-year decline of 20.07%. This year, SAIC Motor was dethroned by BYD, which sold 4.272 million vehicles.

Among SAIC Motor's joint ventures, SAIC-GM experienced a particularly steep decline. In 2024, SAIC-GM's cumulative sales were 435,000 vehicles, a year-on-year drop of 56.54%, effectively halving its sales. Poor fuel vehicle sales and slow electrification progress were key factors behind this decline.

To boost sales, SAIC-GM implemented various measures, with the "price war" proving to be the most effective. In 2024, SAIC-GM launched a "fixed price" promotion, which helped drive a recovery in sales. Additionally, the company plans to introduce new competitive products in 2025, including pure electric, extended range, plug-in hybrid, and L2++ intelligent driving models. This underscores SAIC-GM's commitment to making a significant push in 2025.

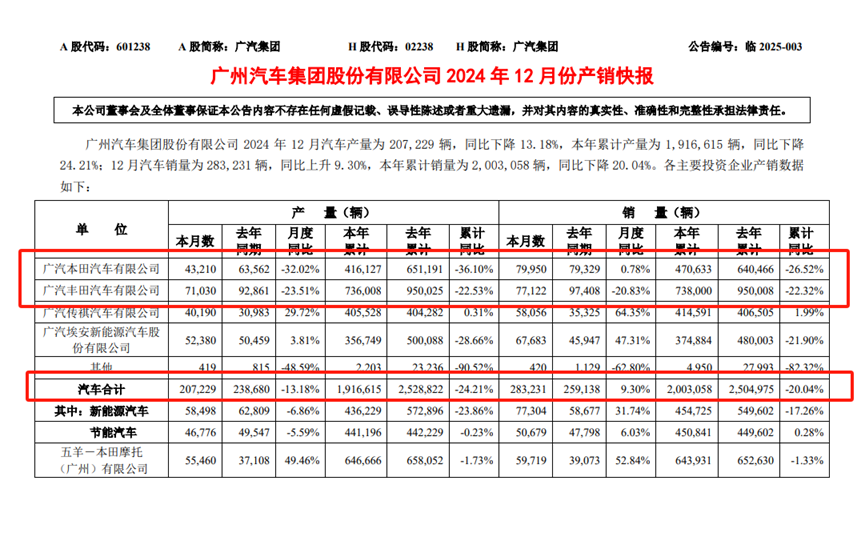

Other SAIC Motor joint ventures fared better, with SAIC Volkswagen and SAIC-GM-Wuling reporting cumulative sales of 1.148 million and 1.34 million vehicles, respectively, in 2024, experiencing only single-digit declines. SAIC Motor is actively making adjustments, but due to the size and complexity of its operations, it may still face challenges in the near term. Meanwhile, GAC Group's sales fell by double digits, returning to levels last seen eight years ago. In 2024, GAC Group sold 2.0031 million vehicles, a year-on-year decline of 20.04%.

Notably, although GAC Group's independent brand, GAC AION, also experienced a double-digit sales decline, the main culprit was the group's joint venture segment. In 2024, GAC Honda and GAC Toyota combined sales totaled approximately 1.208 million vehicles, accounting for 60.34% of GAC Group's overall sales. This underscores the fact that joint ventures are still GAC Group's primary sales driver. However, with the domestic auto market's electrification trend irreversible, GAC Honda and GAC Toyota, which rely heavily on fuel vehicle sales, are at a disadvantage. To mitigate losses, both automakers plan to introduce new electric models such as Ye P7, Boxi 3X, and bZ3X in 2025, demonstrating their commitment to staying current and competitive.

GAC Group has formulated a three-year "Panyu Action" plan, setting a sales target of a 15% increase for 2025. To achieve this, GAC Group must sell at least 2.3 million vehicles next year. Additionally, the company plans to launch multiple PHEV and REEV models in 2025 to support its sales target. Dongfeng Motor Group has also been held back by poor joint venture brand sales. In 2024, Dongfeng Motor Group sold 1.8959 million vehicles, a year-on-year decline of 9.2%. Among its joint ventures, Dongfeng Nissan, Zhengzhou Nissan, Dongfeng Honda, and Dongfeng Peugeot Citroen all experienced declines of varying degrees, with Dongfeng Honda seeing a 29.2% drop.

Currently, joint venture brands still account for the majority of Dongfeng Motor Group's sales. In 2025, Dongfeng Nissan plans to launch its pure electric sedan N7, while Dongfeng Honda will introduce the Lingxi L and Ye S7. These new models are expected to enhance the market competitiveness of these joint ventures.

However, the domestic auto market is increasingly fierce and unpredictable, posing severe challenges to joint venture brands. Dongfeng Motor Group must be prepared for these challenges. FAW Group, with annual sales of 3.2 million vehicles, continues to move forward steadily. In 2024, FAW Group achieved total vehicle sales of 3.2 million and revenue exceeding 550 billion yuan. Among its independent brands, FAW Hongqi sold 411,700 vehicles, a year-on-year increase of 17.4%, while FAW Besturn sold 150,700 vehicles, a 25% year-on-year increase and the highest level in a decade.

Among its joint ventures, FAW-Volkswagen sold 1.659 million vehicles, a year-on-year decline of 13%, contributing to the group's overall sales decline. Nonetheless, FAW-Volkswagen remained the top-selling joint venture automaker in China. FAW Toyota sold 800,100 vehicles, a year-on-year increase of 0.2%, making it the only mainstream joint venture automaker to record positive growth for two consecutive years. Notably, FAW Toyota sold 384,612 electrified vehicles, a year-on-year increase of 36%.

While maintaining steady fuel vehicle sales, FAW Toyota's electrified products have gradually gained consumer recognition. In 2025, the company plans to introduce new electrified models such as the RAV4 Hybrid Plug-in version and bZ3C, further enhancing its market competitiveness. FAW-Volkswagen, on the other hand, will launch a new A-class pure electric sedan under the Jetta brand in 2025, followed by five additional models, including pure electric and plug-in hybrid options. The Audi Q3 Hybrid and Audi Q6L e-tron are also scheduled for release in 2025.

The concentrated launch of these new models will accelerate FAW Toyota and FAW-Volkswagen's domestic market布局, injecting new vitality into the auto market. Chery Group set a new annual sales record in 2024, with cumulative sales of 2.603 million vehicles, a year-on-year increase of 38.4%. Breaking down the sales by brand, Chery sold 1.611 million vehicles, an increase of 31.1% year-on-year and surpassing the 1.6 million mark for the first time. Starway sold 1.409 million vehicles, a year-on-year increase of 12.3%, while Jettour sold 568,000 vehicles, up 80.3% year-on-year. The new brand iCAR sold 65,900 vehicles, and Zhijie sold 57,900 vehicles.

Notably, Chery Group did not disclose Jaguar Land Rover's sales figures. Third-party data shows that in the first nine months of 2024, Jaguar Land Rover's retail sales in China were only 70,283 vehicles, a year-on-year decline of 10.5%. In recent years, Jaguar Land Rover has resorted to price cuts to stimulate sales in China, but these efforts have had minimal impact. The slow pace of electrification development in China is a significant factor. To turn the tide, Jaguar Land Rover announced its cooperation with Chery to revive the "Freelander" brand, adopt a new brand logo, and launch a new model based on the Jaguar Electric Architecture (JEA) in 2025.

Currently, Jaguar Land Rover's presence in the Chinese auto market is weak, with its brand influence significantly diminished. Meanwhile, leading automakers such as BYD, Li Auto, and NIO continue to lead the way, with other new energy vehicle makers also eyeing the market. Even if Jaguar Land Rover's electrification plan progresses smoothly, its path in China will remain challenging.

Final Thoughts: In 2024, joint venture brands transitioned from being profit drivers to liabilities. The slow transformation in areas such as automotive electrification and intelligence, which failed to keep pace with market trends, was a significant factor. Fortunately, these joint venture brands have recognized the problem and begun prioritizing automotive electrification. However, transformation is not an overnight process. In the fiercely competitive domestic auto market, these joint venture automakers will likely continue to face challenges in the short term.

(Images sourced from the internet, please remove if infringing)