Leapmotor Converts Losses to Profits in a Single Quarter: Can Its Ambitious Homophone Pun Become Reality?

![]() 01/23 2025

01/23 2025

![]() 517

517

Introduction

Another newcomer in the automotive industry has announced its achievement of quarterly profitability, signaling an intensifying competition in the domestic automotive market. This new player is adding a fresh dynamic to the scene.

Produced by | Heyan Yueche Studio

Written by | Zhang Dachuan

Edited by | He Zi

Total words: 2858

Reading time: 4 minutes

Yet another player in the burgeoning electric vehicle segment has achieved quarterly profitability.

Recently, Leapmotor announced that its full-year sales for 2024 reached 293,700 units, marking a year-on-year sales growth rate of 104%, far surpassing the 35.5% growth rate of total domestic new energy vehicle sales. Leapmotor delivered an impressive performance in the fiercely competitive domestic automotive market of 2024. Even more remarkably, the company subsequently released a profit forecast, announcing that it had achieved positive net profit in the fourth quarter of 2024, thereby meeting its quarterly profitability target a year ahead of schedule.

△Leapmotor Achieved Quarterly Profitability Target a Year Ahead of Schedule

Leapmotor's Path to Profitability Wasn't Easy

For domestic new energy automakers, achieving profitability has always been a formidable challenge. Only a handful of new energy automakers have managed to turn a profit, with Lixiang One and Thalys, the first to adopt the HarmonyOS intelligent travel mode, leading the pack. Many others are struggling to stay afloat, relying heavily on financing. If their capital chain breaks, they risk shutting down entirely.

△Lixiang One and Thalys Achieved Profitability Before Leapmotor

Leapmotor's achievement of quarterly profitability can be attributed to two primary factors:

Firstly, Leapmotor's sales continued to surge in the fourth quarter of last year, with deliveries of 38,177 units in October, 40,169 units in November, and 42,517 units in December. By surpassing the 40,000-unit threshold, it ranked second in the new energy vehicle rankings for three consecutive months. This sales increase directly led to cost dilution, which was the main driver behind the company's profitability turnaround.

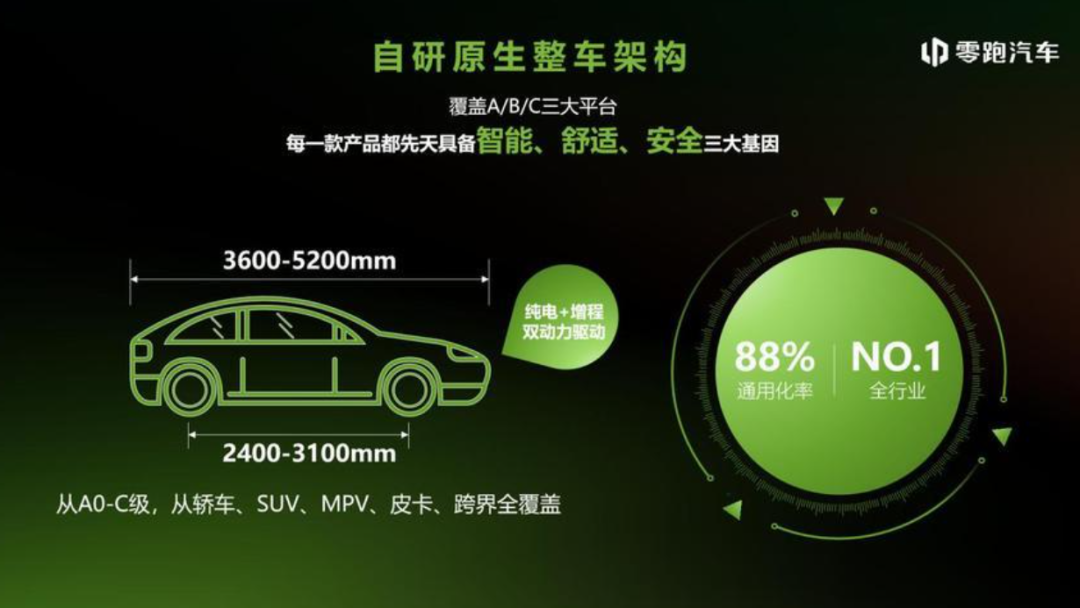

Secondly, according to Leapmotor's statistics, the sales proportion of its higher-priced C-series models exceeded 77%. This laid a solid foundation for the company's profitability in the fourth quarter. The higher-priced C-series models are more profitable, and with the empowerment of platform-based design, the current commonality rate of parts for the Leapmotor C-series reaches 88%. This not only significantly reduces vehicle development time but also lowers vehicle costs, maximizing synergies.

△The Sales Proportion of Higher-Priced C-Series Models Exceeded 77%, Contributing to Leapmotor's Profitability

Leapmotor's Future Growth Potential Is Promising

Leapmotor's achievements are closely tied to its cost control and product planning strategies.

In terms of cost control, Leapmotor has not only achieved self-research and development of core technologies, including all electronic components, but also boasts a self-manufacturing ratio accounting for over 60% of the total vehicle cost. Another domestic automaker that reduces costs through self-research and manufacturing is BYD. As competition in the domestic automotive market intensifies, the room for price reductions by parts companies has become increasingly limited.

Moreover, Leapmotor's planning is quite forward-looking.

Currently, the three SUV models (C11, C10, and C16) of the C-series, which contribute the majority of Leapmotor's sales, are priced between 150,000 and 200,000 yuan. According to sales data released by the China Association of Automobile Manufacturers, sales of domestic new energy vehicles in the 150,000-200,000 yuan range reached 3.375 million units in 2024, with a growth rate of 19.2%. The previously lower-priced T-series has gradually faded from Leapmotor's main sales lineup.

Starting from 2025, Leapmotor will focus on the upcoming new B-series, which will target the price range of 100,000-150,000 yuan. In 2024, sales of domestic new energy vehicles in this price range reached 2.224 million units. While the volume is smaller than that in the 150,000-200,000 yuan range, its growth rate reached 101.7%. For Leapmotor, the B-series offers greater potential in 2025, laying a solid foundation for the company's continued sales growth. From another perspective, the two market segments that Leapmotor focuses on avoid direct competition with the two major new energy automakers, Lixiang One and AITO, which is fully empowered by Huawei.

△B10 Becomes the Key Driver of Leapmotor's Sales Growth in 2025

Compared to its competitors, Leapmotor has not blindly pursued brand upgrading or followed the trend of creating models priced at 800,000 or even 1 million yuan. Building a high-end model requires substantial investment in research and development costs, as well as considerable resources for market promotion, with a relatively high risk of failure. Creating high-end sub-brands and models is a natural progression. With sales and profitability as its primary goals, Leapmotor has not jumped on the bandwagon of establishing a luxury sub-brand but has instead invested its limited resources in models that can generate sales and profits. From this perspective, Leapmotor exhibits a pragmatic approach.

△Pragmatic Leapmotor Has Yet to Focus on Luxury Models

Apart from the above factors, the greatest potential that Leapmotor offers to consumers and investors lies in its globalization efforts. In October 2023, Leapmotor and the European automotive giant Stellantis established a joint venture called "Leapmotor International" and received an investment of up to 1.5 billion euros from Stellantis. This not only signifies that Leapmotor's technology and business model have been recognized by Stellantis but also indicates that Leapmotor has found a reliable "backer" for its overseas expansion. Stellantis currently owns 14 automotive brands and covers more than 130 countries worldwide through production in over 30 countries. In the third quarter of 2024, Leapmotor's C10 and T03 models were already launched in Europe. In the future, whether it's to achieve local production in Europe at Stellantis' factories to avoid EU tariffs or to sell its models through Stellantis' global sales network, Leapmotor will have a significant advantage over other new energy automakers.

△Stellantis Is Leapmotor's Biggest Supporter in Its Global Layout

However, Leapmotor is not without its shortcomings. Its current biggest shortcoming may lie in the fact that its progress in intelligent driving lags behind its competitors. The investment in intelligent driving is substantial, especially with the growing popularity of end-to-end large models. Leapmotor will likely need to seek external assistance to enter the intelligent driving race. To catch up, Leapmotor adjusted its organizational structure in the second half of 2024 and established an Intelligent Driving Research Institute. However, unlike other technologies, it remains questionable whether Leapmotor can replicate its previous self-research capabilities and achieve a latecomer advantage through full-stack self-research in the field of intelligent driving. If Leapmotor's self-research intelligent driving large model scheme is delayed, whether Leapmotor has an alternative plan to ensure that its intelligent driving technology can rank among the top domestic players through external cooperation will depend on the leadership of Zhu Jiangming.

The Secrets Behind Profitable New Energy Automakers

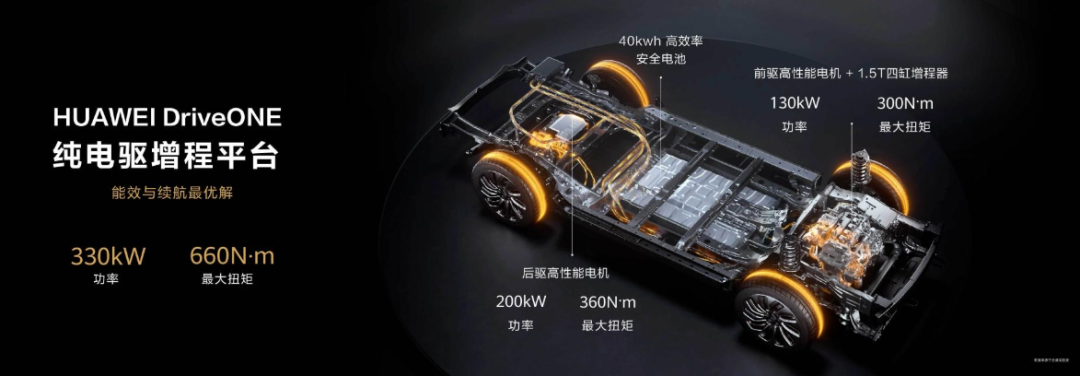

The three domestically profitable new energy automakers actually have their unique strategies. Lixiang One focuses on range anxiety-free extended-range models and offers much higher model configurations than its competitors. To some extent, it follows the cost-effective route of high-end models. Thalys fully integrates Huawei's system capabilities, and with Huawei's strong technical expertise and high brand appeal, it has even allowed the M9 to carve a niche in the BBA market. As for Leapmotor, its profit model is similar to BYD's, controlling product costs and enhancing vehicle cost-effectiveness through self-research and manufacturing of core components. Additionally, all three automakers rely on the dual-wheel drive of pure electric and extended-range technology routes. Therefore, whether it's new energy automakers aiming for profitability or traditional automakers aiming to boost sales, it's crucial to simultaneously deploy pure electric and hybrid vehicle tracks. Whether to deploy plug-in hybrid technology with better performance but higher costs or introduce lower-cost extended-range technology needs to be planned and executed by automakers themselves.

△The Introduction of Extended-Range Technology Has Been Key to the Profitability of Leapmotor and Other Two New Energy Automakers

As mentioned earlier, the key to Leapmotor's profitability is that, like BYD, it can achieve self-research and self-manufacturing of core components, which is also the cornerstone of Leapmotor's successful profitability. For other domestic new energy automakers, if they continue to adopt the traditional automaker mindset, focusing more on vehicle integration and relying entirely on suppliers for component technology, it will be difficult to achieve profitability in today's fiercely competitive domestic automotive market. After all, extreme price pressure on suppliers may force them to discontinue supply. Therefore, whether it's for automakers still in the game or for other capital hoping to enter the automotive manufacturing industry, if they cannot achieve self-research and self-manufacturing of components, it will be challenging to compete with established players in this field.

△Leapmotor Controls Costs and Enhances Model Cost-Effectiveness Through Self-Research of Core Components

Commentary

While Leapmotor's achievement of single-quarter profitability is commendable, the challenges ahead remain significant. The domestic automotive market is fiercely competitive, and the competition among automakers will only intensify. If Leapmotor wants to survive, it must maintain a high degree of vigilance at all times. Any slight strategic misstep could result in being overtaken by competitors. Whether it's NIO, XPeng, or Nezha Auto, which have previously led new energy sales, or Lixiang One, which recently launched its first pure electric model MEGA with great fanfare, they have all encountered significant challenges. The key to Leapmotor's future leadership lies in whether it can accelerate its globalization process through cooperation with Stellantis and drive its progress through both domestic and overseas markets.

(This article is originally created by "Heyan Yueche" and may not be reproduced without authorization)