Thalys Poised for a Banner Year

![]() 01/23 2025

01/23 2025

![]() 560

560

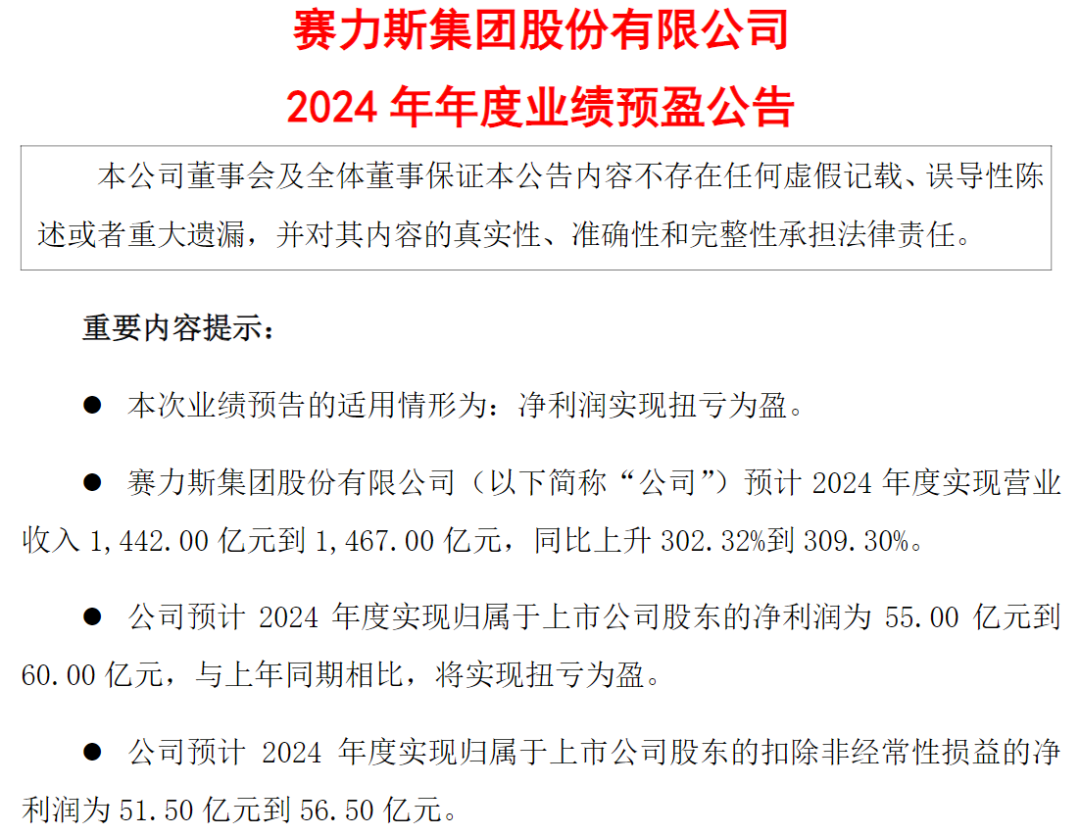

Net Profit Projected at 5.5-6 Billion Yuan

Author | Wang Lei

Editor | Qin Zhangyong

In 2024, Thalys made a remarkable turnaround.

Amidst widespread losses in the automotive industry, Thalys achieved profitability. Last night, it announced that its net profit for the year is expected to reach 5.5 to 6 billion yuan.

This announcement carries significant weight. Thalys had been incurring losses for four consecutive years and was relatively unknown in the automotive industry.

Particularly in the new energy vehicle sector, where losses are common and price wars persist, Thalys stands out as one of the few profitable companies.

Correspondingly, Thalys' revenue also experienced explosive growth, reaching 144.2 to 146.7 billion yuan in 2024, representing a year-on-year increase of 302.32% to 309.30%.

After enduring tough times, Thalys is now reaping the rewards of its efforts.

01 Years of Struggle Yield Results

Since 2020, Thalys had been continuously losing money, with net losses of 1.729 billion yuan in 2020, 1.824 billion yuan in 2021, approximately 3.83 billion yuan in 2022, and 2.45 billion yuan in 2023, accumulating losses of nearly 10 billion yuan over four years.

Thalys' ability to turn losses into profits in 2024 was within expectations. Its net profit turned positive in the first quarter, reaching 220 million yuan, and by the end of the third quarter, the net profit had reached 4.038 billion yuan.

Regarding the reasons for profitability, Thalys stated in its announcement that it is primarily due to a significant increase in product sales. In 2024, Thalys sold a total of 497,000 vehicles, an increase of 96.98% year-on-year, with 426,900 of these being new energy vehicles, up 182.84% year-on-year.

Based on its projected net profit, Thalys earned approximately 13,000 yuan in net profit for every new energy vehicle sold last year.

This figure is significantly higher than that of many other automakers. For instance, Great Wall Motors, one of the most profitable traditional automakers, achieved a net profit attributable to shareholders of approximately 12.4 to 13 billion yuan last year, with a profit per vehicle of around 10,300 yuan.

Why is Thalys so profitable?

It is primarily due to the high unit price and significant contribution of AITO vehicles. Of the 497,000 vehicles sold by Thalys last year, over 420,000 were AITO vehicles, accounting for more than 85%. The AITO New M7 alone contributed nearly 200,000 sales in a year.

If the launch of the AITO New M7 was a crucial step in revitalizing Thalys, then the AITO M9 is the anchor supporting Thalys' profit growth.

At the end of December 2023, Thalys and Huawei launched the AITO M9, which quickly became a market hit. The M9 almost single-handedly enabled Thalys to turn losses into profits in the first quarter of 2024. Furthermore, thanks to the launch and sales of the AITO M9, the average price of AITO vehicles rose above 300,000 yuan in the second quarter, with the gross profit per vehicle reaching a peak of 86,900 yuan in the same quarter.

Generally speaking, the more expensive a car is, the higher its gross profit will be. Taking the AITO M9 as an example, its gross profit margin per vehicle reached 35% in the third quarter, meaning the more it sells, the more it earns.

Data released by Hongmeng Intelligent Mobility shows that cumulative orders for the AITO M9 exceeded 200,000 units within 12 months of its launch, and it has been the sales champion for luxury vehicles priced above 500,000 yuan in the Chinese market for nine consecutive months. Although AITO has not announced the annual total sales of the M9, according to sales data from the China Passenger Car Association for December, total sales of the AITO M9 reached 156,000 units.

In addition, the AITO M8 model has recently been declared with the Ministry of Industry and Information Technology. Based on currently available information, it is similar to the current AITO M9 in size, configuration, and intelligent driving capabilities.

As a smaller version of the M9, the M8 is expected to have a lower price while maintaining comparable product capabilities to its larger sibling, making it highly likely to become another hit.

As soon as 2025 began, Zhang Xinghai, chairman of the Thalys Group, issued a New Year message titled "Sticking to One Goal" to all employees, clarifying the company's objectives for 2025: for AITO to anchor itself in the luxury vehicle segment, with the M9 aiming to maintain its top sales position in the luxury vehicle market, and for overseas sales of new energy vehicles to double; within three years, Thalys aims to sell one million new energy vehicles.

For Thalys, which currently holds a large number of orders for the M9 and M7, and with the upcoming launch of the new M8 model, the company is finally reaping the rewards of its years of hard work.

02 A Symbiotic Relationship

Thalys' success today is inseparable from AITO and Huawei.

In July 2024, Thalys acquired the AITO brand trademark, design patents, and other assets from Huawei Device for a consideration of 2.5 billion yuan. On October 10, Thalys also announced the acquisition of ownership of the AITO Super Factory for 8.164 billion yuan.

On August 23, Thalys invested 11.5 billion yuan in Shenzhen Invision Intelligence Technology Co., Ltd., acquiring a 10% stake.

On October 30, 2024, Thalys announced that its wholly-owned subsidiary Thalys Automobile Co., Ltd. had fully paid the first transfer price of 2.3 billion yuan as stipulated in the Equity Transfer Agreement to Huawei Technologies Co., Ltd.

From Thalys' acquisition of "AITO" from Huawei for 2.5 billion yuan to its investment in Invision, only 54 days passed before Thalys spent another 14 billion yuan to strengthen cooperation between the two parties. It is evident that Thalys is committed to forging a strong partnership with Huawei.

The robust sales of AITO vehicles have not only enabled Thalys to turn losses into profits but have also significantly contributed to Huawei's earnings, enabling Huawei's Intelligent Automotive BU to achieve profitability ahead of schedule in 2024.

According to Yu Chengdong's plan, the Intelligent Automotive BU was originally expected to achieve profitability in 2025. Financial data released by Shenzhen Invision shows that the company achieved profitability for the first time from January to June 2024, with revenue reaching 10.435 billion yuan and net profit reaching 2.231 billion yuan.

Moreover, as Invision's largest customer, Thalys contributed a significant portion of its revenue, accounting for 63.38% of Invision's total revenue. From this perspective, the relationship between Thalys and Huawei resembles a symbiotic one.

Four years ago, Thalys was largely considered a "second-tier" or even "third-tier" new energy vehicle company in the industry, while Huawei was still an "outsider" in the automotive sector.

In 2021, Huawei and Thalys officially announced their cooperation and launched the "AITO" series of models. At that time, the domestic automotive industry had not yet fully appreciated the power of automotive intelligence, and few automakers responded to Huawei's overtures. Some even put forward the "soul theory" argument.

At that time, Huawei's intelligent automotive business primarily cooperated with automakers through three modes:

The component supply mode, which provides standardized modules, is similar to traditional Tier 1 or Tier 2 suppliers and involves a relatively low degree of binding.

The second is the Huawei Hi mode, which was an initial and relatively concrete manifestation of "Huawei on the car." The full name of Hi is Huawei Inside, where Huawei provides automakers with a full-stack intelligent automotive solution. A typical representative is Changan's Avatar.

The third mode is the Huawei Smart Selection mode chosen by Thalys and AITO.

In addition to the intelligent systems involved in the Hi mode, the Smart Selection mode controls most of the decision-making power in vehicle manufacturing, from project initiation and research and development to exterior and interior design, as well as hardware and calibration. Huawei is also involved in marketing and sales under the Smart Selection mode.

Over the past three years, Huawei's Intelligent Automotive BU has undergone several adjustments, including the establishment of the "Invision" company to attract automaker financing and the establishment of Hongmeng Intelligent Mobility, which has given birth to four brands: AITO, Zhijie, Xiangjie, and Zunjie.

Huawei has gradually become a golden sign in the automotive industry. Yu Chengdong once summarized the development journey of AITO by saying, "AITO has experienced a process of being underestimated, misunderstood, and then uncatchable by the industry."

He even boasted, "Many automakers want to cooperate with us, and I'm sorry, but I don't have that many resources."

The latest development is that many state-owned automakers have chosen to partner with Huawei. For example, GAC announced the establishment of a joint venture company with Huawei to create a new automotive brand, and SAIC has also chosen to collaborate with Huawei.

After witnessing Huawei's capabilities, the industry is eagerly anticipating the emergence of the next "Thalys."