NIO and Li Bin: Emulate Lei Jun's Strategic Pricing 'Cut'

![]() 03/02 2025

03/02 2025

![]() 628

628

Source: SourceAuto

Pre-sale price: ¥814,900, Launch price: ¥529,900.

By slashing the price of the Xiaomi SU7 Ultra by nearly ¥300,000, Lei Jun ignited a fervent consumer response among his target audience. Within just two hours of its launch, the Xiaomi SU7 Ultra garnered over 10,000 orders. According to insiders, orders continue to surge, with four-digit figures already recorded at eight stores in Guangzhou alone.

The Xiaomi SU7 Ultra's launch price, one-third lower than its pre-sale price, was a strategic maneuver. Introduced in October as the "fastest four-door mass-produced car on the planet," at the February 27th launch event, Lei Jun repositioned the ¥529,900 Xiaomi SU7 Ultra as a sports luxury vehicle.

To match the official promotion and achieve a faster lap time than the Porsche Taycan Turbo GT at the Shanghai International Circuit, the ¥529,900 Xiaomi SU7 Ultra requires an additional ¥100,000 for the racing kit. The title of "fastest four-door mass-produced car on the planet," meanwhile, belongs to the ¥814,900 Xiaomi SU7 Ultra Nurburgring Limited Edition.

Accuse Xiaomi and Lei Jun of shifting gears? Quite the contrary, this approach merits close scrutiny by industry peers.

01

Precision Pricing: A Triple Victory

Rather than a straightforward price drop of ¥285,000, it's more accurate to say that Xiaomi SU7 Ultra introduced a standard version priced at ¥529,900. Even as a standard version, the Xiaomi SU7 Ultra disrupts the automotive market.

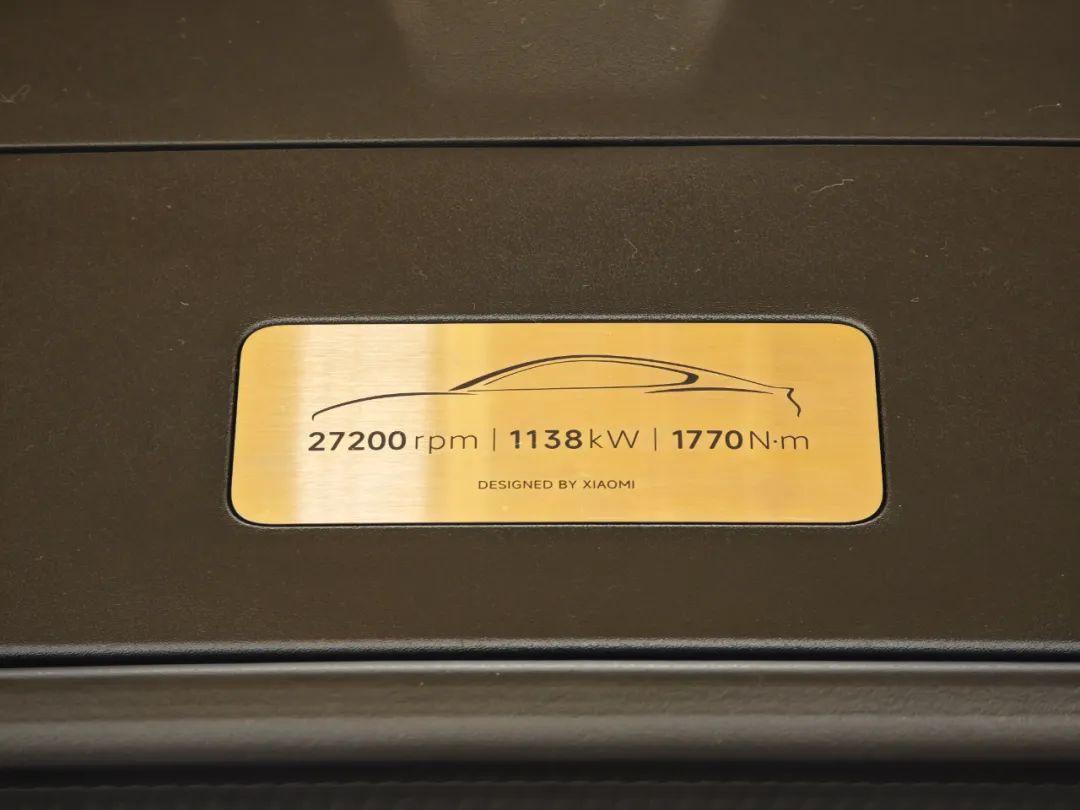

Equipped with a three-motor power system boasting 1548PS horsepower, the Xiaomi SU7 Ultra standard version achieves 0-100km/h acceleration in just 1.98 seconds and a top speed of 350km/h. Power-wise, it rivals multi-million-yuan supercars like the Bugatti Chiron and Koenigsegg Jesko.

While the Xiaomi SU7 Ultra aimed to be the "fastest four-door mass-produced car" and break Porsche's track record, the standard version forgoes racing equipment like coilover shocks, carbon fiber roofs, and high-performance brake pads. Without these, its track performance is reduced, making it more suited for daily driving.

Xiaomi and Lei Jun didn't blindly cut configurations but added extras to the standard version, such as an electric front trunk exclusive to this model.

With this pricing strategy, the Xiaomi SU7 Ultra achieved a shocking price point, securing 10,000 orders within two hours. Car owners can choose a newsworthy car better suited for daily driving, balancing attention and practicality. Onlookers are delighted to see domestic car brands rise, with Xiaomi reaching new heights.

Notably, despite the Xiaomi SU7 Ultra's supercar performance, its ¥529,900 starting price isn't a loss-making strategy. Xiaomi Group's Q3 2024 financial report revealed a 17.1% gross margin for its innovation business, mainly smart electric vehicles, with an average selling price of approximately ¥239,000. Roughly estimating, the average cost of a regular Xiaomi SU7 is about ¥204,000.

Considering the Xiaomi SU7 Ultra is based on the Xiaomi SU7, and referencing the configuration differences between the Xiaomi SU7 Max and Ultra standard versions, if the material cost is estimated at ¥100,000, the cost of the Xiaomi SU7 Ultra standard version is around ¥300,000. With a starting price of ¥529,000 and a 13% value-added tax, the gross profit per unit of the Xiaomi SU7 Ultra standard version is significantly higher than that of a regular Xiaomi SU7.

Selling one Xiaomi SU7 Ultra offsets the sales of several Pro or even Max models, a reason why luxury brands like BBA are keen on creating sports performance cars based on regular models.

With the SU7 Ultra, Xiaomi and Lei Jun achieved a win-win in sales, brand, and user satisfaction. In the automotive industry, especially amid intense price wars, such launch capabilities are skills every automaker must master.

02

The New Force Most in Need of Improvement

Thanks to the standard version, the Xiaomi SU7 Ultra made a big splash. However, a more common industry scenario is having too many models with chaotic relationships, causing internal consumption and operational drag.

NIO stands out as a prime example.

In June 2022, NIO's main sales models based on the NT1.0 platform, like the ES6 and ES8, neared the end of their product life cycles. The market anticipated new-generation NIO models. At this juncture, NIO introduced the NIO ES7.

As the first SUV of the NT2.0 platform, the NIO ES7, like NT1.0 models, has its charging port at the front, unlike later NT2.0 platform models like the ES6 and ES8. Thus, car enthusiasts dubbed the NIO ES7 an "NT1.5" model.

In terms of positioning, the NIO ES7 is slightly larger than the second-generation ES6, both with a 5-seat layout. The primary differences lie in air suspension, all-aluminum body, etc., but it also comes with a ¥100,000 price premium.

With similar positioning, inherited designs, and minor differences in core configurations like motors, batteries, and lidar, the NIO ES7 has been overshadowed by the second-generation NIO ES6 since its launch. According to Tongchedi data, monthly sales of the NIO ES7 maintained three digits in 2023 but fell to two digits in 2024, with a cumulative sales volume of 2,127 units over the past year, less than what the NIO ES6 sells in a single month.

A similar scenario persists in 2025.

With models like the Ledao L60 and NIO ET9 based on the NT3.0 platform already on the market, NIO plans to rely on several "NT2.5" platform models to meet its 2025 sales target of 440,000 units.

"The NT2.0 platform has been in use for less than four years and will continue to be used [for new cars]." In a post-Spring Festival livestream, NIO's founder, chairman, and CEO Li Bin revealed that four models—ET5, ET5T, ES6, and EC6—will undergo facelifts this year, with changes like a horizontal center console screen, column-mounted shifter, and AC charging port addition. However, these models won't switch to the NT3.0 platform.

This means the high energy consumption issue, heavily criticized in NIO models, may not see a qualitative change in the new ET5, ET5T, ES6, and EC6. The Ledao L60 and NIO ET9, both using the NT3.0 platform, received praise for their class-leading energy consumption due to the platform's 900V three-electric system.

Considering the ET5, ET5T, ES6, and EC6 account for 80% or more of NIO's total sales, making the market accept these four "NT2.5" models is a significant challenge.

This year, NIO's position among leading new forces has become less stable, slipping in weekly sales rankings. The once-renowned "NIO, XPeng, Li Auto" trio has been replaced by "Li Auto, XPeng, XPeng," with Xiaomi Automobile taking the third spot.

At this critical juncture, Li Bin should perhaps emulate Lei Jun, an early NIO investor, and seize the opportunity to introduce new models, steering NIO back on track.

Some images are referenced from the internet. Please inform us if there is any infringement for deletion.