Technology Evolution Drives a New Growth Era | AI + Cybersecurity

![]() 07/29 2025

07/29 2025

![]() 633

633

1. Cybersecurity Industry

Cybersecurity encompasses the protection of hardware, software, and information within network systems, ensuring continuous, reliable, and normal system operations, uninterrupted network services, and safeguarding information from accidental or malicious destruction, alteration, or disclosure. With the rapid advancements in technologies such as mobile internet, the Internet of Things (IoT), and artificial intelligence (AI), the definition of networks has broadened beyond traditional computer networks to include new paradigms like cloud, edge, and terminals. Early-stage cybersecurity has evolved into cyberspace security, now mentioned alongside national security domains like land, sea, air, and space.

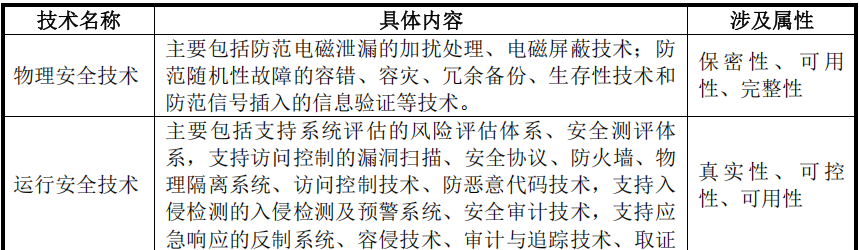

From a technical standpoint, information security revolves around seven core attributes of information systems, information itself, and information utilization: confidentiality, authenticity, integrity, reliability, availability, non-repudiation, and controllability. These attributes manifest across five levels: physical security, operational security, data security, and content security confrontation.

Figure: Mainstream Information Security Technologies

Note: Image source from Bangyan Technology's prospectus

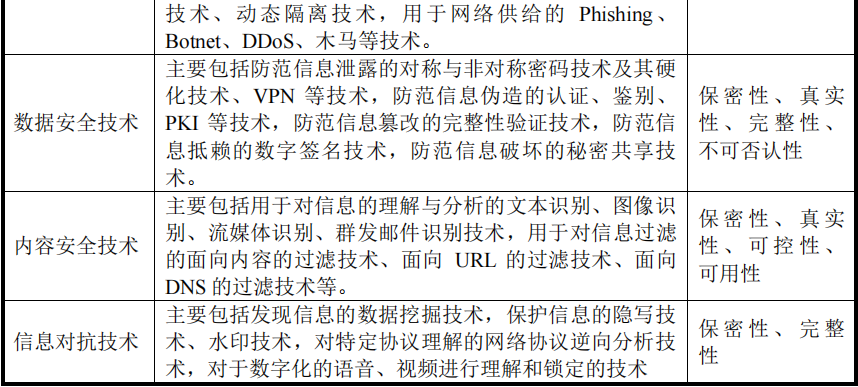

Market-wise, cybersecurity can be categorized into hardware, software, and services, with hardware and software products currently holding the largest shares. In 2023, the cybersecurity market shares for hardware, software, and services were 41%, 43%, and 16%, respectively.

Figure: Classification of Cybersecurity

Note: Image source from Northeast Securities

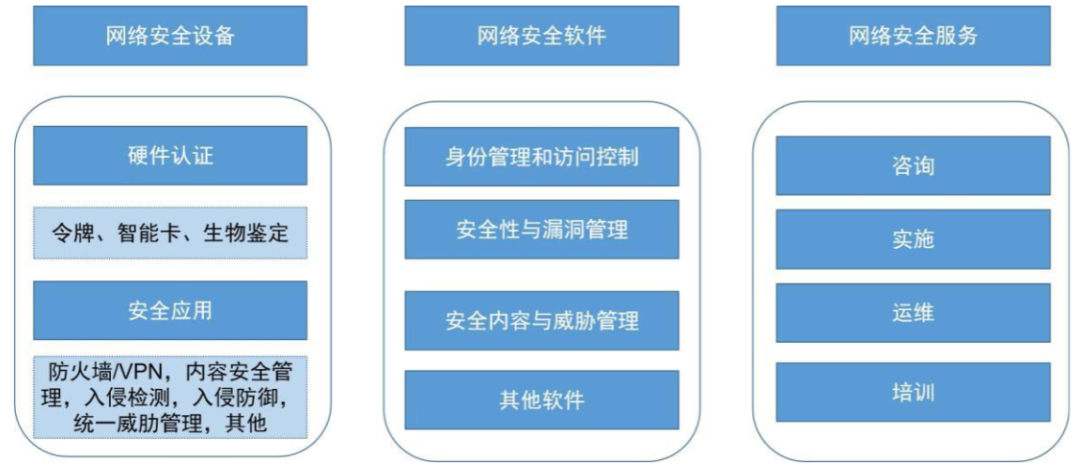

The cybersecurity industrial chain consists of upstream suppliers of equipment and systems (e.g., chips, memory, operating systems, engines); midstream cybersecurity product and service providers (e.g., software security and vulnerability management, cybersecurity equipment like firewalls/VPNs, and service-oriented operation and maintenance training); and downstream application areas encompassing government, military, finance, communications, and personal consumption.

Figure: Cybersecurity Industrial Chain

Note: Image source from Northeast Securities

Regarding development trends, "AI technology empowering cybersecurity" stands out as a pivotal trend. Industry leaders are accelerating deployments, creating secure cloud services in public cloud environments, and leveraging AI to boost operational efficiency. In privatized scenarios, they are promoting the implementation of a system that integrates a "security brain, security large model, and probes."

2. Market and Competition

From the 1980s to 1990s, as the internet commercialized, the first instances of virus attacks on terminals emerged, heightening awareness of terminal cybersecurity. In 2014, cybersecurity became a national strategy. By 2015, big data analysis based on AI emerged as the third generation of cybersecurity technology. The enactment of the Cybersecurity Law in 2016 marked a rapid development phase for the industry. According to IDC predictions, China's cybersecurity market size will surge from $12.16 billion in 2023 to $20.2 billion in 2028, with a compound annual growth rate of approximately 10.68%.

China's cybersecurity market is relatively fragmented, with a CR5 of about 34%. According to the China Industry and Business Research Institute, the top five enterprises in China's cybersecurity market in 2024 were Qianxin, Venustech, Sangfor, Topsec, and CETC Netsec, with Qianxin leading with a 9.80% market share.

In the realm of AI + security integration, competition is intense, involving cybersecurity companies, internet companies, financial institutions, and technology firms. The industry is in the nascent stages of AI integration, characterized by distinct differentiated competition. Traditional cybersecurity companies focus on platforms and integrated services, such as Qianxin, Venustech, and NSFOCUS, while new entrants concentrate on professional scenarios and technological breakthroughs, exemplified by Huawei, Baidu, Alibaba, Tencent, Meiya Pico, Geer Software, Hengwei Technology, and ABT Networks.

END

// The editor's views are for reference only //